Admiral Markets was established in 2001 and has since grown to become a worldwide company with many regulatory licenses in the United Kingdom, Australia, Estonia, Cyprus, and throughout continental Europe. The broker employs 200+ people, has 22,000+ active clients, and has approximately €36 million in Total Tier 1 capital.

Admiral Markets is primarily a MetaTrader FX brokerage that uses MetaQuotes Software Corporation's platform suite and offers excellent features like the MT4 Supreme volatility protection tools. The overall goal of Admiral Markets is to provide clients with access to functional software and high-quality offerings through transparent pricing and fast execution.

The trading process was designed for high trading frequency and low latency, with the system's flow aggregating liquidity from several banks and venues into one liquidity pool. Admiral markets' efforts to become a leading broker in various markets have been paid off, as the broker was recognized by several industry awards, as well as many positive client reviews.

All of this sounds wonderful. But before you jump into creating an account with Admiral Markets, you should first make sure all the positive things said about this broker are true in order to determine whether Admiral Markets is the broker for you. So, join us as we break down everything Admiral Markets offers, as well as everything it lacks.

Summary

Admiral Markets is a well-regulated broker that has gained popularity since it opened its doors in 2001. Traders all over the world prefer this broker for many reasons. It offers new users a seamless, fast account opening process with several account types to choose from. The MT4 and MT5 platforms, which allow traders to access both classic trading features and advanced features for more advanced traders, are always a plus. The broker has a good selection of assets, but when trading cryptocurrency, you can't trade the underlying asset directly.

Admiral Markets fees are often integrated into a spread from the tradable instrument. And it provides retail clients with leverage of up to 1:500. Payment methods at Admiral Markets include Credit Card, iDeal, Mastercard, Neteller, PayPal, POLi, Skrill, Sofort, Swift, and Wire Transfer. And the minimum deposit to start trading with the broker is $100.

On the more negative side, Admiral Markets is not publicly traded and does not operate a bank. It also doesn’t accept traders from the United States.

Admiral Markets Overview

| Trading Platform | Admiral Markets |

|---|---|

| Founded | 2001 |

| Headquarters | Tallinn, Estonia |

| Regulation | ASIC, FCA, CySEC, JSC |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 lots |

| Account Currency | USD, EUR, GBP, SEK, CHF |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| Islamic Account | Yes |

| Inactivity Fee | $10 |

| Products | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, and bonds |

| Mobile Apps | Android and iOS |

| Payment Methods | Credit Card, iDeal, Mastercard, Neteller, PayPal, POLi, Skrill, Sofort, Swift, Wire Transfer |

| Leverage | 1:30 | 1:500 |

| US accepted | No |

| Customer Service | Live chat, phone, and email |

| Our Score | 4.4/5 |

Pros and Cons

There are a lot of great features that make Admiral Markets a good choice to start trading various products. However, it features some drawbacks that can put some traders off. To make your life much easier, we summarized the major pros and cons of Admiral Markets to help you make an informed decision about whether to start trading with Admiral Markets or not.

| Pros | Cons |

|---|---|

| Heavily regulated broker | Does not accept clients from the United States |

| 24/7 customer support | Not publicly traded |

| A wide range of products | Does not operate a bank |

| MT4 and MT5 platforms | Some deposit methods add on extra commission |

| Advanced tools | Relatively high minimum deposit |

| Extensive educational content | |

| Great mobile app | |

| Demo account | |

| Islamic account | |

| Professional account | |

| Social trading |

Admiral Markets Compared to Similar Trading Platforms

One of the most accurate ways to tell whether a broker is a good option for you or not is to compare it with its competitors and see what each has to offer. If it offers more of the features you need, then that’s the one, but if you prefer the features of other competitors, you may want to reconsider using it. Below, we compared Admiral Markets to 4 of its biggest competitors in the industry to help you decide if you really want to trade with this broker.

