Capital.com is an award-winning broker that was founded in 2016 and is headquartered in the UK, Australia, Cyprus, and Belarus. It has licenses from the FCA, CySEC, ASIC, and NBRB. The broker is dedicated to providing the greatest trading experience ever through its unique, AI-enabled technology. It's a fast-emerging leader in the Europe-based leveraged trading market, known for its wide range of assets and high-quality 24/7 customer service.

But is Capital.com really the best out there? We’ve run the reputable broker through our criteria to provide you with a clear answer, and by the end of this unbiased review, you should be able to make a decision on whether you should invest with Captial.com or look for a better alternative.

Summary

Capital.com has proven to be one of the most competitive, reliable brokers, with fewer major flaws than many other brokers. Some of the many aspects to love about it are that it’s heavily-regulated, it has a low minimum deposit ($20), AI technology-driven trading platform, attractive fees, highly competitive spreads, useful educational material, and excellent customer support.

On the more negative side, Capital.com is not available for US-based clients. It also has overnight fees and an outdated desktop platform with low security.

Overview

Here is an overview table of the main features of Capital.com.

| Platform | Capital.com |

|---|---|

| Founded | 2016 |

| Headquarters | UK, Australia, Cyprus, and Belarus |

| Regulation | FCA, CySEC, ASIC, and NBRB |

| Demo Account | Yes |

| Islamic Account | No |

| Minimum Deposit | $20 |

| Base Currencies | USD GBP, EUR, AUD, and PLN |

| MetaTrader 4 | Yes |

| Inactivity Fee | No |

| Offering Of Investments | CFD ( index, crypto, equity, commodity, forex), Stocks |

| Platforms | Web, desktop, mobile |

| Mobile Apps | Android and iOS |

| Payment Methods | Credit/Debit Cards, Wire Transfer, Neteller, Skrill, GiroPay, UnionPay, Apple Pay and WorldPay, iDeal, Multibanco,Sofort, Asian online banking, Qiwi, Przelewy24, and WebMoney |

| US accepted | No |

| Customer Service | Live chat, phone, email, webform, WhatsApp, Messenger, Facebook, Viber, and Telegram |

| Our Score | 4.6/5 |

Pros and Cons

Capital.com has a lot more pros than cons, no one can argue with that. In the following table: we summarized all the aspects where Capital.com excels as well as the aspect where it falls short:

| Pros | Cons |

|---|---|

| Well-regulated by reputable authorities | High fees for stock index CFD |

| Negative balance protection | You may not find smaller currencies |

| AI technology-driven trading platform | No price alerts |

| Commission-free real stocks | Low customizability of workspace and charts |

| Low fees for forex CFD | There’s no fundamental data |

| Low minimum deposit | Outdated desktop platform with low security |

| No inactivity fee | Face/Touch ID login on mobile app (only on iOS) |

| No withdrawal fees | The phone support can be unresponsive |

| No deposit fees | Doesn’t accept clients from the US |

| Demo account | It’s not listed on stock exchange |

| Education | Doesn’t hold a banking license |

| Hedging and risk management tools | Overnight Fees |

| Fast order execution | |

| Competitive Spreads | |

| Fully-digital and fast account opening process | |

| Clear and transparent fee report | |

| User-friendly web and mobile trading platform | |

| Great charts and market analysis | |

| Supports many languages | |

| Diverse options to contact customer support |

Capital.com Compared to Similar Trading Platforms

There are many good brokers out there that strongly compete with Capital.com, the broker outperforms them in some aspects, but falls behind in other ones. Check the following table to get a bigger idea about how Capital.com compares to five of the best brokers in the industry.

| Trading Platform | Capital.com | Currency.com | Binance | Trading 212 | Gemini | eToro |

| Founded | 2016 | 2018 | 2007 | 2004 | 2014 | 2007 |

| Minimum Deposit | $20 | $5 | $10 | $0 | $0 | $10 - $10,000 |

| Regulated | Yes | Yes | Yes | FCA, FSC, CySEC | Yes | ASIC, FCA, CySEC, MiFID |

| Inactivity fee | $0 | N/A | $0 | N/A | Yes | $10/month (after 12 months of no login activity) |

| US-Accepted | No | No | Yes | No | Yes | Yes |

Account Opening

Capital.com offers new users a smooth and quick account opening process. To open a Capital.com account, go to their official website or download the mobile app and fill out a registration form you’ll be asked to provide personal information (your name, phone number, nationality, place of birth, date of birth, and country of residence). You’ll have access to a genuine account in the currency you picked at registration and a demo account once you finish the registration process.

