We ranked ECN Brokers based on the most important factors such as fees, security, execution, regulation, platforms, tools, and more.

Table of Contents

- List of The Top ECN Brokers 2024

- What is an ECN?

- 1. Pepperstone ECN Account

- 2. FP Markets ECN Account

- 3. Interactive Brokers ECN Account

- 4. IC Markets ECN Account

- 5. XM ECN Pricing Account

- 6. FXTM ECN Account

- 7. Forex.com ECN Account

- 8. RoboForex ECN Account

- Compare ECN Brokers

- ECN Accounts for US Clients

- Benefits of using an ECN Account

- Disadvantages of ECN Accounts

- Are ECN accounts good for scalping?

- Conclusion

List of The Top ECN Brokers 2024

Below, we list the best ECN brokers. We base our research on various factors such as fees, commissions, spreads, account types, trading tools, forex trading platforms, security, regulation, and more.

Here are the top rated ECN Accounts:

- Pepperstone – Best ECN Forex Broker Overall

- FP Markets – Best ECN Forex Broker With Tight Spreads

- Interactive Brokers – Best ECN Broker for US Clients Overall

- IC Markets – Trusted ECN Broker

- XM – Great ECN Broker for Education Tools

- FXTM – Good ECN Broker for Customer Service

- RoboForex – Best Micro Account ECN Forex Broker

- Forex.com – Fast Execution ECN Broker

- InstaForex – Good Trading Tools Forex ECN Broker

- Exness – Good ECN Broker for Research Tools

Runner Up

PFI Rating 4.9

Best Overall

PFI Rating 4.9

Disclaimer: 76.6% of retail investor accounts lose money when trading CFDs with this provider

Low Spreads

PFI Rating 4.9

69.0% of retail investor accounts lose money when trading CFDs with IBKR.

What is an ECN?

