CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AvaTrade (AVA Trade EU Ltd) is a CFD and forex broker founded in 2006. They offer a variety of financial instruments, including commodities, bonds, cryptocurrencies, stocks, and stock indexes. AvaTrade is regulated by top-tier authorities, making it a safe and reliable choice for CFD trading.

Table of Contents

- AvaTrade Overview

- Compare AvaTrade to Similar Trading Platforms

- Summary

- AvaTrade Pros and Cons

- AvaTrade Trading Platform Overview

- Order types

- AvaTrade Trading Fees

- AvaTrade Research

- AvaTrade Education

- Customer Service

- AvaTrade Minimum Deposit

- Withdrawals

- Is AvaTrade Safe?

- How to Open an AvaTrade Account?

- Markets & Products Offered

- Summary

- Conclusion

AvaTrade Overview

Here is a quick overview of Avatrade.

| Trading Platform | AvaTrade |

| Regulated | MiFID, KNF, ASIC, FSRA, FSCA, FFAJ, B.V.I. |

| Minimum Deposit | $100 – $500 |

| Mobile App | iOS, Android |

| Desktop | MT4, MT5, Proprietary |

| Deposit Methods | Credit Card, Debit Card, Bank Transfer, eWallets |

| Islamic Account | Yes |

| Automated Trading | Yes |

| Our Rating | 4.9/5 |

Compare AvaTrade to Similar Trading Platforms

Below, we compare AvaTrade to similar trading platforms. Compare how AvaTrade stacks up to other industry leaders.

| Trading Platform | AvaTrade | Pepperstone | eToro | Capital.com | IC Markets |

|---|---|---|---|---|---|

| Founded | 2006 | 2010 | 2007 | 2016 | 2007 |

| Regulation | FCA, ASIC, FSCA, FRSA, Israel Securities Authority, Financial Services Agency, Financial Futures Association of Japan | ASIC, CySEC, FCA, SCB, DFSA, BaFin, CMA | FCA, CySEC, ASIC, FSAS | FCA, CySec, ASIC, MiFID | ASIC, CySEC, FSA, SCB |

| Offering Of Investments | Forex, Stocks, Commodities, FXOptions, Cryptocurrencies, Indices, ETFs, Bonds | CFDs on Forex, Crypto, Shares, Indices, Crypto | Stocks, ETFs, Forex, Crypto, Indices, Commodities | Shares, Forex, Commodities, Indices, Crypto | CDFs on Forex, Commodities, Indices, Bonds, Cryptocurrency, Stocks, Futures |

| Minimum Deposit | $100 | $0 | $50 - $100 | $20 | $200 |

| Demo Account | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fee | $0 | $5 | $5 | $0 | $0 |

| Inactivity Fee | $50/month After 3 Months | $0 | $10/month | No | $0 |

| Deposit Methods | Credit and Debit Cards,Wire Transfer, e-payments | Credit/debit cards, Bank/Wire Transfer, PayPal, Neteller, Skrill, UnionPay | PayPal, Skrill, Neteller, Credit Card, Debit Card, Rapid Transfer,iDEAL, Klarna / Sofort Banking, Bank Transfer, Online Banking - Trustly, POLi | Credit Cards, Bank Transfer, Wire Transfer, Sofort, IDeal, MultiBanko, Trustly, WebMoney, Qiwi, Skrill, and Neteller | Credit Cards, Debit Cards, PayPayl, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Fasapay, Broker to Broker, Poli, Thai Internet banking, Klarna, Rapidpay, Vietnames Internet Banking |

Summary

Our top findings on AvaTrade:

- AvaTrade is a safe online broker regulated by top-tier authorities. This makes it a trusted Forex and CFD broker.

- Their range of markets is exemplary and should be suitable for most traders.

- Avatrade offers a great selection of trading platforms. On top of their proprietary platform, they offer MetaTrader, ZuluTrade, and DupliTrade.

- Their education is good, above the industry average.

