If you want to invest in shares and stocks in the U.K., invest in mutual funds, investment trusts, or ETFs (exchange-traded funds), you will need to open a trading account.

In this guide, we go over the Best Trading Platforms in the UK. We based our analysis on a variety of factors. We consider fees, security, ease of use, trading platform, regulation, customer support, and more. All the top trading platforms in the U.K. had to meet a certain threshold to be included in this list.

Table of Contents

- Top UK Stock Brokers 2024

- Best Online Trading Platform UK Rankings

- 1. eToro – Best Overall

- 2. AvaTrade

- 3. Interactive Brokers

- 4. Pepperstone

- 5. XTB

- 6. IG

- 7. Swissquote

- Other Brokers to Consider

- How to pick a share dealing platform?

- Online Trading in the UK

- Conclusion

- What's the best online UK online trading platform for social trading?

- What is the cheapest online trading platform?

- What is a free trading platform in the UK?

- Which UK trading platforms offer US shares?

- What is a trading platform where UK traders can buy Bitcoin?

- What is the leverage allowed on UK Platforms?

- Do I pay UK tax on share dealing?

- What is a self-select ISA?

- What types of assets can be held within a self-select ISA?

Top UK Stock Brokers 2024

- eToro – Best Overall

- AvaTrade – Best for Forex

- Interactive Brokers – Best for Market Access

- Pepperstone – Low Spreads

- XTB – Best for CFD trading

- IG – Great Platform

- Swissquote – Specialized services

Best Forex Broker

PFI Rating 4.9

76% of retail investor accounts lose money when trading CFDs with this provider.

Best Overall in UK

PFI Rating 4.9

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider.

Best Market Access

PFI Rating 4.9

69.0% of retail investor accounts lose money when trading CFDs with IBKR.

Best Online Trading Platform UK Rankings

Here are our rankings for 2023.

| Rank | Trading Platform | Our Score | Information | Minimum Deposit |

|---|---|---|---|---|

| #1 |  eToro | 4.9 | Best Platform for UK Trading Overall. Best in Class for Copy Trading. | $200 |

| #2 |  AvaTrade | 4.9 | Best Forex Trading Platform in the UK. | $100 |

| #3 |  Interactive Brokers | 4.9 | Best Platform For Investors in UK. Strong Regulation and Reputation . | $0 |

| #4 |  Pepperstone | 4.8 | Low Spread Broker in the UK. | $0 |

| #5 |  XTB | 4.5 | Best for CFD Trading. | $0 |

| #6 |  IG | 4.6 | Well-Established Broker. | $0 |

Below, we go in-depth into the Best Stock Brokers in the UK, starting with the best-rated eToro.

