We do our best to published unbiased reviews. Our opinions and analysis is our own and is based on hours of research. Learn more about our methodology here. Our reviews are not influenced by compensation we might receive from our partners.

Plus500 is a global fintech company providing CFD online trading services. Founded in 2008, and headquartered in Israel, they provide more than 2,500 financial instruments. Their trading platform and mobile app is one of the best in our testing. They offer CFDs on: forex, ETFs, cryptocurrencies, options, indices, shares, commodities and more. Plus500 is regulated by CySEC, MAS, FCA, and FSA and licensed by ASIC, FMA, and FSCA.

Summary

Plus500 is a trusted online broker, regulated by top-tier authorities. Plus500 is known for their great trading platform and one of the best mobile apps. We found that it is great for CFD traders, customer support, easy to use platform and account opening process. The downside is their markets portfolio, offering only CFDs.

“CFD Service. Your capital is at risk.”

Table of Contents

- Summary

- Why should you read this?

- What’s best about Plus500?

- Plus500 Compared to Similar Trading Platforms

- Regulation of Plus500

- Platform Overview

- How to Open a Plus500 Account?

- Minimum Deposit Amount

- Markets & Products Offered

- Order Types

- Fees

- Leverage

- Research

- Plus500 Education Resources

- Portfolio Analysis Tools

- Customer Support

- Withdrawals Options and Fees

- How Can I Withdraw Funds:

- Is Plus500 Legit?

- Conclusion

Retail investors around the world trust Plus500. Plus500 Ltd (PLUS.L) is listed on the London Stock Exchange (LON: PLUS), it is a regulated broker. Read our full plus500 UK review here. Alon Gonen, Gal Haber, Elad Ben-Izhak, Omer Elazari, Shlomi Wizmann, Shimon Sofer are the founders. The current CEO is David Zruia.

| Feature | Plus500 |

|---|---|

| Founded: | 2008 |

| Publicly Traded: | Yes |

| Bank: | No |

| Regulation: | FCA, CySec, FSA, MAS |

| Licensed by: | ASIC, FSCA |

| Demo Account: | Yes |

| Minimum Deposit: | $100 |

| Copy Trading: | No |

| Minimum Trade: | Varies |

| Markets Available: | CFDs on more than 2000 instruments |

| Mobile Trading: | Yes |

| Countries Available: | 50+ |

| Withdrawals: | Free |

| Islamic Account: | Yes |

| Deposit Methods: | MasterCard, Visa, Skrill, PayPal, Bank Fund Transfers |

| Our Score: | 4.8/5 |

This broker is great for active traders, especially due to their great trade executions, platform and Plus500 Fees & Commissions.

Pros and Cons

Plus500 is a great, simple-to-use platform, with an especially useful mobile app. Their platform is great for intermediate to experienced traders. The account opening process is fully digital.

One downside is the fact that they only offer CFDs. Their research tools are average and fundamental data is not available. Their CFD fees are on the low side.

| PROS | CONS |

|---|---|

| Great proprietary trading platform | Only Offers CFDs |

| Mobile App | Education |

| Fees | Support could be better |

| Trusted and Regulated | |

| Wide Variety of Instruments |

We recommend it for advanced experienced traders, looking for a reliable and trustworthy broker.

Read more about it on Wikipedia.

Why should you read this?

Choosing the right platform is important if you want to become an active trader. This review goes over the pros and cons, their fees, platform, security, regulation and more. It will help you decide if it is a good fit for your needs. A great alternative to Plus500 is eToro, Pepperstone or Avatrade.

What’s best about Plus500?

The main advantage of this broker is their easy-to-use platform and low costs.

The best things are:

- Traders open a demo account in a few minutes online. Real money accounts need to be verified. The time frame depends on the workload. It takes a few business days.

- Fees are on the low end of the industry.

- This broker is considered well regulated due to the regulatory coverage.

- The company is listed on the London Stock Exchange.

- Their platform is user-friendly and a good fit for advanced traders.

