Nadex is a well-known binary options, knock-out, and call spreads contract exchange based in Chicago. The Commodities Futures Trading Commission (CFTC) regulates Nadex, giving its traders peace of mind when trading derivatives. The exchange first opened its doors in 2004 under the name ‘HedgeStreet’. The goal at the time was to build an electronic marketplace that allowed regular investors to trade financial derivatives. But HedgeStreet eventually closed its doors by 2007.

The company was purchased by the UK-based IG Group Holdings Plc. in 2009, and HedgeStreet was renamed the North American Derivatives Exchange, or simply Nadex, which was geared with sophisticated instruments and technology.

The company says that it’s the premier US exchange for binary options, which may seem like an exaggeration, but it has a lot to offer its clients, so perhaps this title is well-deserved!

But is Nadex the right trading platform for you? That’s what we’ll find out in this detailed review.

Nadex Summary

Nadex is a trading exchange that offers many benefits to traders — the CFTC fully regulates it; its clients funds are held in segregated US-based banks; it has no misaligned incentives since it operates as an exchange rather than a broker; it has a transparent fee structure; it provides users with high-quality educational content; and it has free demo account with a simulated balance of $25,000.

So, it's overall an excellent option for short-term traders who wish to trade binary options and spreads on a well-regulated exchange located in the United States. However, it falls short when it comes to its mobile trading experience since it doesn’t offer a real mobile app to its clients. Also, it has a minimum first deposit of $250.

Nadex Overview

We list out the main features of Nadex below.

| Trading Platform | Nadex |

|---|---|

| Founded | 2004 |

| Regulation | CFTC |

| Demo Account | Yes |

| Islamic Account | No |

| Minimum Trade | $1 |

| Minimum Deposit | $250 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| U.S. Client Accepted | Yes |

| Our Score | 4.6/5 |

Pros and Cons

Nadex undoubtedly has more pros than cons, but that doesn’t mean that its negatives aren’t deal breakers for some traders. Take a look at the table below to figure out whether Nadex is the right broker for you or not:

| Pros | Cons |

|---|---|

Nadex Compared

It’s always a good idea to see how a certain broker or exchange compares to its biggest competitors in the industry. The following table sets a brief comparison between Nadex and some of its strongest competitors so far:

| Platform | Pocket Option | IQ Option | Nadex |

|---|---|---|---|

| Minimum Deposit | $50 | $10 | $250 |

| Maximum Payout | %128 | 91% | 100% |

| Underlying Assets | 100+ | N/A | N/A |

| USA Accepted | Yes | No | Yes |

| Demo Account | Yes | Yes | Yes |

| Platforms | Web, Windows, Android, iOS | Web, Windows, MacOS, Android, iOS | Web, Android, iOS |

| Regulation | IFMRRC | CySEC | CFTC |

Offering of Investments

Nadex Offers three types of trading instruments: Binary options, knock-outs, and call spreads. Here's a brief explanation of each of them:

- Binary options are contracts with only two possible outcomes based on a question that only has a yes or no answer, like when you ask something like ‘Will the gold price per gram goes above $58 by January 2022?’ If you hold the contract until it expires, it will either be out-of-the-money (OTM), and you will receive $0, or it will be in-the-money (ITM), and you will receive $100 per share. Binary options get their name because they have an either/or result.

- Knock-out (touch brackets) contracts make traders establish a ceiling and floor every week on their trades, which, if met, will knock out the trade. This concept of knock outs serves as stop-loss or take-profit order in a sense. If neither of the parameters is met, you can either retain knock-outs to expiration or sell them early, but only for no more than a week.

- Call spreads are a unique product offered by Nadex. Commodities, Stock index futures, and FX are among the markets where these are available. But don't worry, it’s quite simple to understand these spreads. Call spreads require you to specify an initial trade ceiling and floor (like knock-outs). However, there's no risk of being knocked out of a call spread. If you wish to take profits or avoid potential losses, you can stay in the trade for more than one week or just close the trade out early.

Commission and Fees

The commission and fee structure at Nadex is clear. When you initiate or close a position, you will be charged a fee of $1 per contract, and if you exercise a contract that's in the money, you will be charged a fee of $1. A fee is not charged if a contract expires out of the money.

