Founded in 1982, TradeStation historically focused on experienced and active traders, with its main goal now focused on broadening its reach to include newcomers. The platform is regulated by both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). TradeStation is considered secure, largely because of its trustworthy track record in terms of online exchanges. All of TradeStation’s trading platforms are user-friendly and well-designed by longtime traders.

Summary

TradeStation offers a wide variety of tradeable securities at low stock trading costs. The platform offers various features such as direct-market access, automatic trade execution, and tools to fully automate various trading strategies. This trading platform is an excellent fit active traders that trade in stock, options, futures, and cryptocurrency.

- TradeStation was founded in 1982 and offers a high-powered trading platform that is regulated by both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

- TradeStation’s mobile, desktop, and web platforms are user-friendly and well-structured, which makes all of those platforms great for the avid online trader.

- Another great feature of TradeStation is its educational resources. This trading platform boasts plenty of free video tutorials, e-books, articles, and discussion forums all dedicated to understanding the platform, and to shine a light on different investment and trading strategies.

- The TradeStation platform offers commission-free trades on stocks, exchange-traded funds, and options on both the mobile and web-based platforms.

| TradeStation | |

|---|---|

| Headquarters | United States |

| Year Founded: | 1982 |

| Regulated by: | SEC and FINRA |

| Minimum deposit: | Differs according to account type: Cash account: $1 minimum deposit. Margin account: $2,000 minimum deposit. Futures account: $5,000 minimum deposit. Day-trading account: $25,000 minimum deposit. |

| Deposit Methods: | Cryptocurrency, Bank transfer, Wire transfer |

| Trading Platform: | Web, desktop, and mobile |

| Mobile App: | Yes |

| Demo Account: | Yes |

| Spread: | Included in the trading fees of $5 per trade. |

| Minimum Trade: | $0 |

| Instruments Available: | Stocks, bonds, ETFs, futures, mutual funds, options, and cryptocurrencies. |

| Withdrawal Fee: | $0 |

Pros And Cons

TradeStation offers commission-free trades on stocks, options, and exchange-traded funds at low trading, stock, and ETF fees. The platform offers various fee structures to choose from, has little downtime, and offers amazing technical analysis and charting tools.

On the downside, traders will have to embark on a steep learning curve if they want to develop their trading system. Traders will need to keep in mind that TradeStation charges an annual inactivity fee of $50. This is for accounts that haven’t maintained an average end-of-month equity balance of $2,000.

| PROS | CONS |

|---|---|

| Commission-free trades Low trading fees Various fee structures Charting and analysis tools | Steep learning curve Annual inactivity fee |

Regulation

TradeStation is a premier online brokerage service that was established in 1982 and is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). TradeStation is known for providing industry-leading trading technology to experienced traders. This trading platform is considered trustworthy because its parent company, the Monex Group, is listed on the Tokyo Stock Exchange and it also discloses its annual financial reports to the public.

Trading Platforms

TradeStation offers a web, desktop, and mobile trading platform. The web trading platform is user-friendly and offers a secure two-step login process. After revamping the platform in 2018, it now offers an intuitive interface that ensures a comfortable trading experience for both novice and professional traders.

| Platforms Available: | iOS, Android, Web, Desktop, Proprietary |

| Charts: | Yes (10) |

| Alerts: | Yes |

| Watch Lists: | Yes |

| News Ticker: | Yes |

| Search function: | Yes |

| Research: | Yes |

| Copy Trading: | No |

| Demo Account: | Yes |

The web platform is customizable and offers nine layout options to choose from. Customers have the option of resizing or moving tabs around to make their online trading experiences more comfortable.

TradeStation offers remarkable order management functions, with the Client Center allowing you to view your account performance. The only drawbacks of the web trading platform are its lack of price alerts and the fact that it’s only available in English.

