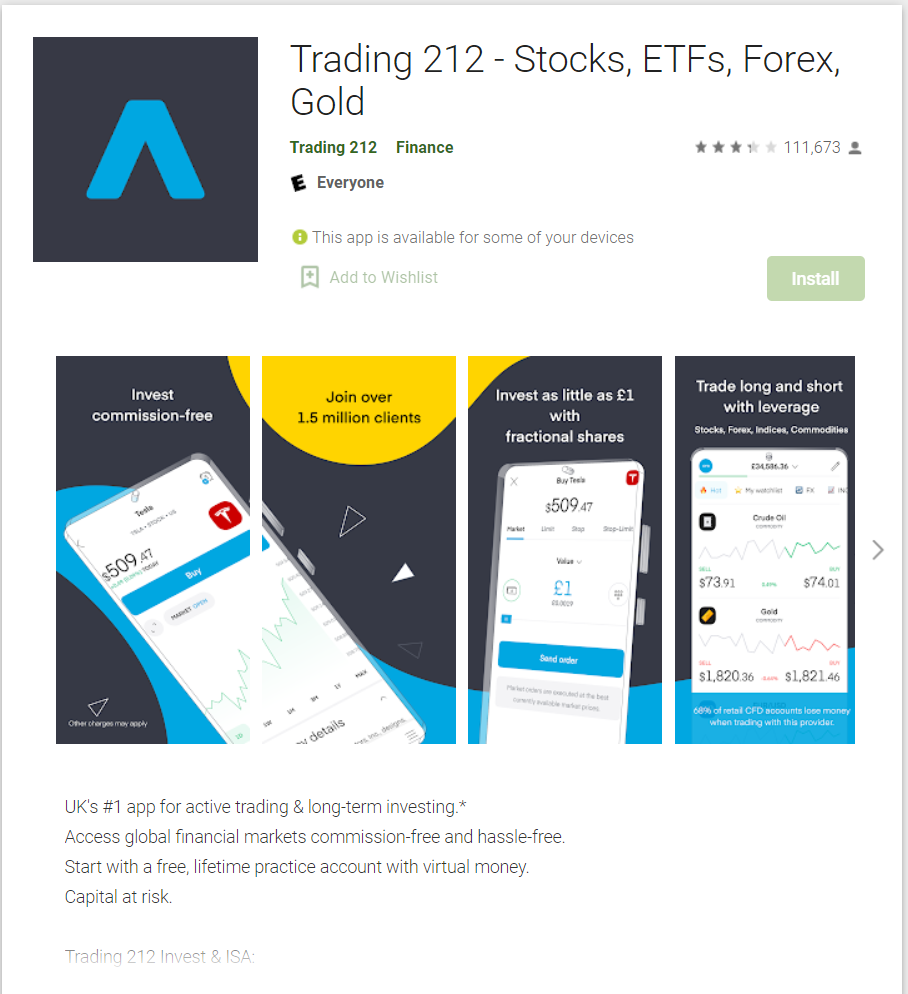

Trading 212 has quickly amassed a big user base over the past years, with 12+ million users having downloaded their trading app, making Trading 212’s app one of the most commonly-used trading apps ever. The broker’s clients get to trade Forex pairs, stocks, ETFs, indices, and cryptocurrencies.

Trading 212 began as Avus Capital in Bulgaria before being incorporated in the United Kingdom in 2013, which implies that the broker is regulated both by the Financial Conduct Authority (FCA) in the United Kingdom, as well as the Financial Services Commission (FSC) in Bulgaria.

Could Trading 212 be the perfect broker for you? This is exactly what you’ll find out by the end of this unbiased review, which will help you find a crystal clear answer about whether you should start investing your money with Trading 212 or not.

Summary

Trading 212 is a CFD broker that is regulated by a number of financial regulatory bodies. It provides its clients with commission-free stocks and ETFs, as well as attractive non-trading and CFD fees. The process of opening a Trading 212 account is quick and easy, and the trading interfaces are almost flawless.

