Picking a Low Spread Broker or Zero Spread Forex Broker is essential, especially for Forex trading and scalping. Lower forex spreads result in reduced trading costs, especially for active high-volume traders. But there are many options out there, and not all are trustworthy.

Many of the so-called zero-spread accounts offered by Forex brokers are a marketing trick to lure new traders.

Table of Contents

- Top Low Spread Forex Brokers in 2023

- A Detailed List of the 7 Best Zero Spread Forex Brokers

- How to Compare Low Spread Accounts?

- How do Low Spread Forex Brokers compare?

- What is a Low Spread or Zero-Spread Forex Broker?

- Conclusion

I've researched regulated forex brokers offering low spreads no commission in the industry, and I've come up with the following list.

Top Low Spread Forex Brokers in 2023

Here are the best zero spread accounts and low spread brokers.

- Pepperstone – Lowest Spread Forex Broker Overall

- FP Markets – Best ECN Lowest Spread Broker

- AvaTrade – Fixed Lowest Spreads Forex Broker

- IC Markets – Raw 0 Pip Forex Broker

- Forex.com – Best Execution Lowest Spreads Forex Broker

- FXTM – High Leverage Lowest Spreads Broker

- eToro – Great Copy Trading Lowest Spread Forex Broker

- IG – Commission-Free Broker with Low Spread

- FxPro – 0 Spread Forex Broker

- Fusion Markets – Low Spread and Commission Forex Broker

My Top 3 Picks

A Detailed List of the 7 Best Zero Spread Forex Brokers

The low spread brokers are reviewed below.

1. Pepperstone

Pepperstone is a popular forex broker. It is our top pick as the best broker with the lowest Forex Spreads and no commissions.

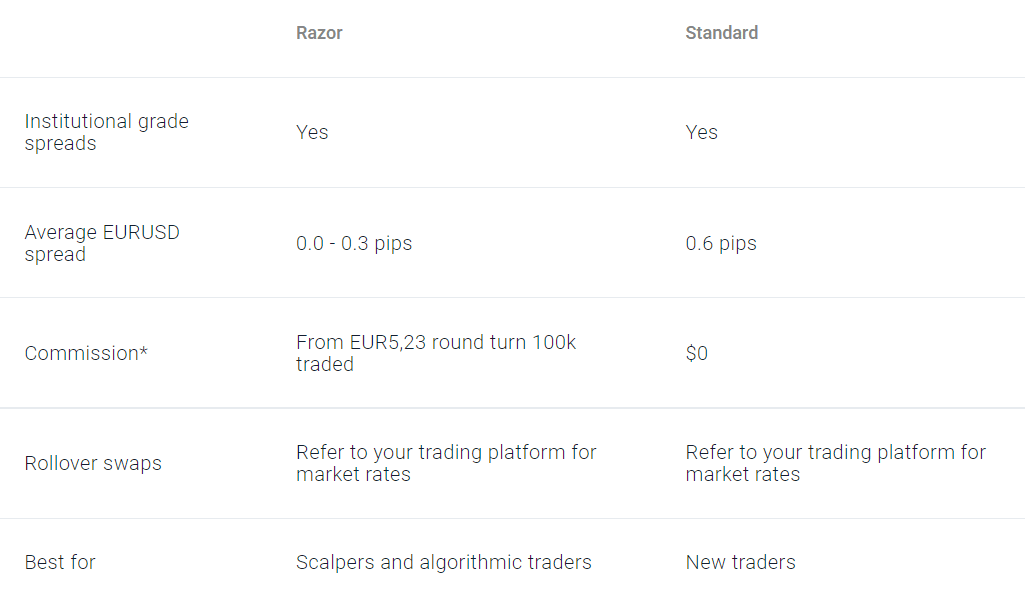

Their Standard Account offers low average spreads from 0.6 pips for the EUR/USD pair and no commission low forex fees. Their Razor account offers spreads from 0.0 – 0.3 pips + EUR 5,23 round turn per 100k traded.

Pepperstone has low trading fees and costs.

81.2% of retail investor accounts lose money when trading CFDs with this provider

2. FP Markets

First Prudential Markets is our pick as the lowest spread broker for scalping. FP Markets are high leverage. FP Markets is a well-regulated and trustworthy zero-spread forex broker. They offer spreads starting at 0 pips and averaging around 0.45 pips. The overall total trading costs are low. It offers access to a range of third-party platforms for you to choose from and an impressive selection of educational content.

On the downside, FP Markets isn’t available to US citizens.