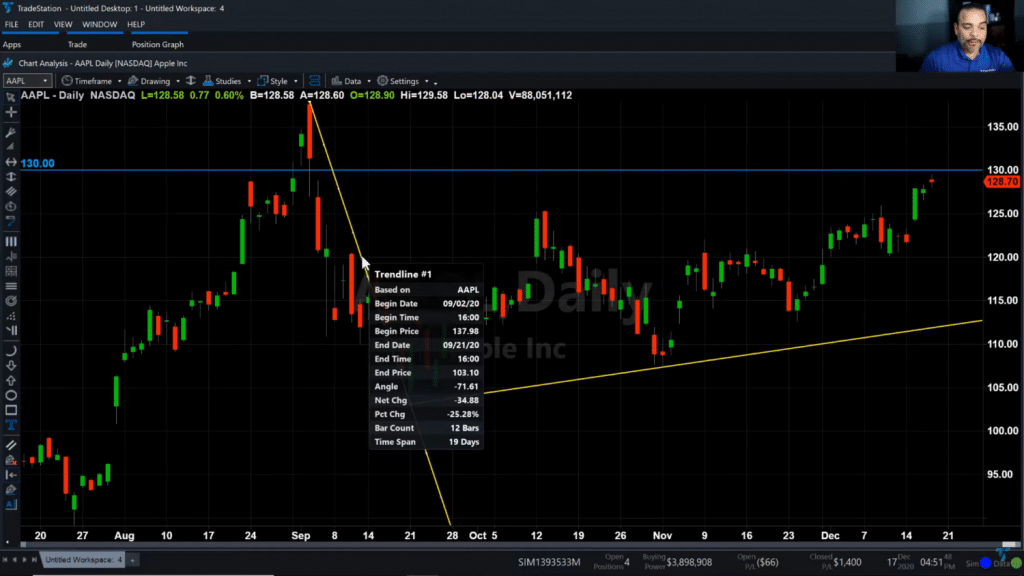

Compared to the web trading platform, we found that the desk trading platform, Trade Station 10, does not stack up in the design department. This platform shines when it comes to its customizability and its various optional functions. It should be noted that the desktop version is only available in English and only runs on Windows.

Another benefit of the desk trading platform is the ability to set up order notifications and price alerts. In summary, this platform includes most features that the web platform offers and is suited to an advanced or professional trader.

TradeStation offers a separate platform for futures traders, called FuturesPlus, which is provided by Trading Technologies. Roughly 85 third-party applications can connect to TradeStation’s trading engine like Yahoo Finance and TradingView. Essentially, this means that you can keep an eye on your stocks via other applications if you would wish to do so.

