* This content is not intended for USusers. eToro USA LLC does not offer CFDs, only real Crypto assets available.

New traders on eToro often don't understand exactly how they can sell on the eToro platform. Traders have suffered significant losses as a result of a misunderstanding of the platform's core terminology.

Here, we'll provide a detailed explanation of these terms, including how they're used, how they affect your trading decisions, and how to use them to confidently win trades. You might want to read our review of the eToro wallet and guide on eToro Leverage.

Selling on eToro

eToro allows you to trade stocks without commissions, and it's simple to sell on eToro. All you have to do after logging onto the platform, or the mobile trading platform, is access your portfolio, select an instrument, select the sell option, and close the deal.

These are the steps to start selling stocks on eToro:

- Start by logging in to the platform.

- Click on your portfolio and then on the item you wish to sell, either on the online platform or on the mobile trading platform.

- Close your position

- Purchase something else or withdraw the money.

What Is Short Selling?

When markets are down, short selling is a great way to make a profit. It’s a strategy that allows traders to create a position that will increase in value if the price of a financial asset falls. This is used as a hedging tool or when markets are dropping.

Short selling is a contract or an agreement between a trader and a broker that can take many different forms. The most basic case is when a broker lends a trader a specific asset, such as a number of stocks in a specific company, so that the trader sells the stocks at their current price. The trader then sells the stocks and then buys them back at a cheaper price when their value drops. The assets are then returned to the broker, and the difference is kept. This is surely the best-case scenario for the trader, and the deal may end up being less advantageous.

We say “short selling” referring to the fact that the trader is now “short” a specific number of stocks after they borrow the stocks and sell them.

Short Selling on eToro

Short selling is done on the eToro platform via a Contract for Difference (CFD). By using CFD, both the broker and trader agree on the conditions in advance and try to settle any difference at the end of the transaction without the asset itself moving from either party’s possession.

How To Open a SELL Position on eToro

Creating a short position on eToro is simple. To do so, simply open a trade and change the toggle from “BUY” to “SELL”. The position will open as a short-selling position once you do that and open your trade. The position will display in your portfolio as a “SELL” position after you open it.

Prices on eToro contain a spread, meaning that the BUY prices are higher than SELL. So, before you close a short position, make sure to check the platform's BUY price, as that is the price you will get.

Closing a Trade on eToro

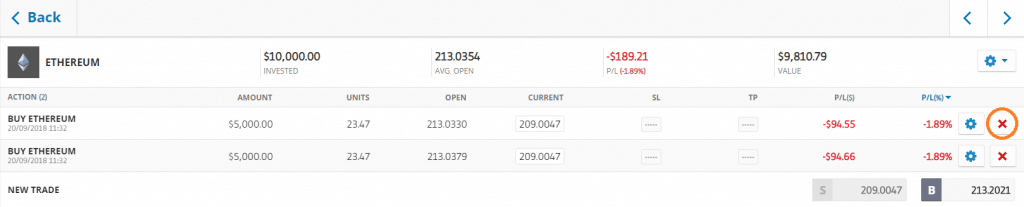

You can only close trades that you currently own on the eToro platform. Let's assume you purchased or sold positions in DIS (The Walt Disney Company) last month and made a decent profit today. To lock in the profits and close your trade, simply go to your portfolio and choose “DIS” from the list of stocks.

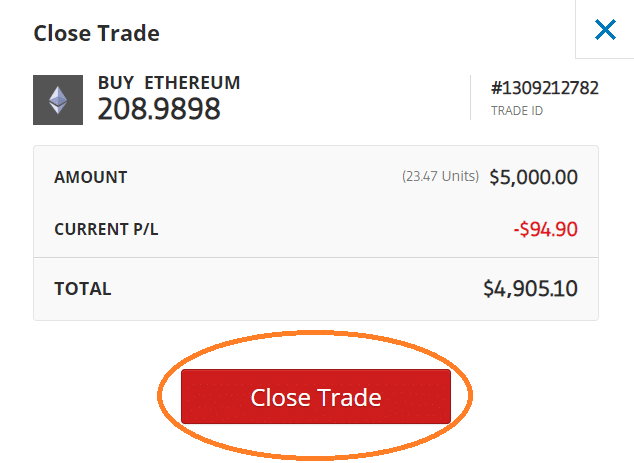

Then, you'll be sent to a page where the red “x” button can be found on the right side of the page. You'll get a pop-up page to confirm the closing after clicking the “x” button, which is the close button.

Finally, click “Close Trade” on the confirmation pop-up page.

Always double-check that you are on the right page when closing a trade. Others confuse “selling” a trade with “closing” a trade, which are two distinct terms that may have disastrous consequences for your portfolio if mistaken for each other.

How to sell crypto on eToro?

Selling cryptocurrency on eToro is pretty much the same as selling other assets. Here are the steps to sell crypto on eToro:

- Click on “portfolio”

- Find the cryptocurrency you wish to sell

- Click the red X next to the position you wish to sell. Swipe left on the position and tap the red X if on your mobile.

- Click “Close Trade”

- Your position will be closed during market hours.

Things To Keep in Mind

You want to be mindful of 6 main points in the Open Trade if you open a SELL position.

- The spread must always be taken into consideration

- The current rate you see is the BUY price

- The SL can be adjusted up to 100% of your investment without any additional funds from your equity.

- The TP can be adjusted to at least 1 pip to market price, and it can be as high as you want it to be.

- The SL price that you see is the BUY price, which is the price you’d get if you were to buy the asset back.

- The TP price you see is also a BUY price, also the price you’d get if you were to buy the asset from the market.

* Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading

CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and

regulated by the Cyprus Securities and Exchange Commission.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the

accuracy or completeness of the content of this publication, which has been prepared by our partner

utilizing publicly available non-entity specific information about eToro.