77.77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Libertex is an established online broker with millions of retail users. They are headquartered in Cyprus and accept clients from the EEA and Switzerland. Since Libertex started its operations, it has won more than 40 international awards. Libertex is the sponsor of Tottenham FC and FC Bayern.

Summary

Libertex is a reputable online Stocks and CFD broker established in 2012. It has since gained millions of users, mostly traders and aspiring traders. Libertex has a lot to offer compared to other brokers, including a good selection of markets, a clean and easy-to-use platform, accepts various payment methods, availability in many countries, and many more. It is overall a great broker for traders who seek a reputable platform and a good choice for those who wish to trade CFDs across different industries.

Overview Table

| Broker Name | Libertex |

| Headquarters | Cyprus |

| Foundation Year | 2012 |

| Minimum Deposit | €100 |

| Deposit Fee | €0 |

| Inactivity Fee | If the Client’s Account is inactive for 180 calendar days (i.e. there is no trading, no open positions, no withdrawals or deposits), the Company reserves the right to charge an account maintenance fee of 10 EUR (10 GBP, 10 CHF, 50 PLN respectively) per month. (Applies to clients with a total account balance less than 5000 euros ( 4500 GBP, 5300 CHF, 22500 PLN respectively). |

| Demo Account | Yes |

| Instruments | Fixed Time Trades |

| Platforms | Libertex online platform and app, MT4, MT5 |

| Assets | CFDs on: Stocks, Commodities, Forex, Crypto etc. |

| Number of Underlying Assets | 250+ |

| Leverage for Retail Clients | up to 1:30 |

| Negative Balance Protection | Yes |

| Guaranteed Stop Loss | Yes |

| Broker Type | Market Maker |

| Scalping | Yes |

| Hedging | Yes |

| CFD Trading | Yes |

| STP Trading | No |

| ECN Trading | No |

| Withdrawal Fee | Varies |

| Withdrawal Time | from Instant to 2-5 days |

| Regulation | CySEC |

| Customer Support | Telephone (Monday – Friday 8 a.m till 6 p.m. CET) |

| Languages | English, German, Italian, Spanish, French, Dutch, Polish, Portuguese |

| Our Score | 3.9/5 |

Pros and Cons

Libertex has many favorable sides to it, but it some of its drawbacks make it impossible for some traders to use. So, have a look at its pros and cons and judge for yourself!

| Pros | Cons |

|---|---|

| Clean and user-friendly interface | Inactivity fee |

| Plethora of technical analysis | |

| Fast switching between demo accounts and real CFD and Invest | |

| Fast withdrawal process | |

| Low minimum deposit | |

| No deposit fee | |

| Competitive spreads | |

| Easy order placement | |

| Trade 250+ underlying assets | |

| Used by millions of traders | |

| Tight spreads | |

| Good selection of tradable assets | |

| Educational Materials | |

| Prompt customer service | |

| Regulated by CySEC | |

| Trading Crypto CFDs with low commission fee | |

| Investment in real shares with zero commission (market spreads apply) |

Libertex Compared to Similar Brokers

Below, we compare Libertex to its strongest competitors.

| Broker Name | Libertex | eToro | Binance | Trading212 |

|---|---|---|---|---|

| Year | 2012 | 2007 | 2017 | 2006 |

| Minimum Deposit | €100 | $50 | $0 | $1 |

| Commission | Yes | Yes | Yes | No |

| Inactivity fee | Yes | Yes | No | No |

| Platforms | Libertex online platform and app, MT4, MT5 | Web, Windows, iOS, Android | Web, Windows, iOS, Android | Web, Windows, iOS, Android |

| Regulation | CySEC | CySEC, FCA, ASIC, FSAS | N/A | FCA, FSC |

We recommend you check out our review of Expert Option and Pocket Option.

Underlying Assets

Libertex allows its users to trade CFD across the underlying assets below.

- 50+ currency pairs

- 70+ cryptocurrencies

- 100 stocks

- 10 ETFs

- 6 agricultural

- 5 oil/gas

- 18 indices

- 5 metals

Libertex Trading Platform

Libertex gives users access to their unique trading platform. It is entirely web-based and does not require any downloads. The Libertex platform runs well and works seamlessly in any online browser, with a user-friendly interface.

The Libertex platform is great in many regards, with fast execution times (which are critical for day traders) that can help users gain a competitive advantage. While many brokers rely on pre-existing platforms (such as cTrader), Libertex has taken the time to create a user-friendly interface. It's a site that is customizable and adjustable to fit the trader's specific requirements.

They have, however, made their service compatible with Metatrader. Clients can use MetaTrader 4 (MT4) or MetaTrader 5 (MT5), two well-known trading platforms with a wide range of capabilities and features, in addition to their own customized platform.

| Trading Platform | Available |

|---|---|

| MT4 | Yes |

| MT5 | Yes |

| MT4\MT5 Add-Ons | No |

| cTrader | No |

| Automated Trading | No |

| Proprietary Platform | Yes |

| Copy Trading\Social Trading | No |

| Stop Loss | Yes |

| Negative Balance Protection | Yes |

| Mobile App | Yes |

Mobile App

You can access the Libertex platform via mobile apps for Android and iOS. They are easily downloaded via the Google Play Store and Apple App store respectively. You can also download the app directly from the Libertex website. Both Android and iOS applications are updated on a regular basis for security and to improve the user experience.

