Interactive Brokers is one of the largest brokerage firms in the world. Founded 1978 in New York City, and headquartered in Greenwich Connecticut, it has more than 24 offices in 14 different countries. IBKR offers brokerage services to more than 1.3 million brokerage accounts. IB is traded as IBKR and in the S&P 500. They serve clients inside and outside the United States.

Table of Contents

IBKR offers low trading fees, a great trading platform, and a great selection of securities. The Interactive Brokers low margin rates are the best in the industry. They cover more than 150 different markets and dozens of different exchanges. This discount broker is at the top of the list for many investors. Traders rely on the fact that they are regulated by some of the most trusted regulatory agencies in the world.

Interactive Brokers

Summary

Interactive Brokers is licensed by top-tier regulators, listed on the stock exchange, with a long track record. Their trading platform is easy to use with loads of tools. Interactive Brokers is an excellent choice for beginner to advanced traders, especially for options, stocks, and margin trading.

Platform Overview

Interactive Brokers has a lot to show for and offer for both beginners and experienced traders around the world. Interactive Brokers' core clientele are institutional investors and professional traders.

They stand out as one of the best brokers for active day traders due to low commissions and fees – check out our day trading apps list. IB is also heavily regulated by multiple top-tier jurisdictions. These include the United States Securities and Exchange Commission (SEC), Securities Futures Commission, the UK's Financial Conduct Authority (FCA), and many others.

| Interactive Brokers | |

|---|---|

| Minimum Deposit | $0 |

| ETFs Fees | $0.005 |

| US Stock Trading Fee | min. $1 or max. 1% of trade value (Free for US IBKR Lite Plan) |

| UK Stock Trading Fee | 0,05% for trades above £50,000, fixed 6£ for trades below £50,000 |

| German Stock | 0,1% of trade value (max. €99) |

| Forex Fees | Low |

| Mutual Funds | $0 |

| Options | $0.65 up to $2.22 per contract |

| Futures Fees | $0.25 up to $2.22 per contract |

| CFD Fees | $0.005 ($1 min.) up to $3.92 per order |

| Bonds | $2.35 up to $5 (IBKR Lite – free for US treasury bond) |

Screening and choosing a brokerage firm for you among the large number of options out there is not an easy task and it will definitely take valuable time you could be otherwise investing in more profitable and rewarding endeavors.

Since there are so many details you have to go through to get a broad perspective of the benefits and disadvantages of choosing a broker, we decided to summarize this broker's key characteristics for you to reduce the amount of time invested in short-listing the best candidates.

Use my review along with reviews we have done for other brokers on Public Finance International to compare certain key features and characteristics so you can finally choose who you go with.

| PROS | CONS |

| Wide variety of products available | Trading Platform could be too advanced for beginners |

| Authorized and regulated by top-tier authorities | |

| Great research tools |

Account Opening

Opening an account is completed online and it should only take a few minutes. After registration, you will have to verify your identity. This step should not take longer than 24 hours as long as all the necessary information is provided.

Interactive Brokers offers both individual and joint accounts along with trust, retirement, friends and family managed accounts, and institutional accounts for businesses, hedge funds, and family offices. A money manager account is also available for professional investment managers.

The availability of these accounts varies depending on the country you reside in.

There are essentially two types of accounts:

- IBKR Lite: This account is designed for retail investors, and it doesn't require a minimum deposit. However, a minimum balance of $2,000 is required to trade on margin. This account provides zero commission trading on US-listed stocks and ETFs and fixed pricing for trading options, futures, and mutual funds. No maintenance fees apply.

- IBKR Pro: The IBKR Pro account is primarily designed for institutional investors, high-net-worth clients, and professional traders. They offer unlimited commission-free trading for U.S. Stocks and ETFs and some mutual funds. It offers both fixed and tiered pricing, which means that it varies depending on the volume of each trade. There is no maintenance fee.

A demo account with $1,000,000 is available for traders who want to test their brokerage services before registering.

The platform gives active users access to all of the tools, even though the data for most instruments is delayed by 10 or 15 minutes.