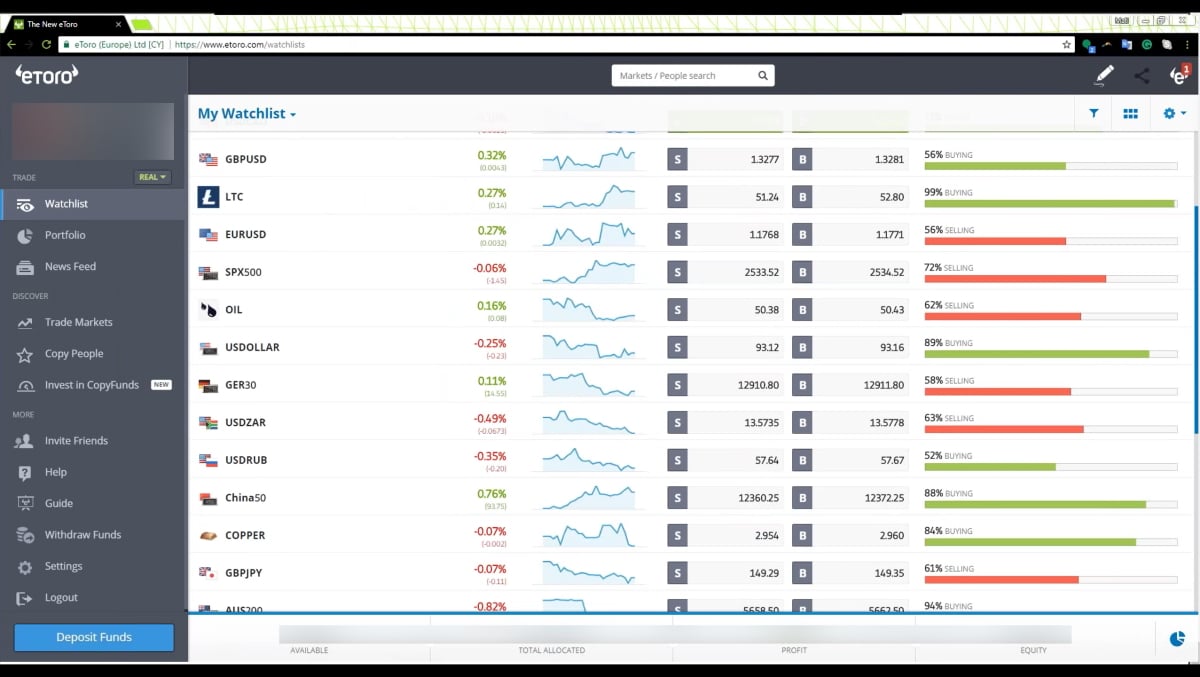

1. eToro – Best Overall

4.9/5

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider.

eToro is our top pick as the best online brokers in the U.K. in 2023.

eToro is a world-leading social trading broker and the best U.K. brokerage account that offers zero-commission trades for stock to its clients. This makes it an excellent choice for UK residents seeking to invest in a wide range of markets.

This online share broker has a user-friendly, free trading platform. This makes eToro attractive for beginners who may not be used to complex trading central environments such as those featured by Metatrader or other advanced platforms. eToro offers a demo account or practice account. Demo accounts are an excellent way for traders to try out the platform before investing.

The social-media-like environment provided by eToro’s interface allows traders within the web trader platform to connect and exchange ideas, and experiences, and copy their portfolios by using a tool known as Copy Trader.

Available Markets

eToro allows traders to buy shares and sell shares of thousands of companies worldwide listed in 17 different exchanges, including the New York Exchange, the London Exchange, and the Frankfurt Exchange.

eToro offers the following markets:

- 173 exchange-traded funds

- Currencies

- Commodities

- Indices

- Cryptocurrencies

Fees

eToro charges 0% commissions for trading selected real shares. Other fees may apply, including inactivity fees and overnight fees. There are no management or ticketing fees. Stocks and shares can be traded direct, or they can be traded via CFDs. eToro’s fees for CFDs are low compared to other share dealing accounts.

| Pros | Cons |

|---|---|

| Regulated by tier-1 jurisdictions, including the United Kingdom and Australia (Australian Securities and Investments Commission) | Market Research Tools |

| You can open a share dealing account with eToro in a few minutes by registering online | Education |

| Zero-Commission Real Stocks | A $5 platform fee applies to each withdrawal, and there’s a minimum amount of $30 per withdrawal |

| The social trading/copy trading feature | |

| 13 years of positive track record | |

| One of the most user-friendly platforms in the industry and it features more than 70 charting tools | |

| No Deposit Fees |

2. AvaTrade

4.9/5

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AvaTrade is our recommended broker for Forex trading in the UK. AVA Trade EU Ltd was founded in 2006 and provides CFD and forex trading services. The firm is headquartered in Dublin, Ireland, and its holding company is registered in the British Virgin Islands. AvaTrade is serving more than 200,000 active investors and executing over 2 million monthly trade orders.

AvaTrade features a straightforward account opening process and the possibility to use third-party stock trading platforms such as Metatrader 4. There are no deposit or withdrawal fees. Bank account transfers and credit card deposits are available. It is possible to open a demo account and test the platform.

Available Markets

There are a variety of financial assets available through CFDs.

The portfolio of CFDs available on AvaTrade includes:

- 56 Currency Pairs

- 17 Cryptocurrencies

- 630 individual stock CFDs.

- 20 stock index CFDs.

- 2 Bonds CFDs.

- 5 ETF CFDs.

- 17 Commodity CFDs.