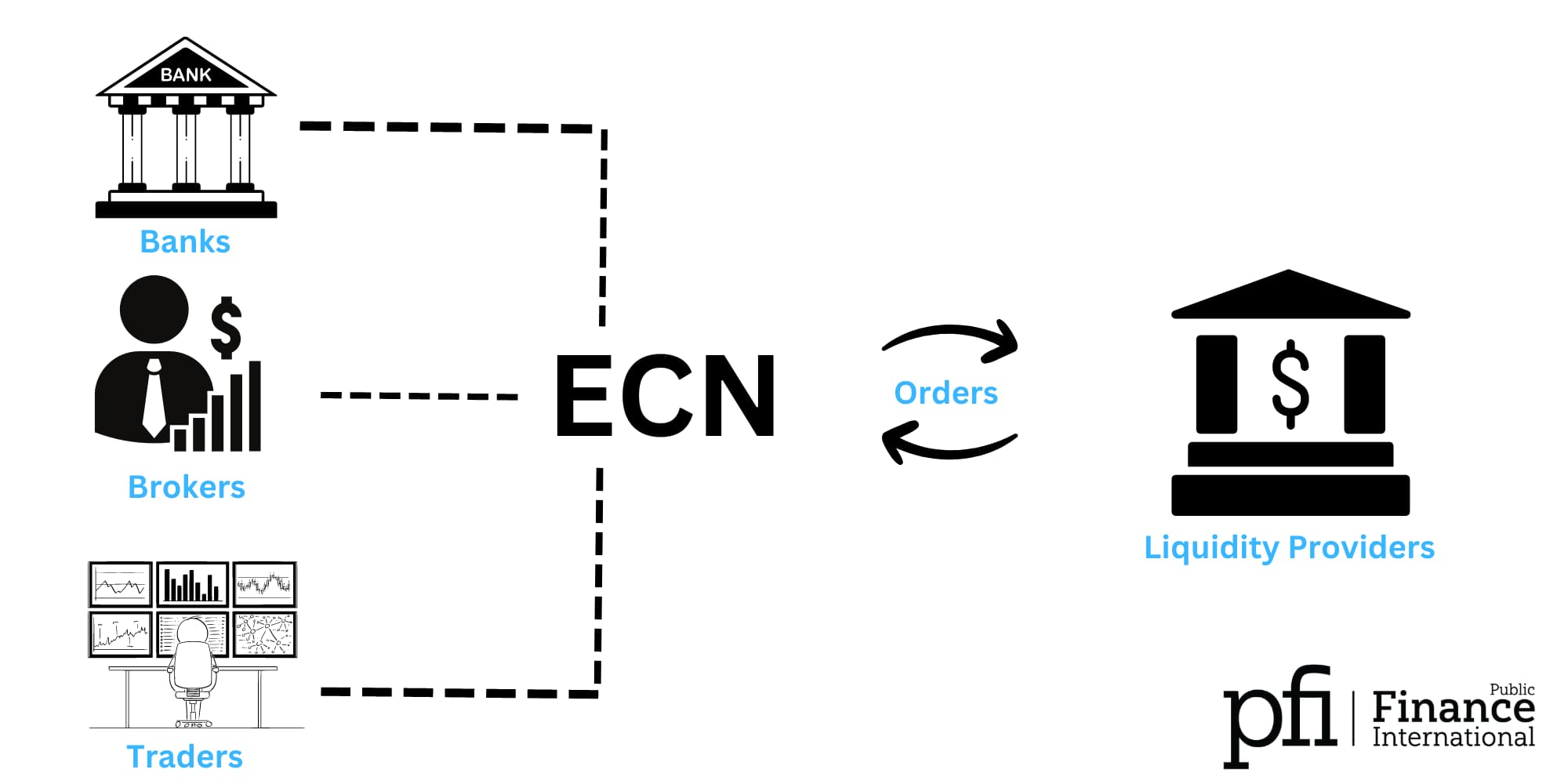

An Electronic Communication Network (ECN) is a computerized network that acts as a financial intermediary that matches buy and sell orders for securities outside traditional stock exchanges. It works by “cutting out the middleman” in forex trading. Where other brokers set their ask price for buying and selling securities, ECN trading platforms offer a straight-through processing execution to clients.

In a study “ECNs, Market Makers, and Liquidity,” Hendershott and Mendelson (2000) found that ECNs offer superior execution quality compared to traditional market makers. Hendershott and Mendelson observed that trades executed on ECNs generally have smaller average quoted, realized, and effective spreads. Further, ECNs have been linked to improvements in overall market quality. ECNs are likely to attract more informed orders than uninformed ones. This contradicts the general trend where secondary markets usually attract less-informed orders.

What is an ECN Broker?

