Advertiser Disclosure: Some of the links in this post are from our partners. We might receive a compensation (at no additional cost to you).

This content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

eToro is a multi-asset brokerage company and cryptocurrency exchange known for its copy and social trading. eToro was founded in 2007 by Ronen Assia, Yoni Assia, and David Ring. They offer CFD trading, cryptocurrencies, stocks, and ETFs. They operate in more than 140 countries and have millions of registered eToro users.

Company headquarters are in Israel, Tel Aviv-Yafo. eToro has registered offices in Cyprus, United Kingdom, the United States, and Australia. Since 2018, the company's value grew from $800 million to $2.5 billion in 2020. eToro is a safe broker, regulated by top-tier authorities.

Summary:

Before beginning our full review, let's start with a quick overview.

eToro is great for copy social trading and cryptocurrency trading; we recommend it to beginner and advanced traders. It is excellent for $0 commissions for US stock trading. One of the downsides of eToro is their forex and CFD trading fees, which are a bit higher than most of its competitors.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is eToro Safe?

While eToro is an established and reliable company that millions of users trust, we take a look at the safety of the trading platform. To avoid scams, here are a few things to consider.

- eToro is safe, secure, and reliable. Your funds are kept in secured tier 1 banks. All of your personal information is kept secure under SSL encryption. You should always look for security signs in your browser window before trading.

- eToro respects your privacy and the user has complete control over the account settings. Your data is never shared or sold to third-parties.

- eToro is regulated by tier-1 financial regulators, including FCA, ASIC, CySEC, and FinCen. Clients' funds are kept secure at trusted banks, and their personal information is protected under an SSL certificate. You should always look for security signs when trading through your browser.

UK investors are protected by the Financial Services Compensation Scheme (FSCS). European investors under eToro Europe are protected by the Investor Compensation Fund designed for Customers of Cypriots Investment Firms up to €20,000.

The company is not listed on a stock exchange and is not a publicly-traded company. eToro is planning to go public soon, with a possible listing on the stock exchange.

Users have an option to enable Two Factor Authentication (“2FA”) which adds an extra layer of security.

| Trading Platform | eToro |

|---|---|

| Demo account: | Yes |

| Minimum Deposit: | $50 - $200 |

| Minimum Trade: | $50 - $1000 (less with leverage) |

| Copy Trading: | Yes |

| Mobile App: | iOS, Android |

| Desktop: | N/A |

| Web Platform: | Proprietary |

| Countries not available: | Canada, Japan, Cuba, Iran, North Korea, Sudan, Syria and Venezuela (full list) |

| Deposit Methods: | Bank Transfer, Maestro, Visa, MasterCard, Skrill, Neteller |

| Withdrawals: | 3 - 8 days |

| Islamic Account: | Yes |

| Regulated by: | FCA, CySec, FinCen, ASIC |

| Our Score: | 4.9/5 |

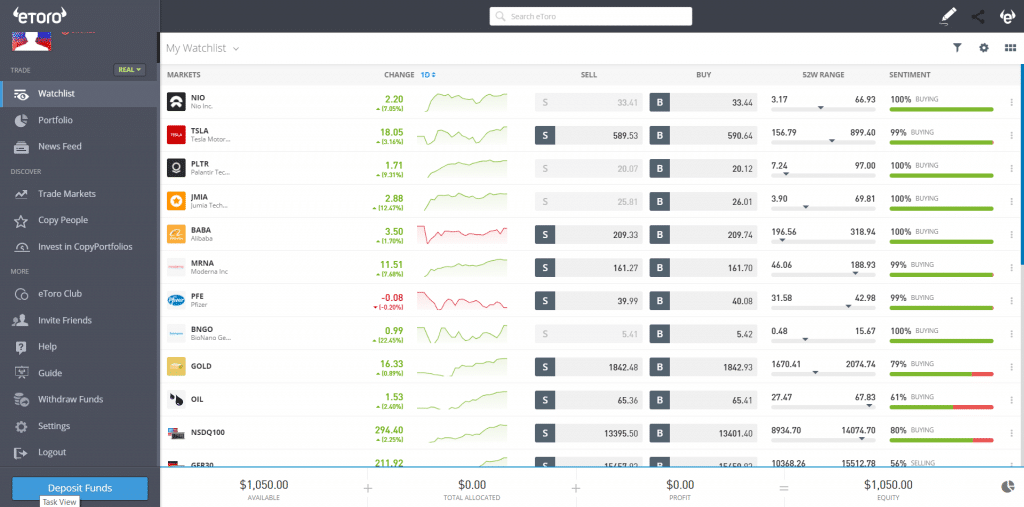

The eToro trading platform has a general main appeal for social trading. This allows users who don't want to trade to copy the trades of successful investors. They allow this by providing a messaging feature, a social media feed, and other similar add-ons that we will explain in further detail. Fully automated trading systems are not permitted.

