Founded in 2017, IQcent is an online broker in the Marshall Islands, and it was the first binary options broker to accept cents in trading. The minimum trade size in IQcent is $0.01. The broker offers a good range of assets, including CFDs on currency pairs, commodities (gold, silver), indices, cryptocurrencies, and binary options.

However, IQcent has been very controversial due to its regulation status. Some think you shouldn’t trade with this broker, and some still do and make profits on it. So, what should you do? Should you start trading on IQcent, or should you pass on this one? Keep reading as we break down every aspect of IQcent, its pros and cons, and how it compares to other brokers.

Summary

In short, we don't recommend IQcent.

IQcent has little to brag about and more to hide. First and foremost, it’s not regulated by any authority. Furthermore, your deposits aren’t protected by compensation schemes, and there are no publicly available reports about its financial performance. The customer service isn’t excellent, not all questions sent by email are answered, and live chat service only provides answers to basic questions. Not to mention IQcent’s poor educational content.

On the positive side, IQcent offers its clients a good product selection. You can also withdraw funds to crypto wallets. They offer 24/7 customer support with a built-in translator in the live chat.

Best Alternative: Pocket Option

Pocket Option

- Over 100 Assets

- $50 Minimum Deposit

- 50+ Payment Methods

- $0 Commissions on Withdrawals and Deposits

- Demo Account

- Regulated by IFMRRC (License number TSRF RU 0395 AA Vv0158)

IQCent Overview

This is a brief overview of IQcent:

| Trading Platform | IQcent |

|---|---|

| Founded: | 2017, but started to offer online trading services in 2020 |

| Headquarters: | Majuro, Marshall Islands |

| Regulation: | N/A Offshore |

| Demo Account: | Yes |

| Islamic Account: | No |

| Minimum Deposit: | $20 |

| Account Currency: | USD, EUR, and GBP |

| Spread: | From 0.7 pips |

| Leverage: | up to 1:100 |

| Inactivity Fee: | No |

| Bonus: | Yes |

| Investment Offering: | CFDs on currency pairs, commodities (gold, silver), indices, cryptocurrencies, and binary options |

| Mobile App: | Yes |

| Payment Methods: | Bank wire transfer, Vsa/MasterCard, Bitcoin, Ethereum, Litecoin, and Altcoins |

| US accepted: | No |

| Customer Service: | Live chat, phone, webform, email, Instagram, Twitter |

| Our Score | 2.2/5 |

Pros and Cons

For many people, IQcent is one of those online brokers whose downsides are too overwhelming if you want to ignore them and focus on their good sides. Check the following table to have a bigger insight into the pros and cons of IQcent:

| Pros | Cons |

|---|---|

| Client funds are held separately in Europe-based banks | Offshore company |

| A good asset selection | Your deposits aren’t protected by compensation schemes |

| You can withdraw funds to crypto wallets | No publicly available reports about the broker’s financial performance |

| 24/7 customer support | Poor educational content |

| Built-in translator in the live chat | Not all questions sent by email are answered |

| Live chat service provides answers to only basic questions |

IQcent Compared to Similar Trading Platforms

You can already tell that IQcent is not the best option available in the market and that it has many competitors outperforming it. In the following list, we compare IQcent to four of its competitors in the industry:

| Trading Platform | IQcent | VideForex | Pocket Option | RaceOption | IQ Option |

|---|---|---|---|---|---|

| Founded | 2017 and started working in 2020 | 2016 | 2017 | 2014 | 2013 |

| Minimum Deposit | $20 | $250 | $5 | $250 | $10 |

| Inactivity Fee | $0 | $10 per month | $0 | $0 | €10 fee after 90 days of inactivity |

| US Accepted | No | No | Yes | No | No |

| Regulated | No | No | Yes | No | Yes |

Account Types

IQcent offers you three account types to choose from, all of which has their own unique features and benefits:

Bronze Account:

- Withdrawals in one hour

- Bonus +20%

- Copy Trading tool

- Demo account

- 24/7 live video chat support

Silver Account:

- Withdrawals in one hour

- Bonus +50%

- Copy Trading tool

- Demo account

- Master class (web session)

- First 3 risk-free trades

- 24/7 live video chat support

Gold Account:

- Withdrawals in one hour

- Bonus +100%

- Copy Trading tool

- Demo account

- Master class (web session)

- First 3 risk-free trades

- 24/7 live video chat support

- Personal success manager

Demo Account:

You can also use a demo account to test the waters on IQcent. To acquire access to a demo account, you must first fund your trading account and contact customer service for credentials.