Plus500 Compared to Similar Trading Platforms

Here is an overview of how Plus500 compares to similar trading platforms.

| Broker | Plus500 | XTB | eToro | Trading 212 | Interactive Brokers |

|---|---|---|---|---|---|

| Founded | 2008 | 2002 | 2007 | 2004 | 1993 |

| Headquarters | Israel | Poland | Tel Aviv, Israel | London, United Kingdom | Greenwich, Connecticut, United States |

| Regulation | CySEC, FMA, MAS, SFSA, FSCA, ASIC, FCA | FCA, Cyprus Securities and Exchange Commission (CySEC), Belize International Financial Services Commission (IFSC) | FCA, CySEC, ASIC | FCA, FSC, CySEC | MAS, FCA, CFTC, SEC, CBI, IIROC, ASIC, CSSF |

| Minimum Deposit | $100 | $0 | $50 – $10,000 | $0 | $0 |

| Withdrawal Fees | $0 | Yes (varies with withdrawal method) | $5 withdrawal fee | No | 1 Free Withdrawal/month |

| Inactivity Fees | $10/month (after 3 months of no login activity) | Yes | $10/month (after 12 months of no login activity) | Yes | $0 |

| Instruments Available | CFDs on: Indices, Forex, Commodities, Crypto, Shares, Options, ETFs | 4000+ (FX, Commodity CFDs, Indices, Stocks, Cryptocurrency) | 2000+ | Over 7000 Global Stocks & ETFs and CFDs on Forex, Commodities, Indices, Stocks | Access to 150 Exchanges (CFDs, Funds, Crypto, Futures, Options, Bonds, Stocks, ETFs, Forex) |

Regulation of Plus500

The following authorities regulate Plus500 and its subsidiaries:

- Plus500UK Ltd is authorized & regulated by the FCA (#509909).

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500SEY Ltd is authorized and regulated by the Seychelles Financial Services Authority (Licence No. SD039).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

- ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Platform Overview

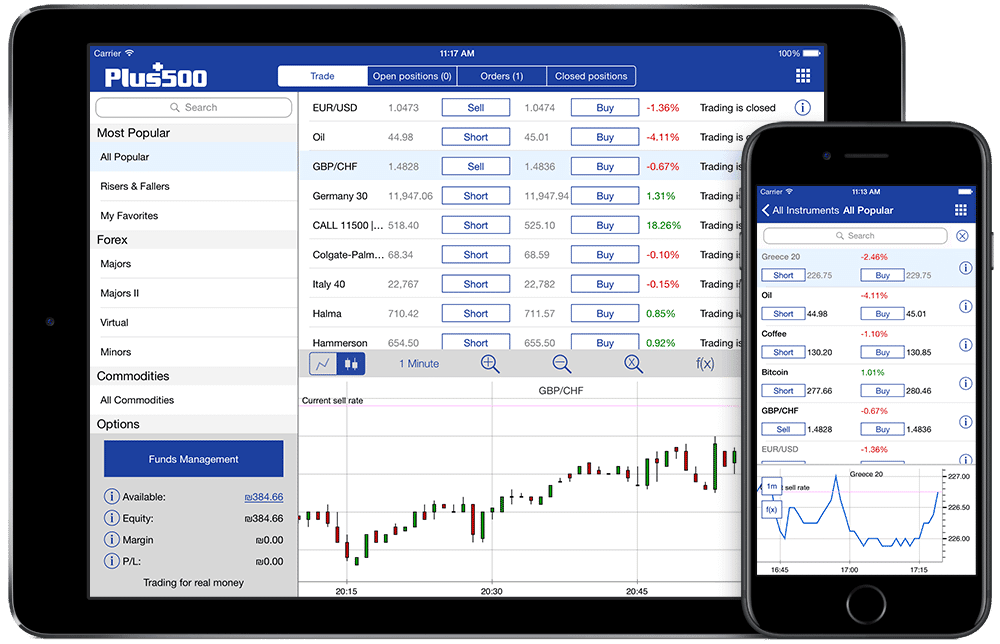

Plus500 offers their proprietary trading platform called WebTrader. It is easy to use and offers a streamlined experience on all devices (Windows PCs, tablets, smartphones, web browsers). Plus500 does not offer the popular MetaTrader 4 (MT4) platform that would have added functionality and customization options.