| Trading Platform | Admiral Markets | Pepperstone | XTB | XM | eToro |

|---|---|---|---|---|---|

| Founded | 2001 | 2010 | 2002 | 2009 | 2007 |

| Minimum Deposit | $100 | $0 | $0 | $5 | $200 |

| Inactivity Fee | $10 | $0 | €10 | $5 | $10/month |

| US Accepted | No | No | No | No | Yes |

| Regulated | FCA,MiFID,FSA | FCA,ASIC,DFSA,CySEC,CMA | FCA,CySEC,IFSC | CySEC, ASIC, IFSC | ASIC, FCA, CySEC, MiFID |

Account Types

Admiral Markets offers a few versatile accounts that allow you to match your trading demands by choosing between one type of the following platforms: Admiral Markets Account or Admiral MT5 Account. The Admiral Markets account, which is available through the MetaTrader4 platform and includes costs integrated into the spreads, is available to both experienced and novice traders.

There are four different account types available at Admiral Markets: Trade.MT4, Trade.MT5, Zero.MT4, and Zero.MT5. You have a variety of trading platforms and spreads. Trade.MT4 and Zero.MT4 accounts are MT4 accounts that have different fee structures. Trade.MT5 and Zero.MT5 are MT5 accounts that allow you to invest in stocks and exchange-traded funds (ETFs) with a one-dollar minimum deposit. The zero spread accounts do not allow you to trade stocks, bonds, cryptocurrencies, or ETFs.

All accounts have leverage up to 1:30, however the zero spread accounts have the largest position sizes, up to 200 lots on FX compared to 100 lots on the basic Trade accounts. All types of accounts require a minimum deposit of $100, and all of them include mobile trading.

Admiral Markets offers new users demo accounts with virtual funds of $10,000. From the sign-up page, you can choose the demo account and get to test the MT4 and MT5 platforms. You can also put leveraged trading to test on a variety of instruments once you have got your login credentials. With a 15-minute delay, Admiral Markets’s demo accounts replicate real-time market data.

Admiral Markets also provides swap-free Islamic accounts, as well as professional accounts for institutional clients.

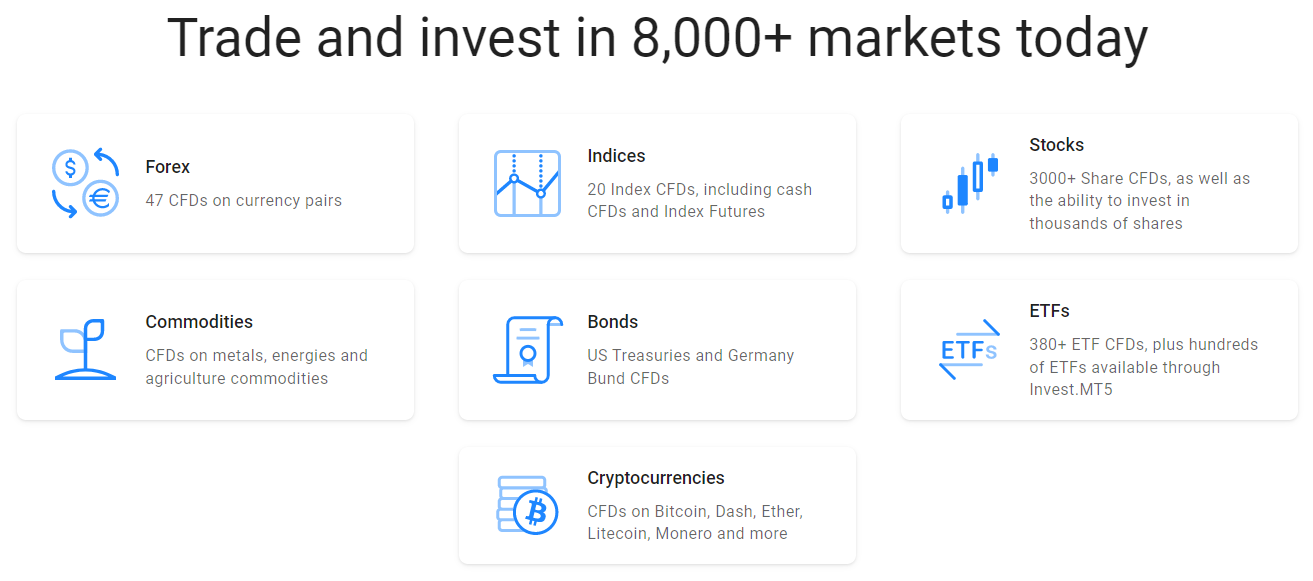

Products

Admiral Markets has a good selection of products, it has Forex trading, CFD trading, US stock trading, Int'l stock trading, and social trading. The broker offers 3800+ instruments, including 55 FX pairs and CFDs on 3300+ single stocks, 380+ ETFs, 40 indices, 30+ cryptocurrencies, 25+ commodities, and 2 bonds.