AvaTrade Pros and Cons

While there are many benefits to AvaTrade, they have some downsides:

| PROS | CONS |

|---|---|

| Mobile App | CFD Only |

| Research and Education | Inactivity Fees |

| Deposits and Withdrawals | |

| AvaProtect |

AvaTrade’s holding company is registered in the British Virgin Islands. The firm is headquartered in Dublin, Ireland.

AvaTrade operates worldwide but operated through regional offices. They serve Australia, South Africa, Singapore, Japan, France, Italy, Spain, Mongolia, China, Abu Dhabi, and more. They serve more than 200,000 active customers and execute 2 million monthly trade orders.

The following is a list of AvaTrade’s subsidiaries registered in some of the mentioned countries:

- British Virgin Islands (holding company): AVA Trade Ltd

- Ireland: AVA Trade EU Ltd

- Australia: Ava Capital Markets Australia Pty Ltd

- South Africa: Ava Capital Markets Pty

- Japan: Ava Trade Japan K.K

- Abu Dhabi: AVA Trade Middle East Ltd

AvaTrade Trading Platform Overview

AvaTrade is a platform that provides hundreds of CFD products and a limited number of currency pairs for traders located in more than 120 countries through its two proprietary platforms – Webtrader and AvaOptions – and third-party platforms such as MetaTrader 4 and 5.

The company and its subsidiaries are regulated by various tier-1 and tier-2 jurisdictions such as the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Japanese Financial Services Agency (FSA).

Compared to its rivals, AvaTrade’s portfolio of available stock, index, and forex CFD is smaller. Their fees for popular instruments and currency pairs such as EUR/USD are a bit higher than the average.

Both the proprietary and third-party platforms supported by AvaTrade – MetaTrader 4 and 5 – are excellent, and their features are attractive. No fees are charged for deposits and withdrawals.

AvaTrade’s platforms include a web-based and mobile trading app called Webtrader. WebTrader is the company’s proprietary trading platform, along with a platform AvaOptions, designed for forex CFD traders.

AvaTrade supports MetaTrader 4 and MetaTrader 5, both of which are third-party platforms.

Web-based platform

The web-based platform of AvaTrade, Webtrader, has a user-friendly interface- It allows traders to browse and select the CFDs offered by this trading platform with ease. Prices are displayed next to their ticker symbols along with buy and sell buttons. Traders can tag their favorite securities as some sort of shortcut.

The search function allows the user to search by symbol or name of the asset. The reporting feature provides all the relevant information traders need to analyze their historical transactions. This information includes the market price, realized gains or losses, fees paid, and cost basis.

It is important to note that the interface cannot be customized. None of its elements can be moved to suit the users’ preferences.

Two-step logins and price alerts are not available. This is a bit disappointing as most platforms send notifications when the price of a security reaches a certain level.

Desktop platform

The desktop platform is similar to the MetaTrader 4 platform. The upside is that it allows for alerts and notifications. Compared to the web-based version, the design of the desktop platform is not as nice. The customization of charts and the interface itself is enabled. The reports section is good, similar to the web-based version. No two-step login is available for the desktop version.

The desktop platform of MetaTrader 4 and MetaTrader 5 platforms are supported by AvaTrade and available in 41 different languages.

The AvaOptions platform, designed for forex options, has a desktop version.

Mobile trading app

The mobile version of AvaTrade has a good-looking user-friendly interface. It offers a lot, considering the narrow screen space of a mobile phone. The search function works great, and the same goes for the reports function.

There’s a unique feature that can be accessed via the mobile app. This is the AvaProtect order, designed to prevent financial losses at an extra fee. AvaOptions has a mobile app version, and they are available for iOs and Android.

The platforms are available in English, contrasting the wide range of languages offered by MetaTrader.

As for security, the mobile app allows for fingerprint login, but no two-step login is available for this version.

Price alerts are set by using the mobile platform. They are displayed on your phone’s screen via push notifications.