Fees

Avatrade lowered its fees in November 2019. The inactivity fee is charged if the user doesn’t log into the share trading platforms account for three months ($50 per quarter).

| Pros | Cons |

|---|---|

| Authorised and Regulated by top-tier authorities | Limited customization for the web-based platform |

| Great charting and trading tools | |

| Great fees when considering all costs | |

| AVA Trade EU Ltd is authorised and regulated by the Central Bank of Ireland (No.C53877) | |

| AVA Trade Ltd is regulated by the B.V.I Financial Services Commission (No. SIBA/L/13/1049) | |

| Serving over 200,000 clients across the globe | |

| Social trading available | |

| Five Currencies Available | |

| No minimum withdrawal amount | |

| One of the Apps (AvaTradeGO) |

3. Interactive Brokers

Interactive Brokers fees charged for shares and ETFs are lower than average, and this stock broker (UK-based) offers a neat web platform and trading app for its users. IBKR doesn’t require a minimum deposit to open an IB account, though a minimum of $2,000 is required to trade on margin.

Another great thing about Interactive Brokers is that it is at the top and so are their educational materials. They are offering investors the opportunity to learn from a wide range of tools, including webinars, an in-house academy, and a series of short videos that cover various topics about online trading. IB charges no deposit fees, and the first withdrawal of each month is free.

Available Markets

Interactive Brokers provide investors with access to 140 exchanges worldwide, making it the biggest investment option for stocks in the industry.

Interactive Brokers covers 78 stock exchanges and offers 13,000 different ETFs, and allow retail investors to pour their money into the stock market through fractional shares, which entitles the investor to a portion of a stock in a business that has a high share price.

Fees

IB’s fees for share trading are low compared to its competitors as this brokerage firm charges $0.005 per US-listed share with a $1 minimum and a maximum platform fee of 1% of the value of the trade.

On the other hand, IB offers two types of plans for stock traders. The fixed-rate plan charges a flat fee for share trades, while the tiered plan adjusts the fees depending on the monthly volume of trades. A high volume entitles the trader to a lower fee.

It is important to note that the cost of trading shares in other markets around the world is lower compared to other brokerage firms, but higher than IB’s fees for US-listed stocks. Generally, it ranges from 0.1% to 0.2% for trading shares in a minor stock market.

| Pros | Cons |

|---|---|

| Incredible portfolio covering basically all financial instruments and a wide range of financial markets | Opening an account with IB takes longer compared to other platforms |

| Interactive Brokers is regulated by the US Securities and Exchange Commission (SEC) and the FCA (UK) | Somewhat complex desktop share dealing platform |

| Great research tools available | |

| $0 Minimum Deposit | |

| No deposit fees are charged and the first withdrawal of the month is free | |

| Education |

4. Pepperstone

Pepperstone is a world-renowned online broker founded in 2010 and headquartered in Australia. Top-tier regulators regulate them, such as ASIC, CySEC, FCA, SCB, DFSA, BaFin, and CMA.

The Pepperstone minimum deposit in the UK is £0. They charge a £5 withdrawal fee and no inactivity fees.

They are best known for their low spreads and great educational resources. Peppersotne offers MetaTrader 5, MetaTrader 4, cTrader, and social trading through DupliTrade.

Available Markets

Pepperstone offers Forex, Indices, Commodities, Share CFDs, ETFs, Currency Indexes, and Cryptocurrencies.

Fees

If you're looking for the cheapest forex trading platform, Pepperstone is one of the best forex brokers. It has low fees and some of the lowest spreads in the industry. For example, trading the GBPUSD pair costs a minimum of 0.0 and 0.59 average spread (Razor Account) and a minimum of 0.6 and 1.19 average spread (Standard Account).

Fees charged by Pepperstone are on the lower end. This is useful for day trading. Compared to the industry average, the trading fee for a £2,000 long position on the S&P 500 index held by a week may generate a $2 platform fee. The same position for the Europe 50 index may generate a $1.6 fee.