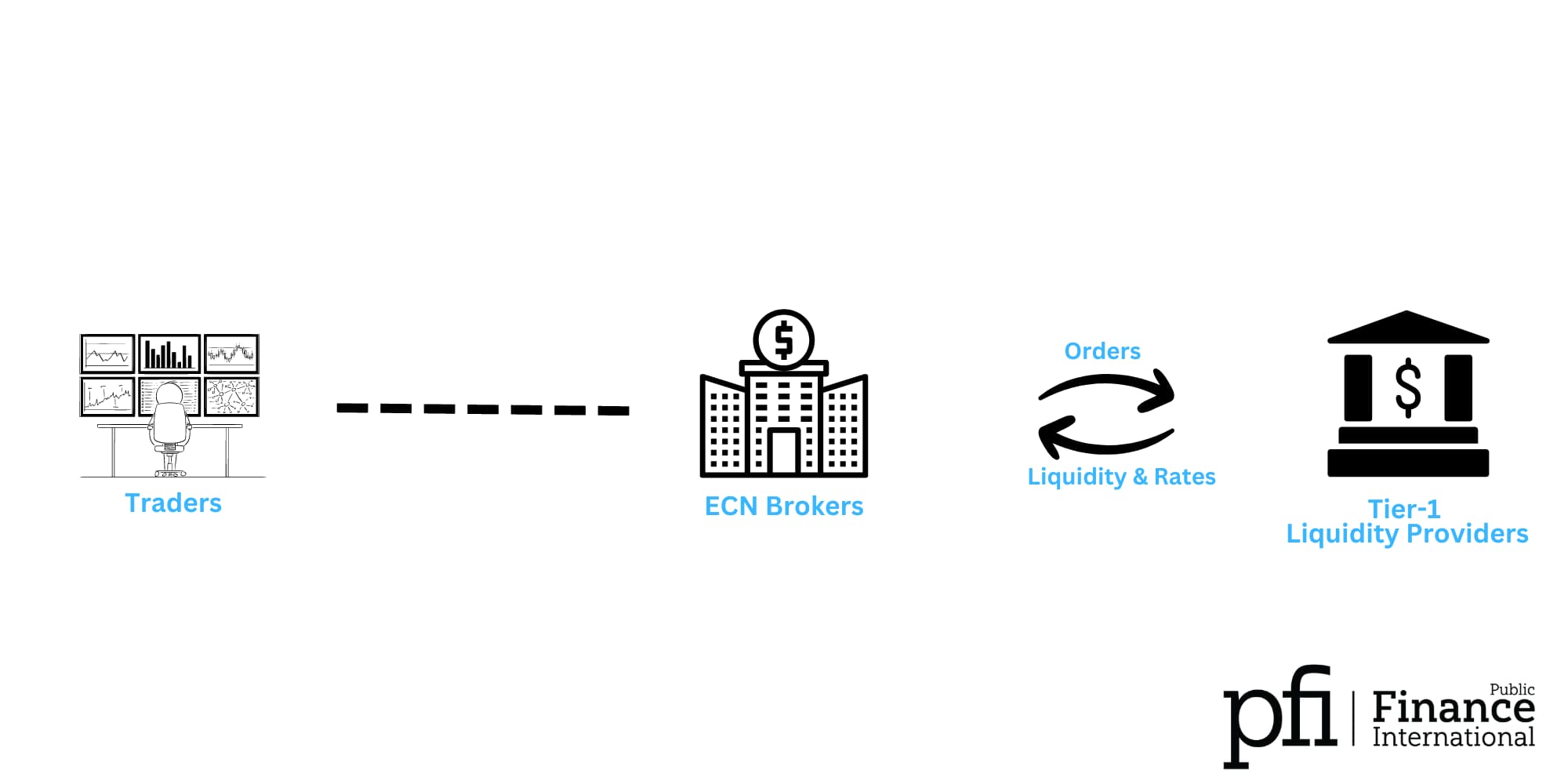

An ECN broker is a financial intermediary that gives traders direct access to participants in the currency and equity markets. By gathering price quotations from several providers, an ECN broker can provide tighter bid/ask spreads than those through non-ECN accounts.

How do ECN Brokers work?

ECN brokers are NDD (non-dealing desk) brokers that electronically match clients in a trade to liquidity providers. They don't pass on order flow to market maker brokers. An ECN broker executes orders on financial markets across the ECN.

Who can trade with an ECN account?

Primarily, market makers use ECNs for NASDAQ trades, but retail traders and small firms can also use them.

Should you pick an ECN account?

In a study conducted, “The Role of ECNs in the Securities Trading Value Chain,” Weston (2006) discussed the choice of online brokers, emphasizing that while ECNs offer benefits like speed of execution and sometimes better prices, market makers sometimes provide price improvements, especially on small trades. Based on your trading volume and needs, you should determine whether an ECN account is beneficial.

How to pick an ECN Broker?

When picking an ECN broker, you should consider many factors, including regulation, security, fees, speed of servers, VPN availability, and more. The broker you pick should meet your requirements. Below we go into each in more detail.