To start trading with a real money account, you must first fund and verify it. The verification process is similar to other trading platforms and involves uploading all the needed documents.

Account Types

You have access to the same CFD trading account type that Capital.com offers to all clients. Individual accounts are available as standard accounts on Capital.com. You can also create a corporate account, but you'll have to contact customer service to do so. Capital.com divides its clients into 2 categories: retail and professional. You start off as a retail client, but you can upgrade to a professional client later on.

Many clients will use the broker to trade CFDs because it has an attractive minimum deposit of $20, which makes Capital.com’s trading account one of the most affordable accounts compared to rivals.

Qualifying clients at Capital.com can upgrade to a professional account, and clients from the UK can choose a tax-free spread betting account. However, you must ask yourself first whether you meet the criteria for a professional account, which grants you more leverage in exchange for a lower level of protection, and if you're a UK-based or Ireland-based client who’s qualified for a tax-free spread betting account.

Capital.com also provides a share investing option, which is suited for long-term strategies that do not require the use of leverage. Negative balance protection is guaranteed for retail accounts, although leverage is limited to 1:30. On the other hand, professional traders have larger leverage, but negative balance protection is limited to 1:50, making them risk losing more than their deposit if they go over that.

Of course, Captial.com provides new users with a risk-free demo account that comes with $10.000 in virtual funds. This gives you the opportunity to introduce yourself to the broker and test your trading strategies to see if the broker fits your trading needs. Bear in mind, though, that demo accounts can lead novices to make poor trading decisions, especially if the account virtual funds are large. It may also result in false expectations about the trading environment.

Finally, Islamic accounts are not available at Capital.com.

Fees

Captial.com does not charge commissions. The broker has tight spreads (as low as 0.6 pips for its normal retail account) and fast execution so you can maximize your profit.

Capital.com’s leverage is 30:1. However, not all traders will enjoy the broker’s overnight fees.

Capital.com applies swap rates on the position value for commodities, Forex, and indices. Swap rates for some asset classes are below the industry average and only apply to the borrowed amount, resulting in a less pricey long-term trading.

Because there are no currency conversion fees, trades quoted in a currency other than the account base currency are less expensive, which is a significant advantage when trading Forex.

Capital.com offers competitive pricing, and it’d be even better if they added a volume-based reward program to reduce trading costs even more.

Deposits and Withdrawals

You get to pick from five different base currencies at Capital.com, which are USD GBP, EUR, AUD, and PLN. You’re not required to pay a conversion fee if you fund the trading account in the same currency as the bank account, or trade products in the same currency as the trading account base currency.

With Capital.com, you can make deposits and withdrawals using a wide variety of methods, such as Credit/Debit Cards, Wire Transfer, Neteller, Skrill, GiroPay, UnionPay, Apple Pay and WorldPay, iDeal, Multibanco,Sofort, Asian online banking, Qiwi, Przelewy24, and WebMoney.

Only money from accounts in your name can be deposited and withdrawn.

