Currency.com is the world's first regulated tokenised assets exchange founded in 2018. Currency.com accepts clients from 183+ countries. Currency.com is constantly proving to be a reliable online exchange, especially when it comes to crypto. It’s a great option for traders who want to invest in a variety of assets such as cryptocurrencies, bonds, equities, indices, and currencies.

Currency.com is not for everyone, so before you rush into creating an account with this crypto exchange, you have to first know exactly what this exchange offers its clients and what it does not. At the end of this Currency.com review, you should be able to make an informed decision about whether you wish to open a Currency.com account or just skip this broker. So, read on to figure out the things you MUST know before you start trading with Currency.com.

Summary

Currency.com is a regulated exchange that deserves to be given a shot for a several reasons — it offers a wide range of assets (including crypto), it has a low minimum deposit of only $5, it features 75+ technical indicators, it boasts an up-to-date trading platform, and it takes the necessary measures to keep your money safe and secure.

On the negative side, Currency.com is regulated only by only one authority, and it does not offer its services to US-based clients. Moreover, its tokenized assets can carry a certain degree of risk.

| Trading Platform | Currency.com |

|---|---|

| Founded | 2018 |

| Regulation | Hi-Tech Park (“HTP”) of Belarus |

| Demo Account | Yes |

| Minimum Deposit | $5 |

| Max. Lot Size Per Trade | None |

| Min. Lot Size Per Trade | 0.01 lots for FX |

| Copy Trading | Yes |

| Products | Forex, ETFs, indices, shares, commodities, indices, and cryptocurrencies |

| Mobile Apps | Android and iOS |

| US accepted | No |

| Customer Service | Live chat, phone, and Support Tickets |

| Our Score | 3.9/5 |

Pros and Cons

Currency.com is an exchange that still has some dispute over it in the industry. Some view it as an outstanding opportunity to trade a wide range of assets with a low minimum deposit, and others think it involves some drawbacks and risks. So, in order to decide which side you are on, you have to first introduce yourself to the basic pros and cons of Currency.com, which are shown in the following table:

| Pros | Cons |

|---|---|

| Low minimum deposit of $5 | Supported cryptocurrencies are the largest by market cap, which limits access to smaller altcoins in the market |

| A wide range of asset classes | Tokenized assets are not the favorite of high authorities and regulators |

| 75+ technical indicators available | All cryptocurrencies have minimum withdrawal amounts |

| Accepts deposits in fiat and cryptocurrencies | Lending, borrowing, and staking of assets is not allowed |

| Up to 500:1 leverage | The exchange does not provide its services to US-based clients |

| Demo account | Regulated only by 1 jurisdiction |

| Up-to-date platform | |

| Robust security measures | |

| Regulated by by the Hi-Tech Park (“HTP”) of Belarus | |

| Prompt 24/7 support team |

Currency.com Compared to Similar Crypto Trading Platforms

See how Currency.com compares to similar cryptocurrency exchanges:

| Trading Platform | Currency.com | Binance | Gemini | eToro |

|---|---|---|---|---|

| Founded | 2018 | 2007 | 2014 | 2007 |

| Minimum Deposit | $5 | $10 | $0 | $200 |

| Inactivity fee | N/A | $0 | N/A | $10/month |

| US-Accepted | No | No | Yes | Yes |

| Regulated | Yes | Yes | Yes | Yes |

How to Open an Account on Currency.com

Currency.com offers a hassle-free account opening process. Follow the steps below if you wish to open a trading account with Currency.com:

- Open the homepage of Currency.com

- Choose the ‘Sign Up’ icon

- Provide your email address and create a password for your account

- Write your nationality and country of residence

- Provide personal information like your last name, first name, phone number and birth year

- If you’re based in the Republic of Belarus, you must pass the blockchain technology test

- Choose your deposit currency and how the list of tokenized assets is displayed

At this point, you can deposit up to €1000 or €900 for Belarus-based clients, as well as trading for 15 days without providing any documents. You must upload your proof of identity as well as your residential address to complete your verification process, and you should be sent a confirmation once your account is verified.

Wallets

On Currency.com, You have a wallet for each of the cryptocurrencies that the exchange supports. Additionally, the exchange offers you supported fiat currency wallets like USD, EUR, BYN, GBP, and RUB. The ‘Wallet’ icon allows you to access your Currency.com wallets.

