Pepperstone is a safe and reliable forex and CFD broker, founded in 2010 and based in Australia. Their customer support is great, and their trading platform is excellent for algorithmic traders. Pepperstone is regulated by top-tier authorities, including FCA (Financial Conduct Authority), BaFin, DSFA, SCB, CySEC, CMA, and ASIC (Australian Securities and Investments Commission). Headquartered in Melbourne, Australia, they have offices around the world. Pepperstone is one of the largest MetaTrader brokers in the industry. Today, 80,000+ traders trust and use Pepperstone services.

Between 74-89 % of retail investor accounts lose money when trading CFDs.

Summary

★★★★★ 4.9/5 (Best for Active Forex Traders)

Pepperstone is an excellent choice for algo traders and offers great pricing for forex. Regulated by top-tier authorities, it is a safe and reliable forex and CFD broker. We found that Pepperstone is excellent for high-volume traders, and offers a good selection of third-party trading platforms with great pricing.

| Pepperstone | |

|---|---|

| Demo Account: | Yes |

| Regulated by: | ASIC, FCA, BaFin, DSFA, SCB, CySEC, CMA |

| Minimum Deposit: | $0 |

| Min. Trade: | 0.01 lots |

| Mobile App: | iOS, Android |

| Desktop: | MT4, MT5, cTrader, TradingView |

| Countries Not Available: | Full List |

| Deposit Methods: | Visa, Mastercard, Bank Transfer, POLi, MPESA, BPay, Union Pay, Neteller, Skrill, PayPal |

| Islamic Account: | Yes |

| Our Rating: | ★★★★★ 4.9/5 |

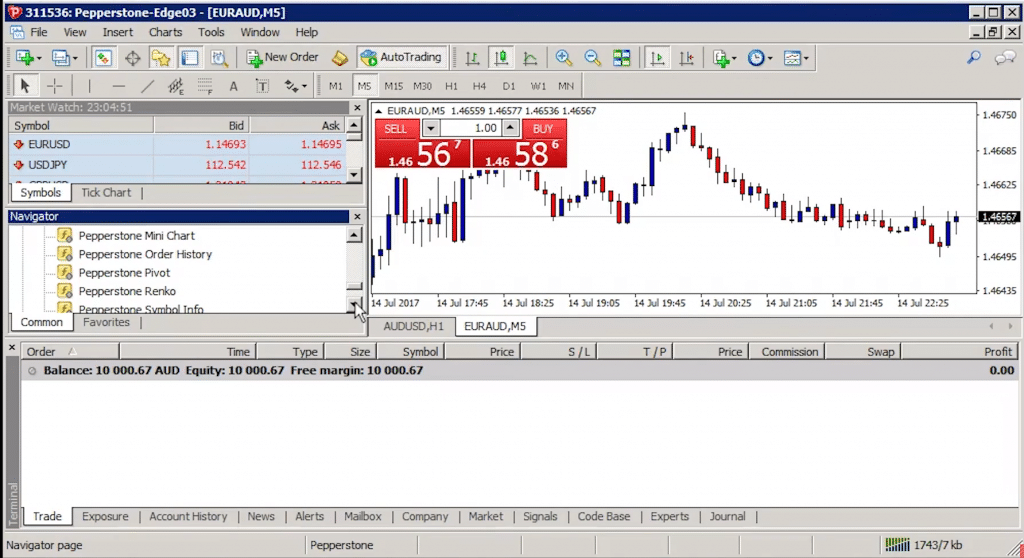

Pepperstone Trading Platform

★★★★★ 4.8/5

Pepperstone doesn’t offer a proprietary platform but has a wide variety of third-party platforms available. The full cTrader (Windows) and MetaTrader (Windows, Mac OS) suite are available. For social copy trading, traders can choose cTrader, DupliTrade, MyFXBook, and Trading View. Both cTrader and MetaTrader support algorithmic trading. A great alternative voted as the best platform for copy trading is eToro.