Here is a list of eToro subsidiaries registered:

- United Kingdom: eToro U.K. Ltd. regulated by Financial Conduct Authority (FCA)

- Australia: eToro AUS Capital Pty Ltd. regulated by the Australian Securities and Investments Commission (ASIC)

- Cyprus: eToro (Europe) Ltd. regulated by Cyprus Securities and Exchange Commission (CySEC)

- United States: eToro USA LLC regulated by US FinCEN

| PROS | CONS |

|---|---|

| Easy Account Opening | CFD and Forex Fees |

| Website and Mobile App | Withdrawals can Take Longer Than Usual |

| Best Social Trading Platform | |

| Great for Crypto Trading |

eToro Compared To Similar Trading Platforms

Here is an overview of how eToro compares to the trading platform of others:

| Trading Platform | eToro | Plus500 | XTB | Trading 212 | Interactive Brokers |

|---|---|---|---|---|---|

| Founded | 2007 | 2008 | 2002 | 2004 | 1993 |

| Headquarters | Tel Aviv, Israel | Israel | Poland | London, United Kingdom | Greenwich, Connecticut, United States |

| Regulation | FCA, CySEC, ASIC | CySEC, FCA, MAS, ASIC, FMA, and FSCA | FCA, Cyprus Securities and Exchange Commission (CySEC), Belize International Financial Services Commission (IFSC) | FCA, FSC, CySEC | MAS, FCA, CFTC, SEC, CBI, IIROC, ASIC, CSSF |

| Minimum Deposit | $50 - $10,000 | $100 | $0 | $0 | $0 |

| Withdrawal Fees | $5 withdrawal fee | $0 | Yes (varies with withdrawal method) | No | 1 Free Withdrawal/month |

| Inactivity Fees | $10/month (after 12 months of no login activity) | $10/month (after 3 months of no login activity) | Yes | Yes | $0 |

| Instruments Available | 2000+ | CFDs on: Indices, Forex, Commodities, Crypto, Shares, Options, ETFs | 4000+ (FX, Commodity CFDs, Indices, Stocks, Cryptocurrency) | Over 7000 Global Stocks & ETFs and CFDs on Forex, Commodities, Indices, Stocks | Access to 150 Exchanges (CFDs, Funds, Crypto, Futures, Options, Bonds, Stocks, ETFs, Forex) eToro stocks and shares isa. |

Overview

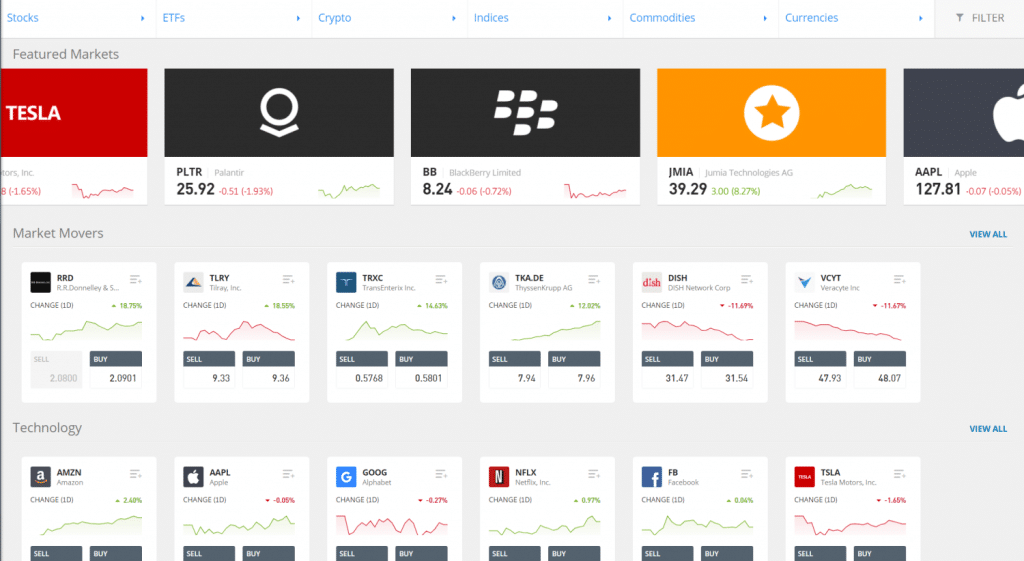

eToro offers a variety of investment products including stocks, fiat currencies, commodities, exchange-traded funds, and 15 cryptocurrencies.