- Fees and Spreads – Fees and spreads should be as tight as possible. Avoid ECN accounts with fees higher than $2 per lot and spreads higher than 0.3 pips.

- Regulation – Always pick an ECN broker regulated by the top-tier regulators. Always double-check on the official regulator's website to make sure the broker is really registered.

- Speed of execution – The top ECN brokers offer super fast trade execution and servers. Quicker execution can lead to better prices and limit slippage.

- VPN – Due to security concerns, many ECN brokers don't allow VPNs for trading.

- Tools and resources – Ensure the broker provides all the tools and resources for efficient trading.

1. Pepperstone ECN Account

Pepperstone is our top pick as the best ECN broker. Pepperstone was founded in 2010 and offers CFDs on Forex, Crypto, Shares, Indices, and Cryptocurrencies. Pepperstone is a safe and reliable ECN forex broker regulated by top-tier authorities. Pepperstone uses proprietary software to execute ultra-fast trades with minimal slippage.

The minimum deposit requirement is $0 with no deposit fees. However, they recommend a minimum deposit of $200. Pepperstone offers a wide variety of deposit methods.

Forex trading fees are low. Pepperstone offers two account types: Razor and Standard.

- Regulated by Top Authorities

- Low ECN Spreads

- No Minimum Deposit

76.6% of retail investor accounts lose money when trading CFDs with this provider

2. FP Markets ECN Account

FP Markets is the runner-up as the best trade execution ECN broker. FP Markets was founded in 2005 and is regulated by top-tier authorities worldwide.

The minimum deposit is $100. They offer two trading account types: Standard and Raw.

Their trading fees are among the lowest in the industry starting from 0.0 pips.

FP Markets offers maximum leverage of up to 1:500 depending on the country of your residence. They offer Forex, Shares, Metals, Commodities, Indices, Cryptocurrency, Bonds, and ETFs.

On FP Markets Official Website

3. Interactive Brokers ECN Account

Interactive Brokers was founded in 1978 and is regulated by reputable authorities worldwide. Interactive Brokers is one of the best ECN brokers that offers access to a wide variety of markets, the best on this list.

The minimum deposit is $0.

IBKR offers competitive trading costs, and their fees are among the lowest in the industry.

They offer trading on Stocks, ETFs, Options, Futures, Currencies, Cryptocurrencies, US Spot Gold, Bonds, Mutual Funds, and Hedge Funds.

On Interactive Brokers' Official Website

Interactive Brokers (IBKR) is one of the most advanced ECN forex trading platform that offers advanced trading tools and the best market access.

4. IC Markets ECN Account

IC Markets was founded in 2007 and is regulated by ASIC, CySEC, the Securities Commission of The Bahamas, and the Financial Services Authority of Seychelles.

While IC Markets isn't a True ECN broker, they offer an ECN environment pricing model. They source their pricing from liquidity providers. This ensures the best prices with no dealing desk intervention.

The minimum deposit is $200.

Their trading fees are low.

IC Markets offer CFD trading on Forex, Stocks, Bonds, Futures, Cryptocurrencies, Bonds, Commodities, and Indices.

On IC Markets' Official Website

5. XM ECN Pricing Account

XM is next on our list and, just like IC Markets, is not an actual ECN broker. XM was founded in 2009 and is regulated by top-tier authorities.

XM offers ECN pricing with the XM zero account. The commission on the XM zero account is $3.5 per lot. The maximum leverage is set to 30:1.

The minimum deposit is $5.

Their trading fees are low.

XM offers CFD trading on Forex, Stocks, Equity Indices, Precious Metals, Energies, and Commodities.

77.74% of retail investor accounts lose money when trading CFDs with this provider.

PFI Rating: 4.7/5

6. FXTM ECN Account

FXTM was founded in 2014 and is regulated by top-tier regulators worldwide.

FXTM offers two ECN accounts: their ECN and ECN zero account.