Wallets can also be accessed through the ‘Portfolio’ tab on the left-hand side of the screen. Wallet-to-wallet transfers allow you to transfer compatible cryptocurrencies from external wallets. You can also fund your fiat wallets via bank transfers or credit/debit cards.

Cryptocurrency

For spot and contract trading, Currency.com provides its clients with 87 Cryptocurrency trading pairs. Contract trading, or future trading, is the agreement to acquire or sell a product at a specific price in the future. The following is a list of Cryptocurrencies offered by Currency.com for both trading types:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Ripple (XRP)

- Litecoin (LTC)

- ChainLink (LINK)

- Polygon (MATIC)

- Snythetix (SNX)

- Tether (USDT)

- Uniswap (UNI)

For more experienced crypto traders, Currency.com provides up to 500x leverage.

Available Assets

When it comes to the type of investments, Currency.com is one of the best in the industry. It offers a tokenized asset exchange that you can use in order to trade across various investments. It currently offers almost 1,700 assets to clients and aims to offer 10,000 assets in the future.

Currency.com touts its tokenized method as a significant strength that sets it apart from competitors. Tokenized assets, according to them, are digital clones of original assets that are pegged to the exact same value as the real ones. It has the ability to mirror the underlying asset’s activity. These digital clones mimic stocks, foreign monies, commodities, precious metals, and other assets.

The following is a list of the tokenized assets offered by Currency.com:

| ETFs | Hang Seng CEI ETF, First Trust Global Wind Energy ETF, Fidelity MSCI Health Care Index ETF, and more. |

|---|---|

| Forex | AUD, CHF, CAD, CNH, EUR, USD, GBP, HKD, JPY, and more. |

| Commodities | Brent oil, platinum, silver, aluminum spot, copper, natural gas, and more. |

| Stocks | Amazon, Apple, Alibaba, China Evergrande, Air France, BP, Tesla, BMW, and more. |

| Indices | CAC40, FTSE100, FTSE China A50, DAX30, DJIA, U.S Dollar Index, NASDAQ, S&P500, and more. |

Bear in mind that traders of tokenized assets don’t hold the underlying asset class. The value of a tokenized asset corresponds to the value of a certain asset and is identical to the original asset.

Currency.com offers fast execution speeds in a convenient trading environment, which is ideal for both newbies and experienced clients. Using the ‘Trade’ page, you can trade the supported pairings by depositing supported fiat or pre-owned supported cryptos.

Currency.com believes that its most valuable asset is its 1,700 assets that it aims to grow to 10,000 assets in the future. However, the nature of those assets can also put traders off due to the potential risk involved. Currency.com is a tokenized asset and cryptocurrency exchange. You don’t obtain an actual share when buying tokenized stocks.

Tokenized assets underpin the entire business model of Currency.com, which is not very popular among high authorities and regulators. So, you should be careful when trading in tokenized assets with any exchange like Currency.com.

With the exception of cryptocurrencies, every sort of financial investment is heavily controlled by organizations and governments around the world. This is a big issue since higher authorities are opposed to cloning these classes of assets. Authorities don’t like the idea of disguising regulated assets as unregulated crypto tokens since it appears to be a devious technique to get around trading restrictions. Regulators, treasury departments, and central banks, all wish to put an end to such abuses.