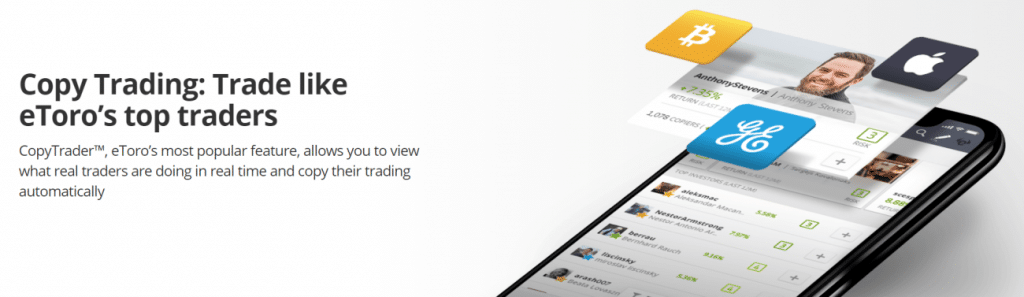

They were one of the first online brokers to offer a social trading feature. They pioneered the trend. These days many competitors are offering similar alternatives, but eToro continues to lead the way in this field. This is a combination of a social-media-like environment where people connect and chat. You can follow people and check out see their performance and what instruments they are trading. They have introduced two innovative products in this field: CopyTrader™ and CopyPortfolios™.

They gained their reputation as a safe and attractive broker for both experienced and beginner day traders. Top that with eToro platform low trading fees and user-friendly interface, and you have a decent addition to your trading strategies. A great eToro alternative is Interactive Brokers or Plus500. For Forex trading platforms, read our reviews of Pepperstone and AvaTrade.

In 2019 they launched a crypto exchange called eToroX, regulated by the Gibraltar Financial Services Commission ( Gibraltar FSC) and registered with FinCEN as a Money Service Business.

Web-Based Platform

They have a web-based and a mobile platform, however no desktop platform is available.

Their interface has 26 different languages available. It looks polished and modern, appealing to a young audience in opposition to the classic and sometimes outdated platforms offered by other brokers.

One downside is that the eToro workspace is not customizable, you will have to feel comfortable with the interface as is.

Mobile App

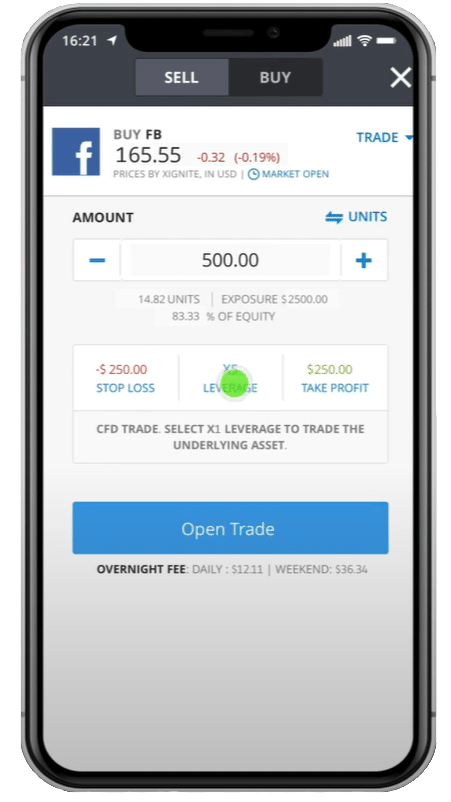

Both the web platform and eToro mobile app offer a two-step login, which increases their level of security for users. Search functions are predictive. They allow you to browse through a large number of available securities on your mobile device.

Both versions include real-time market price alerts and notifications and can be sent via push notifications.

Reports are available under the portfolio tab. You can find a summary of your trades, their market value, and the fees paid. An account statement is available, summarizing the operations made during a certain period.

Minimum Trade Size

The minimum trade size as of December 6th, 2020

| Market | Minimum Trade Size |

|---|---|

| Crypto | $10 |

| Stocks and ETFs | $10 |

| Currencies | $1,000 |

| Commodities | $1,000 |

| Indices | $1,000 |

| Copy Trading | $1 |

*The minimum trade size includes leverage. If a user wants to open a position on oil (commodity – $1000 minimum), they can open it with $100 using 10x leverage. The minimum for copy trading is $200 and the minimum for each copied trade is $1.

Active and high-volume trades will need to look elsewhere, as the small maximum trade sizes will not suffice most.

eToro Fees

eToro fees are on the low-end of the industry. They don't charge fees for US-listed stocks. CFD fees are low and they are built into the spread. For stock indexes, the S&P 500 CFD fee is 0.75 while the Europe 50 CFD fee is 3. Cryptocurrencies have a fee of 1% added to the spread when buying or selling crypto assets. The fee is included in the price shown when users open or close a position. You get ownership of the asset, unless trading under ASIC (Australian Securities & Exchange Commission).