How does trading at Plus500 work?

Opening and closing CFD positions is done in just a few clicks. All you have to do is to open the mobile app, find an instrument and click on “Buy” or Sell.” Select the amount you wish to open the position with and open the trade.

See the video below and learn how Plus 500 works:

All of the financial instruments offered are traded as CFDs.

These are better for active traders, than long-term investments. There are certain additional costs associated with holding these contracts for a period longer than one day.

WebTrader

The WebTrader has a user-friendly interface that enjoys positive 4+ ratings from most of its users. It provides an extra layer of security through two-step logins. Their platform provides reports on fees, historical transactions, positions, and other important information regarding the client activity. There are no built-in tools for analyzing your trading activity. While their platform is great for most traders, it lacks in a few areas. You can't use functions like automated trading via expert advisors, back-testing, trading algorithms or the option to manage third-party funds with PAMM or MAM trading platforms.

The negative side of the platform is that it is not customizable. It does not feature advanced charting tools and it has its limits with the screen layout. It is great for basic charting, but advanced traders will miss more functionality.

The search function works and allows traders to find the security they wish to trade. Plus 500 gives traders the possibility of receiving e-mail, SMS, and push notifications. These triggers if the price of a certain asset moves.

Plus500 Mobile App

Plus500 mobile app features most if not all of the tools and options available within the web-based version. This includes its charting tools, search module, and reports.

The app is available for iOS (iPhone and iPad), Android, and Windows Phone operating systems. It sends push notifications to smartwatches if you have one. Biometric authentication is available for extra security.

Placing orders through the app is intuitive. Traders can trade CFDs in a matter of seconds. You can also deposit and withdraw money directly from the app. Some users might be concerned, because there is no enhanced security measures, as the app provides direct access to funded accounts.

How to Open a Plus500 Account?

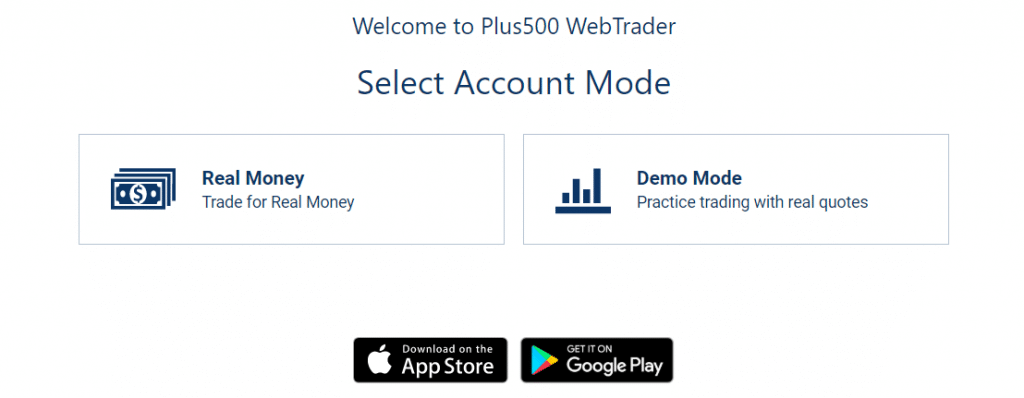

Opening a demo account is easy. It takes a few minutes to register and complete the registration. Real money accounts need to be verified. It takes a few days, depending on the workload.

Is Plus500 Good For Beginners?

Plus500 platform is easy to use, intuitive and well-designed. However, CFDs are complex instruments and we recommend using the demo account first.

Who can open a Account?

They accept investors around the world. There are a few locations that are forbidden from registering. These include Cuba, Iran, and Syria, to name a few. US and Canadian investors cannot open an account. These countries have banned the sale of CFDs to retail investors.

Step-by-step process to open an account:

- Finish the online registration

- Provide proof of residency and documents to verify your identity (national ID, passport, utility bill, etc.)

