PFI Rating: 4.9/5

Merrill Edge, founded in 2010, is an online brokerage firm under the parent company, Bank of America. This platform offers excellent customer service, integrated investment and banking opportunities, educational resources, and high-quality research. Customers can trade ETFs, options, stocks, mutual funds, and bonds.

On Merrill Edge Official Website

Table of Contents

- Summary

- Overview

- Pros and Cons

- Merrill Edge Comparison

- Is Merrill Edge Regulated?

- Trading Platforms Available

- Platforms Overview

- Market & Products Offered

- Commissions and Fees

- Deposit and Withdrawal

- Research and Education

- Is Merrill Edge Safe?

- Account Types

- Customer Support

- Conclusion

- FAQ

- What are the advantages of an online brokerage account with Merrill Edge?

- How do I know if a self-directed investment account is a right choice for me?

- Are Merrill financial advisors reliable?

- Is Merrill Edge legit?

- Can I go to Bank of America for financial guidance on my Merrill Edge account?

- Is Merrill Edge only for Bank of America customers?

- What's the main difference between Merrill Lynch and Merrill Edge?

Summary

Merrill Edge is excellent for investors who want a self-directed account and those who prefer financial guidance. Perks such as account integration for BoA customers, national branch access, and no commission fees when trading stocks and ETFs are undoubtedly attractive, but investors that want more advanced trading opportunities won't find them here.

Overview

Find an overview of Merrill Edge below, with its main information

| Feature | Merrill Edge |

|---|---|

| Founded: | 2010 |

| Publicly Traded: | Yes |

| Bank: | Yes |

| Regulation: | SEC, FINRA, SIPC |

| Demo Account: | No |

| Minimum Deposit: | $0 |

| Copy Trading: | No |

| Minimum Trade: | Varies |

| Markets Available: | ETFs, Stocks, Bonds, Mutual Funds, Options, CDs |

| Mobile Trading: | Yes |

| Countries Available: | USA |

| Withdrawals: | Free |

| Islamic Account: | No |

| Deposit Methods: | Wire Transfers, Securities & Accounts, IRA Rollover, Checks |

| Our Score: | 4.5/5 |

Pros and Cons

Merrill Edge is a reliable online broker that offers excellent customer service, low trading fees, and a seamless account opening process. Their research and educational materials provided to clients are top-tier.

Unfortunately, they lack advanced trading options such as cryptocurrency and futures, and there are no fractional shares.

| PROS | CONS |

|---|---|

| Mobile App | Higher margin rates |

| High-quality research and education | No advanced trading options |

| Integrated banking with Bank of America | No demo account |

| Low trading fees | |

| 24/7 Customer service |

Merrill Edge Comparison

Below, you can compare Merrill Edge to its close competitors.

| Merrill Edge | Robinhood | Fidelity | Vanguard | |

|---|---|---|---|---|

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Fees |

|

|

|

|

| Markets Available | ETFs, Stocks, Bonds, Mutual Funds, Options, CDs | Stocks, ETFs, Options, Cryptocurrency, American Depositary Receipts, Fractional Shares | Stock, Bonds, Mutual Funds, Options, Forex, Fractional Shares, Bonds, ETFs | Stocks, Bonds, Mutual Funds, ETFs, Options, CDs |

Is Merrill Edge Regulated?

Yes, it is regulated by the US Securities and Exchange Commission (SEC), the Securities Investor Protection Corporation (SIPC), and the Financial Industry Regulatory Authority (FINRA).

Trading Platforms Available

Below we list the trading platforms available at Merrill Edge.

| Platforms | Merrill Edge |

|---|---|

| MT4 | No |

| MT5 | No |

| cTrader | No |

| Demo Trading | No |

| Copy Trading | No |

| Proprietary Platform | Yes |

| Desktop Platform | Yes |

| Mobile App | Yes |

| Charting | Yes |

| Order Types | Market, Limit, Stop-quote, Stop-quote-limit, Trailing-stop, Trailing-stop-limit |