The web platform runs on MetaTrader and has excellent customization and language support. The design feels a bit outdated, and the user interface takes getting used to. Pepperstone has in-depth tutorials on how to use its platforms. Moving tabs and their size on the screen is easy. MT4 and MT5 web trader have indicators, expert advisors, DDE protocols, order management tools, and more.

Let's take a quick look at each Trading Platform.

MetaTrader 4

MetaTrader 4 (MT4) is a powerful and popular trading platform used by millions of users around the world. Developed by the company MetaQuotes Software Corp it was first released in 2005.

While most traders associate MT4 with trading Forex, users can also tap into a variety of other markets, including Commodities, Indices, and Cryptocurrency using CFDs.

The main features of MT4 include advanced charting capabilities, backtesting capabilities, mobile trading, algorithmic trading, and an extensive library of technical indicators and resources.

In addition to these features, MT4 also supports Expert Advisors (EAs), which are automated scripts that allow users to design their own trading strategies based on their own preferences.

Having ceased new development and support for MT4, MetaQuotes has redirected its attention to exclusively promoting the use of MT5, which we'll look at next.

MetaTrader 5

MetaTrader 5 was launched in 2010 as an upgrade from its predecessor, the MT4 platform. The main difference between MT4 and MT5 is that MT5 offers more features than MT4, such as more charting tools, more indicators and technical analysis tools, faster trade execution speeds, more order types, and improved market data streaming.

cTrader

An alternative to MT4 and MT5 cTrader is a forex and CFD trading platform developed by Spotware Systems Ltd that first launched in 2010. cTrader is designed for maximum security and speed—and that means faster order execution times.

What I liked about it when I first started using it was its great balance of ease of use combined with advanced features for seasoned traders.

CTrader's WebTrader, a no-download platform, doubles as an ideal and dependable backup for when you're on somebody else's computer.

Capitalise.ai

With Capitalise.ai, you benefit from the convenience of code-free trading automation. This unique platform allows you to transform your trading ideas into automated strategies using everyday English with just a few clicks – no coding required.

As well as being able to create and automate training scenarios with ease, it allows me to backtest with historical data and simulate strategies with real-time data.

TradingView

TradingView has to be the ultimate platform for advanced charting functionality; through its intuitive interface, users can access streaming quotes, real-time news feeds, market analysis tools, interactive charts, and more.

But more than that, its huge interactive social network (15.5 million active users) makes it much more than just a charting tool. By allowing users to post their trades, comment on them and discuss strategies, traders of all levels can benefit from it.

74-89 % of retail investor accounts lose money when trading CFDs

Smart Trader Trading Tools

Their Smart Trader Tools is a helpful set of tools to perfect your strategy. Smart Trader includes up-to-date market data and functions, broadcast facilities, and sophisticated alarms to make trading easier.

Expert Advisors

| Alarm manager | Trade-related events notification, price action moves, and more |

| Correlation Matrix | Insights to view the correlation between trading instruments |

| Connect | Analysis and news in one place |

| Correlation Trader | In-depth correlation analysis through time-frames |

| Market Manager | Market prices, pending and open orders |

| Sentiment Trader | Market sentiment ratings |

| Session Map | Real-time global map of market sessions and overlaps |

| Excell RTD | Analyze and report real-time market data in Excell |

| Mini Terminal | Single market trade terminal |

| Trade Terminal | Professional robust analysis and trade execution |

| Trade simulator | Simulate trades with real market data |

| Tick Chart Trader | Create charts for specific timeframes with Generator EA |

Indicators

| Candle Countdown | Time left in a candle bar |

| Chart Group | Adjust charts through multiple timeframes |

| Bar Changer | Offline Charts available on MT4 |

| Freehand | Draw on your chart |

| Chart-in-Chart | Compare price action on different symbols |

| Donchian | Identify range of trading opportunities and gain insight into trends |