Trading 212, on the other hand, offers a limited product selection, lacking major asset types like bonds and options. There’s also excessive forex fees on Trading 212.

Overview

| Broker | Trading 212 |

|---|---|

| Founded | 2004 |

| Headquarters | London, United Kingdom |

| Minimum Deposit | $1 |

| Inactivity Fees | $0 |

| Withdrawal Fees | $0 |

| Demo account | Yes |

| Forex Trading | Yes |

| CFD Trading | Yes |

| Cryptocurrency | Yes |

| Tier-1 Licenses | Yes |

| Mobile App | Yes |

| US-Accepted | No |

| Customer Support | Live chat and email |

| Our Score | 4.5/5 |

Trading 212 Compared

We compared Trading 212 to some of its strong competitors to see how it does compared to the successful brokers in the industry. Check the table below:

| Broker | Trading 212 | eToro | Degiro | Plus500 | Oanda | Forex.com |

|---|---|---|---|---|---|---|

| Founded | 2004 | 2006 | 2008 | 2008 | 1955 | 2001 |

| Minimum Deposit | $1 | $50 - $200 | $0 | $100 | $100 | $0 |

| Inactivity Fees | $0 | $10/year after 1 year | $0 | $10/month | $14/month | $15/month |

| US-Accepted | No | Yes | No | No | Yes | Yes |

Pros and Cons

Before investing your money with any broker, you should first have a good understanding of what they offer and what they don’t. Take a look at the table below to understand the aspects in which Trading 21 excels and falls back:

| Pros | Cons |

|---|---|

| Commission-free real stocks and ETFs | High financing rate |

| Excellent trading platforms | High-fee forex |

| Fast account opening process | Lack of currencies and no USD currency |

| No minimum deposit | Lack of customizability in workspace and charts |

| No deposit fees | Limited products |

| No withdrawal fees | No news flow |

| No inactivity fee | No phone support |

| Demo account | No webinars |

| Regulated by top-tier authority (FCA) | No public financial information |

| Price alerts on mobile app | Not listed on stock exchange |

| Great search function | Doesn’t hold a banking license |

| Interactive charts | |

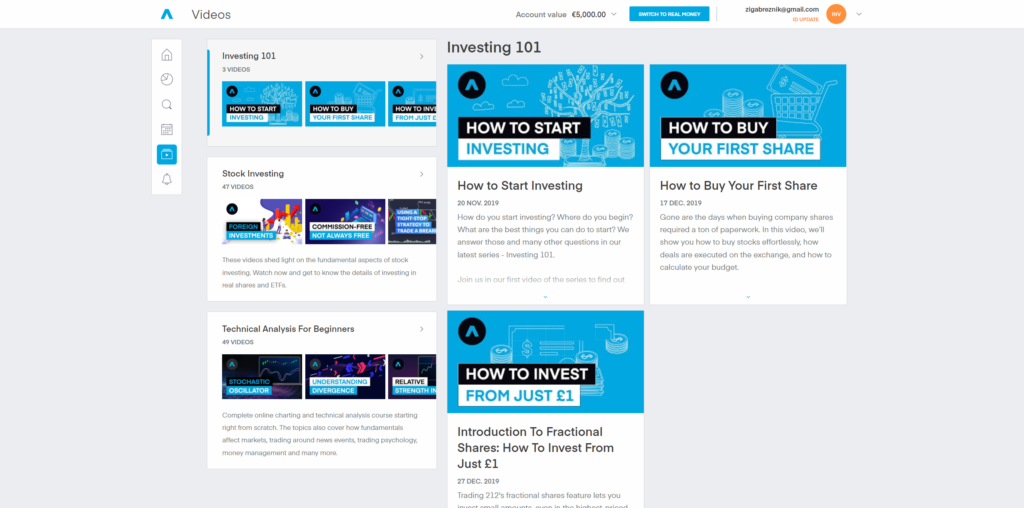

| Useful educational videos | |

| Negative balance protection | |

| 24/7 customer service |

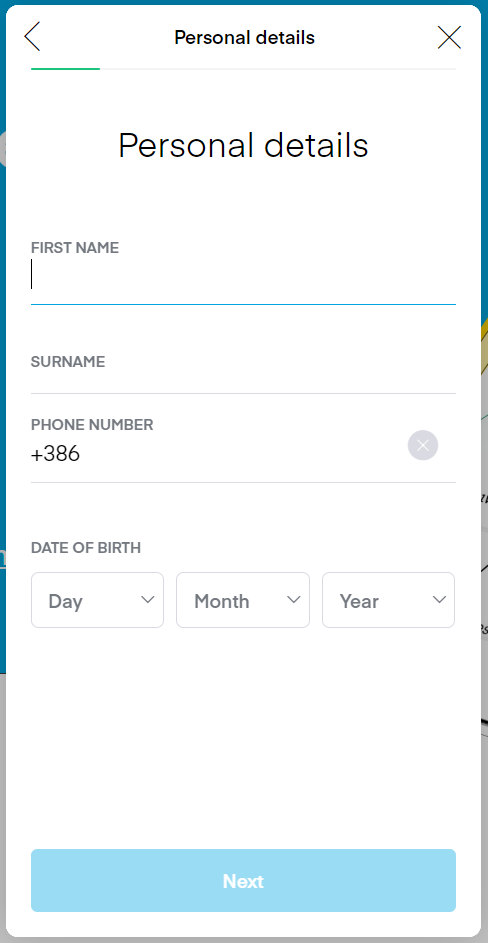

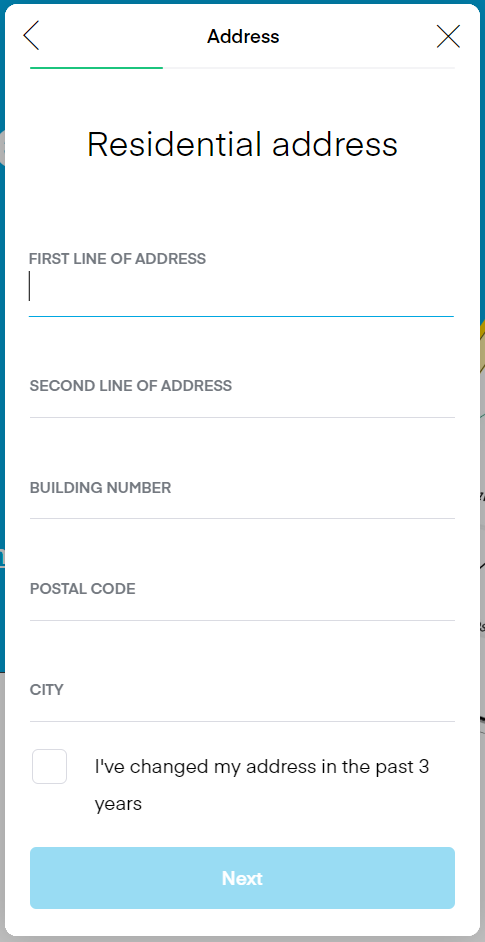

Account Opening

Trading 212 has a smooth, fully digitalized account opening process. The account usually takes 1 business day to get verified. Follow the instructions below if you wish to open a Trading 212 account:

- Enter personal information such as your date of birth and email address as well as your country of residence.

- Provide tax information, such as the state where you pay taxes and your tax identification number.