Moreover, automated clearing house (ACH) deposits and withdrawals are 100% free, and there’s no fee to open a Nadex account.

Check the below table for more details about Nadex’s commissions and fees:

| Account opening | Free |

|---|---|

| Deposits and withdrawal | Free via ACH$25 per wire withdrawal |

| Minimum deposit | The initial deposit is $250 and the minimum incremental deposit is $100 |

| Inactivity fee | $10 per month after one year of inactivity |

| Binary options | Entry or exit: $1 per contractITM trade expiration: $1 per contractOTM trade expiration: Free |

| Call spreads | Entry or exit: $1 per contractTrade expiration: $1 per contract |

| Knock-outs | Entry or exit: $1 per contractTrade expiration: $1 per contract |

Leverage

When it comes to leverage, Nadex spreads offer substantial advantages to traders. The fees are minimal, straightforward, and have good leverage.

Spot forex traders in the United States may rarely acquire better than a 50:1 leverage. Spreads on Nadex are fully collateralized and don’t have a margin. They’re more of a short-term option than a leveraged trading product. But sometimes Nadex spread can be less expensive than trading the underlying market. Because of the low cost, you might get a huge payout at low risk.

With Nadex, you enjoy some risk control because your maximum risk is set at a specified level. You can also exit early to reduce your losses. Plus, you can seize any profits before the expiration of the spread.

Account Opening and Types

Nadex makes it reasonably easy to open an account. Below is a list of account types offered by the broker:

- Standard trading account (for binary options, knock-outs, and call spreads)

- Business trading account

- Free demo account

Nadex does not provide the option of opening an Islamic Account for traders who are interested in doing so.

To open a new account with Nadex, you need to provide the following:

- Date of birth

- Permanent residential address

- Social Security Number or National Identification Number

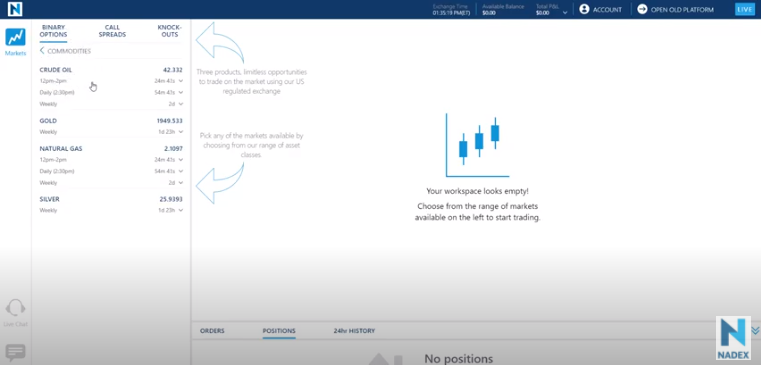

Desktop Trading Experience

Nadex's trading experience is based on a single web page, and you can always access their free desktop trading platform provided you have a web browser and internet access. Thanks to their free demo account that starts with a simulated balance of $25,000, you can try and test this platform to see if it’s the platform for you.

You get to open a Nadex account and fund it using a debit card, wire transfer, ACH, or paper check (clients outside of the US can use an international bank transfer or debit card).

The trading platform is user-friendly, well-designed, straightforward, and clean. However, the platform is designed for binary options and spreads trading, and it offers everything you'd want in this regard, but don’t expect much more.

A relatively small number of technical indicators are available, including the usual suspects like ATR, RSI, Bollinger Bands, Moving Average, and various oscillators. A good array of drawing tools is also available, including Elliott, Gann, and Fibonacci tools. Limit and market orders are supported.

Finally, you can customize charts and easily switch between chart intervals and types (line, candlestick, Mountain, and HLOC).

Nadex Mobile App Experience

Although Nadex features a mobile experience, it lacks a standard mobile app. NadexGO is a progressive mobile application, which means it doesn't need to be downloaded and isn't available on Google Play or the App Store.