| Gravity | Identify support and resistance areas |

| High-Low | See the high-low for a period on the chart |

| Keltner | Channel size based on ATR |

| Mini Chart | The price action of other time-frames and instruments |

| Magnifier | Resizable and draggable sub-window inside the main chart |

| Order history | Previous trades history set open and close of particular trades |

| Pivot Point | Spot market levels based on previous day |

| Renko | Renko blocks on MT4 time-based charts |

| Symbol Info | Dragable window showing symbol data |

Pepperstone Mobile Trading

★★★★★ 4.8/5

Pepperstone offers MT4, MT5, and cTrader apps for mobile trading. The mobile trading app is available on iOS and Android in 22 languages. The MetaTrader 4 mobile app is easy-to-use, has excellent functionality, search, and price alerts. The platform syncs with the online platform on your account and vice-versa.

Traders have access to both forex and CFD trading. The MetaTrader app includes 30 indicators, watch lists, alerts, trendlines, and charts for different time frames. Overall, it should suffice most traders, beginner to advanced.

74-89 % of retail investor accounts lose money when trading CFDs

Pepperstone Fees

★★★★★ 4.9/5

Pepperstone fees are low in general. It is best suited for active traders that trade multiple times per week/day. Their standard account has average trading fees, while the Razor account offers much better fees for active traders. Pepperstone uses multiple liquidity providers to give its traders competitive quotes and low spreads on instruments and assets.

The spreads are variable and depend on market conditions. Prices come from different providers, and during liquid hours, spreads are as low as 0 pips on the EURUSD (Razor account).

Pepperstone commissions on Razor accounts

Below are the commissions for both MT4 and MT5 Razor accounts in USD and EUR.

MT5 Razor Account

| Account currency | Commission per 0.01 lots | Commission per 1 lot |

|---|---|---|

| USD | USD 0.04 (USD 0.08 round turn) | USD 3.50 (USD 7 round turn) |

| EUR | EUR 0.03 (EUR 0.06 round turn) | EUR 2.60 (EUR 5.20 round turn) |

MT4 Razor Account

| Account currency | Commission per 0.01 lots | Commission per 1 lot |

|---|---|---|

| USD | USD 0.04 (USD 0.08 round turn) | USD 3.50 (USD 7.0 round turn) |

| EUR | EUR 0.03 (EUR 0.06 round turn) | EUR 2.60 (EUR 5.20 round turn) |

cTrader Commissions

cTrader accounts have a 0.0035% charge of the base currency you trade. This means that for a $100,000 USDEUR trade, the commission is $3.5 to open the position and $3.5 to close it. Same commissions apply to TradingView.

Overnight funding fees

If you keep a position open overnight, a charge for overnight funding is applied to your account. The rates are set at the benchmark regional rates for Equity CFDs, Share CFDs, and commodities. Pepperstone's fixed rate is 2.5%.