| Alerts | Yes |

| Watchlists | Yes |

Platforms Overview

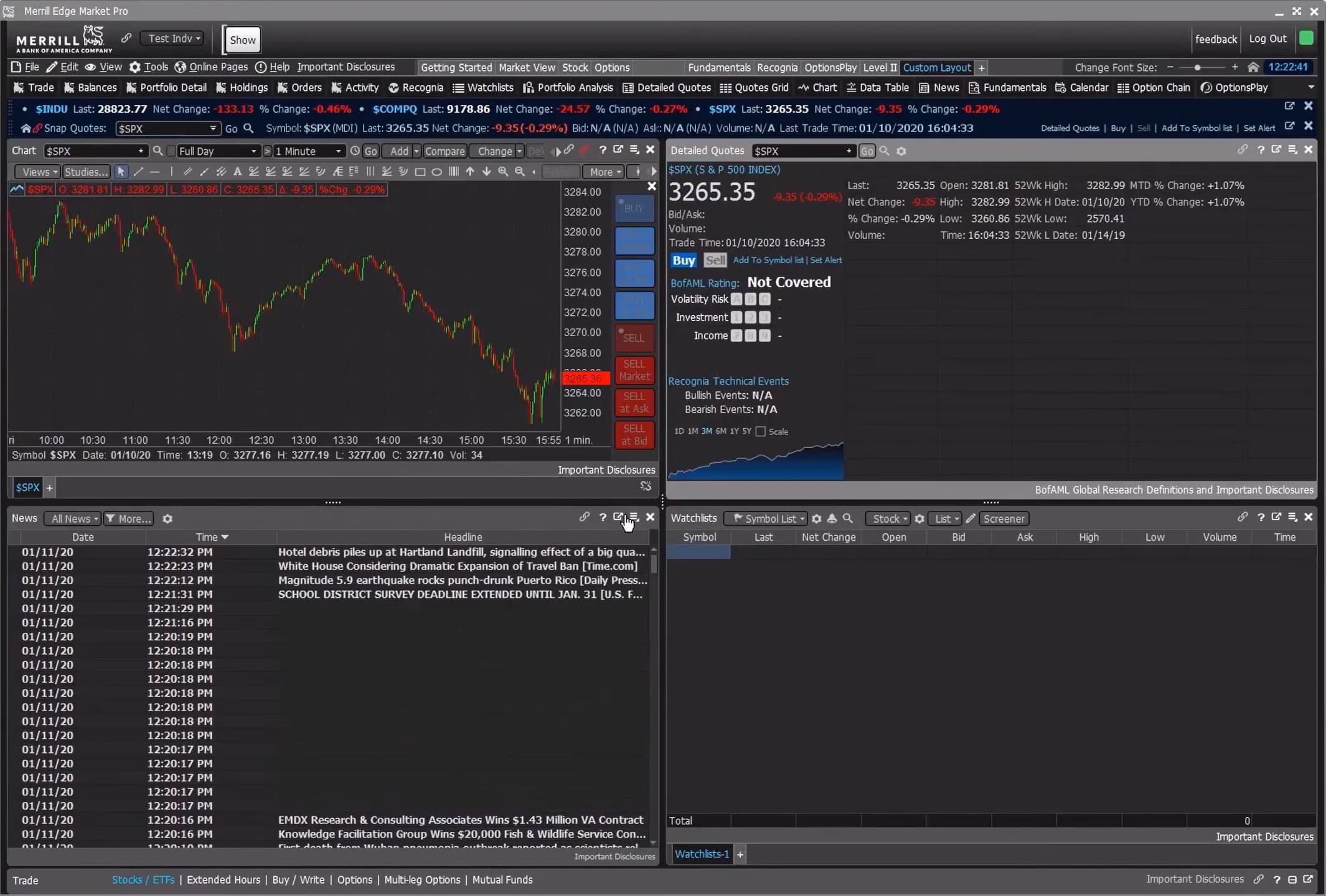

Merrill Edge offers web trading as well as its proprietary active desktop trading platform called MarketPro, which you can view and use on multiple devices. MarketPro isn't suitable for day trading, despite being feature-rich. Merrill Edge doesn't offer MetaTrader 4 and MetaTrader 5 platforms, but their platform is still functional and has some customization options.

Mobile App

The mobile app from Merrill Edge is easy to use with an intuitive interface. The app is excellent for research purposes and has extra benefits for Bank of America customers, such as universal account access and high functionality.