Currency pairs are expensive to trade, as the cost of the EUR USD currency pair is 3 pips while many other brokers charge between 0.6 and 1 pip per trade. Traders looking for forex brokers are better off elsewhere. Higher spreads are not great for active or high-volume traders. We suggest looking at Pepperstone or Avatrade.

Deposit fee

There is no deposit fees. Most brokers don't charge a fee for depositing money.

Withdrawal fee

eToro has a $5 withdrawal fee for bank transfers. This is in line with industry standard.

Inactivity Fee

eToro inactivity fee is $10 per month, if the user fails to log into the account for 12 months. For overnight rollover fees it depends based on current market conditions.

Compare Trading Fees

| Platoform | eToro | Interactive Brokers | Plus500 | Gemini | Binance | Robinhood | Coinbase |

|---|---|---|---|---|---|---|---|

| EURUSD | Varied Spread | Spreads | Spread: 0.01% | N/A | N/A | N/A | N/A |

| GBPUSD | Varied Spread | Spreads | Spread: 0.02% | N/A | N/A | N/A | N/A |

| Bitcoin | 1% | 0.12% - 0.18% of trade value | Spread: 0.30% | $0.99 up to 1.49% of Order Value | 0.02% - 0.1% of Order Value | 0% | 0.6% of Order Value |

| Apple Fees | $0 | $0 commissions | Spread: 0.74% | N/A | N/A | $0.000130 per share | N/A |

| Tesla Fees | $0 | $0 commissions | Spread: 0.75% | N/A | N/A | $0.000130 per share | N/A |

| Amazon Fees | $0 | $0 commissions | Spread: 0.75% | N/A | N/A | $0.000130 per share | N/A |

| S&P 500 Fees | Varied Spread | N/A | Spread: 0.02% | N/A | N/A | 0% | N/A |

| Options Fee | N/A | $0.25/contract - $0.65/contract | Spread | N/A | N/A | $0.00218 per contract | N/A |

| Mutal Fund Fees | N/A | No Transction Fee Funds - 0.00 USD and Lesser of 3% or 14.95 for Transaciton Fees | N/A | N/A | N/A | N/A | N/A |

| ETF Fee | $0 | $0 commissions | Spread | N/A | N/A | 0% | N/A |

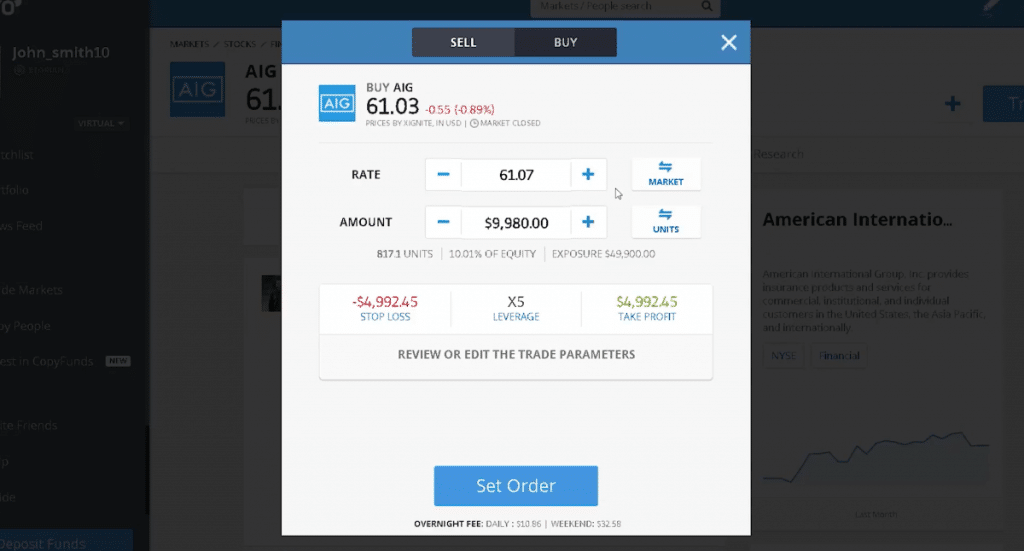

Order Types

eToro has four types of orders available:

- Market: a market order is executed at the price quoted at the moment the order is placed.

- Limit: this order sets a maximum or minimum price at which the financial asset class should be bought or sold.

- Stop-loss: this order is executed once the price of the security reaches a certain level.

- Trailing stop-loss: an order that allows the trader to lock in gains as it executes the sale of the asset only if the price goes down (or up for a short-position) to a certain point, while it remains inactive while the price keeps moving in favor of the trade.