You can trade Cryptocurrency through CFDs, but you can't trade the underlying asset directly. Note that crypto CFDs aren’t available to retail traders or UK residents from any broker's UK entity.

Commissions and Fees

Admiral Markets fees are often integrated into a spread from the tradable instrument. However, circumstances vary depending on the platform and account type you use. There are 4 different account types on Admiral Markets, each with its own set of fees and trading options. All account types have similar pricing when it comes to the all-in cost of trading, with spreads ranging from 0.6-0.7 pip.

The Admiral Markets MT5 account offers the most trading options, but if you plan to just trade forex, you may prefer the Admiral Prime MT4 account. The Admiral Prime account offers the lowest all-in cost , but it has a somewhat narrower choice of tradable symbols.

According to Admiral Markets, the broker offers agency execution in types of account and it neither operates a dealing desk nor takes risk internally. The company serves as an agency broker and routes your orders to the parent company that is its only liquidity provider across all entities.

Accounts that have been inactive for 2 years are charged a monthly inactivity fee of $10. Also, traders who hold positions overnight are charged swap rates, sometimes known as interest fees. Make sure to check the broker's website to learn more information about swap fees.

Leverage

Because Admiral Markets is a global company with four locations across the world, there are changes in the services provided depending on which jurisdiction the broker adheres to. Marginal trading is available at Admiral Markets, which means clients get to operate bigger positions and trade with a multiplied amount of their initial deposit.

Admiral Markets now offers lower leverage than it did before for retail traders. Nevertheless, Australian regulation still allows for a high leverage of 1:500 for FX assets. Since leverage provides a significant advantage and can potentially increase your profits, you should learn how to use it effectively and safely and have a thorough understanding of it.

Deposit

With Admiral Markets, you’ll get to fund your account using a variety of methods, including major bank transfers, MasterCard and Visa payments, and Klarna (which is available in Austria, Germany, Belgium, France, the United Kingdom, the Netherlands, Hungary, Slovakia, Italy, Spain, and the Czech Republic). And none of the above will charge any extra transfer fees.

You can also use e-wallet payment methods such as Neteller and Skrill, but they will incur a 1% withdrawal fee and a 0.9% deposit fee.

Admirals Minimum Deposit

The minimum deposit at Admiral Markets is $100.

Don’t be put off by the relatively high minimum deposit of Admiral Markets; brokers with larger minimum deposits often offer extra premium services that can’t easily be found for free. Brokers that have smaller minimum deposits cater to more mainstream traders who aren't interested in the more advanced technical features. Other brokers that don’t even require a minimum deposit usually do that in order to win as many new clients as possible.

Withdrawal

PayPal, Bank transfers, Neteller, and Skrill, are all options for withdrawal on Admiral Markets. With the exception of bank transfers, which might take up to 3 days, all withdrawals are handled instantly. When a withdrawal is requested, Admiral Markets provides the relevant bank codes. Traders are entitled to two free withdrawals every month, with a minimum withdrawal of $1. Be aware, though, that there could be additional bank currency conversion fees.