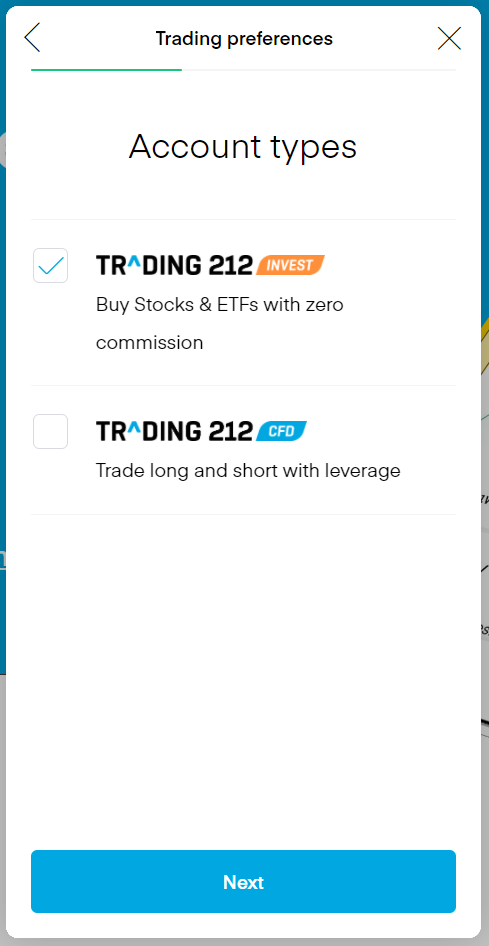

- Choose the account type you want and the base currency for your account.

- You’ll be asked to provide answers to some questions regarding your financial situation and trading history.

- All that’s left is to agree on the terms and conditions, then verify both your identity and residency to activate the account.

To activate your trading account, you must first identify yourself by giving the following information to Trading 212:

- A national ID, driver's license, or passport as proof of identity.

- A utility bill or a bank statement from the previous three months as proof of address.

Account Opening Quiz

Account Types

Trading 212 accounts can be opened from anywhere in the world. However, there are some exceptions, such as clients from the United States or Canada being unable to open one.

There are three account types offered by Trading 212, CFD account, Invest account, and ISA account, each of which differs in terms of the offerings available for trading and the countries in which they are available. Below is a comparison table between the three of them:

| Account | CFD Account | Invest Account | ISA Account |

|---|---|---|---|

| Available Assets | CFDs | Real stocks & ETFs | Real stocks & ETFs |

| Available Countries | All countries available on Trading 212 | All countries available on Trading 212 | UK |

Professional accounts are available at Trading212, which allow regulated clients to access higher leverage. You can apply for a Pro account when you open an account, but you must meet certain requirements (trade frequency, experience in trading, and capital) to be accepted for the account.

Offerings

When compared to competitors in the industry, Trading 212 offers a wide range of products:

| Currency pairs | 179 |

|---|---|

| Stock CFDs | 1530 |

| Stock index CFDs | 35 |

| Commodity CFDs | 28 |

| ETF CFDs | 28 |

| ETFs | 1800 |

| Stock Markets | 12 |

Trading 212 offers a wide range of commodity and forex CFDs. The number of available stock CFDs and stock index CFDs is average, and the number of ETF CFDs available is limited.

You have the option to invest in real stocks and exchange-traded funds (ETFs). Although the stock and ETF portfolio at 212 may appear to be limited in comparison to competitors, there are still 3,000+ instruments to pick from.

Manually changing the leverage helps you reduce the risk of the trades. However, you can’t manually set leverage levels on Trading 212.

When trading forex and CFDs, you want to be cautious of the preset leverage levels since they can be very high. CFDs are sophisticated financial instruments that have a high risk of losing money quickly due to their leverage. When trading CFDs, 74-89 percent of regular traders lose money.

Trading and Non-trading Fees

Trading fees at Trading 212 can be described as average. The fees are also displayed in a transparent manner, which is always a plus for online brokers. It displays daily swap rates, for example, which are easily accessible via their trading platform.

Trading 212 is a broker that is CFD-focused, which provides real stock and ETF trading with no commission. If you open an Invest account on Trading 212, you can start trading actual stocks and ETFs.

CFD trading fees at Trading 212 are relatively high, and so are their their forex fees.

Non-trading fees are low at Trading 212. There are no fees for accounts, inactivity, or withdrawals. Depositing to the Invest accounts and depositing to the CFD account via bank transfer are both free. If you deposit more than €2,000 using a credit/debit card or electronic wallets, you will be charged a 0.7 percent deposit fee.

For CFD trading, there’s a 0.5 percent currency conversion fee associated, and for real stocks and ETFs, there’s a 0.15 percent currency conversion fee. When you trade an asset denominated in a certain currency different from the base currency of your account, currency conversion occurs.