Their execution speeds are great and spreads range from 0.0 to 0.1. The minimum deposit is $500 for the ECN account and $200 for the ECN zero account. The minimum for their FXTM Pro Account is $25,000.

Their Forex trading fees are low.

FXTM offers CFD trading on Forex, Indices, Metals, and Commodities.

77.74% of retail investor accounts lose money when trading CFDs with this provider.

PFI Rating: 4.7/5

7. Forex.com ECN Account

Forex.com was founded in 2001 and is regulated by CFTC.

Like XM and IC Markets, Forex.com is not a true ECN broker but offers competitive fees and ECN pricing. Through an STP pro account, you get access to a deep international liquidity pool.

Their execution speeds are good and spreads are in line with the industry average. The minimum deposit is $100.

Forex.com offers Forex, Gold and Silver, Futures, and Futures and Futures Options.

On Forex.com Official Website

PFI Rating: 4.4/5

8. RoboForex ECN Account

RoboForex was founded in 2009 and is regulated by FSC in Belize. Compared to the regulation of other brokers on our list the Belize FSC is not considered a top-tier regulator.

RoboForex offers leverage up to 1:500 and has no minimum deposit. Through their ECN account, you get access to interbank liquidity.

The execution speeds are good, and the spreads are tight. The minimum deposit at RoboForex is $10.

RoboForex offers Forex, Stocks, Indices, ETFs, Commodities, Metals, Energy Commodities, and Cryptocurrencies.

On RoboForex Official Website

Compare ECN Brokers

Below, we compare brokers offering ECN broker accounts.

| Trading Platform | Pepperstone | FP Markets | Interactive Brokers | IC Markets | XM | FXTM |

|---|---|---|---|---|---|---|

| Founded | 2010 | 2005 | 1978 | 2007 | 2009 | 2011 |

| Regulation | ASIC, CySEC, FCA, SCB, DFSA, BaFin, CMA | ASIC, CySEC | SEC, CFTC, FCA, NFA | ASIC, CySEC, FSA, SCB | CySEC, ASIC, ESMA, BaFin | FCA, CySEC, FSCA, MiFID, FSA, BaFin, AMF, FCMC, AFM |

| Offering Of Investments | CFDs on Forex, Crypto, Shares, Indices, Crypto | Forex, Shares, Metals, Commodities, Indices, Cryptocurrency, Bonds, ETFs | Stocks, ETFs, Options, Futures, Currencies, Cryptocurrencies, US Spot Gold, Bonds, Mutual Funds, Hedge Funds | CDFs on Forex, Commodities, Indices, Bonds, Cryptocurrency, Stocks, Futures | Shares, Forex, Commodities, Equity Indices, Precious Metals, Energies, Stocks | Forex, Indices, Forex Indices, Commodities, Metals, Stocks |

| Minimum Deposit | $0 | $100 | $0 | $200 | $5 | $50 |

| Demo Account | Yes | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fee | $5 | $0 | 1 Free Withdrawal per Month | $0 | $0 | $3 for Credit Cards, $20 - $40 bank transfer, $0 for Skrill / Neteller |

| Inactivity Fee | $0 | $0 | No | $0 | $15 after one year then $5 per month | $5/month after 6 months |

| Deposit Methods | Credit/debit cards, Bank/Wire Transfer, PayPal, Neteller, Skrill, UnionPay | Credit Cards. Debit Cards, Bank Transfer, Ngan Luong, FasaPay, Online Pay, Broker to Broker, Neteller, Skrill, PayTrust, PayPal, Bpay, Poli | Bank Wire, Credit Cards, ACH, Mail a check, Rollover, Online Bill Pay, Trustee-to-Trustee, SEP Contribution | Credit Cards, Debit Cards, PayPayl, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Fasapay, Broker to Broker, Poli, Thai Internet banking, Klarna, Rapidpay, Vietnames Internet Banking | Bank Transfer, Credit Cards, Debit Cards, Electonic Wallets | Credit Cards, Debit Cards, e-Wallets, Bank Wire, Local Payment Solutions |