You can use the app on all mobile devices (smartphones, tablets), including an Apple Watch. Users don't have many customization options, but they can create watchlists and monitor and manage their assets.

The reviews from Android users are a bit lower than from iOS users, mainly because there may be some capabilities available on iOS that are not possible with an Android device.

The mobile app doesn't support drawing in charts of chart trading. Nonetheless, the platform is well-designed and allows you to stage orders for a later time, and you can enter more than one order simultaneously.

Any watchlists created on the web platform automatically get synched to the mobile app, another benefit of using the app and the desktop platform.

The mobile app will not allow investors to engage in drawing on charts or chart trading. However, selecting “Trade” on the chart header will fill in the information for you ahead of time with the precise symbol information for your order ticket. You can head to the web platform to execute the order.

Overall, it is a comprehensive application that serves its purpose and functions like the desktop platform.

Trading Platform

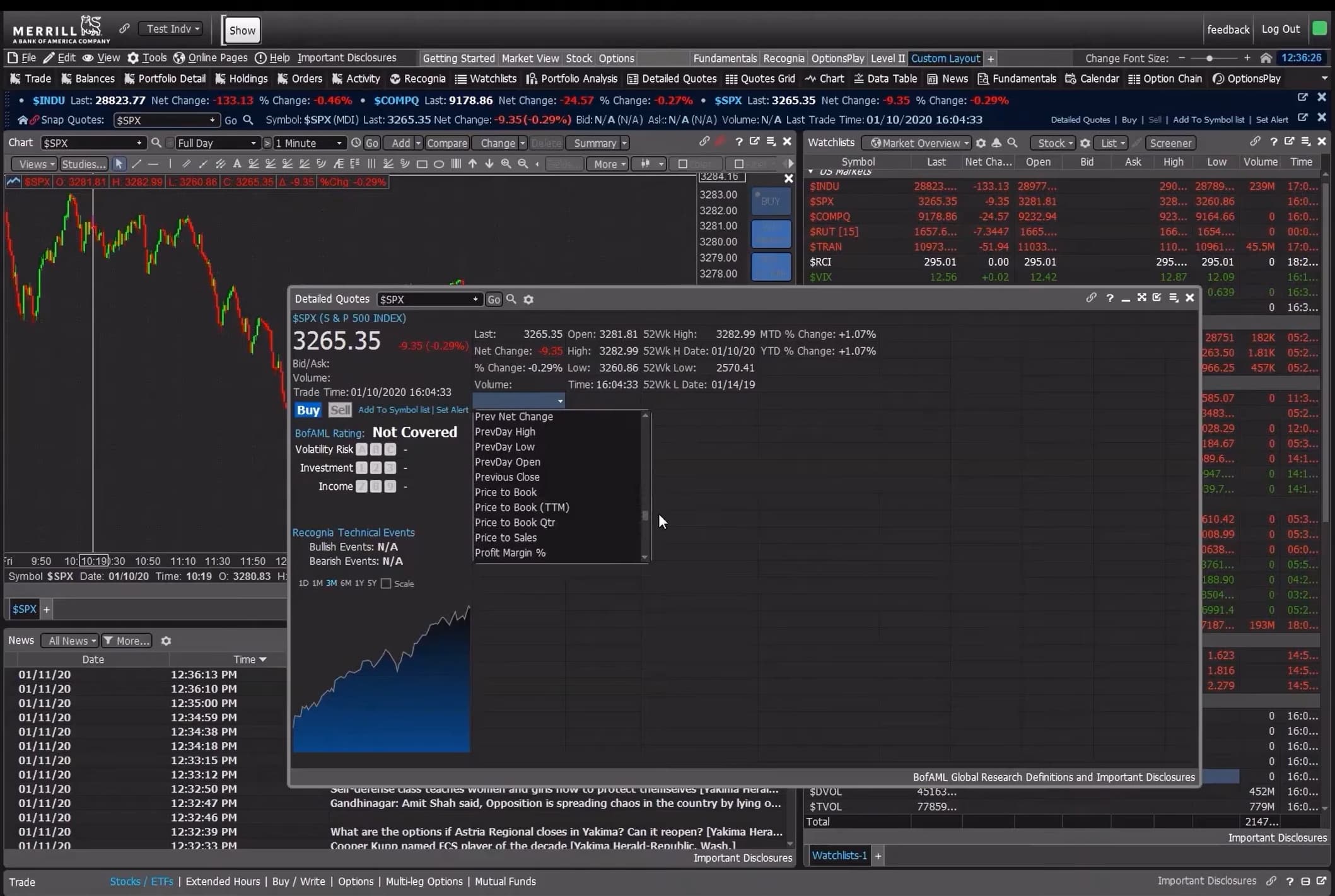

MarketPro is Merrill Edge's online trading platform that is robust, with alerts, interactive charts, a customizable dashboard, Level II quotes, stock news, and more. There are also numerous customizations with their comprehensive charting, despite the interface being somewhat outdated.

Still, MarketPro is straightforward to navigate, with hit keys and trade defaults. The best feature of MarketPro is the personalized dashboard with portfolio analysis tools that delve into your assets to stream data that informs you on how they're performing. And real-time ad news is perhaps the most extensive in the industry.