Commission and Spreads

Trading 212 provides trading that is free of commission in a variety of asset classes, which is a standard practice among top brokers. However, Trading 212 charges fees for currency conversion, which is nothing out of the ordinary.

Trading 212 has some of the tightest spreads in the industry. However, they aren't the best, since other competitors provide trading at a lower cost. Spreads on cryptocurrencies are still competitive though, despite the fact that certain assets have better spreads than others.

In late 2020, the broker abruptly increased its margin requirements to 50 percent, leaving its clients confused about their capital requirements. During the Reddit/Gamestop volatility, Trading 212 also stopped onboarding new traders, and this level of unpredictability can make any trader think twice before investing in a certain broker.

Leverage

On Trading 212, every trade doesn't require the use of maximum leverage.

For professional Trading 212 accounts, leverage is available at a rate of roughly 1:300, which is higher than a lot of competitors. Since leverage increases the impact of both losses and gains, traders must use it cautiously.

Leverage for retail trading in the European Union will be capped at 1:30 and can sometimes be even lower for markets like cryptocurrency.

Base Currencies

The following account base currencies are supported by Trading 212:

- EUR

- USD

- GBP

- RON

- PLN

- SEK

- CZK

- CHF

- NOK

However, in each country, there are only two or three account base currencies available, usually the EUR and local currency. In Poland, for example, only the EUR and PLN are accepted.

Note: you are not required to pay a conversion fee when you fund your account in the exact same currency of your bank account or trade in the exact same currency of your account base currency.

Opening a multi-currency bank account with a digital bank is a great way to avoid fees associated with currency conversion. They provide worldwide bank transfers for free or at a low cost, as well as bank accounts in numerous currencies with excellent currency conversion rates. It will only take you a few minutes to create one.

Deposit

When you make a bank transfer deposit to your Trading 212 Invest account or deposit to your CFD accounts, the broker charges no deposit fees.

But if you deposit more than 2,000 EUR to your Invest account using a debit/credit card or electronic wallets, you'll be charged a 0.7 percent deposit fee.

You can use credit/debit cards, as well as the following electronic wallets, in addition to bank transfers:

- PayPal

- Google Pay

- Apple Pay

- Skrill

- Dotpay

- Direct eBanking

- iDEAL

- Giropay

- Carte Bleue

All of the above e-wallets aren’t available in all countries, and it’s not clear which wallet is available in which country. You can also fund your account with Revolut wire and Wise.

Withdrawal

When it comes to withdrawing money, you have the same options that you do when it comes to depositing money, and there are no withdrawal fees at Trading 212.

It usually takes one business day to withdraw funds from Trading 212.

To make a withdrawal request, log onto your account, select ‘Manage funds', write your password, enter the desired withdrawal amount, then confirm the withdrawal request.