Mobile App

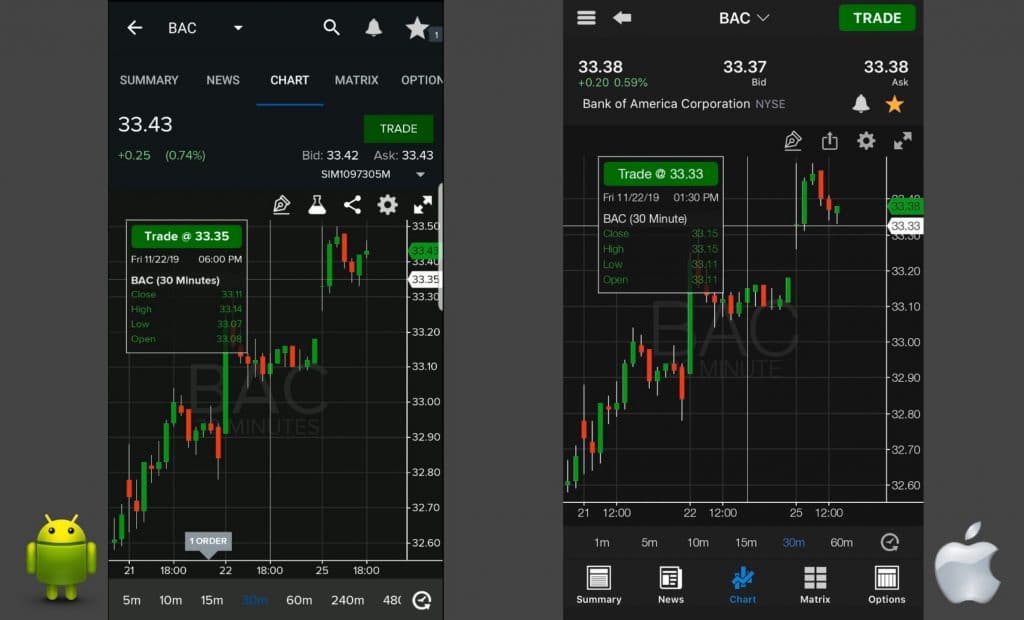

TradeStation’s mobile application is available on both iOS and Android devices. The platform is only available in English. This trading platform allows for multiple watchlists which are transferred between the web and mobile application.

The watchlists will be the first screen you see when logging into the mobile app. You access items on the watchlist by tapping on the designated icons for news, charts and to place a trade. The opening screen is customizable to show your trading balances.

In terms of workflow, the mobile application ensures intuitive maneuvering. Figuring out what trading options you have is easy.

In terms of safety, the mobile platform is similar to the desktop and web-based application and offers a two-step verification system to log in. A great feature of the app is that it offers additional biometric authentication as an additional security measure.

The search function does its job but is not as versatile as one would hope. You can choose to receive notifications and price alerts on the mobile platform, which will keep you up to date with the latest shifts in the trading market.

TradeStation offers a separate crypto application that allows users to place trades and to check on their income and balances.

Languages Available

TradeStation’s web-based, desktop, mobile, and cryptocurrency platforms are all only available in English for the time being.

Products and Markets Available

In terms of TradeStation’s available instruments, you can trade in stocks, bonds, exchange-traded funds, mutual bonds, futures, options, and cryptocurrencies on all of their platforms. The TradeStation Crypto allows users to trade Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), and Ripple (XRP).

Although TradeStation gives its users access to a variety of US products, its non-US market coverage is not as great. Users should note that CFDs and forex are not available.

Research

To make wise, sustainable trading decisions, users need access to lots of research tools. TradeStation realizes this and offers a variety of research platforms, including trading news and other fundamental data. Most of the platform’s research tools are not free.

You will be able to find free trading ideas on TradeStation’s desktop platform, with recommendations concerning each asset class provided by TradeStation staff.

TradeStation offers carefully laid out fundamental data which includes anything from earning rations to financial statements and is sourced by Yahoo. Like the free trading ideas, fundamental data is only available on the desktop trading platform.

The news feed can be accessed under the ‘Market Insights’ tab found on the web-based platform and is categorized based on sectors and products. This means you filter the news you want to read based on the product, asset, or other sector-based criteria.

You will also make use of a variety of research add-ons and external developers that are available on the desktop platform. Although some of the add-ons are free, most are only accessed for a pricey subscription fee.

Education

One of the great things about TradeStation is the amount of educational material that they provide to traders. You will learn about the platform and the available products through informative articles and educational tutorial videos. You can also open a demo account to test things out before fully committing to the platform.

TradeStation’s educational material:

- A simulation account

- Live events

- Educational articles

- Tutorial videos

- Webinars

- Booklets

These educational tools and platforms can be found in TradeStation University under the ‘Market Insights’ tab. TradeStation University also allows you to pinpoint things you want to research by allowing you to filter items based on keywords and your experience level.