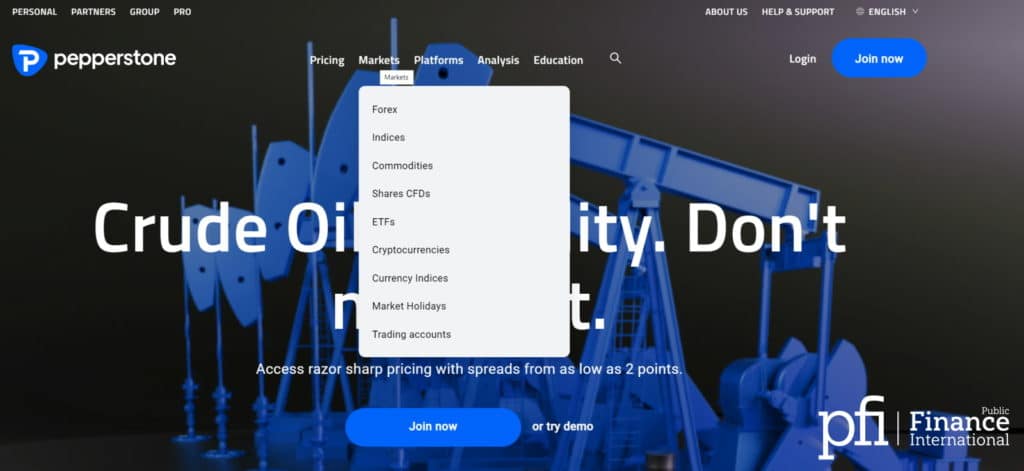

Pepperstone Markets Available

★★★★★ 4.5/5

Pepperstone offers more than 1200 instruments in a range of markets. They offer CFDs on Forex, Indexes, Shares, ETFs, Commodities, and Cryptocurrencies. While Pepperstone offers CFDs, they focus on what they do best – forex trading. They offer majors, minors, and exotics with low commissions and tight spreads.

Financial Instruments available at Pepperstone include:

- Forex – Pepperstone offers around 70 currency pairs, including major, minor, cross and exotic pairs.

- Indices – Trade a range of over 20 global Indices on Pepperstone, such as NASDAQ, FTSE100, All Australian 200 and the Hang Seng

- Share CFDs – with over 1,000 global shares, the lion's share from the US market, Pepperstone's share CFDs offer leveraged trading on some of the world’s biggest companies.

- ETFs – Pepperstone offers over 100 Exchange Traded Funds (ETFs) from 35 countries.

- Metals – Pepperstone offers several metal pairs, including gold, silver, copper and platinum.

- Commodities – Access popular commodities such as crude oil and natural gas or trade soft commodities like corn, wheat, coffee and sugar.

- Cryptocurrency – Join the cryptocurrency revolution with a selection of cryptocurrency CFDs.

Opening an account

★★★★★ 5/5

Opening a Pepperstone account is straightforward and should take 10 to 15 minutes if you have your ID documents handy. There is no minimum deposit (standard account), and I personally found the process of opening a Pepperstone account seamless. Traders worldwide are accepted with just a few exceptions (Canada, New Zealand, Japan, and the US).

Pepperstone offers two different types of accounts to choose from – Razor and Standard. Once your application is approved, you'll be ready to start trading with Pepperstone's competitive pricing and fast execution speeds.

Standard account

The standard account has no commissions, but the spreads are higher than the razor account. It has a 1.0 – 1.3 pip mark upon the raw spread and is popular for new traders looking for a simple account.

Razor account

The razor account is commission based. It features raw spreads from 0.0 pips. It is popular for scalping, algo traders, and clients that want to run Expert Advisors. The average spread for EURUSD is 0.0-0.3 pips. The commission is from AUD$7 round turn for 100k traded.

Pepperstone Minimum deposit

The minimum deposit for a standard account is $0. This is better than the industry average, where minimum deposits range from $10-$10,000.

Swap-free Account

Swap-free accounts provide a great opportunity for Islamic traders who want access to the same financial markets as everyone else but don’t want any interest-based fees associated with their trades.

A swap-free account is an investment account that allows Muslim traders to participate in the financial markets while adhering to Islamic law regarding interest.

In Islamic banking, interest payments or “riba” are forbidden, which is why many Muslims cannot engage in conventional trading activities such as holding an overnight position or using margin or leverage.

Pepperstone makes it easy by offering its clients a swap-free account option that allows them to access its products and services without having to worry about breaking religious laws or sacrificing potential profits.

The Islamic Account is just like the Standard Account, with the exception of no swap fees. Rather than overnight charges, an administration fee applies. This admin fee will be charged every 11th day that you maintain a position open.

However, swap-free accounts are only available in countries with a Muslim-majority population. This means that if you’re a Muslim trader in a non-Muslim country, you won’t be able to take advantage of Pepperstone’s swap-free trading account for online Forex Trading.

74-89 % of retail investor accounts lose money when trading CFDs

Funding Your Account

★★★★ 4/5

Once you have opened and verified your Pepperstone, you can easily fund it using a variety of payment methods. The base currencies accepted by Pepperstone are AUD, GBP, CAD, USD, SGD, EUR, HKD, NZD, CHF, and JPY.