Tools

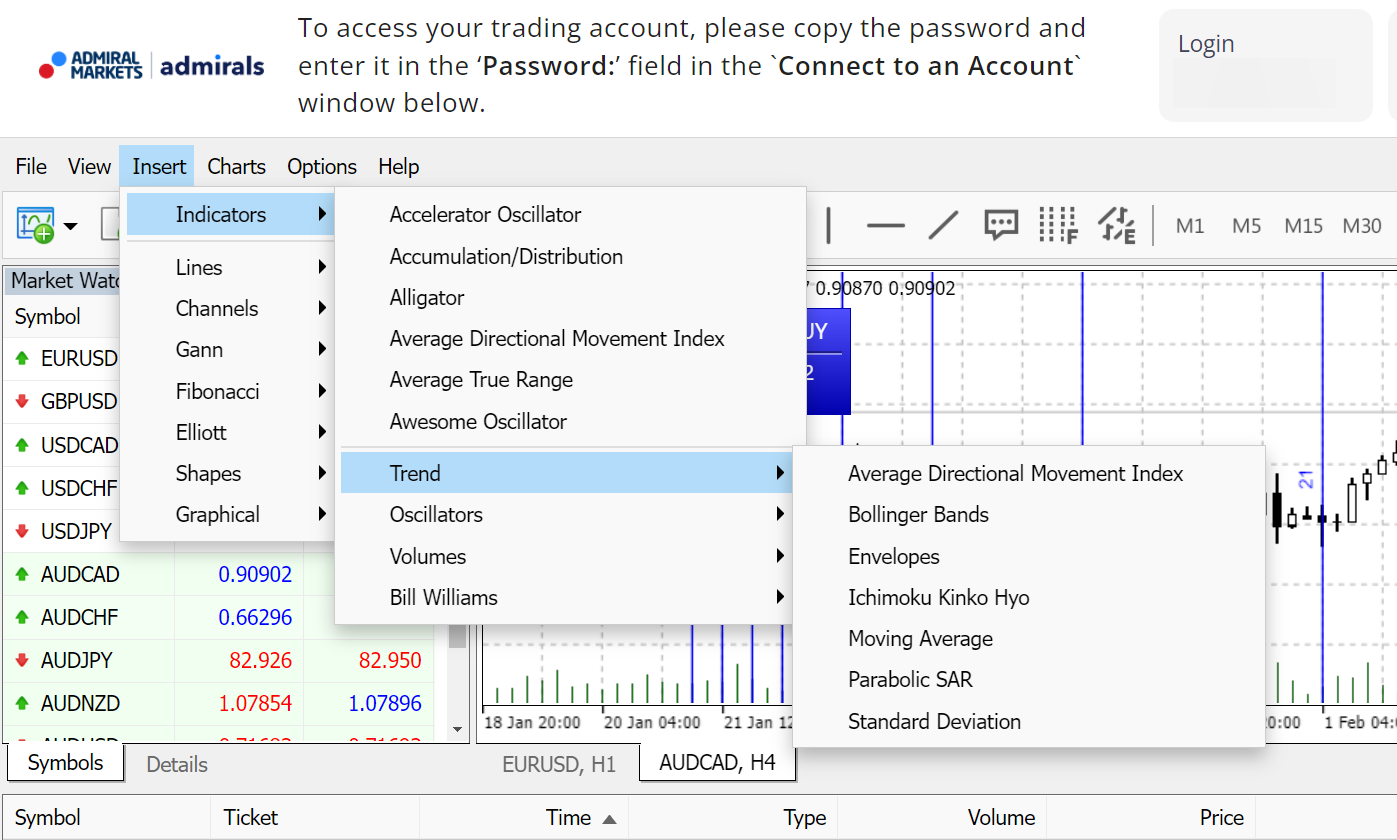

Being a MetaTrader 4 trading platform, Admiral Markets stands out among MetaTrader providers thanks to its MetaTrader Supreme offering that you can access on both MT4 and MT5, which includes a suite of twelve expert advisers and twenty custom indicators.

The MetaTrader Supreme Edition includes sophisticated features for experienced traders to improve trade operations. Award-winning pattern recognition technology, technical analysis indicators, holding timeframes, and day trading strategies are all available. Add-ons for managing numerous currencies and orders are also available with Global Opinion widgets.

Showing news events displayed on the chart is one of the useful add-ons offered by the Supreme service. Other modest features include a spread widget and candle countdown timer.

Admiral Markets has launched a cutting-edge copy trading service. Clients can imitate established traders' strategies and positions using this new technology. The new tool provides a simple way for experienced investors to make extra cash, with members paying long-term fees. To keep track of activity, the members’ area has a leaderboard and a stylish dashboard.

Admiral Markets also provides a one-of-a-kind volatility protection tools set, by which you manage the risks that come with agency execution, such as market gaps and slippage. Such tools are particularly beneficial to experienced traders, but it doesn’t mean novices cannot benefit from them.