Fees and Commissions

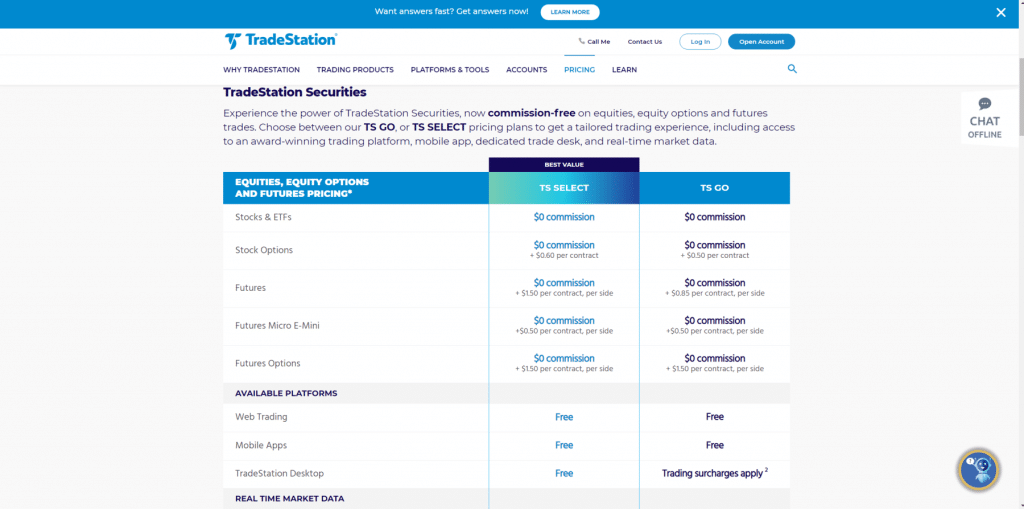

The two most popular pricing plans offered by Trade Station includes TS Select and TS Go. Both of these pricing options incur no monthly platform charges and offer $0 trades.

The TS Select pricing plan has a minimum of $2,000 deposit which grants you access to the mobile, desktop, and web-based TradeStation platforms. When you opt for this plan, all stock trades are $0 with options and futures contracts running at $0.60 and $1.50 per contract.

The TS Go pricing plan is perfect for those that don’t want to pay upfront because no minimum deposit is required. You will also get unlimited $0 stock and ETF trades with your options trades at only $0.50 per contract. Futures trades will run at $0.85 per contract (per side).

Although you will be able to utilize all three trading platforms on a TS Go pricing plan, users have to be aware that trades placed with TradeStation’s desktop platform will incur a $10 fee.

It should be noted that TradeStation's ACH withdrawal is free of charge. However, wire withdrawal costs $35 for clients not residing in the US and $25 for US clients.

TradeStation charges an annual inactivity fee of $50 if accounts haven’t maintained an average end-of-month equity balance of $2,000. We recommend checking out eToro for stocks, Pepperstone for Forex and Plus500 for CFD.

Account Opening

TradeStation offers various trading accounts that trade different products. For access to stocks, funds, bonds, ETFs, and options, you will need to open an equities account. Futures and futures options accounts give you access to those products. A crypto account will allow you to trade in cryptocurrencies.