This is for sure an important competitive advantage of Pepperstone. The fees may be lower for high-volume day traders who sign up for their Razor account.

| Pros | Cons |

|---|---|

| Low Spreads | Bank Withdrawal Fee Outside EU/Australia ($20) |

| Copy Trading Through cTrader | |

| Regulation | |

| Execution speeds |

5. XTB

XTB is one of the UK's best CFD brokers, and it is a company listed on the Warsaw Stock Exchange and regulated by the Polish Financial Supervision Authority (KNF). This CFD online broker is best known for charging low fees for stock index CFDs and requiring a low minimum deposit of $250.

XTB allows specific European clients to trade real stocks and ETFs, and, unfortunately, UK residents are not among those permitted.

The wide selection of stock CFDs XTB provides should compensate for such a disadvantage.

Available Markets

XTB offers 1,700 different stock CFDs that cover a wide range of international markets. XTB offers a portfolio comprised of 103 ETF CFDs and 42 stock index CFDs.

For countries that are allowed to, this brokerage firm offers access to 17 different stock markets and 170 real ETFs.

Fees

The fees are estimated as the average spread cost associated with each CFD transaction.

In this context, XTB fees are on the low end compared to the industry average. They are charging an average spread of 0.6 for S&P500 CFDs and 2.2 for Europe 50 CFDs.

XTB offers two types of accounts – Standard and Pro – designed with different cost structures.

| Pros | Cons |

|---|---|

| XTB offers a wide range of stock, stock index, and ETF CFDs | Real shares cannot be traded |

| There are two types of accounts that offer different fee structures | |

| Opening an account is very easy and can be done online | |

| Withdrawals are free and no deposit fees are charged | |

| User-friendly and easy to use interfaces | |

| Research tools offered by the xStation 5 platform are decent and include a great news flow, trading ideas, and 35 technical indicators |

6. IG

IG is an established online trading platform, regulated by many reputable regulators worldwide, including the FCA. UK residents have the possibility of trading real shares online with IG, along with many other of its products, including CFDs, Forex pairs, and options. IG’s interface is easy for beginner traders, and it features a decent amount of research tools and educational materials, including platform tutorial videos, webinars, and educational videos.

The minimum deposit is $300 to open an IG account if the deposit is made via credit, debit card, or PayPal. A $0 minimum is required if the payment method is a bank account transfer.

Available Markets

IG’s portfolio of CFDs comprises 68 stock indexes, 10,500 stocks, and 1,900 ETFs, while UK residents can buy or sell shares from 8 different stock markets and almost 2,000 ETFs.

Fees

Fees for stock CFDs with IG are higher than average, but stock index CFDs can be traded at a low cost.

On the other hand, the minimum fee for share trades varies depending on the volume of trades per month. They start at £8 per trade if the trader made two trades the previous month and £3 if more than three trades were made.

For U.S. shares, the cost of trading is $0.02 per share with manual currency conversion and free if the trader made more than three trades the month before with instant currency conversion.

For shares listed in other stock exchanges around the world, the cost per trade is 0.10% of the value of the trade.

For ETFs, the cost varies from 0.17% to 0.19% of the value of the trade.

| Pros | Cons |

|---|---|

| No withdrawal fees and no deposit fees charged | Phone support is reportedly lacking in quality |

| Great mobile trading app | No fundamental data is available for individual shares |

| Low fees to trade real shares and ETFs | |

| A wide selection of stock CFDs and real stocks to trade | |

| Research tools include trading ideas and high-quality news flow | |

| An account can be opened with $0 if the payment method is a bank transfer |

7. Swissquote

Swissquote provides a wide range of services aside from stock trading, and it is mainly targeted at asset managers and high-net-worth clients. Swissquote considers itself a “global trading platform” as it serves countries on all continents of the world, and it is one of the best choices for sophisticated investors who are willing to pay above-market fees to buy shares online to enjoy the VIP service offered by this platform.

Available Markets

Swissquote offers trading on 60 exchanges around the world, which puts it at the top of the list in terms of portfolio variety.

Swissquote offers 1,500 different ETFs from different countries and exchanges and allows investors to trade penny stocks listed in the US stock market.

Fees

Trades with Swissquote are expensive compared to other platforms available in the UK. The reason for that is that this share dealing platform caters to sophisticated investors who are seeking high-quality service, not trying to save a bit on transaction costs.