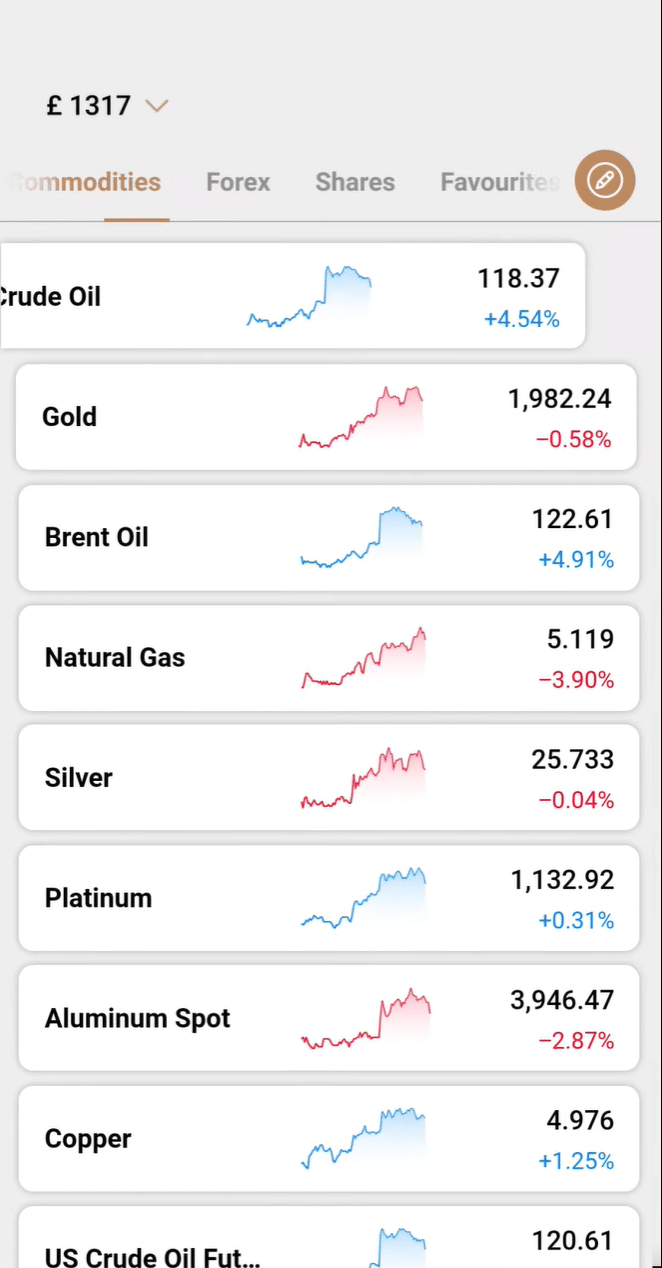

Tradable Instruments

Capital.com boasts a good variety of offerings. It’s also greatly exposed to the Crypto and Forex markets, which is not always a plus for online brokers. Exotic currency pairs such as the Belarusian Ruble, Mexican Peso, Thai Baht, Hungarian Forint and more are available on the broker. Most clients will find a great selection of equity CFD at Capital.com, which includes mid-cap and large-cap companies.

Check out the below list to have a better idea about the offerings of Capital.com:

| Cryptocurrency Pairs | 205 |

|---|---|

| Currency Pairs | 138 |

| Equity CFDs | 3646 |

| Index CFDs | 23 |

| Commodities and Metals | 19 |

| ETFs | 0 |

| Bonds | 0 |

Although the asset options are far more diverse than industry rivals, it’d be great if Capital.com provided small-cap alternatives and ETFs.

Trading Platforms

Capital.com offers you with a technology-driven web trading platform as well as an excellent mobile trading app. The popular MetaTrader4 platform is offered as a web-based platform, desktop version, and a mobile app.