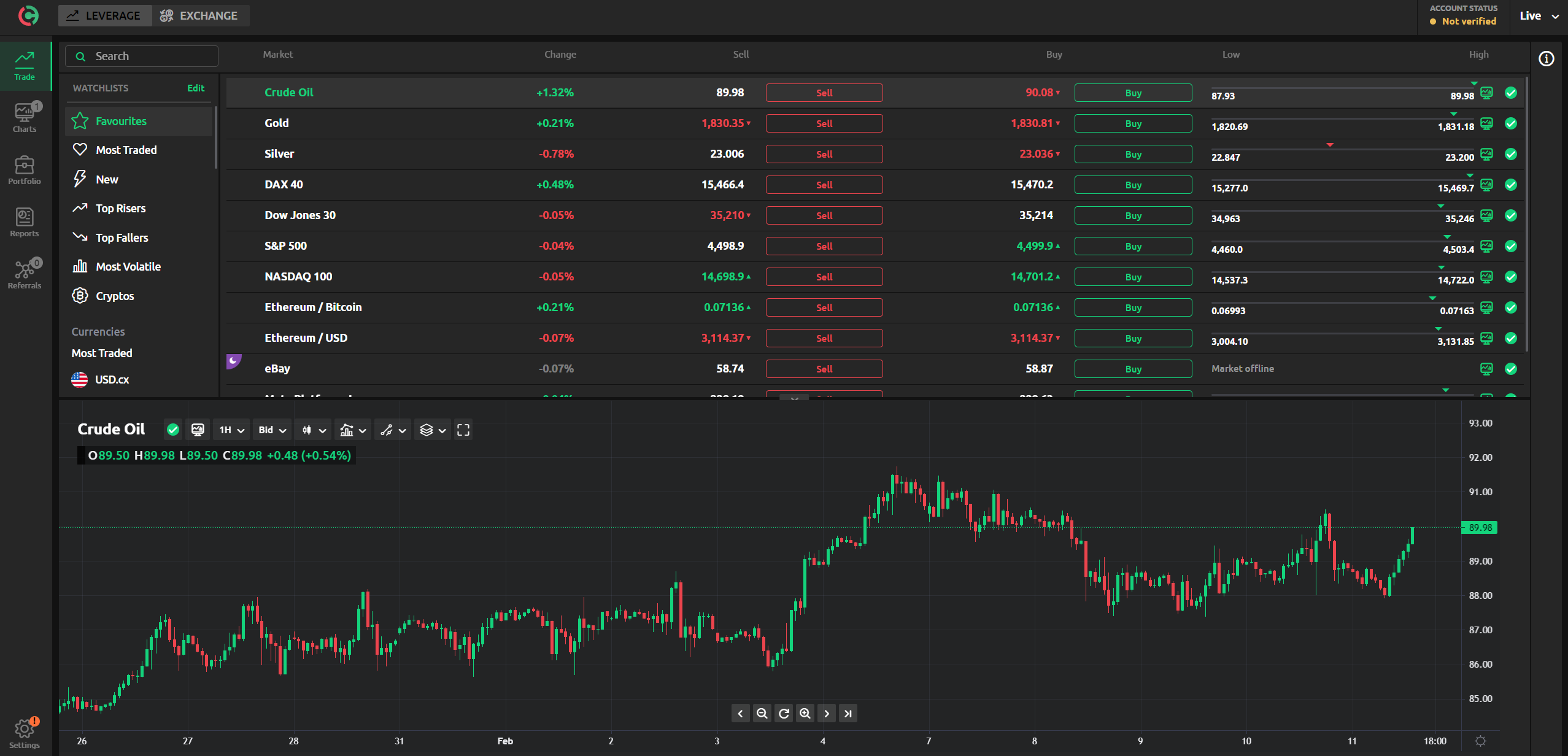

Tools and Platform

Currency.com offers you a user-friendly trading platform that allows you to trade tokenized cryptocurrencies and fiat currencies, commodities, bonds, stocks, and indices. While the site is intended for experienced traders, it does have a demo account that allows beginners to test the waters with virtual funds before leaping into creating an account.