- Wait to get approved

- Deposit funds to start trading

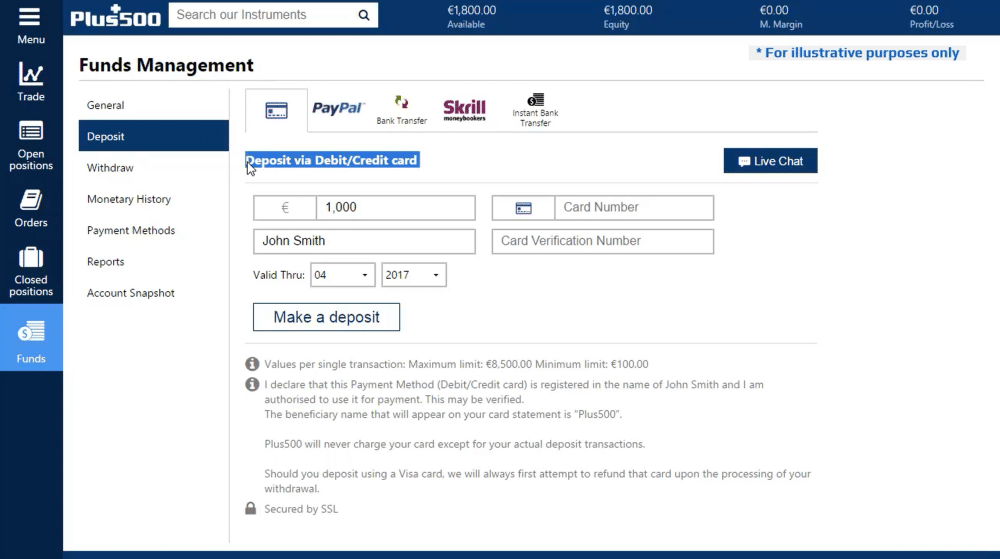

Minimum Deposit Amount

The Minimum Deposit at Plus500 is $100.

They accept debit cards, credit cards, and electronic wallets. The bank transfer minimum is $500.

| Minimum Deposit | Plus500 | eToro | Trading212 |

|---|---|---|---|

| Amount | $100 | $200 | $1 |

Withdrawal and Funding options

- Bank Fund transfers

- Visa or MasterCard Credit or debit card

- Electronic Wallet

- PayPal

- Skrill

Bank Fund Transfers may take several days to be cleared. Deposits made with debit cards, credit cards, and electronic wallets are instant. You will find the instructions in the Funds Management section of Plus500 platform. They don't charge deposits fees. There are 10 different base currencies available for their accounts.

Types of Accounts

There are two types of accounts available:

Both accounts – Retail and Pro accounts – are the same in most aspects. The main difference is that the retail account features lower leverage ratios than the Pro account. Professional clients do not have ICF rights.

To be eligible for a Pro account, the trader has to have a certain minimum amount of net assets or a certain minimum amount of income. Traders have to answer a few questions to verify that they understand the risks involved in using higher leverage ratios.

Markets & Products Offered

Plus500 offers traders CFDs on all popular financial markets and forex. The range of markets is good, compared to their competitors. They offer low competitive spreads, leverage, and options trading on many financial markets. They do not offer bonds.

- 1,800 Stock CFDs

- 33 Stock Index CFDs

- 92 ETF CFDs

- 22 Commodity CFDs

- 14 Cryptocurrency CFDs

- CFDs on 70 Currency Pairs

Plus500 Forex

Plus 500 offers 60+ most popular forex pairs like EUR/USD, GBP/USD and EUR/GBP with leverage. All Forex trading is done through CFDs. They offer advanced tools for protecting your profits and limit potential losses.

Cryptocurrencies offered

Yes, you can trade cryptocurrencies at Plus500. Here is a full list of the available cryptocurrencies available:

- Bitcoin (BTC)

- Ethereum (ETH)

- NEM

- Litecoin

- Bitcoin Cash

- EOS

- IOTA

- NEO

- Cardano (ADA)

- Stellar (XLM)

Plus500 was the first broker that offered Bitcoin CFD in 2013.