On FP Markets Official Website

FP Markets Quick Facts

Founded in 2005, FP Markets is one of the Forex market veterans. The experienced broker has gained quite a reputation throughout the years and remains one of the industry's most renowned Forex trading platforms.

Where FP Markets excels is its customer service. Generally speaking, their approach to user experience and client satisfaction is one of the best I’ve ever experienced from a broker. FP Markets has fast trade execution, and an extensive selection of trading markets.

FP Markets Accounts & Fees

FP Markets offers its users two types of accounts – Raw and Iress. The Raw trading account is compatible with MT4 and MT5 trading platforms and offers spreads as low as 0.0 pips. However, there’s a commission of 3.00 AUD per transaction and a minimum of 100 AUD.

The Iress trading account is tiered as Standard, Platinum, and Premier. Standard and Platinum come with minimum commission fees, respectively 10 and 9 AUD. The premier account has no minimum commission fees but requires a much higher minimum deposit of 50,000 AUD.

Pros and Cons

| Pros | Cons |

|---|---|

| Spreads starting at 0 pips | Not available in the US |

| Wide selection of platforms | |

| Numerous educational resources | |

| Fast order execution |

3. AvaTrade

AvaTrade is an excellent choice for active traders. They offer competitive fixed spreads of 0.9 pips with no commissions. The minimum deposit is $100 to open an account with AvaTrade. They offer access to their proprietary platforms and both MT4 and MT5. On the downside, they charge above-average inactivity fees.

The Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA), FCA, and CySEC regulate AvaTrade.

76% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade Quick Facts

AvaTrade was founded in 2006, which makes it one of the older Forex and CFD brokers on this list. Where AvaTrade shines is its selection of available financial instruments, including commodities, bonds, cryptocurrencies, stocks, and stock indexes.

Another thing I love about AvaTrade is its excellent research tools, which make Forex trading an absolute breeze, even for less experienced traders. On top of that, the broker offers very competitive rates, user-friendly apps, and 100% free deposits and withdrawals.

AvaTrade Accounts & Fees

AvaTrade users can set either a standard, corporate or professional account. The first and the last are dedicated to individual traders, with a professional account being reserved for more experienced traders with documented prior investment experience.

As for the trading fees and spreads, these are very competitive. An average spread is 0.5 pips, which is about the industry standard. The fees are also low, although their exact amount depends on the financial instrument. The downside is that AvaTrade also charges an inactivity fee.

Pros and Cons

| Pros | Cons |

|---|---|

| Highly competitive rates of 0.9 pips | Inactivity fees |

| Wide range of currency pairs | |

| Easy account opening process | |

| Free deposits and withdrawals | |

| Great research tools |

4. IC Markets

With an average spread of 0.1 pips, IC Markets has one of the best spreads on this list. IC Markets fast order execution makes it a top choice for scalpers and algorithmic traders. IC Markets has no deposit or withdrawal commission fees. Plus, customers can access powerful platforms, including cTrader, and MetaTrader. IC Markets' Raw Spread Account features zero spreads + commissions.

A downside is that there is a high minimum deposit required to open an account.

74-89% of retail investor accounts lose money

IC Markets Quick Facts

Although IC Markets isn’t my favorite, it’s still one of the best Forex brokers. I recommend it mostly to Forex traders who rely on algorithms to make their trades. IC Markets offers extensive research tools and advanced features, making this platform one of the most powerful in the industry.

Other than that, IC Markets offers very competitive pricing and fast order execution. And while their selection of available markets isn’t overly comprehensive, it was more than enough to keep me engaged. The one thing that throws many traders away is the high minimum deposit amount.

IC Markets Accounts & Fees

IC Markets traders can take advantage of three trading accounts- Raw Spread (cTrader), Raw Spread, and Standard. The first two offer 0.0 spreads but come with commission fees, respectively 3 AUD and 3.5 AUD, whereas the Standard Account offers no commission fees but spreads start from 1.0 pips.

Pros and Cons

| Pros | Cons |

|---|---|

| Average spreads of 0.1 pips | High Minimum account deposit |

| Fast order execution speed | |

| No withdrawal or deposit fees | |

| Powerful platform |

5. Forex.com

Forex.com is one of the top-rated brokers in the US. This is another safe and reliable choice. Forex.com gives you access to 80 currency pairs. Although spreads are low, there is a flat commission rate of $5 per standard lot. It offers three premium platforms as well as the popular MT4 platform.

A downside is that passive traders will face inactivity fees. There is also a long waiting period for account verification.