The volume of each trade affects the ultimate amount paid in fees which makes it difficult to determine a referential fee per trade. The range goes from $9 for trades valued at $500 or less to $190 for trades valued at $50,000 or less for major markets.

For minor markets or less liquid markets, Swissquote charges a commission fee per stock starting at 0.50%.

| Pros | Cons |

|---|---|

| Incredible portfolio covering more than 60 stock exchanges around the world | High stock and ETF fees |

| No inactivity platform fee | Credit/debit card withdrawal is not available |

| This platform is backed by a bank and it is regulated by various tier-1 jurisdictions | Charges a $10 fee per withdrawal |

| No minimum deposit required | |

| Many base currency accounts available | |

| Wide range of available educational videos | |

| Great user-friendly platform and mobile app |

What are the best platforms for Options Trading in the UK?

The best options trading platforms in the U.K. are:

- Interactive Brokers – Best Options Trading Platform in the UK Overall

- AvaTrade – Best Options Trading App

- Firstrade – Best Professional Options Trading Platform

- Tradestation – Good Options Trading Fees

What is the cheapest UK online trading platform?

One of the best cost-effective share dealing providers is Freetrade which offers zero-commission trading. It also guarantees free stock when you open an account and deposit for the first time. Your stock's value can be anywhere from £3 to £200, and this is what possibly makes Freetrade a great option when it comes to cheap online trading platforms.

What Are the Best Trading Apps in the UK?

Most online brokers offer trading apps, enabling traders to trade on the go. This is a list of the best mobile trading apps in the UK:

- AvatradeGO – Best trading app UK

- eToro – Best trading app for beginners in the UK and copy traders

- Interactive Brokers App (IBKR Mobile)

- XTB xStation trading app

Which trading platforms are the best for beginners in the UK?

The best trading platforms for beginners in the U.K. should cater to beginner traders. The platform should be easy to use and have low trading fees. Based on that, the best brokers for beginners in the U.K. are:

- eToro – Best Platform for Beginners overall

- AvaTrade – Best Trading App for Beginners

- Interactive Brokers Global Trader – Best Market Access Beginner Trading Platform in the UK

Other Brokers to Consider

- Hargreaves Lansdown – this Bristol-based financial service company offers funds and share dealing accounts to retail investors. Hargreaves Lansdown is listed on the LSE and is part of the FTSE 100 Index. The HL platform allows investors to hold multiple assets under a single account. UK investors have ISA, SIPP, fund and share dealing accounts available through one interface.

- Saxo Markets – this Danish investment bank offers its online trading services through Saxo Markets UK Ltd, based in London. Saxo Markets was founded in 1992 and offers online brokerage services to clients in 180 countries across the globe. Saxo Markets offer their platform on a white-label basis to over 100 financial institutions. Saxo Markets is well-known in the industry and has received multiple awards.

- Interactive Investor – based in the U.K., part of Interactive Investor Limited, this online investment service provides financial information and is the largest flat-fee broker in the UK. Interactive Investor serves more than one million users.

Selecting the best U.K. trading platform will depend on your personal circumstances – your financial goals and aspirations. For example, if you're saving for retirement, you will need a SIPP account. However, if you're looking for a tax-efficient way to grow your wealth, you will require a Stocks and Shares ISA, and then you will need to ensure that the dealing platform you choose has a suitable range of investment options as well as compare the prices charged by different providers.

When picking a U.K. trading platform, you should consider the following factors:

- Available stocks – each U.K. broker has a specific list of stocks and shares that you are allowed to trade depending on their coverage and the degree of access they provide to global exchanges. Some do not offer the possibility of buying shares directly, as you can only trade them via CFDs, which are financial contracts that do not entitle the holder to any kind of ownership of the underlying shares.

- Margin accounts and leverage – a margin account allows you to take on debt to trade U.K. shares online, and the level of leverage may be different, so you should make sure the best brokerage U.K. firm you choose offers you the leverage ratios you are looking for.

- Customer support – customer support is something you don’t think you need until you run into an issue. For that reason, best-rated stock platforms offer top-notch customer service to address any issue investors may face during their journey.