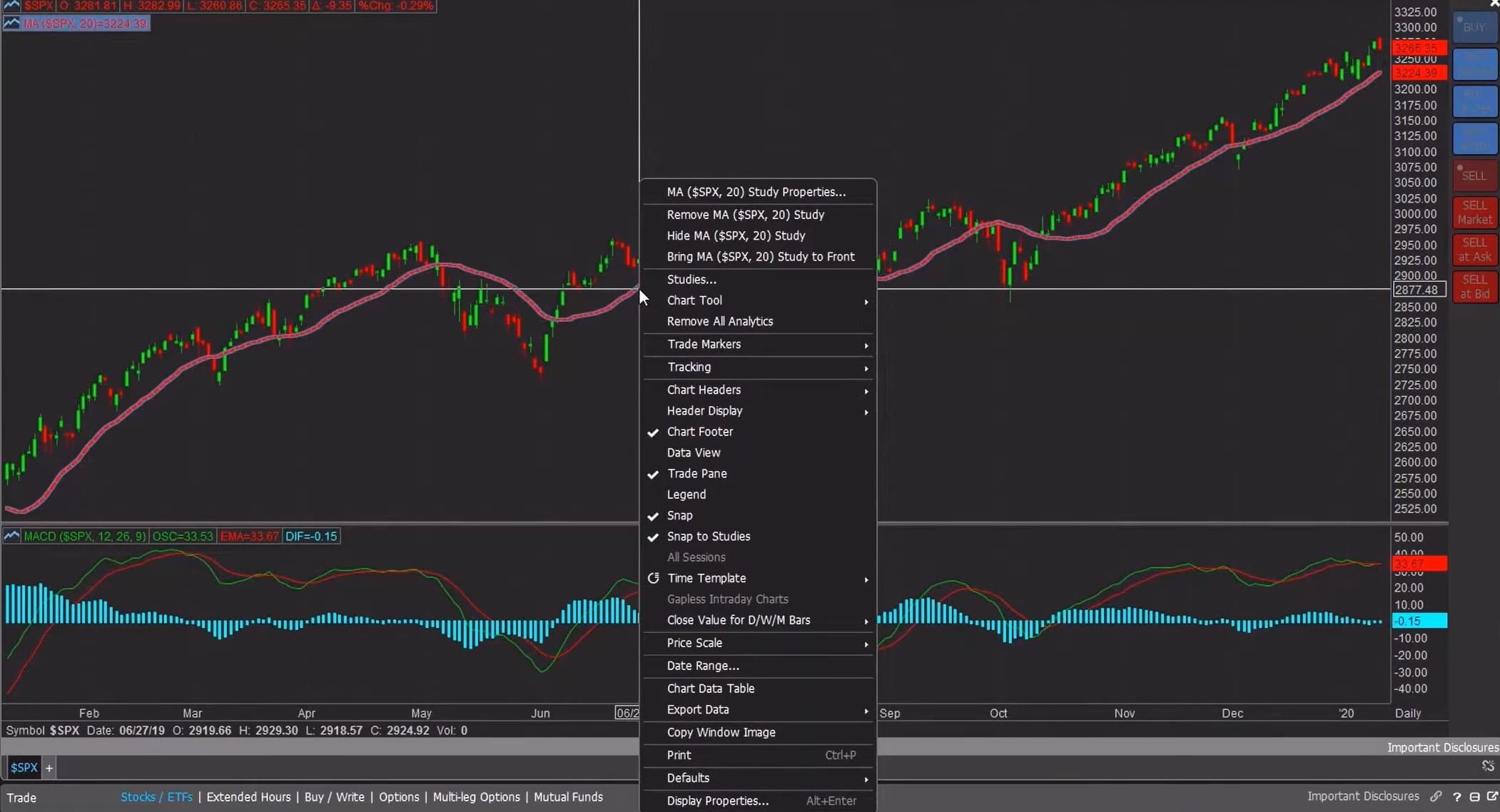

Charting

Merrill Edge offers full customization and charting capabilities through its platform with real-time data through streaming. Investors can choose between line, bar, area plot, OHLC, candlestick charts, and other charting intervals based on time.

With over 60 technical studies, each having its own customizable criteria, investors get access to data from the market that other brokerage firms don't offer. Data from open book, TSX book, Level II, ARCA, and total view are some sources that offer detailed statistics.

Cash Management

Investors can enroll in the cash management program through Merrill Edge, known as the cash sweep program. This option moves cash you're not using and places it into a money market fund of your choice. If you don't want to participate in the program, you can earn 0.01 percent on all cash balances.

Dynamic Insights

One of the best features of Merrill Edge's trading platform is the account dashboard powered by AI. This client dashboard draws all your days into one central location, and the AI begins personalizing it based on your decisions.

Once you start working with Dynamic Insights, you get in-depth and practical summaries about your bank and brokerage accounts. Underneath this information is your gains and losses, how your portfolio performs against the market, news events, tax events, holding insights, rating changes, movers, and much more.

They also provide a market overview for the date, which is valuable and consists of high-level information. Merrill Edge has commented that the tool will continue to evolve in the years to come.

Portfolio X-Ray

This unique feature for Merrill Edge investment accounts is only accessible through the website. This tool breaks down your holdings across multiple regions worldwide, notes if any of them overlap, and displays how your assets look across 12 various sectors.

It provides high-level information about the diversity level of your portfolio and the associated risks and suggests additional asset classes.

There are still many gaps within this tool despite it giving you updated details on the margin information, balances, buying power, rate of return, and more.

You won't find any tools that help you understand the tax implications of your trades, and there's no trading journal, though there is a space for you to attach notes.

MarketPro

