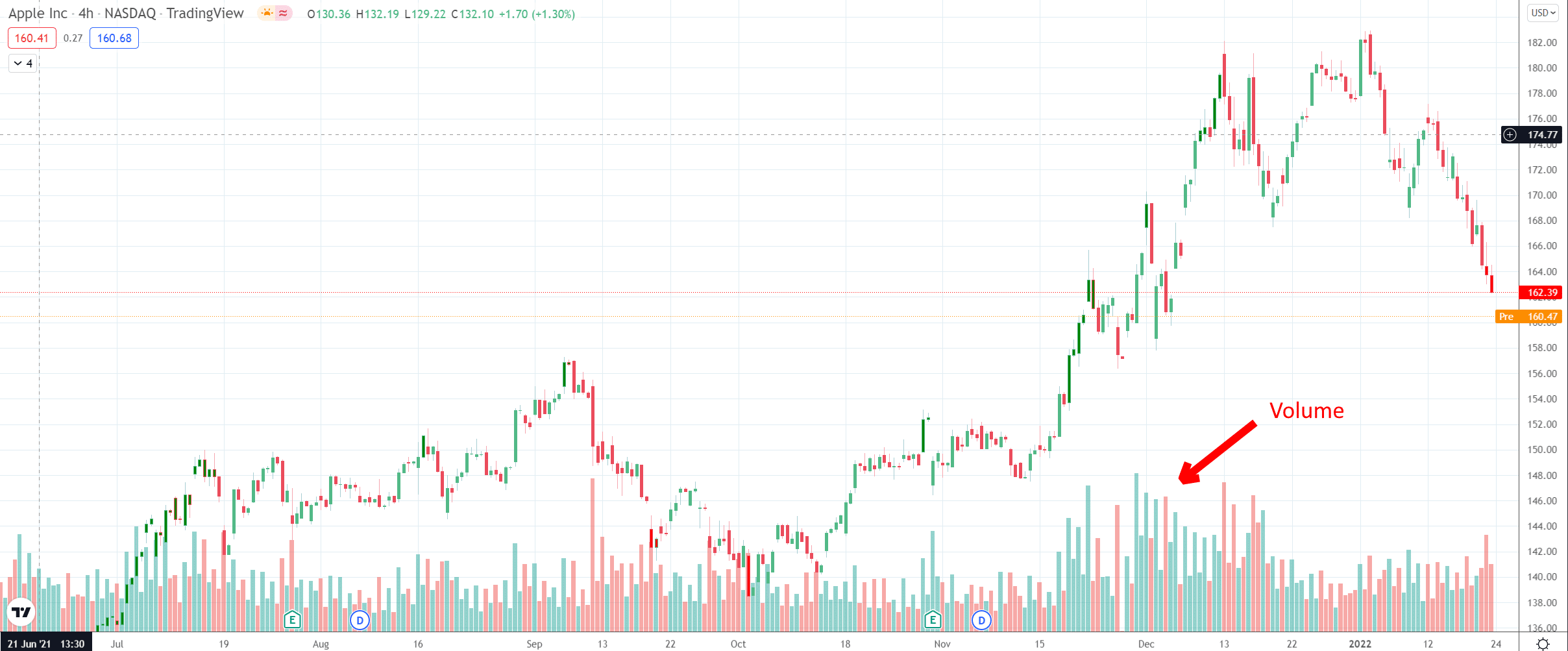

Trading volume or just volume represents the amount of a security that was traded during a time period in the markets. In the context of one stock trading on a stock exchange, the trade volume is often stated as the number of shares that were traded during one day.

In this article, I will discuss trade volume in detail. I will also explain what a good trade volume is, so let’s take a closer look.

The volume of trade is measured in bonds, stocks, new contracts, and different types of products. It represents the overall number of contracts as well as shares exchanged between buyers and sellers of security throughout specific trading hours on a given trading day.

In summary, is a measure of the market’s liquidity and activity during a certain period. A higher trading volume is considered better than a lower trading volume because it means more liquidity as well as better order execution. Let’s take a closer look at examples.