- Types of orders – having various types of trade orders available is a positive feature. It allows you to prevent losses and lock in profits by using certain price points at which you can exit a given position. These orders can include stop-loss orders, limit orders, market orders, stop-limit orders, AON orders, IOC orders, take profit and others.

- Security – your money and your personal information should be safe from unauthorized access. You should make sure the company has a positive track record in this particular topic.

- Research tools – you may not have the best idea every single day, and that’s when research tools are useful. Your broker should offer certain technical analysis tools. Best platforms offer market news, real-time data and real-time alerts.

- Education & training materials – the availability of educational material from your online brokerage firm can be a great asset to help you in improving your skills and ultimately the profitability of your trades.

- Costs – each brokerage firm has its own platform fees and commission structure and you should understand how much you will be paying every time you buy shares and stocks.

- Interface and ease of use –traders spend a lot of time in front of the computer screen analyzing charts and looking at different kinds of information before making trades. For that reason, a user-friendly interface is an important feature your broker should be able to offer to trade stocks online. The

- Mobile app – smartphones have revolutionized the online trading industry. Any broker that earns a fee should be able to provide a decent app for traders to be able to trade shares online on the go.

- Extra features – each online stock broker has its own way of presenting itself to traders as the ‘best.’ They often do this by introducing some convenient features their competitors do not offer.

Online Trading in the UK

The FCA (Financial Conduct Authority) regulates online trading in the UK. The FCA oversees the financial markets in the United Kingdom. Currently, the FCA oversees more than 50,000 financial services and online brokers.

How to verify regulation in the UK?

To verify whether a broker is regulated by the FCA, simply visit the official website and perform a search. You can search by their regulation number or company name.

How to Start Trading With a UK Stock Broker

Once you've chosen the best UK broker for your trading needs, you will need to go through the process of opening an account, making a deposit, and placing your first trade. Here's how you can start the process in a few simple steps:

- Open a trading account. The first step is to open a free brokerage account on an FCA-regulated platform. Enter your name, your email address, and select your password. Make sure to read the terms of conditions and privacy policy. Once you've done that, accept them to proceed.

- Confirm your identity. An FCA-regulated trading platform will require you to provide your proof of identity. Identity verification is needed to meet anti-money laundering (AML) regulations.In order to do this, you will need to upload:• Valid ID card, passport, or driver's license• Bank account statement or a utility bill (issued within the last 3 months)

- Make a deposit. You can use a demo account first to get comfortable with how the trading platform operates. Once you're ready to trade with real money, you can make your first deposit using one of the following payment methods:• Visa• Mastercard• Maestro• Bank transfer• PayPal• Skrill• Neteller

- Search for a trading market. As soon as your deposit is processed, you can start looking for a trading market. Click on the ‘Trade Market' buttons on the dashboard to see supported assets. Once you've found an asset you want to trade, search for it.

- Place a CFD trade. Next to your selected asset, you will find the “Trade” button. Click on it and fill in the following information in the order box:• Buy/Sell: If, in your opinion, the asset will rise in value, click “Buy.” On the other hand, if you think it will fall in value, place a sell order.• Amount: Enter your stake value in the ‘Amount' box• Leverage: Apart from digital currencies.

How Do You Know If an Online Broker in the UK Is Safe?

There are various ways to evaluate this.

You should ensure the investing broker (UK) is regulated by a tier-1 financial jurisdiction such as the United States, Singapore, Australia, or the United Kingdom.

It would be a plus if the brokerage is registered and licensed by the Financial Conduct Authority (FCA), the UK’s financial regulatory body.

You can review an online broker’s credibility by checking how other traders have reviewed their services.

Certain online share brokers (UK) are stock exchange-listed companies, which adds more credibility to them as listed companies have to go through more intense regulatory scrutiny.

You should understand that by stock trading, your capital is at risk as you can lose your entire balance due to unfavourable outcomes from your trades. Losing money by trading stocks is not something your broker can or is obligated to prevent.

Is It Risky to Trade Stocks Online in the UK?

If you're a trader, the biggest risk you take is making bad trade decisions. This may be caused by the fact that you're not educated well enough on how to trade stocks, or you go for schemes that tell you you should get a lot of money back very fast.