Order Types

- Market order – this order is executed at the current market price of the security

- Limit order – a limit order sets a maximum price at which you are willing to buy the securities or a minimum price at which you are willing to sell the securities. The order will only be executed at a limit price or better.

- Stop order – this limits losses if the market price falls below the stop price. The order will become a market order once that price is reached.

- Trailing-stop order – it allows traders to gain from any favorable price movement until the trend reverses and the price falls by a certain percentage or down to a certain price.

- Guaranteed Stop Loss Orders – depend on market conditions but are subject to wider spreads.

Limit, stop, and trailing-stop options work by setting a limit or stop price. The Company does not guarantee the order is executed at that exact price. That is due to slippage.

Slippage occurs when the market price of a security experience significant volatility and the broker cannot secure the price established in the order.

While the platform will do its best to fulfill the order based on those price targets, if it is unable to do so, it cannot be held responsible for any slippage that occurred in the process of trading CFDs.

Fees

Plus500 has low trading costs compared to several of its rivals. They don’t charge a withdrawal fee on the first 5 withdrawals per month, this is a plus for traders with small amounts of capital. Plus500 doesn't charge commissions. They make money from customer trades and the bid/ask spread. The spread is dynamic and constantly changes according to market trends. However, high-volume traders get a discount (the professional accounts do not have ICF rights).

It means that you’ll pay a certain amount above the quoted price for buyers or receive a bit less than the price quoted.

The average varied spreads are:

- S&P500 – varied spread

- Europe 50 – varied spread

- Forex – cost per EUR USD trade is varied

It is difficult to list all the fees per trade based on the available information. Spreads vary per each of the instruments.

Based on hypothetical calculations on the leverage used, the amount of capital invested, and the type of position held, fees are low. The average cost per trade is on the low-end of most online brokers.

Inactivity Fee

They also charge an inactivity fee. Customers who have not logged into the account for more than 3 months are subject to an inactivity fee. The fee is $10 per quarter after these three months have passed.

The fee is triggered for not logging in. Some brokers charge fees for not trading, so this is a plus.

Overnight Funding Fee

If you hold securities overnight, an overnight funding fee is charged. Read about it here. The overnight funding amount is either added to or subtracted from your account. That is, if a position is left open after a specific cut-off time. Fees are a percentage of the amount of leverage associated with the position. The percentage is quoted next to the price of the financial asset. If the trade is in another currency than the account base currency, currency conversion charges are applicable.

Leverage

Leverage levels available for traders vary depending on where traders are located and the particular laws.

Maximum Leverage levels for retail accounts:

- Stock index – 20:1 leverage

- Stocks – 5:1 leverage

- Forex – 30:1

A 30:1 leverage means you can borrow $30 per each $1 committed.

One of the downsides is that leverage levels are fixed. Leverage cannot be modified in case the trader wants to reduce the market risk associated with the position.

Research

The research tools available at Plus 500 are limited. Its technical analysis tools are suitable for traders looking for basic analysis. 107 technical indicators can be applied to different time frames, from tick charts to weekly charts for any instrument under trading consideration. Both the WebTrader and the mobile app offer charting tools. The charts in the mobile app don't look as nice as in the WebTrader due to the lack of space.

Customizable charts are saved after the trader has applied all the indicators to it. This is nice, considering the high number of different securities a day-trader may analyze during a single session. There’s a news feed comprised of an economic calendar and a corporate events calendar. No real-time news feed featuring major news outlets such as Reuters or CNN Money is available within the platform. That’s a downside for traders.

A “Traders' Sentiment” tool is embedded within the overview section of the offered assets. It indicates the percentage of traders that are trading CFDs on the security during the session ie. 41% sellers vs. 59% buyers. Another useful indicator is the “Live Statistics,” which shows the performance for 5-minute, 60-minute, and 1-day time frames.

There is no fundamental data for stocks. This means you have to do your research through third-party tools.