Markets & Products

As part of this review, we thought it would be prudent to explore the various investments available, of which there are hundreds. These include currencies, indices, ETFs, and 15 cryptocurrencies. Each asset class is traded with different investment strategies. Equity trading is not available at eToro. Their offering of investments is more than decent. It is diverse enough to be considered satisfying for most.

You can trade stocks and cryptos directly and not via Contract for Difference. They support a wide variety of Exchange-Traded Securities and offer $0 commission on selectedUS Stocks and fractional shares.

Is eToro good for cryptocurrencies?

We consider eToro is one of the best brokers for cryptocurrency traders, offering a large portfolio of major crypto coins for people who want to focus on this particular market. *Trading crypto assets is not supervised by any EU regulatory framework.

Popular cryptocurrencies available:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash

- LiteCoin (LTC)

- Ethereum Classic (ETC)

- Cardano (ADA)

- Stellar Lumens

- plus 85 more…

CopyPortfolios

eToro allows CFD trading for other financial markets, including commodities and stock indexes, along with certain asset management solutions, such as Copy Portfolios™ and Copy Traders™ solutions. Etoro CFD trading has innovative features that group different traders into a single fund.. These are great for clients who are looking for a passive way to get involved with CFD trading.

Cryptocurrency trading is available through CFD trading the actual underlying asset (“physical”). Crypto CFDs are unavailable to UK clients (FCA crypto CFDs derivates ban).

Copy Trading

The copy trading feature allows traders to copy people on their platform. The platform takes charge of the account and modifies the user’s portfolio based on the changes that the copied portfolio makes over time.

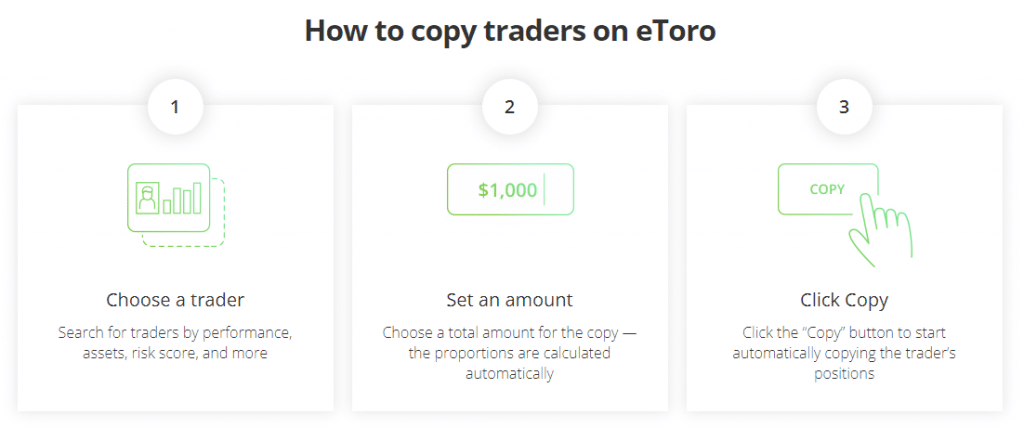

In order to start copy trading on eToro, follow the steps below:

- Choose a trader based on performance, assets, risk score, and more

- Set an amount you wish to copy with

- Click Copy, and you are done

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The Copy Trader lets you browse through a list of traders and pick the best performing ones and copy their portfolios. This is attractive for passive traders and for inexperienced users to merge self-directed and copy trading. If you are just starting out, this is a great place to get insights.

The copy trading structure on eToro is only manual, as fully automated trading systems like the ones available on MetaTrader, are not permitted. This is good to know, as you can be sure that when you copy a trader, he is making those trades manually. Many other social trading platforms permit both manual and automated strategies.

Wallet

The eToro Mobile wallet app is a secure digital wallet with over 120 supported cryptocurrencies. The multi-crypto wallet offers secure buying, receiving, and storing of crypto. The eToro Wallet looks and feels similar to the Mobile app.