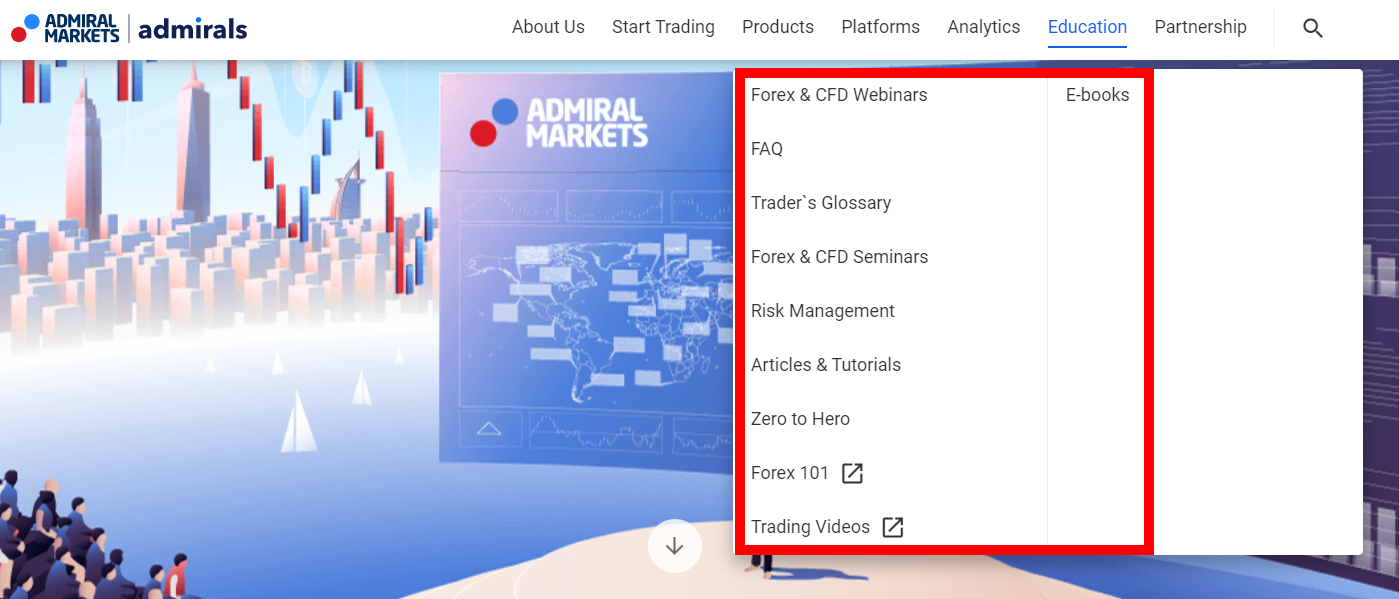

Research and Education

Admiral Markets offers a comprehensive selection of research tools that many traders would find useful. You can easily and quickly find what you need on the website owing to the well-organized content.

Admiral Markets stands out in terms of education; the broker boasts extensive educational material and courses to help its traders as they grow. There are a number of webinars available online that discuss CFDs and forex 101. Admiral Markets also publishes educational books in a variety of languages and provides demonstrations of analytical tools.

You can use the free Admiral Markets Premium Analytics to access Trading Central signals, a Dow Jones News calendar ,and Acuity Trading sentiment widgets. Heat maps, Elliott Wave Analysis, and basic and technical analysis content are among the other tools available.

Platforms

Admiral Markets' trading platforms are MetaTrader4 and MetaTrader5, which were built by MetaQuotes Software Corp., a global leader in trading software. Both platforms provide strong STP execution, with EAs that can be used without constraints and are equipped by a variety of excellent tools.

MT4 is the most powerful and user-friendly platform for trading Forex and CFDs, with the largest number of traders using it across the globe. The MetaTrader Supreme Edition allows you to install a platform on mobile or desktop, as well as use it via your browser as the web version. MT5 is also available in a variety of formats, including a web platform and a mobile app.