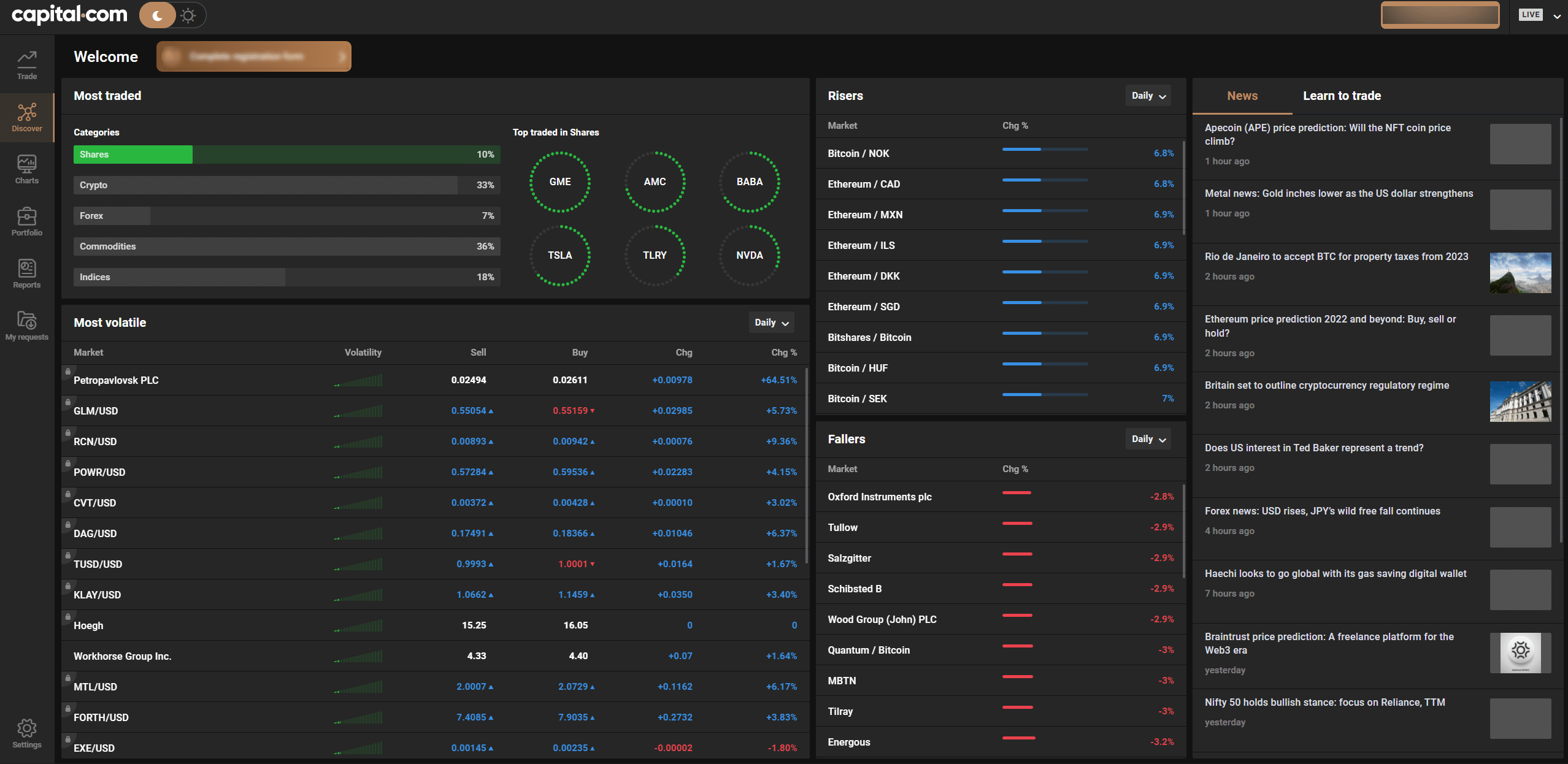

Web Trading Platform

With the web-based version of Capital.com, you'll benefit from actionable trading ideas, in-depth technical analysis, multi-chart toggling, AI-powered post-trade behavioral analysis, financial articles, personalized watchlists, and risk management tools.

All of the essential features a trader could look for, such as search and portfolio reports, are available in Capital.com. The broker provides easy-to-understand portfolio and fee reports. You can find them under the ‘Reports' tab and send them to yourself in an email or download them as a CSV file.

You can access the web-based trading platform in a variety of languages, including English, Swedish, Dutch, German, Italian, Spanish, French, Polish, Arabic, Chinese, Indonesian, Vietnamese, Russian, Norwegian, Malaysian, and Thai.

On the less positive side, there are no MT4 add-ons, VPS hosting, or API trading. Plus, you can't customize the platform to your own preferences or set price alerts and notifications.

