Most of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FP Markets was founded in 2005. FP Markets brokerage firm is also know as First Prudential Markets. They are best known for their customer service, client satisfaction and fast trade execution. This Australian CFD and Forex broker (First Prudential Markets Pty Ltd). Users of this platform have access a wide range of over 10,000 financial instruments. There is an added advantage in being able to automate the opening and closing of positions. FP Markets offers access to news and economic calendars to keep abreast with the market. There are also technical analysis indicators and charts to provide additional insight.

FP Markets is a brokerage firm regulated by the Australian ASIC (Australian Securities and Investments Commission), which is one of the best regulators in the industry. The Cypriot CySEC (Cyprus Securities and Exchange Commission) also monitors FP Markets. Between these two regulatory bodies, there is tremendous confidence in the platform and the financial products that they offer.

This review will explore what FP Markets have to offer in great detail. We will consider some of their most robust features, as well as what could be better. This will be done in the context of this global forex broker as an entity as well as how it compares to other platforms.

| PROS | CONS |

|---|---|

| Low forex trading fees | No ETfs, mutual funds, bonds, futures and options available |

| Easy access to funds | CFD broker fees are relatively high |

| Easy to get started | User interface on desktop trading platform |

| Several base currencies available | Additional fees for deposits made in currencies other than the AUD |

| Various payment methods | |

| Low minimum deposits for forex trading | |

| Access to a demo account | |

| There are no withdrawal fees |

FP Markets Trading Platform Overview

At the time of writing, FP Markets offers a wide range of third party platforms to grant access to users. There are three main ways through which you can access the platform. These are desktop, web and mobile. Most users will make use of all three.

Desktop trading platform

FP Markets offers access to the renowned MetaTrader 4 and MetaTrader 5 (MT4 MT5). The desktop platform is one that most seasoned traders will be familiar with. There are distinct similarities in the functionality that you will come across on both desktop and web applications. This offers the same trading conditions on both.

One key advantage of trading with FP markets desktop platform is that you can get alerts of changes in the prices of instruments that you want to trade. This can be done by changing settings to provide e-mail and mobile notifications.

Through the FP markets desktop trading platform, you can trade forex, stock or CFDs. The stocks are traded through the Australian Securities Exchange. As with other platforms from FP Markets, you will not have access to ETFs, mutual funds, bonds, options or futures.

Web trading platform

The web trading platform provides users access to the market without the need to install additional software on your computer. This is an entirely browser-based experience. FP Markets call this their WebTrader. It provides you with access to both MetaTrader4 and 5.

The WebTrader is accessible on both Mac OS and Windows. You may be required to upgrade your browser to the latest version, for security purposes. There are no limitations to what you can trade on the web trading platform in comparison to other access points. You can trade Forex, Share CFDs, Indices, Commodities & Cryptocurrencies.

Mobile trading platform

FP Markets offers two versions of the mobile trading platform. You can access it through both iOS and Android devices. On iOS, you can download and use MetaTrader 4 on iPad as well as on the iPhone. The mobile trading platform makes it much easier to access the market from anywhere in the world. It makes the trading on the go fairly straightforward.

To access it, you will need to download MetaTrader 4 from the App Store. Through the app, users get real-time quotes throughout the day. There is also the option to execute trades with a single click. FP Markets’ iOS app was recognised for the quality of trade execution 2019 by Investment Trends.

Another feature that distinguishes FP Markets from their competitors is that fact that you can keep track of executed trades. Through the offline mode, you can keep track of charts and symbol prices. The charts are easy to scroll through and read, courtesy of a well-designed user interface.

The Android version of MetaTrader 4 is available through Google Play Store. It gives you the additional option of customisable trading layouts. The advanced features on the charts make them interactive in such a way that the data is easy to read on a small screen. It also comes with the option to keep track of your trading history.

FP Markets – Account opening

An FP Markets account can be opened online. There is no requirement of presenting yourself at a physical location. The main differentiator is the fact that customers from the US, Belgium, Japan, New Zealand, and, a few other countries do not have access to an FP Markets account.

This is due to some constringent regulations that the platform does not adhere to. If you are opening a forex trading account, there is no minimum balance. This makes it ideal for those who are making a start with minimal capital. It is also suitable for beginners who want to test the platform and their own skills before making a larger deposit.

If you are opening an Iress trading account, you will be required to make an initial deposit of at least $1000.