There's no conversion fee if you fund your Pepperstone account in the same currency you are going to trade assets. We'd suggest opening an online multi-currency bank account to save on currency conversion fees.

I noticed that while Pepperstone has a good selection of no-fee deposit and withdrawal methods, you'll be charged a fee of 20 USD for an international bank transfer.

I should also point out that if you withdraw using Neteller or Skrill, you'll be charged a dollar for each withdrawal.

Payment methods available will depend on your region but include

- Bank Transfer

- Visa & Mastercard

- BPay

- Poli

- PayPal

- Neteller

- Skrill

Apart from bank transfers, these payment options offer instant deposits; you can expect withdrawals to take 3-5 days.

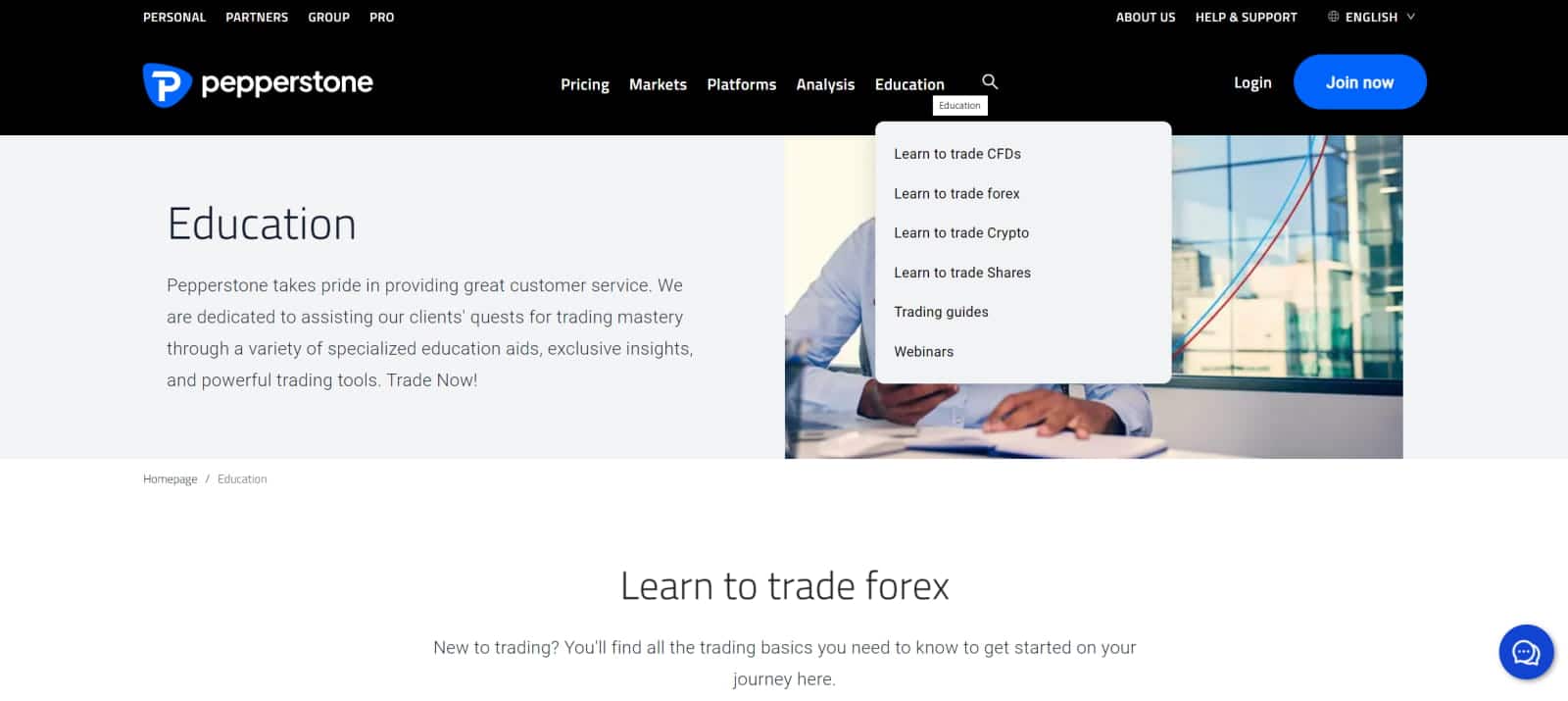

Research and Education

★★★★★ 5/5

Pepperstone research and education is above the industry average. Their website has a whole section dedicated to education and analysis. They host webinars with professional analysts, guides, market news, market analysis, and an economic calendar. For beginner traders, there is a section on how to trade forex and CFDs.

Customer Service

★★★★ 4/5

Pepperstone has good customer service. They have 24/5 phone support, live chat, and email.

If you are an Australian Pepperstone account holder, you can phone them at 1-300-033-375; international account holders can call +613 9020 0155. The email support address is support@pepperstone.com

I tested out the response times for all three, and I can confirm they performed great. I found the live chat especially useful; the support agents are friendly and well-educated. The Pepperstone website also features a support page with frequently asked questions that are useful.

Support languages available include English, Vietnamese, Thai, Chinese, Polish and Arabic.

Pepperstone Leverage

Pepperstone offers leverage up to 400:1. The leverage depends on the jurisdiction and is 30:1 for forex in ASIC, 30:1 in DFSA, and 30:1 in the FCA jurisdiction. With every $1 you can trade $30 in ASIC, $30 in DFSA, and $30 in FCA in the forex market.

Here is the leverage ratio under different regulations:

| Regulation | Leverage |

|---|---|

| ASIC | 30:1 |

| CySEC | 30:1 |

| FCA | 30:1 |

| DFSA | 30:1 |

| BaFIN | 30:1 |

| SCB | 200:1 |

| CMA | 400:1 |