Deposit and Withdrawal

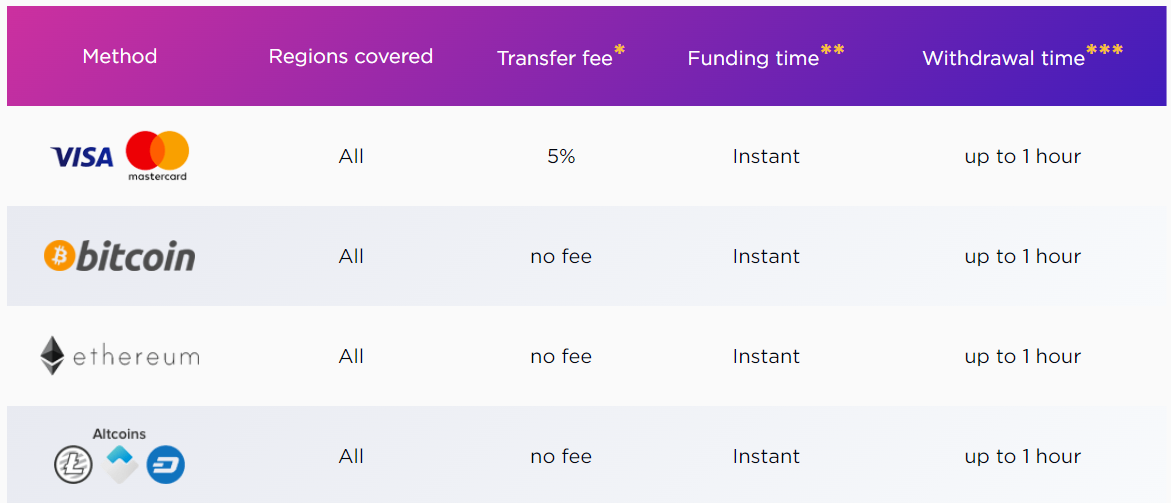

IQcent requires a $20 minimum deposit to create an account. You can fund your account, as well as withdraw your money using many methods, including Visa, MasterCard, Bank Wire Transfer, Neteller, Skrill, Perfect Money, Bitcoin, Ethereum, Litecoin, and Altcoins.

Most deposits on IQcent are processed almost instantly, but withdrawals can take up to an hour to be processed with a minimum withdrawal amount of $20. Regardless of the withdrawal amount, all withdrawals require the person's identification for security reasons.

Commission and Fees

The trading cost on IQcen is determined by various factors, such as spreads, commissions, and margins. For currency pairs with the JPY as the term currency, one pip equals 0.01; for all other pairs, one pip equals 0.0001.

The margin is the amount of cash required in your account to open a position. It is determined based on the current exchange rate of the base currency against the US dollar, the leverage applied to your account, and the volume of the position.

IQcent charges no commission, and although it is unclear what spreads IQcent offers, sources claim that they are quite low.

IQcent doesn’t charge its clients any deposit or withdrawal fees. However, third-party bank fees may apply, especially if you use a debit or credit card.

Leverage

Leverage is measured in terms of a ratio, such as 30:1, 80:1, or 100:1. If you have $2,000 in your account and are trading $100,000 tickets, your leverage will be 50:1.

The maximum leverage ratio allowed by IQcent is 1:100. Leveraged product trading raises your potential profit while simultaneously increasing the risk of losing money, so you want to be wise while using leverage.

Products

Binary options, CFDs on stock indices, currencies, cryptocurrencies, gold, and silver are all available on IQcent. The broker allows you to trade options 24 hours a day, seven days a week, with a high payout. The potential profit for currency pairs can be as high as 84 percent, cryptocurrencies up to 70 percent, and commodities up to 60 percent.

Note: if you don’t know how to trade on your own, you can copy successful traders’ trades directly in the web terminal.

Platform and Tools

You can use IQcent's WebTrader to trade CFDs and options. It doesn't require any installation and works with all major online browsers. A PC, tablet, laptop, or smartphone can be used to access IQcent’s trading platform. It’s a shame that they don’t offer third-party developers' terminals, such as MT, which are popular among Forex traders.

Technical and fundamental analysis widgets are integrated into IQcent’s trading platform. And you can get real-time information on price changes in a chart and diagram form created using technical analysis.

You also benefit from current financial and economic events listed in the ‘Market News’ section. It is shown on the terminal and provides real-time news. There’s also the Economic Calendar, which delivers vital news and macroeconomic information. Date, country, asset price movement, and name, can all be used to sort events.

Education

When it comes to educational material, IQcent's only help is the creation of a demo account and their FAQs section. However, they mention that traders who open a silver or gold account are eligible for a master class web session, but it’s unclear what that is.

The FAQs section provides information about CFDs, binary options, Cryptocurrency, Margin call, Rollover, Double-up, and Sell out. They don’t provide information about using their platform, the basis of technical and fundamental analysis, reading charts and other graphs, or any analysis of common strategies.

Is Your Money Safe on IQcent?

Your money is kept safe in a European bank on IQcent. The most important fact you should know about this broker is that it’s not regulated or registered by a reputable regulatory authority. It’s an offshore online broker that isn’t subject to any regulatory laws. IQcent or any of its agents or partners are not registered in the United States and do not provide services.

Investors thinking about creating an account with IQcent should know that their money is at more risk compared to regulated brokers. There’s no regulatory body or set of rules and regulations that the broker must follow.

Customer Service

Before deciding to trade with a specific online broker, we recommend that you first check if their customer support is of good enough quality to answer your inquiries later. You can reach out to IQcent using different methods, including phone, email, live chat, feedback form, Instagram, and Twitter.

- Email: support@iqcent.com

- English Phone Number: +1-8299476383

- Russian Phone Number: +7-499-3806317

- Thai Phone Number: 02-21345671

- Chinese Phone Number: 3-395-0396

- Singapore Phone Number: +7-499-3806317

- Australia Phone Number: 61-8-5550-7288

The Bottom Line: Is IQcent a Legit Broker?

From what we’ve seen in our in-depth review, we can positively say that IQcent is not considered a legit online broker. It has one drawback that is a nightmare for most traders: no regulation.

But if you want to benefit from its selection of products and the ability to trade in cents, and if you’re not afraid to lose your money at any moment due to the lack of legitimate regulation, then IQcent may be a good option for you.

Are there any withdrawal fees on IQcent?

No, IQcent does not charge any withdrawal fees. However, financial institutions may charge you withdrawal fees.

Why is working with IQcent through Traders Union more profitable?

It’s more profitable since you’ll receive monthly payments from Traders Union while all other functions on the selected trading platform will stay the same.

How can I close my account on IQcent?

In order to request closing of your IQcent account, send an email to support@iqcent.com. You’ll receive a confirmation when your request is completed.