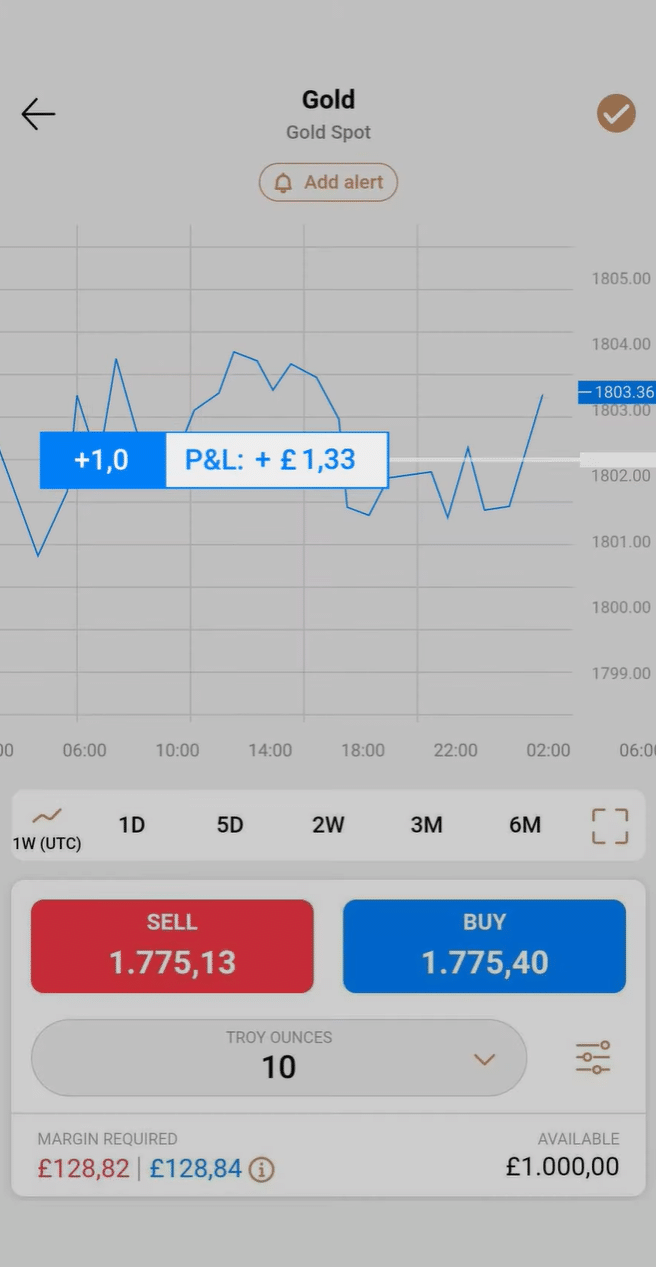

Mobile App

Capital.com has a great mobile app that stacks up to their web-based platform. In fact, the mobile trading platform supports a far larger number of languages than the web platform does, such as English, Danish, German, Bulgarian, Czech, Greek, Dutch, Estonian, Italian, Latvian, Lithuanian, Finnish, French, Croatian, Hungarian, Portuguese, Romanian, Russian, Thai, Vietnamese, Arabic, Norwegian, Polish, Slovenian, Spanish, Swedish, Slovakian, Malaysian, Chinese, Indonesian.

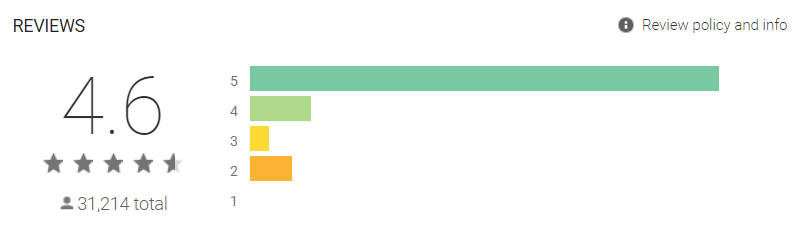

Their trading app has a 4.6/5 rating from 31,214 reviews on Google Play:

Unlike the web-based platform, you can set alerts and notifications on this mobile-based platform. Just choose the asset and select the price level for which you want to get notifications.

It’s an easy-to-use mobile app and you won’t have hard times learning about all of its capabilities and functions. It also has a secure two-step login process, which assures traders that they won’t easily get hacked. On iOS devices, you can enable biometric authentication.

Desktop Platform

Instead of building an in-house desktop platform, Capital.com uses the popular MetaTrader4 (MT4). The desktop platform is highly customizable and both the position and size of the tabs can easily be changed.

Unfortunately though, this platform is full of flaws, one of them is that it doesn’t offer a two-step login process, which is quite risky. Another drawback is that the platform is outdated and you can’t find all of its features as easily as you can with the web-based and mobile platform.