Example of trade volume

Imagine a market that consists of 2 traders. The first one, X, buys 100 shares of stock Alpha. They sell 50 shares of stock Beta. The second trader, Y, purchases 200 shares. They sell 100 shares of the same stock, Gamma, to the first trader.

In this situation, the total trading volume in the market would be 350 since 50 shares of Beta were traded along with 100 shares of Alpha and 200 shares of Gamma. Now, let’s learn how this works in detail.

How Does It Work?

Market exchanges keep track of their trading volume and provide volume data. And that type of data is reported as frequently as 1 hour during the current trading day.

The hourly reports of trade volumes are estimates. The volume reported at the end of the trading day is also an estimate. And the final real figures are reported the next day.

Investors can also follow a security tick volume. Or the changes in a contract’s price. They’re a surrogate for trade volume since prices tend to alter more often with a larger volume.

The volume informs investors about the market’s liquidity as well as activity. And a higher trade volume for certain security means better order execution, higher liquidity, and a more active market for linking a buyer and seller.

When investors aren’t sure about the future of the stock market, trading volume increases, which often causes futures and options on certain securities to trade more frequently. Typically, volume tends to be higher near the market’s closing and opening hours as well as on Fridays and Mondays.

The trade volume tends to decline at lunchtime and before holidays.

Special considerations

Recently, index funds and high-frequency traders have become big contributors to the trading volume reports in US markets.

In 2017, a JPMorgan study discovered that passive investors like ETFs as well as quantitative investment accounts, which use high-frequency algorithmic trading, can be thanked for 60% of trading volumes.

Fundamental discretionary traders who examine the basic elements influencing a stock before investing, on the other hand, were responsible for only 10% of the total figures.

Traders and volume

Traders consider different trading factors for technical analysis including trade volume, which is one of the easiest technical factors evaluated by traders before making market trades.

The volume of trade during a high price increase or decrease plays a key part in their decision because a high volume with price fluctuations can indicate certain trading catalysts. High volumes associated with directional price changes can also help to improve the support for the value of a security.

The volume level can also help traders decide when it’s the right time for a transaction. They follow the usual daily trading volume of a security over long-term and short-term periods when deciding about trade timing. They can also use multiple technical analysis factors that include volume.

The Securities and Exchange Commission manages the trades of securities by traders, therefore sellers can’t make security sales surpassing 1% of dominant shares of the same category being sold.

What’s Good Volume?

Low-priced stocks equal higher investment risk, so high-priced stocks equal lower investment risk.

To lower the investment risk, it’s best to stand by stocks with a minimum dollar volume of $20 million to $25 million.

Note that institutions tend to take part in stocks with a daily dollar volume of millions.

Is High Volume Good?

If a stock with a high trading volume is rising, it means there’s buying pressure due to investors' demand which forces the stock to higher prices.

If the price of a stock with a high trading volume is decreasing, it means more investors sell their shares. Therefore, high trade volume is good.

How Is Volume Calculated?

The volume of trading is a measure of the overall shares traded for a certain time.

Dollar volume is estimated by the trading volume multiplied by the price. For instance, if XYZ has a total trading volume of 100,000 shares at $5, then the dollar volume is $500,000.

The volume calculates the amount that a financial asset trades during a given time. For stocks, volume is based on the number of shares traded. For options and futures, on the other hand, volume is measured in contracts.

A transaction happens when a buyer agrees to purchase assets from a seller at a certain price. And each transaction increases the security’s volume count.

For instance, if 10 transactions for security occur in 1 day, then the volume for that day would equal 10. Securities with high daily volume have more liquidity than those with low daily volume.

Summary

In summary, the volume of trading informs investors of how many shares are traded. They combine this information with other data in the analysis and decide if a stock price is likely to go up or down. However, the volume doesn’t tell whether trends will change. Still, it does provide some insight into what’s probably going to happen.

When the price is going up with high volumes, investors will be able to sell stock more easily. But if a stock isn’t traded frequently, and there’s limited purchasing interest, investors can have a harder time unloading their shares.