Leverage increases profits and losses. The larger the position size, the bigger leverage has on your P/L (profit/loss). Margin is the money you need in your trading account to enter or maintain a position. The margin requirements are a percentage of the full amount (0.5%, 1%, 2%). The leverage ratio depends on the regulation and the financial instrument, and the asset class. Forex has higher leverage while cryptocurrency leverage is lower.

Bonus

Pepperstone doesn’t offer a deposit bonus. This is because deposit bonuses are banned in Europe. Pepperstone aims to provide a low-cost trading platform and great service to their clients, instead of deposit bonuses. In 2018 the European Securities and Market Authority banned all forex deposit bonuses in the EU.

The refer a friend program is available for traders that invite friends or family to trade with Pepperstone. The bonus for referring a trader varies based on jurisdiction. The referral has to fund their account and trade a certain amount in lots.

With Pepperstone's Active Trader Program, traders earn cash rebates and save on commissions based on their forex trading volume. The more you trade, the more you save – the rebate depends on how many standard lots you trade per month.

If you are a high-volume trader, you'll also benefit from joining the Active Trader Program with priority customer support and free VPS.

Pepperstone Regulation

One of the significant benefits I found with this trading platform is that Pepperstone Group Limited is regulated under multiple authorities.

These include the Financial Conduct Authority (FCA #684312) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, the Dubai Financial Services Authority (DFSA), the Seychelles Financial Services Authority (SCB), the Capital Markets Authority of Kenya (CMA), the Cyprus Securities and Exchange Commission (CYSEC), and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN).

Being regulated by multiple authorities makes Pepperstone a safe and reliable choice for traders looking to make investments in various markets.

All client funds are held in segregated accounts with tier-1 banks, and client assets are protected through the compensation schemes provided by both the FCA and the ASIC.

Independent third-party organizations regularly audit Pepperstone to ensure that it meets the highest standards of financial regulation and customer protection. This commitment to regulatory compliance has given Pepperstone a reputation as one of the most reliable Forex brokers in the industry.

