In recent years, the subject of payment for order flow, often known as PFOF, has garnered a significant amount of attention, notably in the aftermath of the scandal involving GameStop and Robinhood.

In this blog, we will be taking a deep dive into what payment for order flow is, how it operates, as well as the benefits and drawbacks of using this trading model for a retail customer.

In addition, we will go through the regulations governing PFOF, look at some real-world applications of it, and speculate about its potential stock market uses in the years to come.

What exactly is meant by “Payment for Order Flow”?

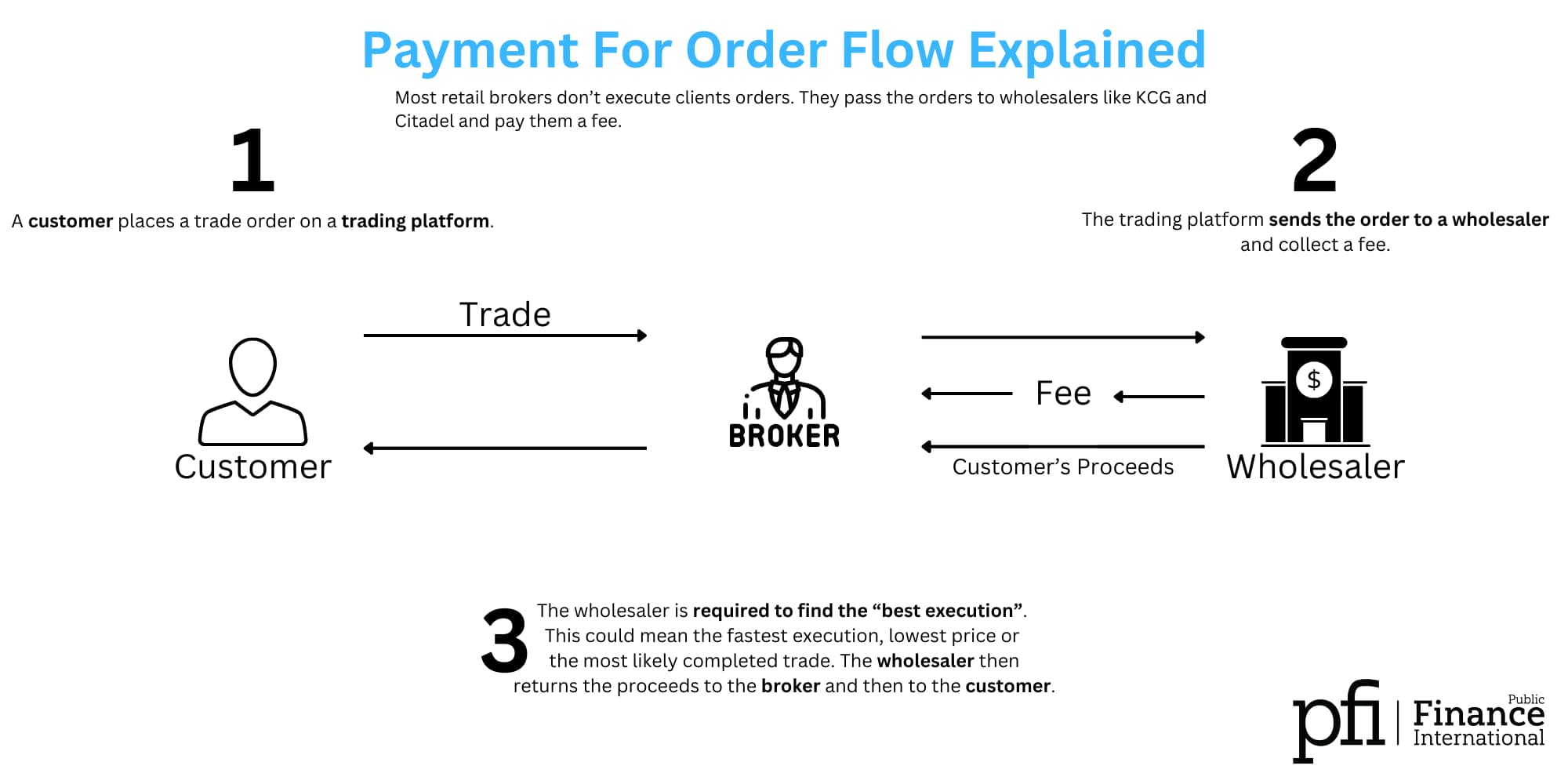

In layman's terms, pay-for-order-flow, or PFOF, refers to the practice of brokers receiving payments from market makers in exchange for sending client orders to specific market makers. On the other hand, market makers earn money off the difference in price between a security's bid and ask price. This remuneration may come in the form of a percentage of the spread or a flat charge per share, depending on the agreement between the parties.