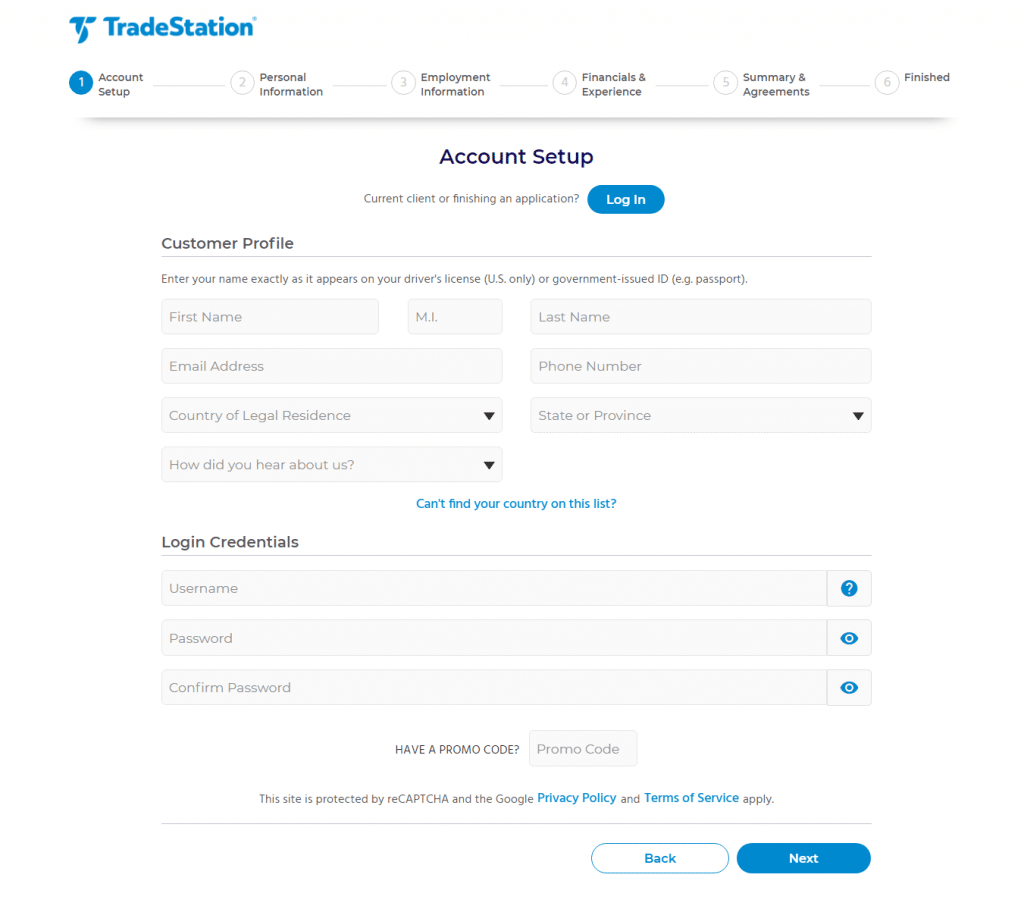

Opening any TradeStation account is easy and account approval is usually settled within 1-2 business days.

To open a TradeStation account, you have to go through the following steps:

- Decide what type of account you would like to have.

- Provide your personal information on the online application form.

- Fill in details about your employment status, where you work, and who your employer is.

- Provide more information about your financial and trading experience. You will also have to provide an estimate of your net worth and annual income.

- Verify your address by uploading your latest utility bill and prove your identity by providing your passport, license, or national ID card.

Customer Support

TradeStation provides excellent 24/5 customer support in the form of online live chat, email, or telephone. Traders should note that customer service is only available in English and you will only be able to contact them on weekdays. Phone support is quick and informed. The live chat function also supplies relevant help but may result in a slower response compared to their other customer support options.

If you would like to voice your query via email, you can expect a response within 1-2 business days.

New Accounts Customer support

Customer support for new account is available both in the United States and Internationally from Monday to Friday, 8:00 a.m. – 5:00 p.m. ET. For institutional accounts Tradestation offers a separate support line working from Monday to Friday, 8:00 a.m. – 5:00 p.m. ET.

Technical Support & Client services

For existing clients Tradestation offers support via phone and live chat. The trade desk support operates in US, Europe and Internationally.

- Stock/options desk works from Monday – Thursday, 7:30 a.m. – 6:30 p.m. ET, Friday, 7:30 a.m. – 5:00 p.m. ET

- Futures desk works 24 hours from Sunday 5:00 p.m. to Friday, 6:00 p.m. ET

- Crypto desk is available 24 hours a day, seven days a week, except the second weekend of each month when we are closed from Friday at 6:00 p.m. to Saturday 5:00 p.m. ET.

- Institutional support works from Monday – Friday, 8:00 a.m. – 5:00 p.m. ET

Conclusion

We found that Tradestationtrading platform is a serious competitor in the online stock market, and since it is launching new ways to attract young traders, the platform’s growth projection looks very promising. Tradestation offers lots of trading products and has low fees compared to other stockbrokers. This broker is trustworthy because it is regulated by both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

It offers three different trading platforms that are packed with different features that aim to educate, train, enlighten, and support its traders. All three of the trading platforms are considered user-friendly with TradeStation catering to an overall experienced crowd of online traders.