Though MarketPro doesn't have the same bells and whistles as some competitors, it gets the job done. It is a platform for active traders with nearly 300 voluntary columns for the tools available to investors, like watchlists, charts, idea generators, and more.

The drawback to the MarketPro function is that day traders might become deterred since there aren't any sell or one-click buttons to enter your order quickly. Making decisions on the fly is highly important to many investors. You also won't find the choice to disable your order confirmation window.

Lastly, more advanced order types are not available through Merrill Edge. Options for direct market routing conditional orders, and others, are nonexistent. Therefore, many investors may feel limited by the lack of diversity.

What’s more, though it doesn't seem to present major issues, the Merrill Edge platform is on Java, which can present various problems during the installation process, depending on your device.

Market & Products Offered

Merrill Edge offers a multitude of products for investors. Customers can trade ETFs, stocks, weekly options, mini options, binary options, treasuries, mutual bonds, mutual funds, CDs, corporate bonds, and municipal bonds.

They do not support forex, futures, futures options, or cryptocurrency. It is not possible to buy penny stocks or fractional shares. There's a robo-advisory tool within reach at all times for financial guidance on making the best decision.

Here's a breakdown of the major categories where they offer their services for active traders:

Stocks

Merrill Edge customers have access to over 1,300 stocks on the US markets, plus several tools (Stock Story/Portfolio Story) to help make informed decisions regarding stock holdings and how their portfolios are performing. Long and short stocks are available, and the stock borrow process has become fully automated to execute short sales.

Customers can explore a vast collection of stocks grouped by ideas and themes, and the Dynamic Insights feature provides critical updates regarding your stocks. It is free to trade stocks on Merrill Edge, and real-time data is always available.

Tools

Investors can find 24 different tools available for use through Merrill Edge. The calculators are particularly helpful because they assist with retirement planning, personal finance, investing needs, and college planning.