ECN Fees Compared

Compare the trading fees below to understand better how leading ECN accounts compare.

| Trading Fee | Pepperstone | FP Markets | Interactive Brokers | IC Markets | XM |

|---|---|---|---|---|---|

| EURUSD | Minimum from 0.0 and 0.17 average spread (Razor Account) Minimum from 0.6 and 0.77 average spread (Standard Account) | from 0.0 - 1.3 (average 0.2 pips) | Spreads | N/A | average 0.00017 |

| GBPUSD | Minimum from 0.0 and 0.59 average spread (Razor Account) Minimum from 0.6 and 1.19 average spread (Standard Account) | from 0.0 - 1.8 (average 0.7 pips) | Spreads | N/A | average 0.00021 |

| Apple Fees | 0 + market spread | Spread | $0 commissions | N/A | average 0.00021 |

| Tesla Fees | 0 + market spread | Spread | $0 commissions | N/A | Spread from 1.73 |

| Amazon Fees | min. 0.4 spread | Spread | $0 commissions | N/A | Spread from 5.85 |

| S&P 500 Fees | N/A | N/A | N/A | N/A | N/A |

| Options Fee | N/A | N/A | N/A | N/A | N/A |

| Mutal Fund Fees | N/A | N/A | N/A | N/A | N/A |

| ETF Fee | $0 | N/A | $0 commissions | N/A | N/A |

ECN Accounts for US Clients

Regulated ECN Brokers accepting US clients must be registered with the CFTC or NFA. These include Forex.com, IG, and ATC Brokers.