Interactive Brokers Margin Rates

Here is a comparison of USD margin rates for Interactive Brokers:

| $25K | $300K | $1.5M | $3.5M | |

| Interactive Brokers | 6.08% | 5.75% | 5.53% | 5.42% |

| Fidelity | 12.33% | 11.075% | 8.50% | 8.50% |

| Schwab | 12.33% | 11.08% | N/A | N/A |

| E-Trade | 12.95% | 6.95% | N/A | N/A |

| TD Ameritrade | 13.50% | 12.00% | N/A | N/A |

Deposits

Interactive Brokers does not charge deposit fees. They provide more than 24 different base currencies for its accounts. These include the most popular ones – US Dollar, Australian Dollar, and Euro – and some exotic ones like the Israeli Shekel, and the Mexican Peso.

Interactive Brokers Minimum Deposit

To open an account with Interactive Brokers there is no minimum deposit at Interactive Brokers.

If you plan to invest with several securities and trade heavily, they recommend you deposit $25,000. This ensures you don't get your account locked by the SEC and the pattern day trader rule.

The following is a list of the available deposit methods:

- ACH deposits

- Checks

- Online bill payment

- IRA rollovers

For Wire Transfers, Interactive Brokers routing number is 021000089.

Bank transfers typically take between 2 and 3 days to be cleared.

Withdrawals

Interactive Brokers does not charge a fee for the first withdrawal of each month. Withdrawal methods are limited to bank transfers as withdrawals cannot be made to debit cards, credit cards, or electronic wallets. Withdrawals typically take 1 to 2 business days to be cleared.

Furthermore, they offer multiple base currencies for its accounts. This could help traders in saving conversion fees when withdrawing money.

Interactive Brokers Withdrawal Fees

Subsequent withdrawal fees after the first free one – vary depending on the account's base currency. In general, they can be estimated as $10 per withdrawal. Additionally, check payments for US clients generate an additional $4 fee.

Interactive Brokers Markets Available

Interactive Brokers offers one of the industry's most extensive portfolios of financial products. A wide range of products are available for both active traders and buy-and-hold investors.

Their platform offers access to 140 different exchanges worldwide. This includes 78 stock markets, 33 options markets, 32 futures markets.

Interactive Brokers provide access to the following number of investment products:

- Thousands of individual stocks

- Fractional Shares Trading For U.S. and European Stocks

- OTCBB (over-the-counter bulletin board) – Penny Stocks

- 13,000 exchange-traded funds (ETFs)

- 105 currency pairs

- 250 mutual fund providers

- More than 62,000 individual bonds

- Thousands of options

- Dozens of commodity, stock index, and other futures

- 13 stock index CFDs

- 7,100 individual stock CFDs

- Cryptocurrency Trading through Paxos Trust (Bitcoin, Ethereum via Bitcoin Index, Bitcoin futures, and ETN products)

They offer a robo-advisory service called Interactive Advisors. It provides investment advice for clients depending on their financial goals. For that particular service, there's a minimum $100 investment required and certain fees apply.

Mutual Funds include a neat Mutual Fund Search Toll to search by categories such as fund type, fund family, and country.

Interactive Brokers is probably one of the few that provides access to a selection of hedge funds. Even though customers must meet certain criteria to be granted access to this type of investment vehicle. The minimum investment typically starts at $200,000 even though some funds may require a minimum investment of $1 million.

Interactive Brokers Trading Platform

Interactive Brokers offers multiple trading platforms and systems. These include a web-based client's portal, a desktop version, Mobile Trading Apps, a messaging-based trading system, and advanced API features for sophisticated active traders. The IB Trader Workstation includes investment tools like Options Strategy Lab, Volatility Lab, Markets Scanners, and Portfolio Builder.

Take a look at this short tutorial on how to use Interactive Brokers platform

All of these versions are available for IBKR Pro accounts. The Client Portal, IBKR Trader Workstation and the mobile trading app – IBKR TWS Mobile – are available for retail investors with an IBKR Lite account.