Idea Generator

In August 2020, Merrill Edge developed an idea builder that allows investors to search for investments they may find interest in based on an idea instead of standard metrics such as companies, sectors, performance, etc. The research behind a tool such as this has been in the making for years, as it helps the investor have a more personal experience with the platform.

ETFs

With ETFs, which are also free to trade throughout the day across Merrill Edge, the broker takes all the guesswork out of figuring out which funds meet analyst standards.

Using screeners pre-defined to meet your needs, the system displays ETFs and index funds that only meet a five-star rating on Morningstar.

You can also choose to search for the funds you want using a specialized set of criteria based on the filters available (fees, risk performance, rating, etc.) There are thousands of ETFs from multiple providers at your disposal.

Mutual Funds

It's easy to figure out which funds work best for you when you use the comprehensive Fund Story tool, which informs investors and engages them to learn more about the thousand of funds available on Merrill Edge. Some carry fees, while most are commission-free.

The screeners make mutual fund selection simple for self-directed accounts. You can screen by international and domestic equity, international fixed-income, and non-taxable and taxable fixed-income. There are around 2000 fee-free mutual funds available, much less than the average of 3,000 competitors offer.

Bonds

Merrill Edge has hundreds of bonds for trading, which have been vetted through the Select Funds program. Choose between CDs, money market funds, individual bonds, and more. When you log into the platform, you can compare the bonds by type, rating, industry, etc.

At the same time, investors can customize their screens for future use with predefined criteria that help to find the most lucrative investment opportunities.

Options

Customers have to apply to get access to the options trading through Merrill Edge. This component of their product offerings is reserved for seasoned investors who understand the risks involved with trading options contracts.

The program OptionsPlay is accessible through the desktop platform MarketPro, and it offers multiple views, trends, and strategic information useful to generate trading ideas while analyzing risk exposure.

Commissions and Fees

The trading fees through Merrill Edge are low across the board for all asset classes.

They do not charge commissions on stocks, bonds, or ETFs as of October 2019. Still, the fees for mutual funds can be high, and the options fees are reasonable and even competitive, depending on the comparison company.

Merrill Edge is known for having high margin rates, which they do not publish publicly. You would have to call them directly to understand how much they'll charge you when you trade on the margin because it varies based on several factors. Customers must have at least $2,000 deposited to trade on the margin.

Here's a list of some of the other charges that you'll want to be aware of with Merrill Edge:

- Stock Fees: $0

- Option Fees: $0.65

- Mutual Funds Fees: $19.95

- ETF Fees: $0

- Broker Assisted Trades: $29.95

- Bonds: $1

- Inactivity Fee: $0

- Wire Transfer: $24.95

- Account Closure: $49.95

- Retirement Account Closure: $49.95

- Early-Redemption Fee (Mutual Funds): $39.95

- Insufficient Funds: $30

- Return Deposit: $20

Deposit and Withdrawal

Merrill Edge does not offer flexible deposit and Withdrawal options. For example, it is only possible to withdraw money from your account via bank transfer, and it often takes longer than three days to execute this transaction.

Remember that it's only possible to withdraw from an account under your name. There is no fee to withdraw funds from Merrill Edge.

You will not incur any fees for deposits, but the options are limited because you cannot use credit or debit cards to add funds. You may only use account transfers, wire transfers, bank transfers, and checks.

Merrill Edge Minimum Deposit

Merrill Edge's minimum deposit is $0. They accept wire transfers, securities & accounts transfers, IRA rollovers, and checks.

| Merrill Edge | Fidelity | Vanguard | |

|---|---|---|---|

| Minimum Deposit | $0 | $0 | $0 |

Research and Education

Merrill Edge is a leader in fundamental research for online brokerages. They have an impressive arrest of third-party and proprietary stock rankings and research.

To complement the numerous educational articles in their online library, the platform offers videos, courses, free tools, webinars, calculators, and more to assist investors in making the best financial decisions.

Research

Merrill Edge offers exemplary research for mutual funds, ETFs, stocks, and more. They provide the best ESG (Environmental, Social, and Governance) research in the industry as of 2022.