- Web Trading

WebTrader is a web-based platform that is very user-friendly. With only an internet connection and a browser, you can trade from almost anywhere. Price analysis and simple trade management are both available with the WebTrader platform. You can also employ a variety of indicators, such as Bollinger Bands and pivot points, as well as a simple forex pip calculator.

Some risk management tools like guaranteed stop out levels can be employed to reduce losses. WebTrader also supports well-known strategies like 1-minute hedging and scalping.

- Mobile Trading

With Admiral Markets, you'll receive either the MT4 or MT5 app that is compatible with Android and iOS, according to account choice. However, the great add-ons available on the desktop version are not compatible with mobile.

The mobile app offers you a customizable platform, live price feed, custom indicators, 3 chart types, 30 charting indicators, trading journal, and news releases.Is Admiral Markets a Safe Broker?

The broker's legal standing is determined by the regulatory status and required licenses in the country in which it operates. Admiral Markets is considered to be a medium-to-low-risk broker. Admiral Markets isn't a publicly traded company, and it doesn't operate a bank.

However, Admiral Markets is a well-regulated broker that is regulated by the Australian Securities & Investment Commission (ASIC), the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Jordan Securities Commissions (JSC).

Admiral Markets holds customer funds segregated from the group's assets in an EEA-regulated credit entity to comply with regulatory requirements. Client funds are also safeguarded if the broker goes bankrupt, thanks to deposit guarantee systems and financial services compensation schemes.

Accepted Countries

Traders from the United Kingdom, South Africa, Hong Kong, Thailand, India, Norway, Sweden, Italy, Denmark, France, Germany, Luxembourg, Qatar, the United Arab Emirates, Saudi Arabia, Kuwait, and the majority of other countries are accepted by Admiral Markets.

Traders from Australia, the United States, Canada, Japan, Singapore, and Malaysia are unable to trade with Admiral Markets.

Customer Support

Admiral Markets has a prompt team of professionals to answer all of your questions. Within a few minutes, you should be able to contact a customer support person via live chat or phone. Most account-related and technical questions, including requests to close your account, can be handled by the multilingual support team.

You can also send them an email or fill the feedback form on their website with your enquiry and you should get a response pretty quickly.

- Mobile number: +442035041364

- Email: global@admiralmarkets.com

- WhatsApp: +447495097435

The Final Verdict: Is Admiral Markets the Broker for You?

If we compare Admiral Markets to other MetaTrader-only brokers who offer no features over the default ones, Admiral Markets stands out thanks to extra tools and extensive research, including Premium Analytics, which gives you access to Dow Jones News, Trading Central, and Acuity Trading.

Also, not all companies are regulated the same. Admiral Markets is considered to be heavily regulated, with reputable authorities like the ASIC, FCA, CySEC, JSC regulating it. Although Admiral Markets isn’t traded publicly and doesn’t operate a bank, it still has a good level of security that is enough to assure many clients they won’t lose their funds at any moment, which are segregated from the group's assets in an EEA-regulated credit entity,

You can enjoy trading many assets on Admiral Markets, including Cryptocurrencies. You can also benefit from its thorough educational material, which helps you grow as a trader. Customer service at Admiral Markets is available in several forms, and the demo account with $10,000 in virtual funds offers new users a chance to test the waters before deciding to create a real account.

So, if you’re located in one of the countries that Admiral Markets supports, you may already be interested in trading with this broker if any of the advantages mentioned above have caught your eye.

How long does it take to withdraw my money from Admiral Markets?

Apart from bank transfers, which might take up to three business days, all withdrawals are handled instantly.

What is the minimum deposit in Admiral Markets?

Admiral Markets has a minimum deposit of $100.

Can I have both a retail account and professional account at the same time?

Admiral Markets only categorizes traders as professionals with respect to their CFD products, which covers Trade.MT4, Zero.MT4, and Trade.MT5 accounts. You can be a retail trader or a professional trader for all of your above-mentioned accounts, but you can’t be both at the same time.

Admiral Markets doesn’t classify clients as professionals when it comes to exchange-traded assets on the Invest.MT5 account, so even if you can access Admiral Markets Pro terms for CFD assets, you’ll still be categorized as a retail client when it comes to stocks and ETFs on the Invest.MT5 account.