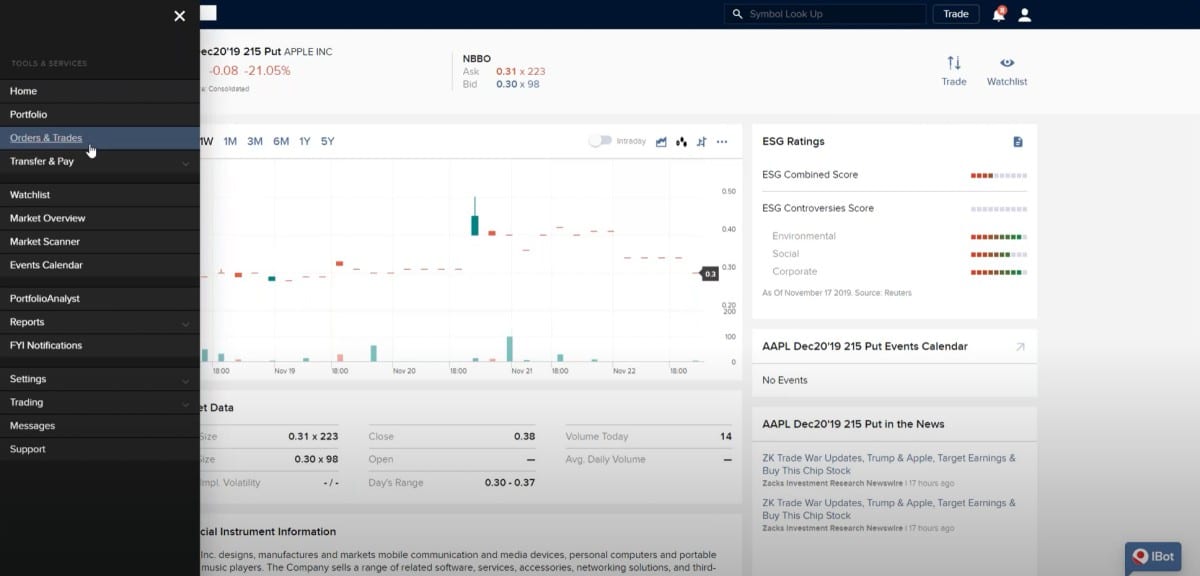

Web-based platform

Interactive Brokers Client Portal is a user-friendly cloud-based trading interface. It features a modern design, a user-friendly menu, and an intuitive search function. This reduces the overwhelming feeling caused by overcrowded desktop versions requiring significant customization to navigate them easily.

This Client Portal seems to have been conceived for retail traders due to its easy-going processes when placing trades, browsing through different securities, checking reports, and other daily tasks a trader usually goes through. Additionally, the system can be customized for multiple languages including Dutch, English, Chinese, and Spanish.

Traders can increase the level of security of their accounts by using two-step authentication, which works by sending a verification code via SMS.

Meanwhile, the web-based platform allows traders to place a wide range of different orders. These include:

- Market Order

- Stop Order

- Stop-Limit Order

- Limit Order

- Trailing-Stop order

Interactive Brokers also include other less frequently seen in most platforms like Limit-on-Close and Market-on-Close orders. Its trading desk also allows for various time-bound order alternatives like Day, Good-til-Canceled (GTC), Immediate or Cancel.

Alerts and notifications can be set and they are will appear as push notifications on the screen if the price of an asset reaches a certain level and so on.

The charting tool within the Client Portal looks amazing and comes with a wide range of indicators and drawing tools including traditional and advanced charting patterns.

Additionally, a news feed is displayed right next to the ticker summary and fundamental data on the asset can also be pulled as needed. Since 2021 they offer technical opinions direct from the Trading Central.

According to their website, the Client Portal was designed to provide an easy-to-navigate trading interface. This is useful for new clients who would like to see the real-time performance of their portfolios without having to interact with a more complex tool such as the TWS.

Desktop Platform

Their desktop trading platform is called TWS. It features more advanced tools and supports sophisticated strategies and systems like algo trading.

It was primarily designed for experienced investors and traders who want to take advantage of a wider range of securities and certain more insightful analytics. These trading tools come handy once a portfolio reaches a certain level of complexity.

It incorporates anything you need, from the most basic to the most advanced strategy and investment approach. This makes the TWS interface not that user-friendly and complex to navigate, especially for inexperienced traders.

Traders who already have some experience working with complex trading systems will find this platform interesting. There's significant room for customization, which would ease the difficulty of navigating through its various layers.

As for its security features, it provides the same alternatives as the web-based platform, which is a two-step login that requires an SMS code to grant the user access.

Meanwhile, there are much more complex order types in the desktop version compared to the Client Portal. Such as: mid-price orders, snap-to-midpoint, snap-to-primary, IBALGO, Hedge, relative, and snap market orders.

Time-bound trade order alternatives are great as well.