On Forex.com Official Website

Forex.com Quick Facts

If you’re looking for an online brokerage platform that specialises in currency trading, Forex.com should be your top choice. Launched all the way back in 2001, Forex.com is one of the most renowned Forex brokers in the Forex industry, coming with all the major currency pairs, competitive prices, and very low fees and spreads.

Forex.com Accounts & Fees

Spread-wise, Forex.com is one of the cheapest Forex brokers on the market, with spreads going as low as 0.1 pips. However, considering that there’s a flat commission rate of 5 AUD per standard lot and non-trading fees, such as an inactivity fee, more cost-efficient options are available. Also, while there’s only one account type, the application and verification process is relatively long and complex compared to some other brokers.

Pros and Cons

| Pros | Cons |

|---|---|

| Top-rated broker | Inactivity fees |

| Low fees | Long account verification waiting period |

| Diverse research tools | |

| Great range of currency pairs | |

| Access to premium educational resources |

PFI Rating: 4.8/5

6. FXTM

ForexTime (FXTM) is another reliable choice for experienced and beginner traders. FXTM offers traders spreads starting at 0.1 pips with a great selection of account types.

FXTM gives clients access to over 200 markets which include 48 currency pairs. It stands out for its excellent customer service and educational tools.

On the negative side, FXTM charges high CFD fees. There are also inactivity fees and withdrawal fees.

On FXTM Official Website

FXTM Quick Facts

Founded in 2011, FXTM has established itself as one of the best Forex and CFD brokers, especially regarding user experience and customer support. Its trading platforms are incredibly straightforward to use, the registration process is fast, and I was able to contact its customer service almost instantly. Furthermore, FXTM is a great online broker for beginners due to its extensive number of educational and research tools.

FXTM Accounts & Fees

Although FXTM isn’t the cheapest Forex broker, with spreads beginning from 0.1 pips and low commission rates, it lands below the industry average. Opening an account is also a blast, especially if you opt for the Micro Account with a minimum deposit of only 50 AUD. The Advantage Plus Account requires a minimum deposit of 500 AUD, but it comes with more advanced features and lucrative trading conditions for more experienced Forex traders. Its non-trading, withdrawal, and inactivity fees are relatively high, though.

Pros and Cons

| Pros | Cons |

|---|---|

| Spreads from 0.1 pips | High CFD trading fees |

| Responsive customer service | Inactivity and withdrawal fees |

| Extensive educational tools | |

| Fast account opening process |

How to Compare Low Spread Accounts?

To compare low spread forex broker accounts, you need to consider factors such as commissions per trade, spreads, trading platforms, regulation, security, and currency pairs offered.

How do Low Spread Forex Brokers compare?

Below is a comparison of low spread brokers based on information such as foundation year, regulation, offering of investments, and more.

| Trading Platform | Pepperstone | FP Markets | AvaTrade | IC Markets | Forex.com | FXTM | eToro |

|---|---|---|---|---|---|---|---|

| Founded | 2010 | 2005 | 2006 | 2007 | 2001 | 2011 | 2007 |

| Regulation | ASIC, CySEC, FCA, SCB, DFSA, BaFin, CMA | ASIC, CySEC | FCA, ASIC, FSCA, FRSA, Israel Securities Authority, Financial Services Agency, Financial Futures Association of Japan | ASIC, CySEC, FSA, SCB | CFTC | FCA, CySEC, FSCA, MiFID, FSA, BaFin, AMF, FCMC, AFM | FCA, CySEC, ASIC, FSAS |

| Offering Of Investments | CFDs on Forex, Crypto, Shares, Indices, Crypto | Forex, Shares, Metals, Commodities, Indices, Cryptocurrency, Bonds, ETFs | Forex, Stocks, Commodities, FXOptions, Cryptocurrencies, Indices, ETFs, Bonds | CDFs on Forex, Commodities, Indices, Bonds, Cryptocurrency, Stocks, Futures | Forex, Shares, Commodities, Cryptocurrencies, Gold and Silver, Indices | Forex, Indices, Forex Indices, Commodities, Metals, Stocks | Stocks, ETFs, Forex, Crypto, Indices, Commodities |

| Minimum Deposit | $0 | $100 | $100 | $200 | $100 | $50 | $50 - $100 |

| Demo Account | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Withdrawal Fee | $5 | $0 | $0 | $0 | $25 in the US, and $40 for international | $3 for Credit Cards, $20 - $40 bank transfer, $0 for Skrill / Neteller | $5 |

| Inactivity Fee | $0 | $0 | $50/month After 3 Months | $0 | $15/month after 12 months | $5/month after 6 months | $10/month |