The languages available in the desktop trading platform are English, Bulgarian, Danish, Dutch, German, Estonian, Farsi, French, Spanish, Swedish, Greek, Arabic, Hebrew, Hindi, Croatian, Czech, Hungarian, Ukrainian, Uzbek, Indonesian, Italian, Persian, Polish, Japanese, Korean, Latvian, Serbian, Lithuanian, Chinese, Malay, Tajik, Mongolian, Portuguese, Romanian, Russian, Slovak, Slovenian, Vietnamese, Thai, and Turkish.

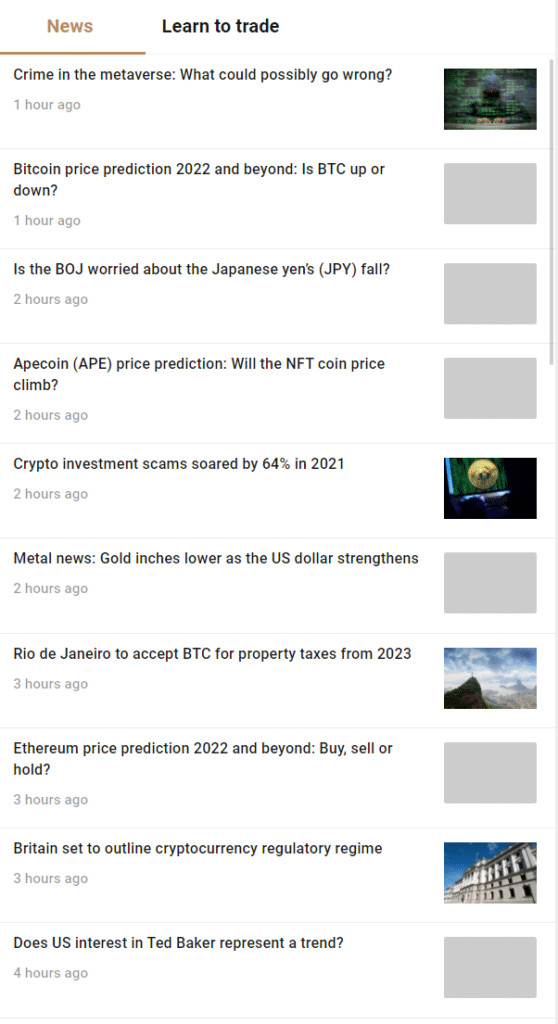

Research

While Capital.com does not offer trading ideas, on Capital.com TV and in the ‘News and features' section, you’ll find excellent analysis of market assets and events, which provide information on what to trade and how to trade it.