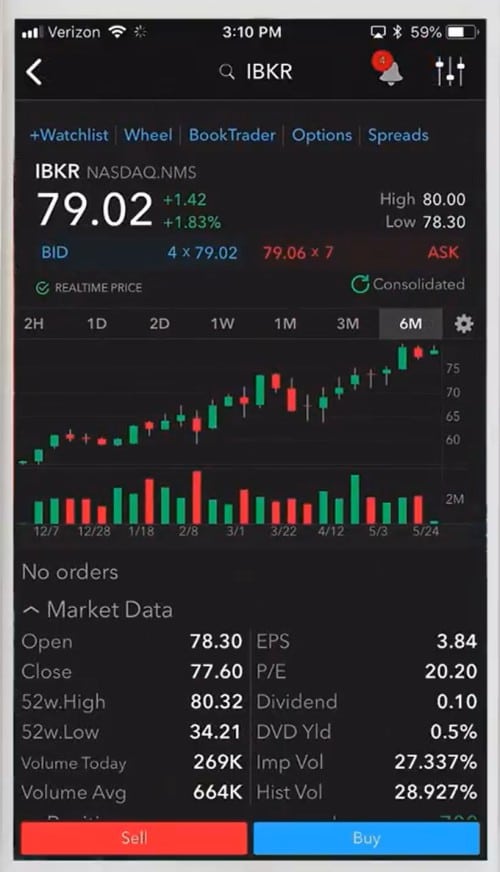

Mobile Trading App

The platform's mobile version features a modern and user-friendly design for traders on the go. It is more similar to the web-based version than the desktop version.

This app is available for Android and iOS devices and comes with the same security features as the other versions.

The search function is very easy to use and it is pleasantly structured as it allows the trader to browse through different asset classes listed under the same ticker or containing the same letters.

Additionally, research materials are available in the mobile app, including analysts' recommendations, fundamental data, news, and an economic calendar.

The type of orders available in the mobile app are the same as in the web-based version.

IBot Function

Interactive Brokers has introduced an innovative chatbot feature called IBot. It allows you to place orders and get information by texting or saying certain commands.

The function is very advanced in terms of the number of commands that you can use. Such as displaying a chart for a given security or snatching some key fundamental data for a stock.

The IBot feature can be used from within the TWS mobile app, from a mobile phone via SMS, from the FB Messenger app, from Amazon's Alexa system, or from within the Desktop TWS platform.

Advanced APIs

Interactive Brokers has designed various APIs for institutional and seasoned traders that allow them to access their database and systems by using a shared programming language such as Python, C++and .Net.

Interactive Brokers Fees

Trading fees are low in general. They don't charge a fee or charge only a small amount. So how does Interactive Brokers make money?

Interactive Brokers is earning money through four sources – commissions, Net Interest Income, Trading gains and various other income. Interest earing assets increased by about 15% in the past couple of years.

There are three important expenses that must be analyzed to understand how much it costs to trade with Interactive Brokers. These are its trading fees and commissions, the applicable margin and interest rates, and other non-trading fees. For fees, I'll break down the cost of trading various different asset classes for the different plans.

Stocks, ETFs, and Warrants

IBKR Lite clients enjoy commission free US exchange-listed stocks and ETFs trades, while IBKR Pro accounts have a fixed or tiered rate to trade both US-listed and non-US-listed shares.

For both accounts, non-US shares can be traded at a fixed commission that starts at 0.1% of the trade value with a minimum that varies from one stock exchange to the other.

Also, certain maximum limits to fees apply when the trade value exceeds a certain threshold.

As for the tiered plan – applicable to IBKR Pro accounts – the cost per trade is reduced progressively after a certain minimum monthly volume has been exceeded.

Options

Options have a fixed pricing scheme for both accounts with US-listed options trading at $0.65 per contract with a $1 minimum per order, while certain surcharges apply to some specific instruments.

Options are available for many other instruments overseas and for European exchanges the trading fee is a bit higher – starting at EUR 1.5 per contract – with minimums that range from EUR 1.5 to EUR 3 per trade.

Tiered plans offer a significantly lower rate per contract for trade volumes higher than 10,000 contracts per month.

Futures

US-listed futures and future options can be traded for as little as $0.85 per contract, while e-mini FX futures can be traded for $0.50 per contract.

Trading costs go lower for trading volumes that exceed 1,000 contracts per month.

Spot Currency Pairs

Spot currencies generate a 0.20 basis points times the trade value for volumes lower than $1 billion per month with a minimum of $2 per order. Higher volumes enjoy a tiered pricing scheme that can go as low as 0.08 basis points for volumes that exceed $5 billion each month.