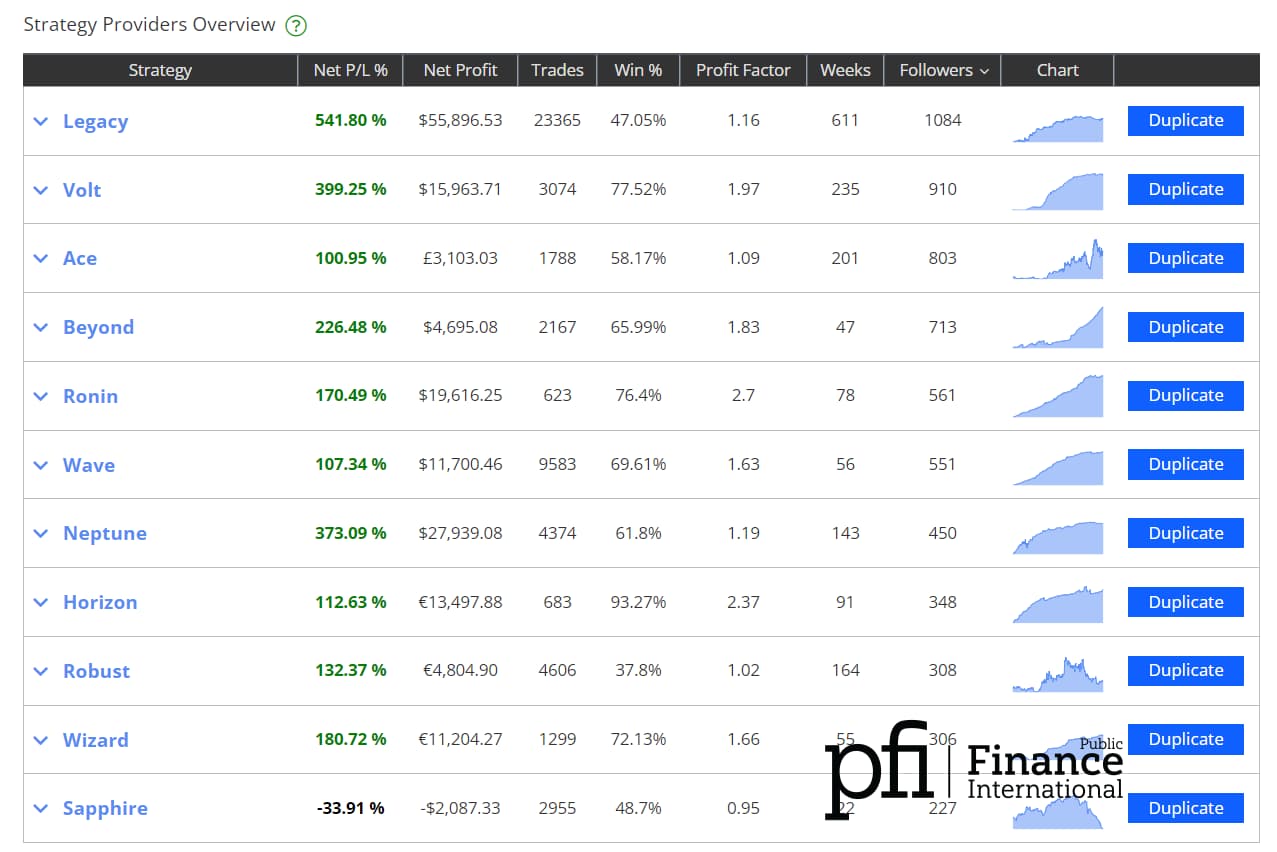

AvaSocial – Copy Trading

Avatrade copy trading integrates through DupliTrade and Zulutrade. This ranks them among the best copy trading brokers such as Pepperstone and eToro. Avatrade launched AvaSocial in the UK, with which traders can follow and copy the best traders.

How to start copy trading on AvaTrade?

- First, you need to sign up with AvaTrade

- Complete verification

- Fund your account

- Select ZuluTrade or Duplitrade for copy trading

- Pick the signal provider

- Copy one or more signal providers

Order types

AvaTrade’s platform allows three different trader order types:

- Market order – this order is executed at the current market price of the security.