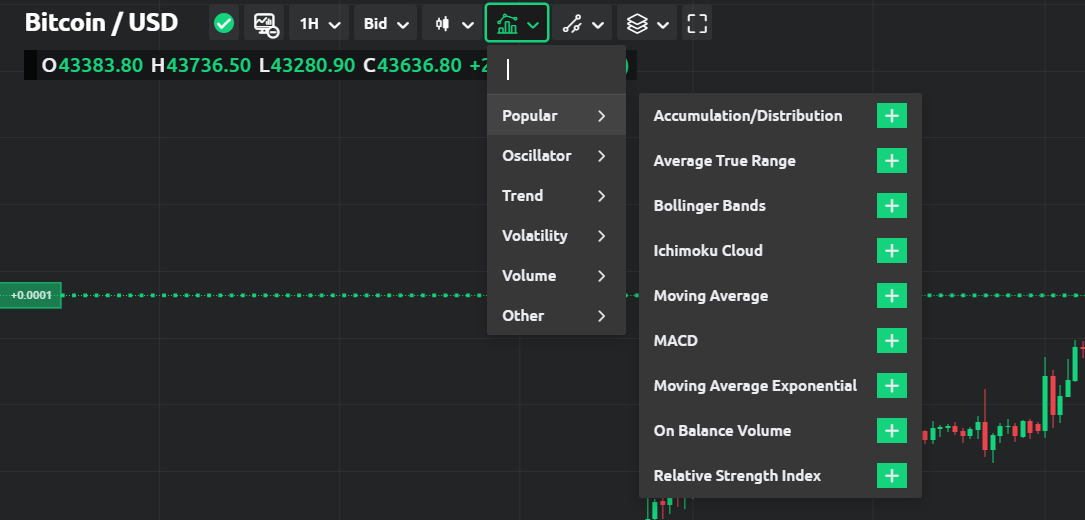

On the platform, you get watchlists, search for assets and search across predefined categories. The exchange provides real-time price charts as well as a slew of other tools that help traders. It also includes a section on latest news.

You can access the most up-to-date technical analysis indicators, price charts, and price movement comparison tools. These tools Having access to these tools guarantees that you’re prepared to profit from price changes at any time.

All of this is accessible via Currency.com’s app on both Android and iOS.