Merrill Edge has high-quality screening tools and solid data on all the available instruments. That includes reports and ratings from CFRA and Morningstar with options to sell, hold, or buy. Several of their research tools are not available anywhere else in the industry.

You'll find plenty of links to news articles from reputable sources, diverse information regarding options, valuation numbers, historical earnings, and much more. Customers can also use Recognia Technical Insight for even more chart data.

This platform also hosts a global database through the Global Research Library from Bank of America. It displays reports by global markets, performance, earnings, and more.

The mutual funds and ETF research is unique because it uses Lipper and Morningstar as the main research providers. The bond research is not as highlighted amongst the tools offered by Merrill Edge. However, their many screening tools that offer fundamental analysis for competitive bond markets still puts them over the edge in the research department.

Screening Tools

Merrill Edge offers screening tools that help investors find the stocks and funds they're looking for online. The screeners are easy to use, even for beginners, and experts from around the globe back the research.

ME can take advantage of the resources provided through Bank of America, which is a separate database of information related to banking. Still, some sponsors also offer knowledge on the United States stock market.

Stock

Available through their stocks and research section, Merrill Edge has a reputable stock screener available through their stocks and research section. This tool can help you find stocks based on dividend yield, price, industry, institutional ownership, metrics, exchange, market cap, and more.

You can always save a screener for use at a later time if you personalize the settings based on what you prefer when trading stocks. These screening tools are also based on heavy research by industry experts in terms of quality analysis.

ETF

Customers can use two proprietary tools to find and dissect exchange-traded funds. View the underlying investments, leverage, Morningstar rating, equity sector, premium/discount, product type, and more to discover the best ETFs for your portfolio.

Merrill Edge Select ETFs is a simpler version for investors to use under the financial guidance of qualified experts.

It's best when using these tools to be as specific as possible about what you want, as there are thousands of funds available, and finding the perfect match, even with a self-guided account, is made easy with the screening options and filter.

Mutual funds

While numerous mutual funds don't carry any transaction fees, there are specific fees associated with other mutual funds, especially if you try to redeem them before 90 days.

Using the screening features, you can research the Lipper and Morningstar ratings and find available funds. Merrill Edge also created The Fund Story in 2019, which helps investors quickly evaluate holdings, rating costs, and more for mutual funds.

Options

Options are more difficult to research and understand for many, and it requires special permission and access to trade options on Merrill Edge. Investors can use filters related to volatility and option value to find suitable strategies that present them with the best trading options.

The options strategy builder also helps investors to assess their outlook, risk tolerance, and goals to create a more comprehensive watchlist for their records. Merrill Edge also has options chains that empower investors to search the options contracts available for particular securities.

Fixed income

After recent enhancements, the research section has become easier to navigate for the fixed income account and investment products. The new screening tools include filters for maturity date, yield, price, Moody rating, coupon rate industry, type, and many other distinguishing factors.

Though the interface appears somewhat clunky compared to competitors, the overall experience is positive. We would like to see some improvement even further with this particular screener to make it more intuitive, as it is challenging to understand the criteria for newcomers.

Third-Party Influence

There's a database that investors can use on the Merrill Edge website that searches for analyst reports amongst thousands of different equities. For example, a home investor can review the Fixed Income Digest every quarter.

Or, in-depth information about individual equities is available through the “Stock Story.” This source pulls information from over 30 sources to find the most impactful details from other well-known research analysts.

News

Investors can always view the latest news and updates about stocks and trading in the US markets from other third-party sources like Dow Jones, Business Wire, PR Newswire, and others.

You even get the option to filter the news that you see when you log into your account based on watchlists, holdings, or whichever outlets you prefer.

Education

When you're a new investor, you want opportunities to understand the market and how to make smart decisions. Merrill Edge offers a fantastic experience for beginners and seasoned investors alike, thanks to the excellent quality and organization of their curated content.

The Investor Education section on their website showcases a wide variety of online courses that you can search through to find interesting topics that you're unfamiliar with, as well as financial guidance for your portfolio.

There are also articles and videos at your disposal in this learning center.

When learning the basics, head to the curated webinars that Merrill Edge offers on their site. They present various themes, such as technical analysis, options trading, ETFs, and more, along with on-demand videos. The best feature here is that you can adjust everything to your level of experience and understanding.