It’s simple to use the app: just open your mobile web browser and type the NadexGO URL into it. You can trade on Nadex with your smartphone and tablet. However, it isn’t a unique experience that adds anything to the platform. The mobile trading experience is nearly identical to the desktop one.

We can say that Nadex doesn’t have a real mobile trading app, which is a big drawback, especially when compared to other brokers who offer real mobile trading apps in addition to desktop platforms.

You can still trade online when you aren't at your computer thanks to the “mobile trading app,” meaning that you can keep track of and manage your investment portfolios from wherever you are, but through the web browser on your phone.

Research

Nadex doesn’t offer broad-based research and analysis on specific securities, and it doesn’t offer third-party research tools either, so you'll have to do your homework before you decide to place any trade.

On the bright side, you can still sign up for a series of webinars that incorporate market insights and live technical analysis. Plus, there’s a news section that provides up-to-date market commentary, as well as analyses of individual commodities and currencies.

Education

Nadex excels when it comes to its educational content. The platform knows that the derivatives' wide range of markets can be confusing for new traders. Hence, they challenged that by creating a comprehensive education suite that includes tutorials, articles, webinars, FAQs, and demos.

You’ll find that the Learning Center is packed with how-to guides to help you create an account and start trading with solid strategies. You can benefit from the glossary, which helps you wrap your head around new concepts, or the blog, which keeps you updated on market news and new updates.

Nadex’s webinars are real gems. Their free webinars go through complex trading tools in full so novice traders can completely understand them and know how to use them. The basics of binary options are covered, as well as new potential opportunities and current market analysis.

Nadex goes to extreme lengths to explain to its users the concepts of binary options and spreads and how they function. It makes it such an easy task to comprehend and trade these products! Nadex relies on having good traders who make consistent profits over time, hence the fact that it offers free trading classes and other tools like trading e-books. The library of online courses, e-books, and videos provides traders with a thorough educational experience and a reliable reference library to return to.

Macro

Economic events aid analysts and economists in determining a country's overall macroeconomic health. They directly affect financial markets, which is why investors pay close attention to economic data. Economic calendars list major economic events, and traders get to make predictions based on them directly or trade on related markets.

You can trade US macroeconomic events such as currencies or commodities using Nadex's binary options feature, which enables you to bet on economic data like unemployment rates. Weekly jobless claims, nonfarm payroll numbers, the unemployment rate, and future GDP statistics are all available as contracts.

Nadex Regulation

Because sophisticated derivatives are frequently held in unregulated regions, many traders get skeptical about binary options. As a result, a slew of con artists get involved. However, because Nadex is a regulated platofrm under the US Commodity Futures Trading Commission (CFTC), you can rest assured that it’s in their best interest to offer you the most honest trading experience possible.

On Nadex, your funds are held in major US-based banks and kept in segregated accounts. This means two things: they provide a level of protection for your funds in the case that the platform goes into insolvency, and they make it possible for businesses to automate both inbound and outbound wire transfers.

Special Features

Because the Nadex platform is designed exclusively for trading binary options and spreads, it has features that are geared toward making those trades easier. Since it’s an exchange rather than a broker, you can access free live market data from the exchange. You can also place orders right from a chart thanks to the price ladder charts, and you can go from selecting markets through chart analysis to order placement.

The floor and ceiling levels are embedded into Nadex's binary options and spread contracts, ensuring that your maximum profit or loss is defined ahead of time. So before finalizing your trade, the maximum possible profit and loss are shown on the order ticket, meaning that you won’t lose more money than this amount.

Nadex – Overall User Experience

There’s no middle ground regarding binary options; there’s either a win or loss. To open a Nadex account, you don't have to be a seasoned trader in the derivatives markets; you only have to know how these instruments function and be aware of their degree of risk. Creating a new Nadex account won't take an hour of filling out online forms. It offers a 5-minute, 5-step sign-up process that’ll get you up and running in no time.

Nadex does an excellent job of easing new clients into the platform and providing plenty of assistance to start trading the right way. You can always try out a demo account before starting trading with Nadex, and the Learning Center contains a wealth of valuable educational material.

Creating a Nadex demo account is both easy and free, and you don't need years of experience in the derivatives markets to do so. But you should have a basic understanding of how these complicated financial instruments work as well as an understanding of your risk tolerance to put proper safeguards in place to protect you from losing a significant amount of money.