Fixed Income Securities

US-listed fixed income securities such as US Treasury bills and corporate bonds generate a commission fee starting a 0.1% of the bond's face value with a minimum of $1 per order and a maximum of $250 or 1% of the trade value, whichever lower.

Bonds from other latitudes generate a similar commission fee of 0.1% for European bonds and 0.08% of the trade value for Hong Kong government bonds.

Precious Metals

Gold and silver is available. Commission fees start at 0.15 basis points times the trade value with a minimum of $2 per order. Storage costs are calculated as 0.10% of the value of the metals per year.

Mutual Funds

Interactive Brokers offers a wide variety of commission-free mutual funds with no transaction fee. These include Blackrock and Allianz funds, while others are offered at a fixed low commission of €4.95 per trade outside the US and $14.95 per trade in the US.

Margin Rates & Interest Rates

They charge a different rate for Lite and Pro accounts for their margin trades.

This rate starts at 1.59% for IBKR Pro clients for margin amounts lower than $100,000 while a higher 2.59% rate applies to IBKR Lite clients.

The rate varies per currency and can be modified at any moment.

Meanwhile, due to the low-interest-rate environment we are currently in, cash held on IB accounts is not generating any interest on behalf of depositors regardless of the balance of their accounts.

Non-Trading Fees

Interactive Brokers has no inactivity fees for trading accounts.

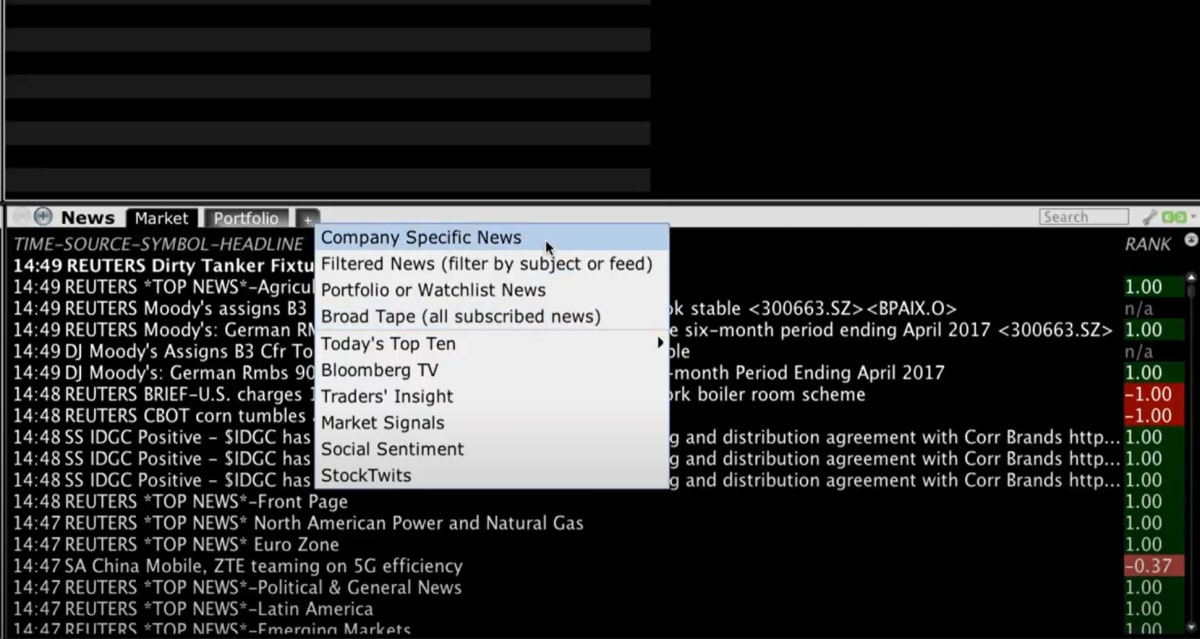

Research Tools

Interactive Brokers offers an extensive selection of top-of-the-line research tools. Third-party research is available in Trader Workstation (TWS) and the web-based Client Portal. A great source for research is their Traders' Insight blog, where you can find content published during the trading week.

Charting

Starting with charting tools, the workstation provides more than 120 different technical indicators.

Charts are just one of the ways to get a trading idea, as there are many other features such as Validea and The Leading Edge, which are two real-time in-depth analytics tools that provide valuable insights to traders. IBKR's charts are fully customizable. You can modify them from the Edit menu and save layouts as your own personal template.