Apart from avoiding those “get rich quick” schemes, there are also other ways to manage the risk related to trading online:

• Operate with a trading strategy. Make sure you're consistent with a strategy rather than “going with the flow,” as having a structured system is a key factor when it comes to trading.

• Manage your money properly. Have a clear understanding of how much of your funds you're willing to risk with each pot, as well as how to use stop losses. It's much easier to lose money than it is to make it back. The common rule of thumb is that for every pound to lose, you have to invest double the amount to make it back.

How much capital do you need to start online trading?

You can start investing even with as little as £1 on your selected online trading platform. The starting amount will depend on the platform you choose and the minimum investment amount they require. Make sure to familiarize yourself with the fees associated with your selected online trading platform, as they can soon affect your investment capital if you're starting with a small amount.

What do I need to open an UK account with a stock broker?

In order to open an account with an online trading platform in the UK, you will need to provide certain documents depending on the trading app you choose.

Most UK trading websites will require:

• Your full name

• Your valid ID document

• Your e-mail address

• Your phone number

• Your national insurance number

• Your bank account details

Conclusion

There are many stock trading UK platforms that offer various beneficial features for both beginner and experienced investors.

Above, we have listed 8 of the best shares trading UK platforms that will meet your investment needs, no matter your circumstances and preferences.

If you're looking for a social UK trading platform that will allow you to make commission-free trades is eToro, which also works exceptionally well for trade mirroring. Among the best investing platforms (UK) that feature great speed, low prices, and clear regulations, as well as have many handy tools are, for example, AvaTrade and Pepperstone. If you're only just beginning your journey with online trading, Hargreaves Lansdown will be a suitable alternative for you.

There are also many other options for you to choose from that will certainly help you reach your investing goals. Select the best UK trading broker today and start your journey with investing.

The best trading platforms for social trading is eToro which has an array of social features. These include, for example, copy trading, which allows you to copy successful traders. What's more, The Popular Investor program encourages successful traders onto the trading platform by incentivizing them with rewards of up to 2% of their assets under management.

What is the cheapest online trading platform?

One of the best cost-effective share dealing providers is Freetrade which offers zero-commission trading. It also guarantees free stock when you open an account and deposit for the first time. Your stock's value can be anywhere from £3 to £200, and this is what possibly makes Freetrade a great option when it comes to cheap online trading platforms.

What is a free trading platform in the UK?

The best place to buy stocks (UK) is eToro which is the best broker (UK-based) that offers commission-free trading. It provides zero commission on traditional stocks, EFTs, cryptocurrencies, as well as all CFD markets. This online broker (UK-based) also waives the 0.5% stamp duty tax, payable on UK stock purchases.

Many stock brokers (UK-based) now offer access to US shares. However, as most of the UK stock platforms charge premiums when you buy non-UK assets, you may need to keep an eye on the additional fees. However, eToro allows you to buy hundreds of US shares on a commission-free basis, therefore, it might be the best UK broker for US stocks.

What is a trading platform where UK traders can buy Bitcoin?

Even though the FCA banned crypto-CFDs in January 2021, you are still able to buy digital currencies traditionally. eToro is the trading website (UK) that offers Bitcoin and over 60 other cryptocurrencies, with the minimum investment starting at only $10.

What is the leverage allowed on UK Platforms?

Best brokerage accounts (UK-based) are capped to leverage of 1:30 on main currency pairs and less on other assets. In order to trade stocks with leverage, you will need to use a platform that offers CFD markets.

Yes, if you have any gains from share dealing on a UK trading platform, you are required to pay tax at your normal rate unless you are share dealing from within a tax wrapper.

What is a self-select ISA?

A self-select ISA is a type of investment ISA that gives you the freedom to select the specific investments that make up your portfolio. Depending on the provider you pick, you'll have the chance to either choose individual investments and manage your portfolio or select from a variety of ready-made portfolios.

What types of assets can be held within a self-select ISA?

When you open a self-select ISA with an online share trading platform, you can invest in various assets. These assets include stocks and shares, funds, gilts, unit trusts, Investment Trusts (ITs), Exchange-Traded Funds (ETFs), Open-Ended Investment Companies (OEICs), and structured products.