Pepperstone Awards

While I wouldn't consider the winning of awards a deal-breaker when choosing a broker, it certainly goes a long way in establishing trust and offers proof that they are highly regarded in their industry.

Pepperstone has won numerous awards for excellence in trading and customer excellence over the years, including:

- TradingView Broker of the Year 2022

- FX Scouts Global Forex Broker of the Year 2022

- InvestinGoal Best Broker in the World and Best Broker in Australia 2021

- Best Forex Trading Support – Europe (Global Forex Awards) 2019

And multiple other awards going back over the years.

Pepperstone Pros and Cons

So let's briefly recap on the many benefits Pepperstone has as a trusted broker. And as I always like to totally transparent with my reviews, some of the downsides as well.

| Pros | Cons |

|---|---|

| Regulated by multiple regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority. | No US-based clients due to regulatory restrictions. |

| Offers a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies. | They are a relatively new company compared to some established brokerages. |

| Low fees, with competitive spreads and no deposit or withdrawal fees. | CFDs are the only options available for those looking to purchase bonds, stocks or mutual funds. There is no opportunity for direct purchasing. |

| Fast and reliable execution with multiple trading platforms available, including MetaTrader 4 and 5, as well as cTrader. | |

| Safety features, including negative balance protection, to safeguard your account. | |

| No fees are incurred for inactive accounts. | |

| Strong customer support, with 24/5 availability and multiple languages supported. |

Pepperstone Review Conclusion

As a forex trader myself, I totally get that finding a reputable and safe platform to invest in can be a challenging task. After rigorous testing of Pepperstone's services, I can plainly see why this platform has established such a solid reputation in the industry.

Its Razor account and Active Traders program offer exceptional pricing that's a cut above the rest, making it an excellent platform for seasoned traders.

My thoughts on the matter are clear – Pepperstone knows what traders need, and they deliver on that promise.

However, what truly sets Pepperstone apart is its dedication to making sure that its trading platform can be used by anyone–even novice investors. Their standard package is user-friendly and packed with the tools you need to get started on your forex trading journey. As someone who struggled as a beginner trader, I can attest to the fact that Pepperstone is a great place to get started.

Without a doubt, I can confidently say that Pepperstone is a reliable broker that ticks all the right boxes. Their competitive pricing, tight spreads, low commissions, and excellent customer service make it an obvious choice for all types of traders.

I hope that my Pepperstone review has helped you make an informed decision on if to choose this platform to trade Forex or other financial instruments.

74-89 % of retail investor accounts lose money when trading CFDs

FAQs

Does Pepperstone have a Demo Account?

Yes, Beginners searching for real-world forex trading practice with no financial risk can capitalize on Pepperstone's free demo account. This platform provides a secure and safe way to try different trading strategies while getting comfortable using the trading platform.

You get to practice in a 100% risk-free environment and get acquainted with the different features that Pepperstone offers. Demo accounts are available for up to 30 days, which I think should be enough time for you to gain some confidence in your trades so that when you do switch to live trading, you can hit the ground running.

Which countries are excluded from using Pepperstone's trading platforms?

Though Pepperstone is a Forex broker for worldwide clients, there are certain countries that are excluded from using its services. These include the United States and its territories, Canada, Japan, New Zealand and Zimbabwe.

Is Scalping Allowed at Pepperstone?

The Razor trading account at Pepperstone enables scalping and hedging. Scalping is permitted in the MetaTrader 4, MetaTrader 5, and cTrader forex trading platforms.

Does Pepperstone use a Market Maker Model?

No, Pepperstone is a no-dealing desk (NDD) forex broker that acts as an intermediary between traders and liquidity providers. This means that all client orders are sent directly to the market via its execution venues without any intervention by Pepperstone or any other market-making entity.

How does Pepperstone ensure the security of client funds?

Pepperstone keeps client funds in segregated accounts and uses SSL encryption for its website and client area.