When a consumer uses a broker to place an order, the broker can either carry out the transaction themselves or forward the order to a market maker.

In the second scenario, the market maker is the one who is responsible for paying the commission to the broker in exchange for the right to carry out the order. Afterward, the market maker either carries out the transaction themselves or forwards the order to another venue, such as a stock exchange.

The primary benefit of PFOF is that it enables brokers to offer commission-free trading to customers. Brokers can collect money from market makers while at the same time offering consumers with minimal or no commission costs because of the relationship between the two parties. On the other hand, market makers profit from a steady stream of order flow.

Pros and Cons of Using Payment for Order Flow

PFOF, like any other kind of trading practice, has both its share of pros and cons. Let's have a look at some of the most important benefits and drawbacks of this option for retail traders.

Pros

- Low or No Commission Fees: The primary benefit of order flow payments is that it enables brokers to provide consumers with the option of zero commission trading. This presents a substantial opportunity for many traders, especially those who engage in frequent transactions or who work with very small amounts of money.

- Better Prices: Because market makers profit from the spread, they have an incentive to offer the best possible price for a security. This can result in better prices for customers than they might receive if their orders were executed by the broker itself.

- Improved Liquidity: PFOF may also be of use in increasing the market's overall liquidity. Market makers have the opportunity to earn a profit from the spread by buying and selling securities, an action that may contribute to the market's ability to sustain a healthy level of activity.

Cons of PFOF

- Potential Conflicts of Interest: One of the most serious concerns when dealing with PFOF is that it has the ability to generate possible conflicts of interest for brokers. They may be encouraged to prefer one market maker over others since they are getting charged for taking orders to a certain market maker. Yet, doing so may not be in the best interest of the consumer because it is in the best interest of the market maker.

- Lower Transparency: PFOF may also have the effect of lessening the degree to which the market is transparent. Clients may not be aware of which market maker their order is being sent to or the remuneration that their broker is getting for directing that order in certain cases.

- Less Control Over Order Execution: When a customer places an order through a broker, they may have less control over how that order is executed than if they were executing it themselves. This can lead to potential slippage and other issues.

Official Regulation

PFOF is a heavily regulated practice in the United States. The Securities and Exchange Commission (SEC) requires brokers to disclose the compensation they receive for directing customer orders to market makers. The SEC also requires brokers to ensure that customer orders are executed at the best possible price, taking into account all available market information.

Recently, there have been calls for increased regulation of PFOF. Some critics argue that it creates potential conflicts of interest and reduces transparency in the market. Othershave proposed banning PFOF altogether, while others have suggested alternative models that would provide customers with more control over their orders.

In 2020, the SEC conducted a review of the practice of PFOF and released a report on its findings. The report highlighted the potential conflicts of interest associated with PFOF and recommended that the SEC take additional steps to increase transparency and ensure that brokers are acting in the best interest of their customers.

Examples of Payment for Order Flow in Action

Many popular brokers and market makers in the United States use PFOF. Some of the most well-known examples include Robinhood, TD Ameritrade, and Citadel Securities.

Robinhood is perhaps the most famous example of a broker that relies heavily on PFOF. The company has been criticized for prioritizing its relationships with market makers over the best interests of its customers. In 2021, Robinhood paid a $65 million settlement to the SEC for failing to properly disclose its use of PFOF and for other violations.

TD Ameritrade is another well-known broker that uses PFOF. The company has been criticized for not being transparent enough about how it routes customer orders and for potentially prioritizing certain market makers over others.

Citadel Securities is one of the largest market makers in the United States and is a major player in the PFOF space. The company has been accused of having too much influence over the market and has been the subject of investigations by regulators.

Conclusion

PFOF is a complex and controversial practice that has both advantages and disadvantages. While it allows brokers to offer commission-free trading to customers and can help increase market liquidity, it can also create potential conflicts of interest and reduce transparency.

As the SEC continues to review the practice of PFOF, we will likely see increased regulation and potential changes to how brokers and market makers operate. While it is unclear what the future of PFOF will look like, it is clear that it will continue to be a topic of discussion and debate in the trading community.