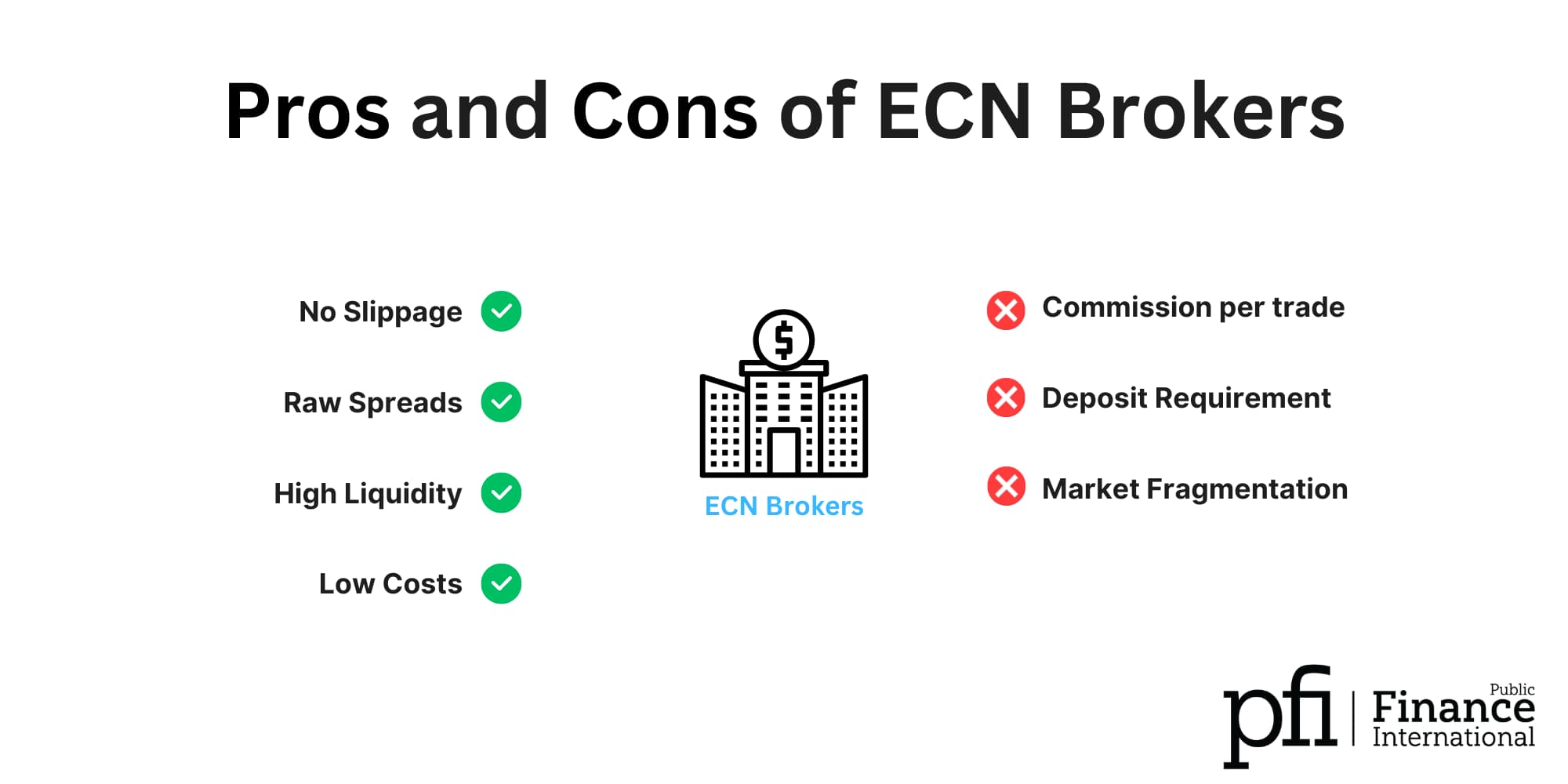

Benefits of using an ECN Account

So now you know what an ECN is and how it works, but what are the advantages of using this type of broker? We’ve made a handy list to help you out.

Transparency

ECN trading platforms consolidate market prices from liquidity providers from all across the globe. Because they do this in real-time, traders receive the same prices from the price feed. Traders can use this information to compare data on lot prices.

The broker cannot manipulate prices since the information is disseminated widely. Price and market manipulation is among the largest concerns many casual traders have about their brokers.

Direct Trading

ECN trading platforms do not trade directly with traders. They link traders with liquidity providers who offer various positions.

One advantage is that traders can take positions instantly rather than waiting for their broker to secure that position.

The best ECN brokers are not involved in either side of a trade, so they have no vested interest in the trader making or losing money.

Tighter Spreads

Because ECN accounts aggregate bid and sell prices from different market participants, such as investment banks and hedge funds, they can offer lower bid-ask spreads than other brokers.

As a hub for market players, traders will have access to liquidity providers asking for a range of prices. Some of these spreads will be higher than market standards; others will have lower.

Traders can choose the positions and spreads that best suit them from thousands of providers worldwide.

Disadvantages of ECN Accounts

Although an ECN account offers many benefits, there might be more expensive than a typical market maker broker charging spreads.

As a general rule, ECN brokers charge commissions for each trade placed. The ECN pricing model might favor traders with higher trading frequency and volume, while it might be more expensive for low-volume retail traders. The ECN commission ranges between $2 and $4 per traded lot.

Commissions vary depending on account types and depend on initial trading capital.

Further, opening a true ECN account through an ECN broker might require a higher minimum deposit than with a standard account.

ECN Accounts vs. Market Maker

Market Maker brokers – Dealing Desk brokers – operate oppositely to ECN accounts. Instead of decentralizing trade positions, the market maker model counter each trader's trade.

Market Makers are liquidity providers. They decide both the bid and sell price that is displayed to traders. The only thing that keeps Market Maker brokers from massively inflating their prices is a highly competitive market.

Market Maker brokers make money on the spread (the difference between the bid and ask price) at either end of the trade and whatever profits they earn during the trade.

Institutions like major banks and other large financial institutions are all Market Makers.