Interactive Brokers offer over 120 technical indicators for technical traders with easy-to-use drawing tools.

You can choose:

- The time period

- Bar Types (TWS charting offers bar, candle, line, historical volatility, implied volatility, hollow candles, option volume, option open interest, and heikin-ashi)

- The Vertical Scale

- Number of bars to display

- Dividends

- Volume Plot Height

- Many other chart parameters

Fundamental company data is available, including financial statements, dividend calendars, and peer group analysis tools.

News Feed

The news feed includes real-time news sources embedded within the platform. These include sources like Benzinga Crypto News, Benzinga Pro News, Thomson Reuters Global Financial Market News, IBKR Traders' insight, IBKR Market Signals, IBKR Quant Blog, Insider Insights, Dow Jones North American Briefing, Market Realist, Morning Star Insider Trade Log, China Investment Insight, TipRanks Market News, SeekingAlpha, The Motley Fool, StreetInsider.com, TipRanks Market Nes, Zacks Investment Research, and many others. At the same time, other tools include a probability estimator tool for options, a mutual fund and ETF replicator, VaR analysis, Sharpe calculators, and many other similar features.

For premium news, subscriptions are available.

Furthermore, there's an economic calendar covering worldwide events, daily market summaries, and many other similar tools that you can look at if you ever feel your mind goes dry on new trading ideas.

Some of the features come at an extra fee – you'll have to decide if they are worth paying for – while others are only available for IKBR Pro clients.

Trading Ideas

Interactive Brokers offers trading ideas to inspire traders with new ideas. When you customize parameters on the platform, you can find new trades specific to your asset class of interest. Interactive Brokers clients have access to Benzinga, IBKR Market Signals, Capitalise, Refinitiv Significant Developments. There is a “Top Lists” in the research portal which lists the most interesting assets in different regions and asset classes.

Educational Tools

Interactive Brokers offers a large variety of educational tools that include:

- Traders' Insight

- Webinars

- Traders' Academy portal

- Podcast Series (Traders' Insight Radio)

- Traders' Glossary

- IBKR Quant Blog

These programs are found under “IBKR Campus.

Perhaps one of the most interesting educational tools is the Traders Academy program that they offer to clients. This program features 48 different courses that go from the most basic topics of investing – including platform basics – to explaining how certain complex products like leveraged and inverse ETFs work.

This is possibly one of the best and most complete programs and it is available whether or not they are a client.

IBKR regularly organizes webinars and other similar events to update traders about the market's situation from the perspective of experienced and qualified financial professionals within the Interactive Brokers' team. These are also free and available to the public.

Is Interactive Brokers Safe?

Interactive Brokers is considered a safe online broker. Their Security Protocols for your personal information, account data is among the best. Accounts opened at Interactive Brokers LLC are protected under the Securities Investor Protection Corporation (SIPC) up to $500,000, with a cash sublimit of $250,000.

Security depends on the country you reside in and where client funds are held along with the related regulations that the Interactive Brokers entity is under.

Their mobile app is protected by biometric login. Accounts over $1 million can also request a digital security card.

Customer Service

Interactive Brokers offers its clients different channels to reach out in case they find an issue within the platform or their account.

A customer service representative can be contacted via live chat from within the platform, while phone and e-mail channels are also available in various languages, with most regions offering at least one toll-free number.

In general, users have reviewed IBKR's customer service positively, even though they have pointed to the fact that they only offer 24/6 availability, which is a problem for traders who tend to operate outside regular business hours.

Conclusion

Interactive Brokers is a publicly-traded brokerage firm founded in 1978 and headquartered in the United States. This broker holds nearly 13,000 brokerage accounts and it is heavily regulated by multiple top-tier financial agencies like the SEC (US), the FCA (UK), and the ASIC (Australia). They offer an extensive portfolio of securities covering more than 135 markets around the world. They have a demo account with $1,000,000 to test the platform before depositing money. Trading fees charged are on the low end of the industry including zero-commission for US-listed stocks and ETFs. Educational tools include a Traders' Academy, which is a program that covers an extensive number of basic and complex financial topics for traders to improve their skills. The quality of the customer service provided is good and customer service representatives can be reached via live chat, e-mail, and phone.

Our Rating: 4.9/5

Interactive Brokers is licensed by top-tier regulators, offers a wide range of products. It is listed on the stock exchange, with a long track record. Interactive Brokers is a good choice for both experienced and casual traders. Their fees are low and offer a great trading environment.