- Limit order – a limit order sets a maximum price at which you are willing to buy the securities or a minimum price at which you are willing to sell the securities. The order will only be executed at a limit price or better.

- Stop order – a stop order limits losses if the market price falls below the stop price. The order will become a market order once that price is reached.

- AvaProtect: AvaProtect is a type of order that serves as an insurance policy against losses resulting from trading operations made during a specific period. This type of order comes with an extra fee, and all the losses resulting from the trade will be reimbursed to the trader as long as they occurred during the time frame covered by the order.

AvaTrade Trading Fees

AvaTrade Trading fees and spreads are competitive and in line with the industry average. The average spread charged S&P 500 index CFD is 0.5, while the average spread charged for trading a Europe 50 index CFD is one pip. The cost of the EURUSD pair is 0.9 pips, right around the industry’s average.

To estimate the cost of trading with this broker, we have assumed a hypothetical $2,000 position held for one week with leverage of 20:1 for stock index CFDs and 5:1 for individual stock CFDs.

For this hypothetical scenario, the fees paid for each of the following instruments were:

- S&P 500 index CFD fees: $0.9

- Europe 50 index CFD fees: $0.6

- Apple stock CFD fees: $4.1

The cost of trading using this broker is lower than what traders would pay with other platforms such as Plus 500 or XM.

To estimate the cost of currency pairs, we have assumed a hypothetical trade of $20,000 with a 30:1 leverage ratio held for one week.

In that scenario, the cost of the following popular Forex pairs would be:

- EURUSD: $19.2

- GBPUSD: $15.7

- EURGBP: $10.5

In this case, the cost of trading forex pairs is slightly higher than trading the same pairs with XM and Plus500.

An inactivity fee is charged by AvaTrade if the user doesn’t log into the account for three months. This fee is $50 per quarter (around $13.33 per month), a bit higher than what other competitors charge.

AvaTrade Research

AvaTrade research tools are good. It includes a news feed, an economic calendar, an idea hub, and many other resources. These are embedded into the broker’s platforms – Webtrader, MetaTrader, and AvaOptions.

For trading ideas, AvaTrade offers a section known as ‘Analysts View’ or ‘Forex Featured Ideas’. Traders can find hints into potential trading signals spotted by other traders for most of the financial assets covered by the platform.

The economic calendar covers a wide range of economic and corporate events around the world, rating them based on the potential impact they may have on the financial markets.

AvaTrade news feed is one of the best out there. It features an excellent visual interface that tracks the number of publications per day, the orientation of such news – positive/negative – and the type of news covered. This feature is known as ‘Market Buzz’.

AvaTrade charting tools provide 90 different technical indicators applied to each chart. These charts can be edited and modified to spot potential signals, price patterns, and trends.

AvaTrade Education

This review found documented educational resources available for registered users. These go from basic platform tutorials to advanced materials, covering strategies and fundamental topics.

AvaTrade’s educational resources include:

- Trading for beginners

- Economic indicators

- Forex (eBook available)

- Professional strategies

- Platform tutorials

- Types of trade orders

These materials cover major topics that help traders in expanding their knowledge to improve the performance of their portfolios.

AvaTrade offers a demo account for traders to gain experience in trading before they commit real money.