Trading Experience

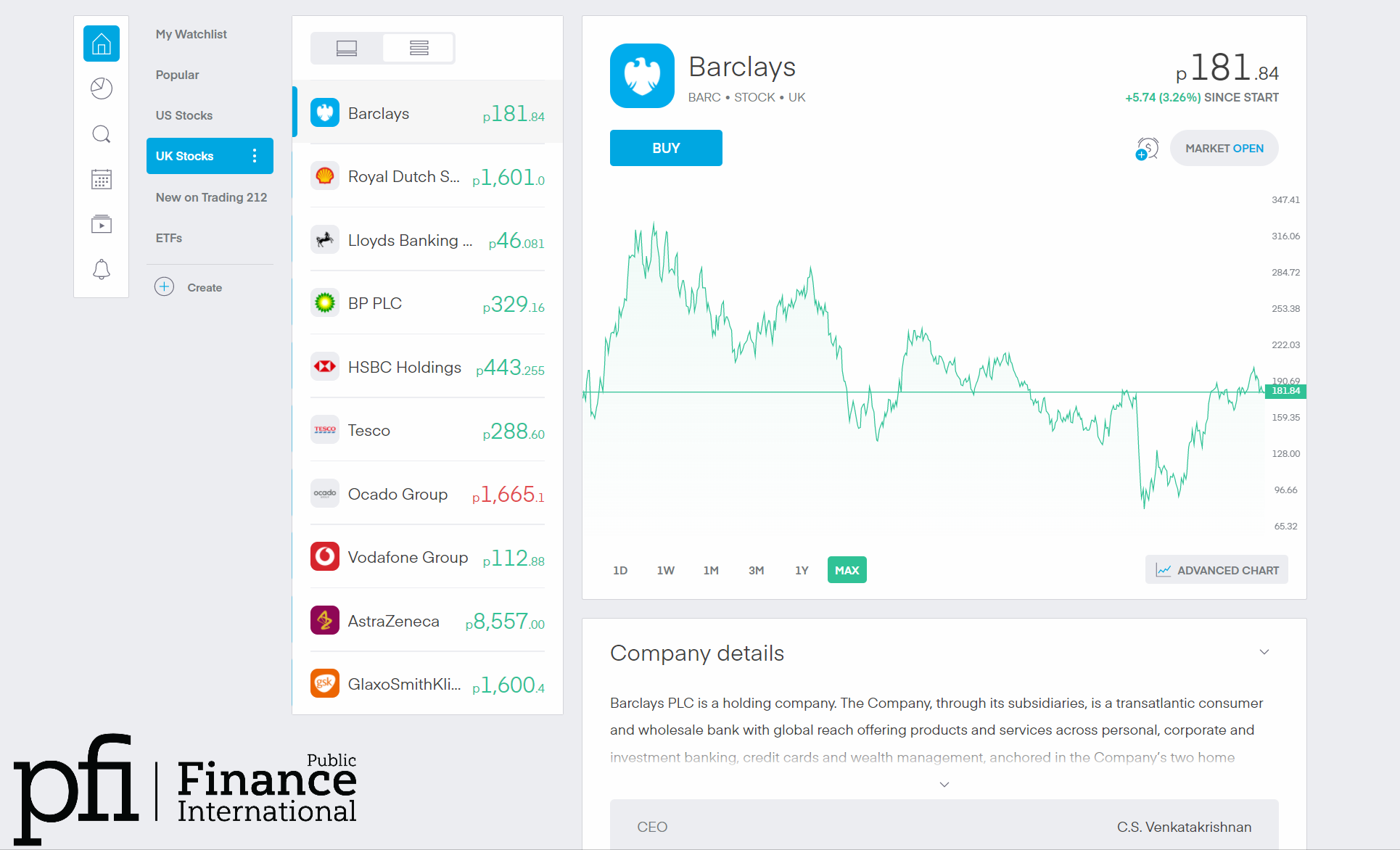

Trading 212 has succeeded to build its own in-house trading platform, and it's accessible in a variety of languages, which are English, French, Italian, German, Dutch, Spanish, Polish, Chinese, Russian, and Romanian.

Two-step authentication is available on Trading 212. An authenticator app, such as Google Authenticator, can be used to set it up.

The web trading interface at Trading 212 is user-friendly, even if you’re not a seasoned trader, you’ll find it incredibly easy to use. The platform, on the other hand, is uncustomizable.

The search functions on Trading 212 are excellent. You may easily find what you're looking for by typing it into the search box or browsing predefined categories like indexes or stocks.

Trading 212 provides easy-to-understand fee and portfolio reports. If you click on your username and choose ‘Report,' you'll be able to see them.

On Trading 212 platform, you have the option to set price alerts. Simply choose the asset and select the ‘Alert' icon to set it up.

Mobile App

Both Android and iOS users can use the Trading 212 mobile app. It's available in the same languages as the web-based trading platform. Like the web platform, Trading 212’s mobile app is well-designed and easy to use.

Trading 212 offers two-factor authentication, which is a fantastic feature. Biometric authentication systems, like Touch ID, can also be used.

You’ll find price alerts on the app in the form of push notifications. Price notifications delivered via email or SMS or, on the other hand, aren’t included in the notification options.

Search functions on the mobile app work just like they do on the web-based platform. You'll be able to find the asset you look for effortlessly.