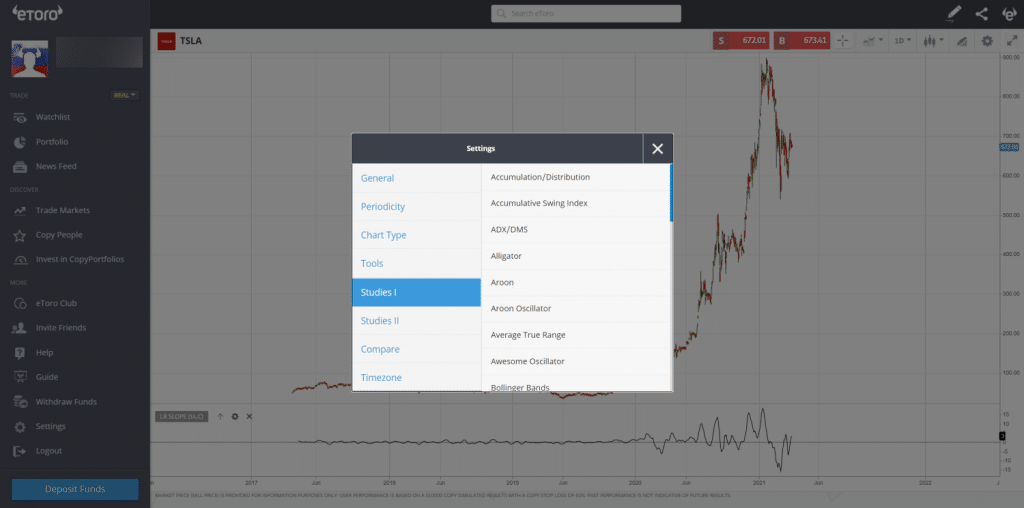

Research and Technical Analysis Tools

eToro has technical analysis tools along with some recommendations by analysts, but lacks on the fundamental data. Charting tools are good, with more than 70 technical indicators and charts. The longest time span permitted by the charting tool is 6 months. These tools allow you to analyze prices.

eToro Research tools have the economic calendar, news, daily market analysis series, podcasts, earnings reports.

Market Sentiment Data: Each financial asset has its own market sentiment data. It indicates the percentage of traders inclined to buy and sell the security. The sentiment data is calculated from the trades of top users, which is a better way to calculate it. You can find comments from analysts for certain popular assets.

The news feed is limited to tweets and comments from users within the eToro ecosystem. This is a public news feed from eToro users. The content from the in-house staff tends to be of higher quality. No major media outlet such as Reuters or Bloomberg is included.

The fundamental data provided consists of basic financial ratios. No historical record of balance sheets, income statements, price targets, or earnings estimates included.

When it comes to cryptocurrency tools, users can find crypto trading ideas, copy individuals or a group of traders across 94 supported cryptocurrency pairs.

Their main strength is its hands-off trading and the community to share ideas. No relevant third-party analysis is offered.

Education

The educational resources at eToro are ok. The educational material offered includes weekly webinars, video platform tutorials and frequently asked questions. These include basic platform tutorials, beginners guides and some advanced tutorials.

Platform Educational Content

You can find a details section next to instruments on their platform. The details really provide more than just the basics and list into extra information. For example, you can find information about the instrument itself and what to consider before investing.

Trading School

eToro features a “Trading School” where you can find a series of basic videos. These do not go in-depth into any particular topic, and I didn't find them particularly useful. They also have a YouTube channel where you can find past webinars and other educational content. The YouTube channel features analysis videos, webinars, and other tutorials.

eToro demo account helps beginners in their process of learning without having to invest real money.

An rather basic test is required for a new trading account. This is known as eToro trading knowledge, assessment answers shouldn't be too challenging for those with a reasonable grasp of trading basics.

Customer Support

eToro customer support is decent, though it lacks in a few areas. The help center features a live chat feature but it is a bit hidden within the FAQ section. Traders have reported that representatives are busy and no attention is available during the weekends. There’s no e-mail or phone support, as this broker relies on support tickets sent through the interface. The response to these tickets is sent to the e-mail inbox of each user. The response time is fast – 24 hours or less. Their customer service is not the best, but it is sufficient to deal with basic issues.