Account types

FP Markets offers different account types. These are Forex trading and Iress trading accounts. The forex trading accounts are either Standard or Raw. The standard is compatible with MT4 and MT5 trading platforms. It is suitable for spreads of at least 1.0 pip. There is no commission taken on trades that are made through this account. To get started, you will need to make a deposit of $100 AUD or its equivalence in your currency. There is maximum leverage of 500:1.

Raw

The FP Markets RAW account type is compatible with MT4 and MT5 trading platforms. It is suitable for spreads as low as 0.0 pips. There is a commission of $3.0 USD on transactions made on this account. There is a minimum of $100 AUD or its equivalent in your currency. The maximum leverage on this account type is 500:1.

Iress Accounts

FP Markets Iress trader account types fall under Standard, Platinum or Premier. The standard account has a minimum commission of $10 AUD per lot. This then attracts additional fees at a rate of 0.1%. The minimum deposit for a standard account is $1,000 AUD. There is an equity CFD margin rate of at least 3% and FP markets base rate of upwards of 4%.

A platinum account has a commission rate of at least $9 AUD. This then attracts an additional fee of 0.09% per lot. The minimum deposit is $25,000 AUD. There is an equity CFD margin rate of at least 3% on this account type. The FP market base rate is upwards of 3.5%.

The premier account has no minimum commission per lot. It does attract a 0.08% commission rate per lot. The minimum deposit for this account is $50,000 AUD. There is equity CFD margin rate of at least 3%. The FP market base rate is upwards of 3%.

Account types can also be differentiated based on ownership. An account can either be individual, joint, corporate or trust. An individual account has a sole owner. A joint account will have combined ownership between two or more people. A corporate account is one that is registered to a legally recognised entity.

A trust account is one that is managed by a trustee. This is often done on behalf of a group or cooperative.

Islamic Accounts

Those that have religious restrictions for when they can trade may opt for an FP Markets Islamic Account. This is specially designed to stop overnight rollover charges or profits on positions. Metatrader accounts can be converted into an Islamic account. They are a prerequisite to opening one.

There are admin fees attached to trading with FP Markets accounts. These are outlined here.

Deposit and withdrawal

Deposits to your FP Markets account can be made in any of the following currencies:

- CAD

- CHF

- EUR

- GBP

- HKD

- JPY

- NZD

- SGD

- USD

You can make a deposit using a credit card or a debit card. There are no first time deposit fees for MT4 MT5. An FP Markets Iress account will attract 1.6% fee if paid in AUD or a 3.18% fee for international deposits. There is no waiting time for the funding to appear in your account in both MT4 or MT5. There may be a wait of up to 1 business day for Iress accounts.

Deposits can also be made through a bank transfer. There is no deposit fee for using a bank transfer. The waiting time for funds to appear in your account is usually up to 1 business day. If you are making a deposit in currencies other than AUD, the transaction will be classed as international. There is no deposit fee for international transactions either. There is one business day waiting time for the funds to appear in your account after they have cleared.

Customers from China or those looking to make deposits in RMB can do so using online payment systems. There is a fixed charge of $18 USD for these deposits. The funds appear instantly on both MT4 and MT5 trading platforms. Iress accounts may take up to 1 business day to show the funds.

If you want to use PayPal, you can do so. There are no deposit fees on both MT4 and MT5. There is a 2% fee for Iress accounts. The funds will appear instantly on MT4/ 5. There is one business day waiting time for Iress accounts.

Other deposit options available at FP Markets include:

| Deposit Method | Deposit Fees | Deposit Times |

|---|---|---|

| Neteller | 4% for Iress accounts | MT4/5 done instantly Iress in 1 business day |

| Skrill | 4% for IRESS accounts | MT4/5 done instantly IRESS in 1 business day |

| PayTrust (PayTrust deposits can only be made in the following currencies: MYR, IDR, TBH, VN) | There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

| NganLuong.vn (Deposits can only be made in VND) | There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

| FasaPay (Deposits can only be made in USD or IDR) | There are no deposit fees | MT4/5 done instantly IRESS in 1 business day |

| Broker to Broker (deposits can be made in the following currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD or USD.) | There are no deposit fees on deposits made in AUD. Other currencies attract an international charge of 25 AUD. | All transactions take up to 1 business day to clear |

Minimum deposit

When opening a FP Markets forex trading account, you will be required to make a deposit of $100. Iress accounts have a minimum of $1000.