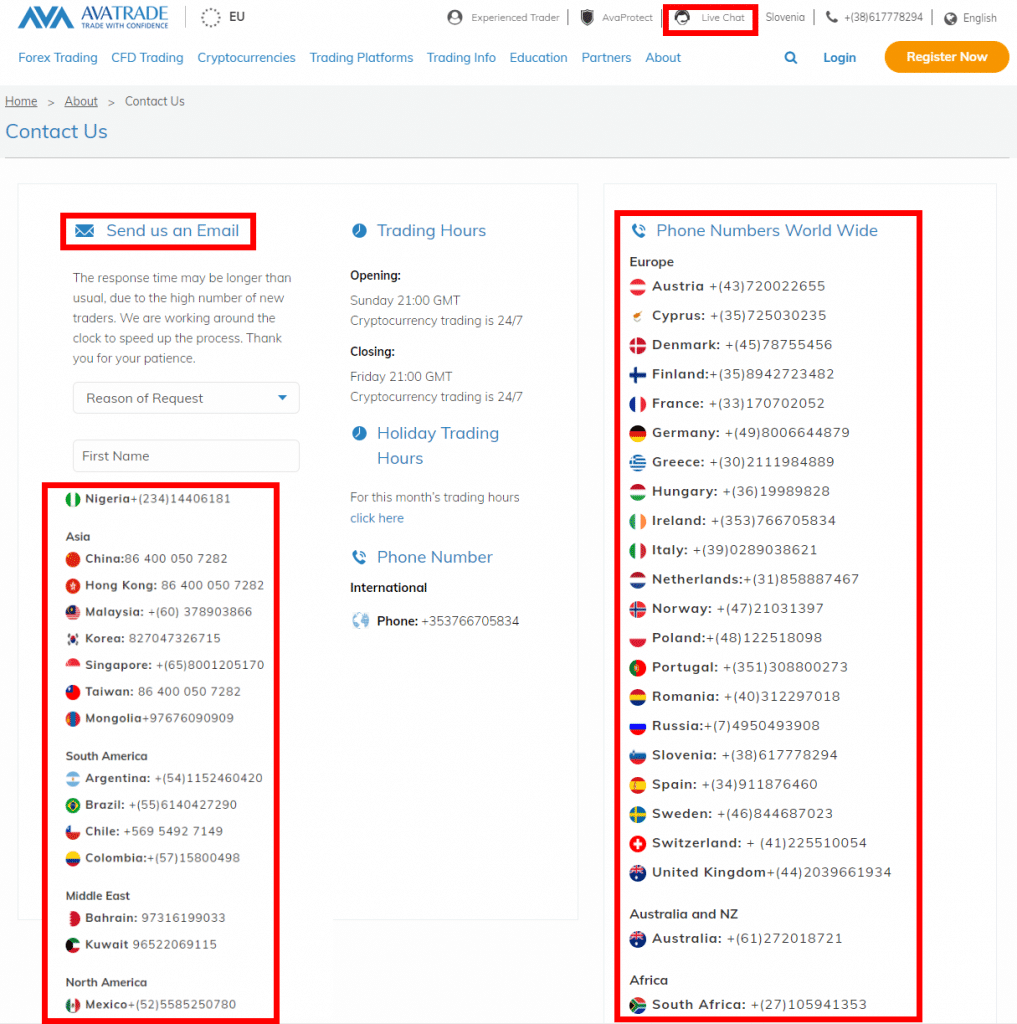

Customer Service

AvaTrade offers three channels for users to communicate with its customer service team:

- Live chat

- Phone

The live chat feature is good. Response times are instant and customer representatives are well-trained to provide accurate information about different topics.

Phone support, on the other hand, is one of the weak spots of the customer support, as phone calls take long to be answered and, even though the company offers domestic phone numbers for different locations, some of its numbers cannot be reached. E-mail queries are answered in 24 hours or less.

They don't offer 24/7 customer support, rather 24/5. Its customer support team is able to handle inquiries in different languages including German, Russian, French, English, and Chinese.

AvaTrade Minimum Deposit

The minimum deposit required to open an account with AvaTrade is $100 for debit or credit card deposits. The minimum deposit for bank transfers is $500. Same as many other trading platforms, AvaTrade will conduct an identity verification process. This consists of requesting certain documents from you to ensure you are who you say you are. That said, the process is faster than with most brokers.

Withdrawals

AvaTrade offers free of charge withdrawals. There’s a withdrawal limit for debit or credit cards. It is up to 200% of the amount the trader deposited into the account prior to the withdrawal. This limit does not apply to bank transfers.

Withdrawals to electronic wallets take one business day. There is no minimum withdrawal limit. Withdrawals take up to one business day (credit, debit cards, electronic wallets), bank transfers take a few business days.