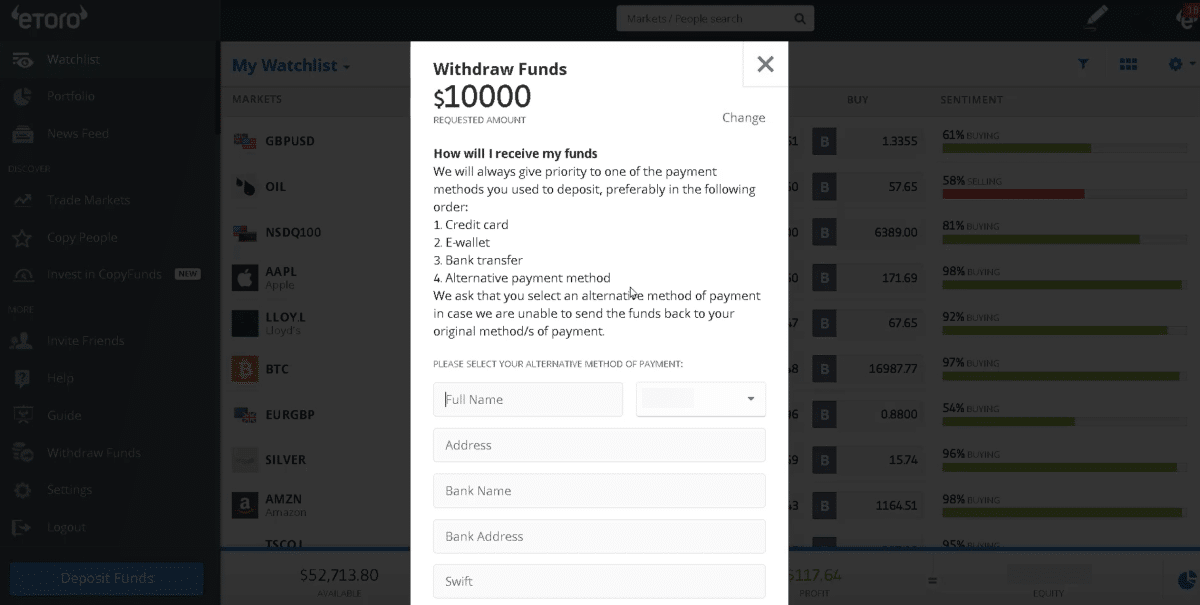

Withdrawals

Withdrawing money is easy. eToro charges a $5 withdrawal fee. It requires a minimum amount of $30 per withdrawal. Clients withdraw to a bank card, electronic wallet, or bank account. Withdrawing money to an account that has a base currency different than the US dollar will result in extra currency conversion fees.

Credit, debit card, and electronic wallet withdrawals are instant, bank account transfers take up to 2 business days.

Withdrawals are shown as ‘eToro withdrawal under review' while pending. There are no eToro withdrawal limits.

How to Open an eToro Account?

Opening a new eToro account is simple and fast, with everything being completed 100% online. It will take a few minutes to go through the registration. You can take a look at the web platform if you have not yet registered.

An eToro account is available in most countries. There's a sizable list of countries that are banned from opening an account with them. These countries include Albania, Canada, Cuba, Iran, Iraq, Jamaica, Japan, Nicaragua, Pakistan, Syria, and Serbia. U.S. customers outside the US territory cannot open an eToro account.

Account types

There are two types of eToro account available – retail or professional.

Retail

Retail Traders get access to all the assets and copy or manual trading. Leverage is restricted, but coverage by the investors compensation fund and negative balance protection is available.

Professional Clients

For a professional account, clients have to pass a test to determine their qualification. ESMA investor protection like the Investor Compensation Fund and recourse to the Financial Ombudsman Service is not available. As a professional client you get access to leverage.

Demo Account

A demo account is available with a balance of $100,000. Traders start virtual trading with virtual funds to get to know the platform. The account comes with real-time prices so it is a great way to practice.

Popular Investor Program

For successful traders, they have a program called the popular investor. The Popular Investor Program is great for traders that allow others to copy their strategies and has four levels.

Verification Process

Before you deposit money you will have to go through an ID verification process. It will require proof of identity and proof of residency. The process takes less than a day to be completed when they recieve all the required documents. You’ll have to take a quick survey intended to assess your trading knowledge and experience.

eToro Tiers

This is the member program, enabling various benefits available. There are several eToro membership levels ranging from silver to diamond, depending on trade amounts.

Funding

Depositing money is easy and there are no deposit fees.

Deposit Methods

You can deposit money with debit or credit cards or an electronic wallet such as Skrill. Funds are credited instantly. Bank transfers take up to 7 days to clear. They are adding adding more funding options in the near future.

Minimum Deposit

The minimum deposit at eToro is $50. The minimum first deposit was reduced in United Kingdom, Switzerland, Italy, Sweden, Ireland, Spain, Netherlands, Germany, Austria, Norway, France, and Australia.

There are the following exceptions:

- For clients in Israel is $10,000.

- For bank transfers, the minimum deposit is $500.

The professional account requires the same minimum investment. It allows the user to take on more leverage for transactions. The trader has to meet certain criteria to qualify as a professional client. They sometimes require that the first deposit is made via a debit or credit card. Subsequent deposits are made using other methods accepted. One downside of this broker is that they offer one single currency base for its accounts, the US dollar. Other brokers offer five or more different base currencies for their.

eToro traders must pay a conversion fee if they deposit funds by using a payment method that features a currency different than the US dollar. Conversion costs start at 50 pips, which is around 0.46% of the amount deposited. You can only deposit money from accounts in your name.

| Regulation | eToro |

|---|---|

| CySEC | Yes |

| ASIC | Yes |

| FinCEN | Yes |

| FCA | Yes |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

They offer zero-fee stocks for US-listed securities. This is a great advantage and puts them on top of many of its rivals.