Plus500 Education Resources

Education and training aren't the best. The company has a demo account for traders who want to try out the platform before they deposit money into it. Experimenting with the demo account is great for beginners who don't have experience. They provide the KID document (“Key Information Document”) to their clients. The KID document outlines instrument information and risks associated with trading commodities, ETFs, Forex, Indexes, Options, Equities, or cryptocurrencies.

Their website has a section called “Trader’s Guide” featuring six short videos:

- Slippage when opening a position

- How to trade?

- Popular strategies

- What is a Rollover?

- What are options?

These videos are tutorials on how the platform works. These educational tools aren’t for traders who want to boost the performance and results of their portfolios.

Plus500 has a Risk Management section. It explains each of the types of conditional orders available and how they help traders in minimizing risk.

There’s also a FAQ section:

- Account verification process

- Deposits

- Fees & Charges

- Financial instruments

- Opening an account

- Regulators

- Submitting identification documents

- Trading

- Withdrawals

Some materials guide the trader through the platform. None of the educational resources help traders improving their skills.

Portfolio Analysis Tools

There are basic analysis tools for client activity. These include the profit/loss breakdown, balances, and transactions. There is no tax accounting tools or trading journal available on the platform.

Customer Support

Their customer support enjoys positive feedback from traders within their platform. The Plus 500 platform has live online chat customer service and e-mail customer support, and representatives are available 24/7. The live chat is quick to respond and customer service responses were relevant and knowledgeable.

Users reported that e-mail responses take up to an hour, though response times vary depending on the issue's complexity. Traders report that this broker is transparent in disclosing their rates and fees.

However, investopedia.com found that when asked about the average spread on the EUR/USD and USD/JPY pair via email, Plus500 gave a strange response. They did not disclose the number but gave an open-ended answer.

They don't offer phone customer service.

Withdrawals Options and Fees

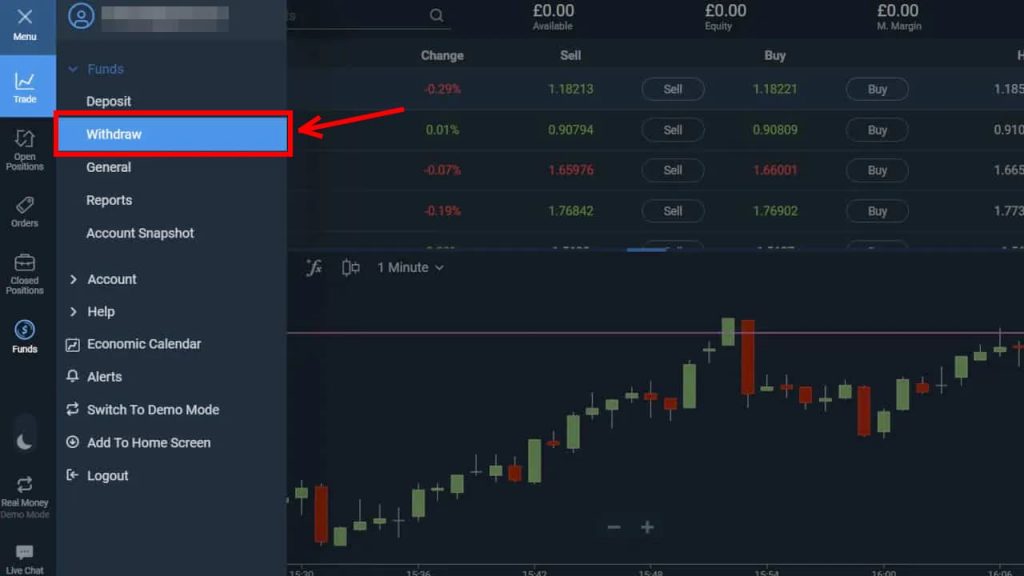

How Can I Withdraw Funds:

Here's is how to withdraw money from Plus500:

- Click on the Menu Button in the top-left corner of the platform

- Click ‘Withdraw'

- Select a Withdrawal Method

- Enter an Amount you wish to Withdraw

- Click ‘Open a Withdrawal' and finalize the withdraw

Plus 500 withdrawals are easy and straightforward. They don't charge a fee for the first 5 withdrawals. After, the fee is $10.