| Deposit Methods | Credit/debit cards, Bank/Wire Transfer, PayPal, Neteller, Skrill, UnionPay | Credit Cards. Debit Cards, Bank Transfer, Ngan Luong, FasaPay, Online Pay, Broker to Broker, Neteller, Skrill, PayTrust, PayPal, Bpay, Poli | Credit and Debit Cards, Wire Transfer, e-payments | Credit Cards, Debit Cards, PayPayl, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Fasapay, Broker to Broker, Poli, Thai Internet banking, Klarna, Rapidpay, Vietnames Internet Banking | Credit Cards, Debit Cards, Wire Transfer | Credit Cards, Debit Cards, e-Wallets, Bank Wire, Local Payment Solutions | PayPal, Skrill, Neteller, Credit Card, Debit Card, Rapid Transfer, iDEAL, Klarna / Sofort Banking, Bank Transfer, Online Banking - Trustly, POLi |

How do Low Spread Forex Costs Compare per $100,000 Traded?

| # | Forex Broker | Spread | Pips on Major Forex Pairs * | Established |

|---|---|---|---|---|

| 1 | Pepperstone | Variable | from 0.7 | 2010 |

| 2 | AvaTrade | Variable | from 0.9 | 2006 |

| 3 | FP Markets | Variable | from 1.4 | 2005 |

| 4 | IC Markets | Variable | from 1.0 | 2007 |

| 5 | Forex.com | Variable | from 1.0 | 2006 |

| 6 | FXTM | Variable | from 0.4 | 2011 |

Fees Compared

While it is hard to compare fees as spreads vary, we compared fees below to give you a basic understanding. When comparing fees, you should look for all fees combined, not just the spreads.

Compare the fees in the table below.

| Trading Fee | Pepperstone | FP Markets | AvaTrade | IC Markets | Forex.com | FXTM |

|---|---|---|---|---|---|---|

| EURUSD | Minimum from 0.0 and 0.17 average spread (Razor Account) Minimum from 0.6 and 0.77 average spread (Standard Account) | from 0.0 - 1.3 (average 0.2 pips) | Spread: 0.9 | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | average 1.15 | Commissions +Minimum 1.6 pips - Typical 1.9 (Standard Account) Minimum 1.9 pips - Typical 1.9 (Micro Account)Minimum 0 pips - Typical 0 (AdvantageAccount) |

| GBPUSD | Minimum from 0.0 and 0.59 average spread (Razor Account) Minimum from 0.6 and 1.19 average spread (Standard Account) | from 0.0 - 1.8 (average 0.7 pips) | Spread: 1.5 | Raw Spread account: 0.0 pips spread and $3.5 (per lot per side) commission Standard Account: 0.6 pips spread and $0.0 (per lot per side) commission | average 1.7 | Commissions+Minimum 1.8 pips - Typical 2 (Standard Account)Minimum 2.2 pips - Typical 2 (Micro Account)Minimum 0.1 pips - Typical 0.2 (AdvantageAccount) |

| Apple Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| Tesla Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| Amazon Fees | 0 + market spread | Spread | 0.13% | Spread | N/A | Spread + Commission |

| S&P 500 Fees | min. 0.4 spread | Spread | 0.25 over market | Spread | N/A | Spread + Commission |

| Options Fee | N/A | N/A | N/A | N/A | N/A | N/A |

| Mutal Fund Fees | N/A | N/A | N/A | N/A | N/A | N/A |

| ETF Fee | N/A | N/A | 0.13% - 0.15% | N/A | N/A | N/A |

What is a Low Spread or Zero-Spread Forex Broker?

Low spread brokers offer the lowest Forex or zero spreads. Trading costs have declined over recent years as forex brokers compete to win more clients. Many offer zero spread cost as an extra enticement, but knowing the terms and conditions is essential before choosing a broker.

The Lowest Spread for the EURUSD forex pair ranges from 0.1 – 0.9 pips with no commission charge. However, you should check all fees, including overnight, commissions, non-trading, deposit or withdrawal, and inactivity charges.

How to Pick a Low-Spread Forex Broker?

Before you start trading, research your shortlisted low spread no commission brokers. While some forex brokers promise low dealing spreads, they might not be the best for your trading strategy.

When selection a broker look for:

- Fixed Spreds – Be on the lookout for fixed spreads. This could mean that the spread is wider than average. The broker might also be trading against your positions as a market maker.

- Spreads across different forex pairs– Check the spreads on different major forex pairs and account types. While some low spread brokers advertise low spread costs, spreads can vary depending on currency pairs or account types.

- Regulation – Make sure a top-tier regulator regulates the broker. This adds an extra level of confidence in the ethical business practices of your broker. It is good practice to avoid forex scams.