Base currencies

FP markets offer some flexibility when it comes to the currencies that they use when making deposits. There are some perceived advantages of using AUD. However, several other currencies are accepted. You can make a deposit using any of the following base currencies: CAD, CFH, EUR, GBP, HKD, JPY, NZD, SGD or USD. The key difference between using theses instead of AUD is the additional fees that they attract. As such, we could say that AUD is the preferred currency.

Available Markets and Financial Products

There are 6 key financial products that one can trade through FP Markets:

- Forex

- shares

- metals

- commodities

- indices

- cryptocurrencies

Forex

There are over 60 currency pairs that can be traded through the FP Markets platform. Throughout the week, all of the major currency pairs can be traded at any time of the day. The forex trading market is shut on weekends. Traders have access to FP Markets award-winning customer support when they need assistance.

By using Equinix servers, trades are executed at lightning speed. One key advantage of a market that is open at all times is that users can enter positions before the trading floors are open and exit at will. They can also leverage options up to 500:1 to maximise the spread.

Trade spreads start from as low as 0.0 pips.

Shares

There are over 10,000 Australian and international shares available to trade through FP Markets. They cover 4 continents. CDF Trading through FP Markets trading platforms is ideal for those that are looking to benefit from the changes in price in either direction.

There are two options through which you can trade shares with FP Markets. Through Iress, you have access to upwards of 10 000 CFDs to trade on exchanges across the world. MT4 & 5 allows you to trade up to 54 shares on global exchanges.

Metals

Precious metals are also available to trade on through FP markets trading platforms. They are popular as a way to safeguard capital against a volatile market. This market is open all day long, 5 days a week. Metals can be traded against currencies. The most common ones on this market are the USD and AUD. They are often traded against gold and silver.

Commodities

There are a few commodities that can be traded through FP Markets. A complete list can be found here. Through this platform, there is access to worldwide commodity prices. There are few CFD brokers that offer lightning fast execution speeds. There is leverage of 500:1 on commodities giving a tight spread. Trades can be executed through MT4 platform.

Indices

FP Markets recommend using MT4 when trading indices. This allows you to take full advantage of their technical analysis indicators as well as the customisable user interface. Their margins on indices from across the world start from as low as 1%.

Overseas stock available include NASDAQ 100, S&P 500, EUREX, among others. By partnering with international banking institutions and other stakeholders, FP Markets ensures that investors have access to low latency order execution as well as competitive market prices.

Cryptocurrencies

FP Market gives you the option to trade in 5 of the most sought after cryptocurrencies. You can trade Bitcoin, Ethereum, XRP (Ripple), Bitcoin Cash, and Litecoin. One feature that separates this platform from other places is that you will not need a crypto wallet to purchase any of these currencies. They trade at low spreads.

Research tools available

There are several research tools available to investors through this broker. Let’s look at some of our favorites.

The Mini Terminal is designed to de-clutter your workflow. It makes it easier to zero in on specific markets. Sentiment Trader uses live and historical data to reveal insights that can be sued to decide whether to short/long a trade. Trade Terminal allows you to get an overview of all positions that you have open.

FP Markets also offer fundamental analysis. Daily fundamental analysis is available on their blog section of the website.

There is always a risk of an overload of information. This often causes inaction. Session Map is a remedy for this. It is designed to present the key indicators that help in decision making.

If you are entering and exiting several positions throughout the day, the Tick Chart will be a great tool to add to your arsenal. It reveals the smallest of movements and tracks volatility within the market.

Customer Service

FP Markets customer support is efficient. The representatives can be reached 24 hours a day on weekdays. You can reach customer service via live chat, phone or email. There is reduced customer support service on weekends. What makes their customer service even better is that the staff members are trained to answer technical questions related to trading.

You get reach customer support via live chat, on the website. If the request is not urgent, an email to customer support at support@fpmarkets.com will get a prompt response. It is best practice to use your registered trading account email to reach customer service.

If your query is specific, it is worth reaching out to the right customer support team via email. Here are some of the query-specific email address:

New enquiries: sales@fpmarkets.com

Opening an trading account: onboarding@fpmarkets.com

Withdrawal related: cash@fpmarkets.com

Funding related: accounts@fpmarkets.com

Trade-related: risk@fpmarkets.com

General Customer Support: support@fpmarkets.com

They can also be contacted via the phone: +61 2 82526800

Regulation

First Prudential Markets are an Australian Securities and Investments Commission regulated global forex broker. The segregation of the funds also means that their regulation is globally compliant. There are but a handful of countries across the globe from which you can not open an trading account with of FP Markets.