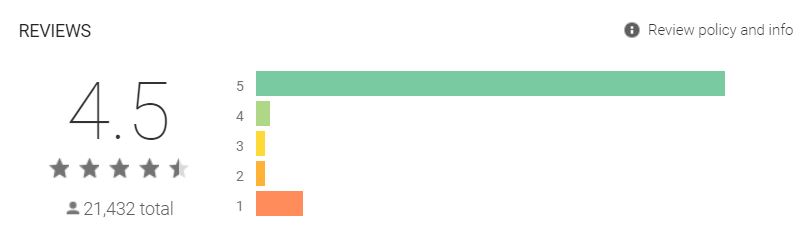

The fact that the app has high ratings in both the Android and iOS app stores demonstrates that it fits many different people’s tastes, and also that it’s well-designed and works effectively on both systems. The software is simple and easy to use, with features like easy order placing, pre-ordering, profit taking, a stop loss feature, and live quotes.

Technical analysis is accessible for free to help mobile traders. The app provides immediate access to news stories from the most popular financial news sources. The option to convert from demo mode to a genuine account with a single tap onscreen is a unique feature of the Libertex app. Since it's easy to fund the app, mobile users will always have an advantage when it comes to on-the-go trading.

Regulation

Libertex is authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC) license number 164/12. It is a reputable government authority that examines firms' ability to provide fair financial services. Libertex has a trading licence by CySEC, indicating that Libertex is a reputable broker.

Payment Methods

Traders can finance their Libertex accounts using a variety of payment methods. You should be able to find a method that works for you at https://libertex.com/payment-methods.

Deposit

The majority of payment methods are handled instantly. Bank transfers, on the other hand, can take several hours on rare occasions. You can make deposits on Libertex via the methods below:

- Debit/credit card

- Bank transfer

- PayPal

- Sofort

- Neteller

- Trustly

- iDEAL

- GiroPay

- Multibanco

- Rapid Transfer

- P24

- more…

Withdrawal

Withdrawals are easy and instant but can take up to 2-5 business days, depending on the withdrawal method. We recommend reading the Libertex terms and conditions for additional details.

Commission & Spreads – Fees

Libertex is a Stocks and CFD broker and charges spread. The spread varies from trade to trade and from asset to asset. Commissions on some of the most popular currency pairs start from 0.003% on average.

Spreads are tight and start from 0.1 pips. It's a good idea to read the terms and conditions to learn more about how commission percentages change and factors affect them.

Leverage

Leverage is set by default to a maximum of up to 1:30 for retail traders. This level is widely regarded as an industry standard among all European licensed brokers.

Account types

Libertex, unlike other online brokers, claims to not provide various account types, and instead just a “real” account and a “demo” for trading and Invest account for investing in real shares.

Demo Account

Libertex offers a demo account to all of its clients. This allows you to practice your trading skills and learn more about the Libertex platform before depositing real funds into it. The account comes with a virtual balance of €50,000 to trade with.

The demo account is helpful since it helps new users decide whether the platform is right for them. Clients that register for a demo account also register for a genuine account (although they will be unable to access the real account without first making a deposit).

Demo accounts are available on the web and through mobile apps. On the Libertex website/app, switching between demo and real mode is simple, which allows users to take advantage of quickly shifting market situations.

Research & Education

Professional Charting

Libertex's traders have access to detailed charting for each asset. There is also the option to view the chart in full-screen mode, which allows for a thorough analysis. There are several free indicators and sketching tools available with this broker. In most cases, chart analysis is the most crucial tool for making trades.

One of the best charting systems for traders is being used by Libertex. Tradingview.com provided the inspiration for this design. On this platform, almost every indicator and tool is available. All of the tools can be adapted to the chart or trading strategy on their own. You can choose from various chart displays and time units for the analysis depending on the technique.

Educational Materials

Beginner traders have free access to lessons about the basics of trading. Other than that, Libertex lacks a lot of important educational material.

Special Features

Beside being user-friendly, the platform features a lot of unique tools, such as charts, indicators, and timeframes that are important during technical market analysis. Libertex is great for traders from different countries since it can show information in 8 languages.

You can choose from nine different timeframes, ranging from one minute to one month. There are 43 indicators available: 13 oscillators, 22 trend indicators, and 8 volatility indicators.

You can look at live quotes for every asset by using the Order Management feature. And you can also customize a favorites list to only include your most frequently traded assets. This is helpful for managing price fluctuations on regular trades. You can view your order history, pending orders, and balance from the same section of the site.

Other users' trading activities on Libertex are announced in the Live Trades section. This is particularly useful for traders who wish to keep an eye on trends or maybe mimic other traders' profitable decisions.

Customer support

Phone calls, email, and chat are all options for contacting Libertex’s customer service from Monday to Friday from 8 a.m till 6 p.m. CET. The FAQ section tries to answer a variety of issues, and Libertex promises a one-business-day response time for email queries.

Contacting info are listed below:

- Phone: +35722 025100

- Email: info@libertex.com

Is Libertex Legit?

Libertex is a reputable online broker, regulated by CySEC. Libertex has implemented client fund segregation, meaning that if the company runs into financial difficulties, traders may be confident that their assets will be handled separately.

Additionally, Libertex keeps its clients' personal information safe and secure. Apps for Android and iOS are also updated on a regular basis for security.

Bottom Line

In comparison to other trading platforms, we can conclude that this stocks and CFD broker has a lot to offer. It is regulated by CySEC and is a football teams sponsor. Libertex has over 250 underlying assets to choose from. Since its operations years ago, it has received more than 40 international awards.

This broker has a very reasonable charge policy. It's a plus that it doesn't charge any fees for deposits and only has little withdrawal fees that are easy to handle. The platform is clean and well-designed.

Risk warning:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.77% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.