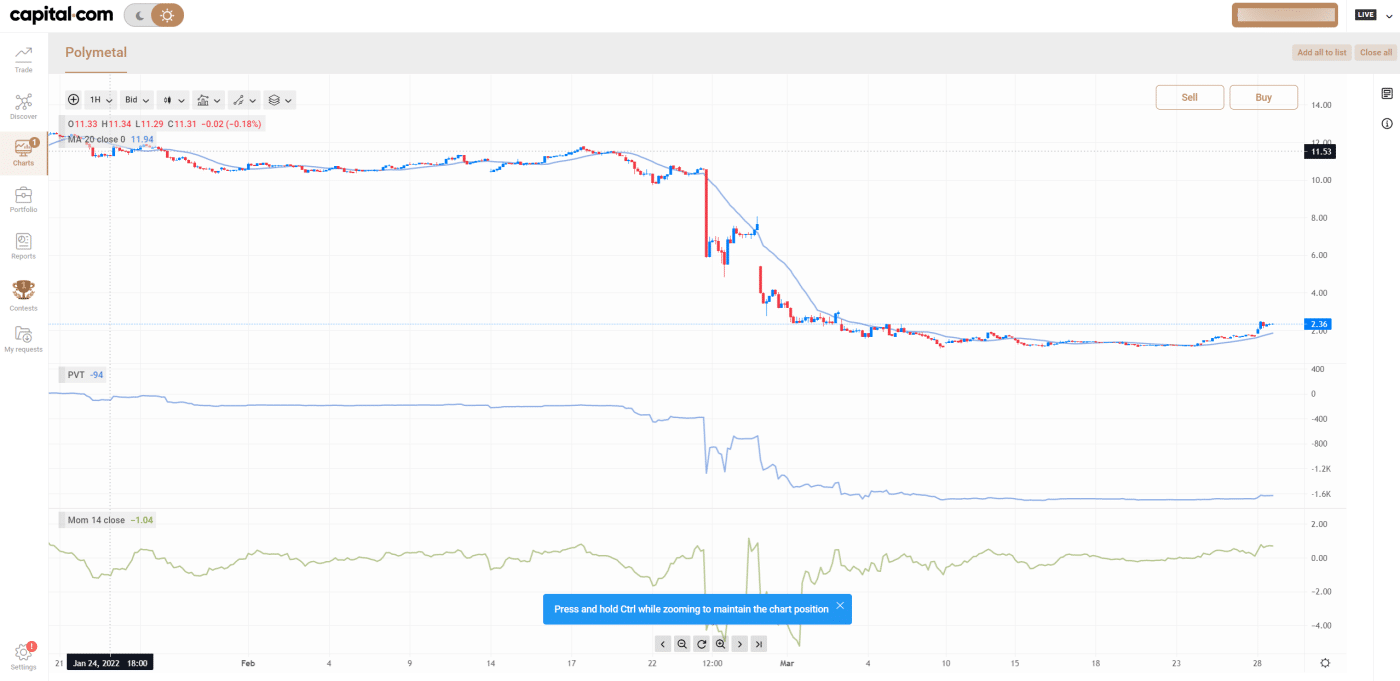

Capital.com's charting tools are also excellent. The charts are user-friendly and a variety of technical indicators are available. Furthermore, the broker has fantastic news feeds that can be found under the ‘Discover' menu option. The feed is reader-friendly, contains relevant charts and images, and is fully integrated into the platform.

Finally, trading stats, like the most volatile or traded assets, are available on the broker's platform. These stats can be found in the ‘Discover' section.

One downside is that fundamental data isn't available on Capital.com.

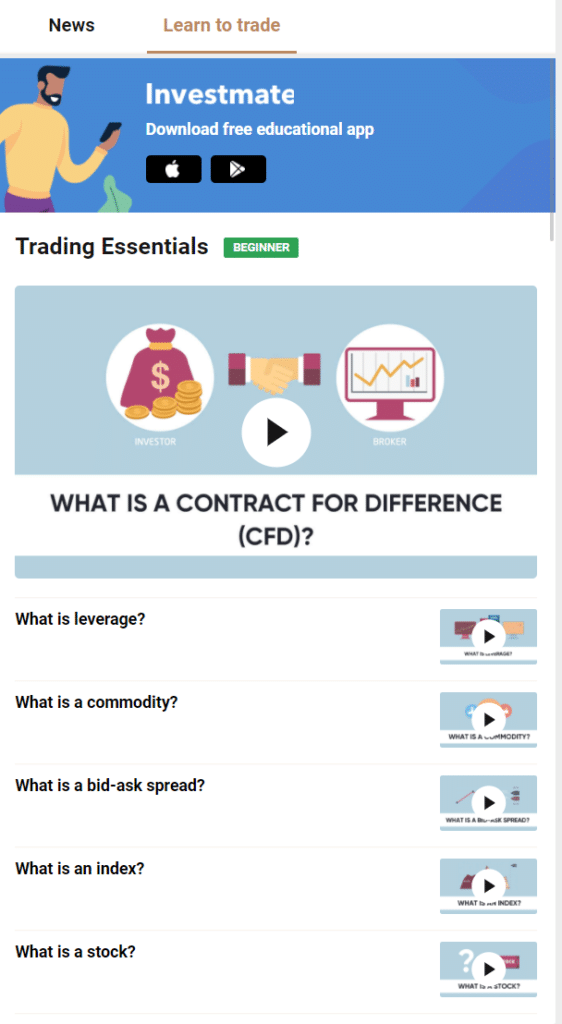

Education

Captial.com excels when it comes to providing its clients with useful educational content, including video tutorials for the platform, educational articles, webinars, and glossary. Investment is at the heart of Capital.com's educational material.

The official YouTube channel of the broker is another excellent source of education on Capital.com. You get access to 650+ educational videos, which are updated on a monthly basis, as well as free 30-minute webinars conducted by David Jones.

Is Capital.com Safe?

Capital.com is compliant with PCI Data Security Standards. Client funds are routed through the best and most secure data environments. Capital.com is a heavily regulated broker that you can safely trade with. It’s regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the National Bank of the Republic of Belarus (NBRB).