FP Markets also holds and operates under the Australian Financial Services License (ASFL) #286354.

FP Markets maintains segregated client funds. This means that client’s money is safeguarded. To facilitate this, clients’ money is kept separate from FP Markets capital. Investors’ finances will never be used for the company’s needs.

The Australian Securities and Investments Commission (ASIC) is an independent body. Their role is to impartially oversee the fair practice of brokers and other financial institutions within Australia. The regulations that they have in place for brokers to follow are designed to protect investors.

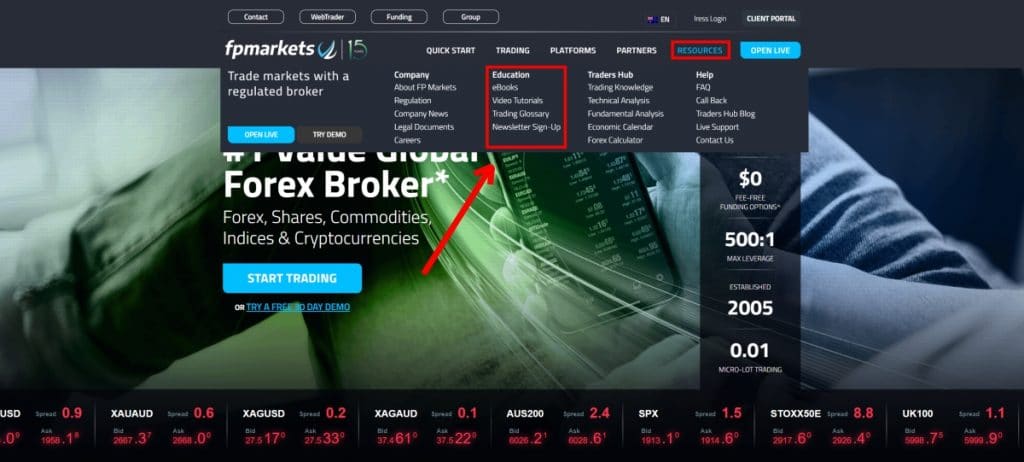

Education

FP Markets offers a variety of educational materials. Their education is one of the best in the industry. The first form of education offered by this platform comes in the form of access to a demo account. It is through this demo account that beginners can improve their trader skills or indeed develop them from scratch. This is done through being able to test their ideas on live data without risking their capital.

For those who are yet to get the hang of the trading platform, there is access to tutorials. FP Markets tutorials are designed to making it easy to find options and functionality within the platform. This is useful for beginners and experienced traders alike.

FP markets also offers daily fundamental analysis, written by their First Prudential Markets experts.

For those who are looking to delve even more in-depth, FP Markets offers a comprehensive trading course. It is suitable for beginners looking to take their skills to the next level. Even an experienced trader will find a few nuggets within the content. If the terminology is still confusing, there is a detailed trading glossary to assist you.

If you prefer processing your information in the form of written text, there are high-quality eBooks available through the platform. You can access all of this through the resource tab on the website.

Conclusion

For peace of mind, you will be pleased to find that FP Markets offers top tier liquidity. This is provided in partnership with financial juggernauts such as JP Morgan, Barclays, HSBC and Goldman Sachs. Multi-bank liquidity provides an additional safety-net for investors.

Let’s summarise some of our favourite features provided by FP Markets. There is an incredibly low barrier to entry for forex trading. An account will take very little time to be set up and ready to go. A deposit of $100 is quite reasonable. You can make a deposit using various currencies and payment mehtods. We also like that there are no fees for making a withdrawal.

On the other hand, CFD trading attracts relatively larger fees. There is also a higher minimum deposit. This places the barrier for entry at a higher level. However, considering the increased risk that comes with trading CFD the barrier of entry may be a worthy deterrent to a lesser experienced trader.

Having considered this from both angles, we would certainly recommend using FP Markets.

Our Score: 4.5/5

- Established in 2006

- Relatively low minimum deposit

- Forex Trading Fees are Low

- Easy account opening

- Great customer service

- Seamless Deposits and Withdrawals

Most of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.