Difference Between ECN, STP, and Dealing Desk Broker

ECN and STP brokers are both examples of No Dealing Desk brokers. Essentially, they are not Market Makers and do not provide liquidity to their traders.

An ECN account link traders through a decentralized network to liquidity providers to execute trades.

Market Maker or Dealing Desk brokers “make” a market for their traders by setting bid and ask prices for instruments. They take the opposite side of each trade and provide liquidity directly to their clients.

STP Forex Brokers are another example of No Dealing Desk brokers. They are less common than an ECN account, but many traders prefer them for secure trades. The differences between ECN and STP brokers may seem small but crucial.

STP – Straight Through Processing – brokers do as their name implies. They pass orders from traders directly to liquidity providers in the market. Unlike ECN brokers, they do not provide traders with a massive list of all compatible liquidity providers in the market.

Using an STP model, traders compete with other traders rather than their brokerage.

Sometimes STP brokers absorb some or all of the liquidity from a trader’s position without passing it on to the interbank market.

How do you identify a true ECN broker?

Tre ECN brokers have variable spreads. If an ECN broker has fixed spreads, it is not a true ECN broker. It is mandatory for regulated brokers to state if they are a True ECN or ECN by association.

How to tell if a broker is a fake ECN broker

Every day, traders are becoming savvier about the unsightly business practices that some Dealing Desk brokers engage in. Because of this, many DD brokers try their best to make it appear that they are ECN brokers.

Some traders using DD brokers have noticed that prices reported in demo accounts vary from those listed on their live trading account. This is a sign that your broker is playing dirty, trying to make their platform more appealing to potential clients.

Firstly, users should read through the client agreement thoroughly. It may seem like a chore, but in the user agreement, the broker should state clearly whether they utilize ECN technology or other No Dealing Desk accounts.

As tempting as it may appear, ECN accounts will not offer fixed spreads. By their nature, ECN brokers have to offer variable spreads as the liquidity providers may change their prices at any time.

Next, see what your broker’s terms are around scalping. We’ll cover exactly what scalping is later in this article, but to put it simply: it’s a trading strategy that relies on trading large volumes over very short timeframes.

Because scalping is carried out in minutes or sometimes even seconds, Dealing Desk brokers tend to disallow this strategy. ECN accounts can execute trades at the fastest execution speeds and facilitate scalping without much issue.

Lastly, it’s best to research your broker extensively. Read as many reviews and articles about your broker before committing your money.

Are ECN accounts good for scalping?

ECN brokers are considered the best for forex scalping as they provide direct access to liquidity providers. This means traders get fast executions, no broker interference, best available prices and no slippage.

One of the reasons ECN brokers are becoming so popular with day traders is that they allow traders to use the scalping strategy. This term has earned an unfair association with people selling concert tickets at massively inflated prices. Still, it is a perfectly legal and ethical trading strategy that many traders use to maximize profits.

To use scalping as a viable strategy, traders should have access to tools such as live economic news feeds and accurate charting programs. It also requires quite a significant time investment as placing trades at the right time is crucial.

Scalpers trade by taking positions for very short periods. They earn profits by buying and selling securities and taking advantage of minuscule gains between 5 and 20 pips. This relies on the idea that multiple small profits are easier to attain than large ones.

ECN brokers facilitate scalping because of their automated execution. Because ECN brokers act as intermediaries between trade parties, they can execute thousands of trade orders every second.

Dealing Desk brokers will not allow scalping because of the calculating power needed to facilitate thousands of short-order trades.

Runner Up

PFI Rating 4.9

Best Overall

PFI Rating 4.9

Disclaimer: 76.6% of retail investor accounts lose money when trading CFDs with this provider

Low Spreads

PFI Rating 4.9

69.0% of retail investor accounts lose money when trading CFDs with IBKR.

Conclusion

The best ECN account is Pepperstone, followed by FP Markets and Interactive Brokers. We found these the best based on all things combined.