Their fees for CFDs are below the market average, even though its forex broker fees are higher compared to other brokers.

Their social trading interface has an incredible design and it is a captivating alternative for those who are starting out their journey. Traders can connect with more experienced peers or seek potential ideas to start off by using the social feed.

Conclusion

eToro is a legit and safe, zero-commission stock broker. It has a simple, easy-to-use platform, and a great mobile trading app. eToro offers investing in stocks, forex pairs, and ETFs. It is best for copy and cryptocurrency trading. Account opening is easy and customer support is good.

This broker operates in more than 140 countries and has over 11 million clients. There are 30 countries banned.

In the United States, users from registered states can sign up and trade cryptocurrencies. The demo comes with a balance of $100,000. You have to complete ID verification, before depositing money.

eToro is a multi-asset broker that offers a decent selection of US-listed stocks, currency pairs, cryptocurrencies, and other assets. They offer 26 different languages. Charting tools include more than 70 technical indicators.

It is a great broker for less experienced traders who require a bit more handholding. However, for active or high-volume traders, it is not the best, due to their high spread and small maximum trade size.

So that should be eToro explained in as much detail as is relevant to the typical investor.

- Best For Social Copy Trading

- 0% Commissions on Stocks

- Regulated by top-tier Authorities

- Easy to Use

- Great Variety of Investments

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

FAQ

How does eToro make money?

eToro makes money in 3 different ways. They operate as a market maker brokers utilizing a NDD – STP hybrid model. They make money from traders losing trades and are audited to ensure market fairness. The second way they make money, is through CFD fees and commissions. They also make some money from non-trading fees, like withdrawal fees and inactivity fees.

Is eToro it trustworthy?

eToro was established in 2007 and is licensed in many top-tier jurisdictions. As a regulated financial services company, they are audited and monitored regularly. It is trusted by over 15 million users in over 170 countries. They recently merged with FinTech Acquisition Corp. V to become a publicly traded company. Once this is done, it will be listed on the NASDAQ stock exchange, which goes to show it is a trusted company.

Generally speaking, there are no reasons for concern – at least no more so than other established platforms with a large customer base.

What type Of broker is eToro?

Just like most brokers and banks, eToro is a market-maker. Depending on which entity you are trading with it can act either as a market-maker or agency broker. They use this model and combine it with best aspects of STP (Straight-Through Processing) and NDD (Non Dealing Desk) practices. This way they provide high quality execution.

Is eToro good for beginners?

Based on our analysis and research, eToro is great for beginners. Their trading platform is easy to use, intuitive, with clear fees and a safe login. Some instruments can be traded for free. eToro offers a demo account, low minimum deposit and a great mobile trading platform, which makes it perfect for beginners.

There is a multitude of platforms available online or through apps, and of them all, eToro might be the most user-friendly. There is a definite charm to the interface that might feel less intimidating to beginners in comparison to platforms created for season investors.

Does eToro Offer ISA?

I was slightly disappointed to learn that eToro does not offer an eToro ISA account, thus removing the potential to trade in a more tax-efficient strategy, but I will keep an eye on future developments in the hope of seeing an eToro ISA account made available.

Can you make money?

Yes, you can make money on eToro. However, just like with any other broker, you need to know what you are doing. If you want to make money you have to make smart trading decisions and keep your average losses smaller, compared to average profits. What sets them apart from the competition is the copy trading capabilities, which can be better for in-experienced traders.

But there’s so much more to eToro; I usually recommend it to friends and family who are just taking their first steps in stock investing. At eToro, you can invest in real stocks free of charge on very user-friendly online platforms, especially on mobile. For the more adventurous, there’s a good selection of crypto coins and crosses. I was annoyed by eToro’s withdrawal fees and the fact you can only open a USD account (which resulted in conversion fees for me), but there are ways to minimize these costs.

eToro’s trading service could be described as quite enjoyable in comparison to many platforms – possibly even a little fun – but without stating the obvious, you will need to be aware, at all times, of the potential for losing money here.

New investors, or investors with limited experience, in particular, should always go into this with that thought at the forefront of their minds. Yes, there is potential here, and yes, there is much anecdotal evidence to suggest inventors without experience can do very well. But the user-friendly interface has been designed with investors of all experience ranges, both new and seasoned, which can cause a carefree, haphazard approach to those on unfamiliar ground.

Disclosures

eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money quickly due to leverage. {etoroCFDrisk}% of retail accounts have lost money when trading CFDs with this provider. You should consider whether you understand how they work and whether you can afford to take the risk, given that such a high percentage of accounts lose money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and

regulated by the Cyprus Securities and Exchange Commission.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the

accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.