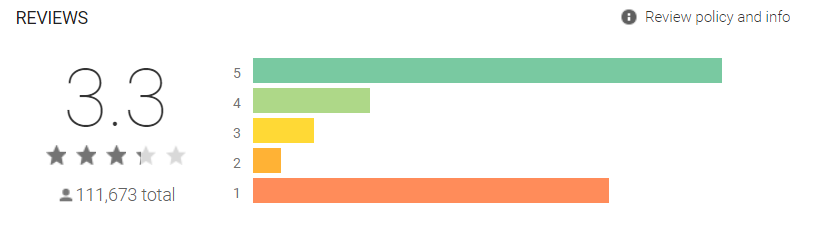

The app is rated 3.3 on the Google Play store and 4.7 on Apple App Store for an aggregated rating of 4 out of 5.

Research

Research tools can be found on both the web-based platform and mobile app. The platforms' research tools are available in the same languages as the platforms.

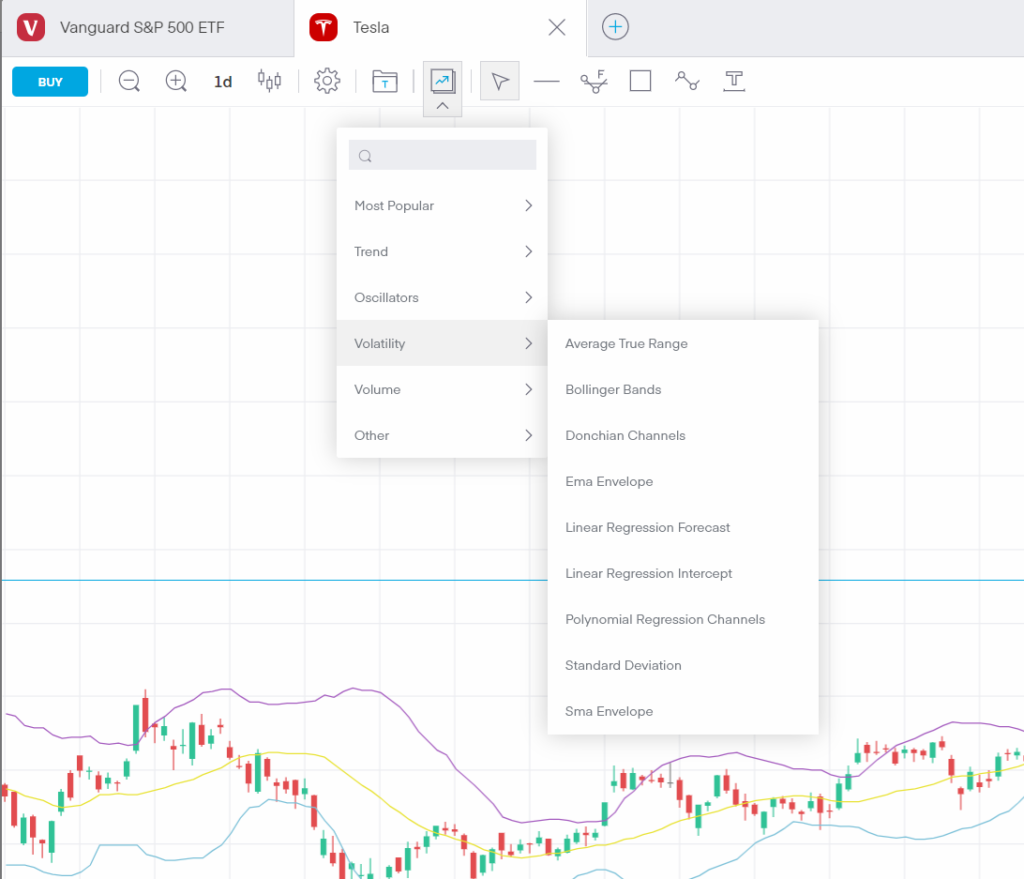

Trading 212 excels when it comes to charting. It provides most of the essential technical analysis studies, and you have access to around 50 technical indicators to help you make better decisions.