- Minimum Deposit – Make sure the minimum deposit isn't too high.

What Is Spread in Forex?

The spread is the difference between the ask and bid price on a trade. A low spread means that there is a small difference between the bid and the asking price of a currency pair. An increase in spreads usually means volatile market conditions or liquidity in the market. Spreads usually widen during less frequent trading hours, volatile times, or before news events.

The prices originate from the interbank market for most of the major brokers. Spreads are quoted as fractions of a pip (fractional pips).

The spread is how no-commission brokers make a profit. The low spread cost is built into the bid-ask spread of each currency pair you trade. This is done instead of paying a commission fee per trade. While some brokers advertise lower spreads, they are more expensive because they charge higher commissions. Because spreads change during periods, it is best to calculate average spread data over an extended period (monthly spread data) and commissions (spread + commission). That is how you avoid higher average spreads.

You shouldn't look at the minimum spread but calculate the average.

How does spread work in Forex?

The bid price is the current market price at which you are willing to sell a currency and the price a broker is willing to pay. The asking price is the price at which you buy the same currency and the price at which a broker is willing to sell it. The bid price is generally lower than the asking price.

When you buy a Currency Pair from a broker, you buy the base currency and sell the Quote Currency. When you sell the currency pair, you sell the base and receive the quote currency. Currency pairs are quoted based on their bid and ask prices.

A currency quote is the value of one currency compared to another foreign currency. These two currencies are known as the base currency and the quote currency. The base currency is always the first currency listed. The second one listed is the quote currency.

How are spreads calculated?

Spreads are a key figure when calculating trading costs. There are two parts to how the spread is calculated. This price difference is calculated in pips. The width of the spread is based on factors such as trading volume, market volatility, and liquidity.

Pip stands for “percentage in points.” In Forex, 1 pip usually equals 1 point movement in market value. This is based on the fourth decimal place of your currency pair.

First, there is an interbank spread. This is the difference between the bank that wants to buy the currency at a set price and the selling bank's offer.

Second is the spread of the specific broker. Retail traders use brokers for order execution, so the broker adds a markup spread above the Raw Spread. The way forex and CFD brokers make money depends on the available execution methods and their business model.

To calculate it, you need to determine the difference between the buy and the selling price in pips. All you need to do is subtract the bid price of a currency pair from the asking price.

1 pip is equal to 0.0001 for most currency pairs.

An example of a 1 pip spread for USD/EUR would be 1.1061/1.1062.

How to spread bet in Forex?

Spread betting is only available in certain countries like the United Kingdom. A spread bet is where traders “bet” on the direction of the price, up or down. This way spread betting brokers are a way to cut taxes for traders.

What Is Considered a Good Spread?

Spreads are considered good when they are as close to zero as possible. Those usually have an average of below 1 pip. An example of a good spread would be 0.5 pips for a currency pair. It is also important to base your calculations on average price data over an extended period.

What is the lowest spread in Forex?

A low spread is when the difference between the bid and ask price is small. It is best to trade when the spreads are low, like during the major forex sessions. Low spreads usually mean that liquidity is high and volatility is low.

0 pips is the lowest spread (zero spread) in Forex. ECN-STP brokers offer 0 pips spreads. To calculate which broker has lower spreads, it is essential to calculate all trading costs. While some brokers offer zero spreads, they still charge per-trade commissions, which could cost you more.

What is a zero-spread account?

Zero Spread Trading Account is a Forex trading account with no difference between the bid and ask price, or the spread is close to zero. Spreads can widen depending on the trading conditions, account type, and whether or not the broker charges commissions.

Raw Spread Account vs. Standard Account

In Forex, a Standard Account refers to a standard lot size of 100,000 units of currency. A Raw Spreads account refers to the cost where the broker doesn't add a price markup but offers the price directly from liquidity providers.

Do Spreads Matter When Trading Forex?

The lower the spread, the cheaper it is to place a trade order. A smaller spread means low trading costs. Incorporating tighter spread into your trading strategy is key to making higher profits.

On the other hand, make sure you check what other commissions your broker charges. Some charge higher commissions to make a profit.

Scalping and Spreads

Finding a broker with zero spreads is significant for scalping. Scalping is a strategy that involves profiting off of small price changes. As a result, traders make a high number of trades. Traders need fast order execution and a strict exit strategy, as one significant loss could erase the many small gains.

Conclusion

While any of the brokers mentioned above will cover all your trading needs, my top recommendation is Pepperstone. It’s not just the cheapest Forex broker around, but an overall top choice for both experienced and beginner Forex traders.