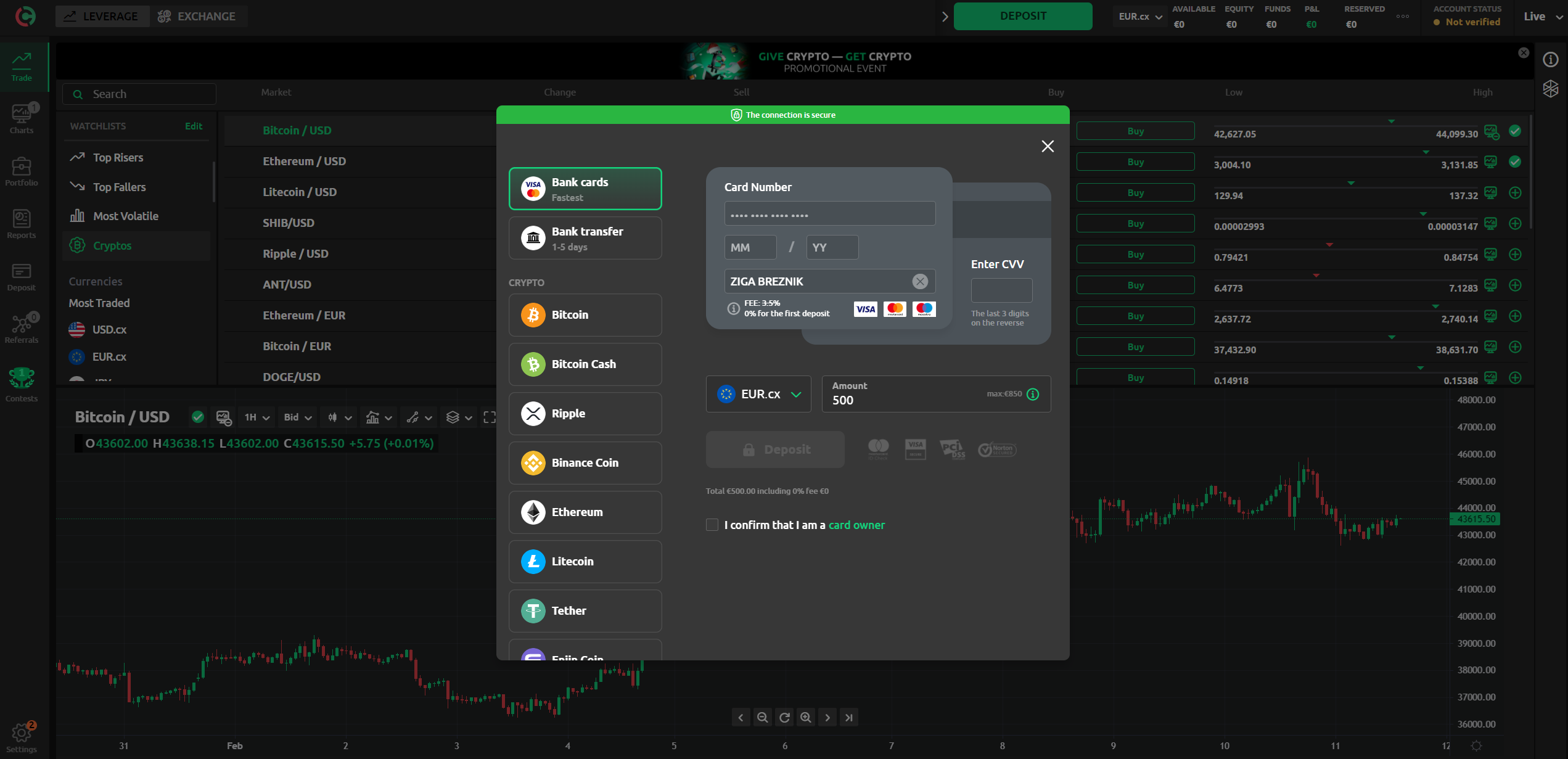

Deposit

Currency.com has an attractive minimum deposit of $5. This minimal barrier to entry attracts traders at all levels to create an account with the exchange.

Wallet-to-wallet transfers are available for clients who already have Currency.com supported cryptocurrencies. Follow the steps below to transfer already held crypto:

- Open the “Wallets” or “Deposits” page.

- Click the deposit icon to choose the crypto wallet you want to deposit.

- Scan the QR code or copy the address to the external wallet.

Enter the amount you want to send into your external wallet and complete the transaction process.

Withdrawal

Not only does Currency.com have a low minimum deposit, but it also has a low minimum withdrawal limit that provides you with more freedom in terms of profit-taking and taxation. When compared to other exchanges in the market, Currency.com's withdrawal limits are incredibly low, as low as $100.

You can withdraw cryptocurrency from your Currency.com wallets to an externally compatible wallet. Follow the steps below in order to withdraw your crypto:

- Open the ‘Withdrawal’ icon and pick the wallet that you want to withdraw the crypto from.

- Copy and paste the destination wallet address

- Write the amount in coins that you want to withdraw

- Make sure you've entered everything correctly before completing the transaction, as incorrect information could result in your crypto holdings being permanently lost.

Trading Contests

Currency.com has trading competitions with great prize pools. Traders with the highest P&L win prizes. At the time of this writing, the seven leading traders got:

- 1st place – 3500 USD.cx

- 2nd place – 2000 USD.cx

- 3rd place – 1300 USD.cx

- 4th place – 800 USD.cx

- 5th place – 800 USD.cx

- 6th place – 800 USD.cx

- 7th place – 800 USD.cx

Currency.com Fees

See the below table to get a comprehensive idea about the fee structure of Curreny.com:

| Coin | Minimum Deposit | Minimum Withdrawal | Deposit Fees | Withdrawal Fees |

|---|---|---|---|---|

| BTC | 0.001 BTC | 0.001 BTC | $0 | 0.0005 BTC |

| ETH | 0.03 ETH | 0.03 ETH | $0 | 0.01 ETH |

| LTC | 0.1 LTC | 0.1 LTC | $0 | 0.03 LTC |

| BCH | 0.05 BCH | 0.05 BCH | $0 | 0.015 BCH |

| USDT | 20 USDT | 50 USDT | $0 | 20 USDT |

| USDC | 20 USDC | 40 USDC | $0 | 20 USDC |

| XRP | 30 XRP | 30 XRP | $0 | 5 XRP |

| LINK | 1 LINK | 2 LINK | $0 | 0.75 LINK |

| COMP | 0.07 COMP | 0.15 COMP | $0 | 0.05 COMP |

| UNI | 0.7 UNI | 1.4 UNI | $0 | 0.7 UNI |

| Tokenized Assets | $100 equivalent | $100 equivalent | $0 | 1.5% (min 0.02) |

| DAI | 20 DAI | 40 DAI | $0 | 20 DAI |

| OMG | 4.6 OMG | 9.2 OMG | $0 | 4.6 OMG |

| SUSHI | 1.5 SUSHI | 3 SUSHI | $0 | 1.5 SUSHI |

| BAT | 44 BAT | 88 BAT | $0 | 44 BAT |

| KNC | 13 KNC | 26 KNC | $0 | 13 KNC |

| WBTC | 0.00043 WBTC | 0.0009 WBTC | $0 | 0.0005 WBTC |

| ZRX | 15 ZRX | 30 ZRX | $0 | 15 ZRX |

| MATIC | 15 MATIC | 30 MATIC | $0 | 15 MATIC |

| AAVE | 0.063 AAVE | 0.13 AAVE | $0 | 0.07 AAVE |

| UMA | 1 UMA | 2 UMA | $0 | 1 UMA |

| SNX | 1.1 SNX | 2.2 SNX | $0 | 1.1 SNX |

| REN | 19 REN | 38 REN | $0 | 19 REN |

| YFI | 0.00065 YFI | 0.0013 YFI | $0 | 0.00065 YFI |

| OCEAN | 24 OCEAN | 48 OCEAN | $0 | 24 OCEAN |

| ANT | 4.7 ANT | 9.4 ANT | $0 | 4.7 ANT |

| BAND | 1.6 BAND | 3.2 BAND | $0 | 1.6 BAND |

| REPV2 (REP) | 0.8 REPV2 | 1.6 REPV2 | $0 | 0.8 REPV2 |

| BNT | 4.1 BNT | 8.2 BNT | $0 | 4.1 BNT |

Is Currency.com Safe to Trade with?

Currency.com is regulated and authorized by the Hi-Tech Park (“HTP”) of Belarus. Currency.com emphasizes that security is their primary focus. The website displays the following statement to support their claim:

“Currency.com is directly authorized and regulated by the Hi-Tech Park (HTP) of Belarus. This means that we're subject to the strictest scrutiny from the world's only jurisdiction with overall legal regulation of businesses based on blockchain technology. It also means that your rights — as an ICO participant — are protected by the highest laws in the land.”

But while the HTP has a strong technological base in Belarus, it doesn’t have any legal or regulatory status outside of the country. Plus, only Currency.com’s home country of Belarus has regulated and authorized the exchange. Belarus has diplomatic and commercial ties with the European Union, but it’s not a member of it. There’s not even any mention by Currency.com of plans to collaborate with the European Commission or adjacent nations to build unified regulations concerning the cryptocurrencies.

Apart from those shortcomings, Currency.com appears to have good security standards and processes in place. Every time you use the platform, you must use two-factor authentication (TFA). To make deposits using fiat money from a credit card or a bank, you must first complete the know your customer (KYC) security process. For bitcoin transfers from another exchange or digital wallet, Currency.com will ask you to complete the same security process.

TFA screening is activated many times, such as when logging in, depositing, or trading. 2 additional kinds of email encryption and verification are also used by Currency.com. This is intended for secure document upload and to prevent tampering with any of your assets or personal information.

Physical security measures are also used by the exchange. According to Currency.com, the servers are in a remote data center locked in private cages, protected by armed guards, retina eye scans, and video monitoring. Also, stored cash cannot be lent, borrowed, or staked for security reasons.

Furthermore, all deposits you make on the platform are sent to an encrypted cold wallet, which are encrypted computer hard drives that aren’t linked to the internet and cannot be reached by a crypto attack, whereas hot wallets can. According to Currency.com, coins that are stored in their hot wallets are employed to maintain operational liquidity, but they don’t explain who exactly provides the liquidity.

Currency.com keeps full reserves on hand to protect its clients from a bank run. All client funds are kept segregated from the operating account at the exchange.

Customer Support

Most clients will find the customer support on Currency.com useful; it has a thorough FAQs section that includes answers to most of your questions. But if you don’t find your answers there, Currency.com has responsive phone and live chat services that you can depend on to solve any issue. You can also send them a request and wait to get your answer.

- Phone number: +447418353584

The Final Verdict: is Currency.com for You?

Currency.com has a user-friendly platform that makes any trader tempted to trade on it. One of the best things about this exchange is the various assets it offers, as well as the robust security measures it takes. Currency.com is great for seasoned, non-US traders who wish to have access to a wide variety of assets and do not mind tokenized assets and not borrowing. So, if you fit with these criteria, Currency.com may well be one of the best options out there in the market.