This may be a drawback for seasoned derivatives traders, but Nadex only has one browser-based platform. There’s no desktop or mobile app. New traders will welcome that the counterparty on the other side of the contract lacks a technological advantage.

Customer Service

Whether you're an existing customer or considering starting an account, Nadex provides excellent customer support with easy access. If you're already a client, you can contact Nadex customer support via phone or email. However, there’s no live-chat option for individuals who prefer real-time assistance, as well as o TTY line for hearing-impaired clients.

On the main Contact page, there’s no phone number for customer service, but existing clients get to access customer service through their accounts. Clients can contact customer care by email or by using the live chat on the Contact page.

Email: customerservice@nadex.com

Accepted Countries

Nadex accepts clients from many countries like:

- Austria

- The British Virgin Islands

- Belgium

- Czech Republic

- Cyprus

- Denmark

- Estonia

- France

- Finland

- Gibraltar

- Greece

- Germany

- Guernsey

- Hungary

- India

- Isle of Man

- Ireland

- Israel

- Italy

- Jersey

- Japan

- Lithuania

- Liechtenstein

- Luxembourg

- Malaysia

- Norway

- Netherlands

- New Zealand

- Poland

- Portugal

- Slovenia

- Slovakia

- Spain

- South Africa

- South Korea

- Sweden

- Switzerland

- United States

- United Kingdom

Final Verdict: Is Nadex the Right Choice for You?

Nadex is a trading exchange that has a lot to offer. It mainly allows you to safely buy and sell sophisticated derivatives. Binary options and call spreads — which typically attract fraudulence because they lack regulatory oversight — thrive in brightly lit markets. However, because Nadex is an exchange rather than a broker, its goals are aligned with those of its clients to provide the healthiest possible trading experience.

Nadex is a winner regarding educational content, which helps users understand how to trade binary options and get up on their feet.

However, the fact that the market is regulated doesn't imply that it's ideal for everyone to participate. In fact, Nadex's derivatives are complicated instruments, and inexperienced traders may experience big losses if they are not careful.

Before opening a Nadex account, make sure you understand all of the risks associated with these forms of derivatives. And if you have no experience in trading them, starting with a demo account is the way to go. Trading binary options, according to the CFTC, have high risk.

So you'll need to come up with an excellent strategy since failure to do so may result in putting your account balance at risk. You won’t, however, lose more than your initial deposit thanks to Nadex's capped risk guarantee.

Overall, Nadex is a great choice for short-term traders who wish to trade binary options and spreads on a well-regulated exchange situated in the United States. Binaries and spreads are offered on 5,000+ contracts, including FX pairs, stock indices, commodities, and innovative products like Bitcoin, as well as the ability to wager on macroeconomic events. It’s also great for active traders who want to day trade and place bets on a wide range of products.

FAQ

Can you have more than one account on Nadex?

You can only have one active Nadex account at a time. Nadex doesn’t allow multiple accounts, so don’t open and fund more than one. Similarly, you’re not permitted to access, fund or manage any other Nadex Member's account.

What is the maximum amount I can withdraw from Nadex?

You can withdraw up to the amount funded on each debit card used to deposit to Nadex, less any previous withdrawals. The maximum withdrawal transaction limit is $10,000, with a daily limit of $50,000.

How long does a demo account last on Nadex?

Your demo account can only be replenished one time every day, and you'll see a countdown timer to when it can be replenished again.

Has anyone made money on Nadex?

Yes, it is possiblo to make money with Nadex. The sad truth is that most fail, but not because Nadex, rather because of lack of skill and discipline required as a trader.

Is trading on Nadex worth it?

Nadex, just like any exchange isn't for everyone. If you are a trader who is willing to trade with high risk/high reward, Nadex is the place to go. Their low account minimum and easy to use platform are great for traders of all levels.

How to Trade Binary Options on Nadex?

1. Predict the market trends.

2. Pick the markets you want to trade

3. Select a strike price and expiration

4. Place the trade

5. Wait for expiration or close the trade early.