There’s a minimum amount of $50 for PayPal and $100 for bank transfers. If the amount is lower than the minimum, it costs $10.

You can withdraw money from Plus 500 after you have completed the verification process. All legit brokers must verify their customers before allowing them to trade. Before you can withdraw, you must verify your identity.

Withdrawal Methods

There a variety of withdrawal options available:

- Credit or Debit Card

- Wire/Bank Transfer

- e-Wallets (PayPal or Skrill)

How long do withdrawals take?

Plus500 withdrawals take 5-7 business days after withdrawal verification. Funds should arrive in your bank account in 5-7 business days. Withdrawals to a bank account might take longer, depending on your bank and jurisdiction.

Is Plus500 Legit?

Here is what makes Plus500 legit:

- Plus500 is legit and regulated by the top financial authorities. It is overseen by top-tier financial regulators. These include the Monetary Authority of Singapore (MAS), Financial Conduct Authority of the United Kingdom (FCA), and the Australian Securities and Investment Commission (ASIC). This makes it a relieble broker (low-risk).

- Plus500CY Ltd. is authorized & regulated by CySEC (#250/14).

- It is a publicly-traded company, listed on the LSE (LSE: PLUS) and included in the FTSE 250 Index.

- Traders are protected under the Financial Services Compensation Scheme (FSCS)

The company is listed on the London Stock Exchange. This adds a significant degree of transparency to its operations and to the company’s solvency and liquidity. This is crucial to protect the money it holds for its investors.

The firm is regulated by top-tier institutions worldwide. These regulatory bodies promote transparency and a certain degree of reliability to the company’s operations.

Balance Protection

The company hedges its exposure with their parent company and acts as a principal. Plus500 is registered across Europe and the Asia-Pacific Region with trusted regulatory authorities. In the U.K. and the FCA's client money rules, Plus 500 has to keep corporate funds and client funds in segregated accounts at regulated banks.

| Residence | Amount | Regulated by |

|---|---|---|

| UK | £85,000 | Regulated by the Financial Conduct Authority (FRN 509909) |

| South Africa, New Zealand and South Africa | No balance protection | ASIC (AFSL #417727), Financial Markets Authority (FSP #486026), and FSCA (FSP #47546) |

| EU, Norway, Switzerland (EEA) | €20,000 | Cyprus Securities and Exchange Commission (#250/14) |

| Israel | No balance protection | Israel Securities Authority (#515233914) |

| Singapore | No balance protection | Monetary Authority of Singapore (#CMS100648-1) and the IE Singapore (#PLUS/CBL/2018) |

According to the FCA, the UK’s financial regulatory body, and the European Securities and Markets Authority (ESMA), investors who trade CFDs are exposed to high risk, as it involves taking short-term positions in volatile instruments. Research shows that more than 79% of investors who trade CFDs lose money. High costs associated with these transactions, the amount of leverage used, and volatility of the markets tend to evaporate their account balances.

In March 2019, ESMA decided to renew a restriction that forbids the marketing, distribution, and sale of CFD products to retail clients in Europe for a period of three months starting on May 1, 2019. These restrictions included a limit on the degree of leverage on various types of CFDs, the minimum required margin that would trigger a margin call, and a restriction on the incentives offered to trade CFDs. The institution enforced the publication of risk warnings to inform investors about the potential of losing money.

Before you trade with this provider, you should make sure you understand CFDs. Investors are advised to invest money they can afford.

Conclusion

Plus500 is an excellent online broker for advanced traders looking to trade CFDs. It is regulated by tier-1 authorities and listed on a stock exchange. Their fees are on the low-end. The user interface of its web-based and mobile platforms are great. Minimum deposits are low. Pro accounts provide significant levels of leverage for Forex traders.

It is among the best platforms available. This article should provide enough details for you to know what to expect when you sign up for their platform.