Is AvaTrade Safe?

AvaTrade is considered safe, regulated by tier-1 financial regulators. AvaTrade is a reliable trading platform to buy and sell CFDs and Forex products.

The main element that contributes to this conclusion is the fact that the company and its subsidiaries are regulated by various reputed agencies in the countries it operates. These include:

- The Central Bank of Ireland

- The Japanese Financial Services Agency (FSA)

- The Australian Securities and Investments Commission (ASIC)

- The Financial Futures Association of Japan (FFAJ)

One of these regulators offers protection for investors whose assets are managed or held by one of AvaTrade’s subsidiaries. The extent of those protections are:

- A €20,000 protection from the Central Bank of Ireland to EU clients

- Negative balance protection for retail clients in the EU

How to Open an AvaTrade Account?

Opening an account with AvaTrade takes a few minutes and it is done 100% online. Various countries allow their residents to open an account with AvaTrade. Exception is a small list that includes the United States, Belgium, and Iran, Israel.

Four types of accounts available with AvaTrade:

- Standard Account: held by an individual

- Corporate Account: held by a company

- Islamic Account: this account does not charge swaps

- Professional Account: this account allows for higher leverage ratios for forex and CFD trades but it requires significant experience in the financial sector, such as prior investment experience, a track record of significant activity, and a portfolio of at least €500,000

Funding your Account

Traders can choose from five different base currencies for their account. These include: the pound sterling (GBP), the euro (EUR), the US dollar (USD), the Australian Dollar (AUD), and Swiss Franc (CHF). That said, an AUD account is available for residents of Australia, while a GBP account is available for UK clients. This is an advantage for clients whose local currency is one of these 5, as they can save money by avoiding currency conversion fees.

While debit or credit card deposits are instant, traders have reported that, in some cases, it takes a few hours for the money to show up in the account’s available balance.

Bank transfers, on the other hand, may take a few days to clear. Transfers should be sent from an account held by the verified user of the AvaTrade account.

There are no deposit fee at AvaTrade for the these payment methods.

Markets & Products Offered

AvaTrade offers CFDs for various financial assets including stock and forex CFD.

This means that these financial assets are traded via CFDs.

The portfolio of CFDs available on AvaTrade include:

- 20 stock indexes

- 630 individual stocks

- 5 ETFs

- 17 Commodities

- 2 Bonds

They offer 56 currency pairs and 17 different cryptocurrencies.

Compared to its rivals, AvaTrade’s portfolio of available products is limited, when it comes to ETFs, bonds, and individual stock CFDs.

AvaTrade offers the alternative of using two social trading platforms – ZuluTrade and DupliTrade – which require a minimum deposit of $500 and $2,000 to be accessed.

Summary

AvaTrade, founded in 2006, is registered in the British Virgin Islands as AVA Trade EU Ltd. The company is headquartered in Dublin, Ireland and serves more than 200,000 clients across 120 countries. Avatrade is regulated by various tier-1 institutions. These include the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC). This platform is considered safe due to its extensive regulatory coverage. A €20,000 protection is available for EU investors provided by the Central Bank of Ireland along with negative balance protection for EU clients. Clients can open an account with AvaTrade in a few minutes through an online registration process.

Conclusion

AvaTrade is a safe and trusted broker regulated by tier-1 jurisdictions. This online brokerage firm offers a wide variety of CFDs that cover various financial instruments. These include stocks, bonds, and ETFs. We found AvaTrade great for their mobile trading app, copy trading, best for their pricing and education.

AvaTrade trading fees are a bit higher compared to its rivals. The cost of trading with Avatrade is lower once all other fees are considered.

Opening an account is easy and takes a few minutes. Verification is required, and takes a few business days.

This review should provide many important details to help you in making an informed decision about which broker you decide to chose for your trading journey.

Our Score: 4.9/5 Stars

- Regulated by top-tier financial authorities

- Serving over 200,000 clients worldwide

- Customer support available in many languages

- Social Trading Available

- Five Basic Currencies Available