Through the Guidance and Retirement Center, Merrill Edge allows customers to engage in the goal planning tools for life events, try the calculators to assist with finding areas where there are deficiencies, schedule in-person appointments for guidance, read educational articles, and more.

You'll also find audio segments like the Merrill Perspectives Podcast and the CIO Audicast series. Both are focused on market research specifically, but there is a lot of educational material covered.

Is Merrill Edge Safe?

Merrill Edge is a safe online brokerage regulated by several governing authorities. The broker is regarded as highly reliable thanks to their parent company, Bank of America, which has an established reputation of excellence. Merrill Edge offers low-to-no trading fees and is the perfect option for beginner investors.

Account Types

Merrill Edge offers various accounts within the categories of retirement, general, educational, and small businesses. Individual investors may also enjoy estate and trust accounts for various purposes. The common account that you'll find on this platform are:

- Roth IRA

- Traditional IRA

- Rollover IRA

- SEP IRA

- 529 plans (save for college)

- Individual/joint taxable

- 401(k) for individuals and small businesses

- HSA (Health Savings Account)

Account Types Merrill Edge

| Account Type | Feature |

| 529 Plans |

|

| Custodial Account (UTMA/UGMA) |

|

| Estate Account |

|

| Retirement Account |

|

| Custodial/Trust Brokerage |

|

| Joint Brokerage |

|

| Individual Brokerage |

|

Customer Support

Merrill Edge stands out for stellar customer service. They have 24/7 availability by chat, mail, or phone, or you can visit a BoA branch nearest you. You can upload documents online for general inquiries. Unfortunately, there is no email support available.

Conclusion

At the conclusion of our Merrill Edge review, we recommend Merrill Edge for investors who are starting to get their feet wet and want to enjoy growing and learning more about the market.

The standard product offerings are adequate for most, though some advanced traders may not prefer Merrill Edge because of the lack of accessibility to more variety.

The mobile app and desktop platforms are convenient and easy to use, and opening an account is seamless. With excellent customer service, educational materials, and research tools available to clients, Merrill Edge is worth a strong consideration for any investor.

FAQ

Here are the answers to commonly asked questions regarding a Merrill Edge review:

What are the advantages of an online brokerage account with Merrill Edge?

Online brokerage accounts allow customers to transfer funds between their BoA accounts and investment accounts with Merrill. You get full access to multiple investment choices and can enjoy the convenience of perks and the rewards program.

How do I know if a self-directed investment account is a right choice for me?

If you enjoy making decisions regarding your investments, you may prefer a self-directed account instead of one guided by a financial professional. You can monitor your portfolio performance independently and use any tools only to help inform your decision.

Are Merrill financial advisors reliable?

Merrill Edge's financial advisory program is perfect for those who want to learn the ropes as they endeavor to become an expert investor. If you appreciate someone else building the portfolio while you call the shots, this may be the option for you. The representatives are highly skilled and qualified to make decisions on your behalf based on your personal information and expert strategy.

Is Merrill Edge legit?

Merrill Edge is a legitimate company that has received a lot of trust from the general public as a subsidiary of the Bank of America. Both BoA and Merrill Edge have an A+ rating from the Better Business Bureau. Your funds will also receive insurance under the SIPC, though all transactions will not be eligible for coverage under this organization.

Can I go to Bank of America for financial guidance on my Merrill Edge account?

While investors can go to any of the over 2,000 physical locations for Bank of America, the representatives are not known for being able to provide in-depth information regarding financial decisions and trading. Fortunately, they can assist you if you're having trouble with your account. Issues such as technical difficulties, inaccurate transactions, fees, and problems along these lines are where they excel.

Is Merrill Edge only for Bank of America customers?

Merrill Edge is suitable for all investors, but it is particularly promising if you bank with Bank of America. You can easily move your money between accounts under your name, and they have a Preferred Rewards Program that offers numerous benefits for those with an account balance of at least $20,000 every month.

What's the main difference between Merrill Lynch and Merrill Edge?

Many people confuse these two companies, but the primary difference between them is that Merrill Lynch is more of a conventional broker firm compared to Merrill Edge. Merrill Lynch has a more high-profile client base of primarily affluent clients. Merrill Edge is a discount online brokerage firm that captures the attention of retail traders instead.