Check the below table for more details about the Capital.com regulation:

| Country | Regulation | Legal Entity | Protection Amount |

|---|---|---|---|

| UK | Financial Conduct Authority (FCA) | Capital Com (UK) Limited | £85,000 |

| Australia | Australian Securities and Investments Commission (ASIC) | Capital Com Australia Limited | No protection |

| EU (not Belgium) | Cyprus Securities and Exchange Commission (CySEC) | Capital Com SV Investments Limited | €20,000 |

| Rest of the world | National Bank of the Republic of Belarus (NBRB) | Capital Com Bel CJSC | No protection |

The Cyprus Securities and Exchange Commission (CySEC) is great because it has a negative balance protection and a wide variety of deposit and withdrawal methods. Plus, under the regulation of CySEC, all transactions made by clients adhere to the PCI Data Security Standards, and clients' deposits are segregated from corporate funds. That doesn’t mean these benefits are all absent under the regulation of other authorities, but they’re not necessarily the best, especially since they don’t have higher leverage or third-party insurance.

Capital.com is a safe broker that 750,000+ clients trust and is highly rated on Apple App Store, Google Play, and Trustpilot.

Customer Support

Capital.com does a great job of introducing new clients to its features and offerings, so the possibility that you’ll need to contact their customer support is relatively low. But when you need to, live chat, phone, email and a webform are all options for reaching out customer service at Capital.com.

Not only that, but you can also reach them out using WhatsApp, Messenger, Facebook, Viber, Telegram, which we don’t normally see in the industry.

It’s always a good idea to go through Capital.com’s thorough FAQs section before deciding to reach them out, but if there’s any emergency, we recommend you use their phone numbers. However, they can sometimes redirect you to live chat and email support, which can be annoying for impatient clients.

For less critical situations, live chat will do the trick just fine, you should get connected with an agent and get your answers within minutes.

- Phone number: +44 20 8089 7893

- Email: media@capital.com

Final Verdict

We obviously can’t say Capital.com is the best broker out there, but we can at least say that it’s among the best ones you can find. You can expect a very smooth experience while using Capital.com. The broker offers its own AI-based platform that allows you to make use of advanced technology while investing. You can clearly see the strong emphasis on user experience, as evidenced by the platform's intuitiveness and high-quality design. Its advanced platform offers you important trading news, information, and support that helps you make the most informed trading decisions.

Capital.com also offers great quality customer service. Its customer service staff is fluent in 20+ languages, ensuring that questions from all over the world are promptly answered. And in case you’re worried about losing money on Capital.com, the broker offers you negative balance protection, which keeps you from losing more money than you’ve invested.

Plus, you’re not compelled to create a genuine account with Capital.com to have a taste of all its great features. You can start with a demo account that comes with virtual funds to try and test and see whether the broker offerings meet your trading needs or not.

You’re not charged any commissions at Capital.com and it provides tight spreads that are among the most competitive in the market , allowing you to optimize your profits. It offers leverage of 30:1, giving you the chance to generate large profits once again. Capital.com, however, charges an overnight fee.

You can definitely ignore some of its drawbacks like the outdated desktop platform, we’d say it’s worth it, especially with leading regulation authorities giving licenses to Captial.com.

You should also read:

- eToro – Copy Trading

- Share Trading Platforms in South Africa

- Buy Bitcoin in Singapore

- PocketOption

- Plus500

- Day Trading Mobile Apps

How do I withdraw money from my Capital.com account?

Follow the steps below to withdraw your funds from your trading account at Capital.com:

– Make sure you're logged in to your account.

– In the top right corner of the screen, select ‘Live.'

– From the drop-down menu, choose ‘Withdraw Funds.'

– Choose your preferred withdrawal method and type the amount you want to withdraw

Can I open more than one account on Capital.com?

Yes. You can have up to ten accounts, including demo accounts, in multiple currencies such as GBP, EUR, and USD.

How long does it take to withdraw my money from Capital.com?

Usually, your withdrawal process takes up to 2 days to be completed.

Are there any deposit fees on Capital.com?

No, Capital.com does not charge you deposit fees.

Are there any withdrawal fees on Capital.com?

No, Capital.com does not charge you withdrawal fees.