Trading 212 does not offer trading ideas, but you have the option to set pattern recognition tools on charts. These patterns help you predict whether the price will rise or fall. The platform also offers fundamental data, such as historical financial statements.

Trading 212 does not provide a news feed. The economic calendar, on the other hand, is great. It's convenient and allows you to see all of the major financial events in one place, and you can even filter events by currency pairs or impact.

The broker offers a ‘Filter’ tool, by which you get to filter stocks based on the prices of stocks.

Education

You can find plenty of good educational content on Trading 212, including general educational videos, tutorial videos, and quality educational articles. The educational materials available on this broker website are well worth your time. You can learn how to use the trading platforms in a detailed manner that is easy to understand.

However, Trading 212 doesn’t provide webinars.

Is Trading 212 Safe?

Trading 212 is a legitimate company that is regulated by the Financial Conduct Authority (FCA) of the United Kingdom, the Financial Supervision Commission of Bulgaria (FSC), and the Cyprus Securities and Exchange Commission (CySEC).

If you want to ensure that your money is safe with a certain broker, we strongly suggest you find answers to two questions. The first one is “what is the broker's background?” And the second one is “what protection do I have if something goes wrong?”

As for the first question, Trading 212 first opened its doors in 2004. The longer a broker has been in business, the more evidence you have that it’s successfully weathered prior financial crises. Trading 212's safety is enhanced by the fact that it is regulated by a top top-tier authority and has been in business for many years.

According to the legal entity you open your account with, there will be a specific compensation schemes that applies on it, as shown below:

| Country | Regulation | Investor Protection | Legal Entity |

|---|---|---|---|

| United Kingdom | FSA | £85,000 | Trading 212 UK Limited (UK) |

| Countries in the EEA | CySEC | 90 percent of your funds, maximum €20,000 | Trading 212 Markets Ltd |

| Other countries | FSC | 90 percent of your funds, maximum €20,000 | Trading 212 Ltd |

Some of Trading 212’s disadvantages concerning this are that it doesn't hold a banking license, it doesn’t offer financial data isn’t publicly, and it isn’t listed on stock exchange. But one good thing is that the broker provides negative account balance protection.

Customer Support

Customer service at Trading 212 provides relevant and prompt answers to its clients. You can contact them through both live chat and email. However, phone support is not provided.

Customer service is available 24 hours a day, 7 days a week.

Accepted Countries

Trading 212 accepts clients from most countries, including the United Kingdom, Australia, South Africa, Thailand, Hong Kong, Singapore, India, France, Norway, Germany, Sweden, Denmark, Luxembourg, Italy, Saudi Arabia, United Arab Emirates, Kuwait, Qatar.

However, clients from the US and Canada cannot use Trading 212.

The Final Verdict: Is Trading 212 a Good Option For You?

Trading 212 is a wonderful option for people looking to invest in equities or trade leveraged CFD products on a good-quality trading platform. It provides you with quick and easy account creation, flawless trading platforms, commission-free stocks and ETFs, and attractive non-trading and CFD fees.

But it falls short when it comes to major asset types like bonds and options, as well as when it comes to the excessive forex fees on Trading 212.

If you’re hesitant to try it out, you can use the Trading 212 demo account to try and test to see if this broker is a good fit for you.

Is there a demo account on Trading 212?

Yes. Trading 212 makes it simple to switch between real and demo accounts, eliminating the need to create two different accounts. It takes less than a minute to set up a new account, it also takes one minute for the account to be ready for use.

How do I know the entity that my Trading 212 account is registered under?

Go to your ‘Menu’ and choose ‘Share Dealing Services’ to see if you're registered with Trading 212 Markets Ltd. or Trading 212 UK Ltd. You need to choose ‘Client Agreement’ at the bottom of the screen on the CFD platform.

Is there an inactivity fee on Trading 212?

No. trading 212 does not charge its clients an inactivity fee.

How does Trading 212 make profit?

The spreads between the buy and sell prices on Trading 212's assets are how they generate money. In addition, there is a 0.5% currency conversion fee, as well as stamp duty on ETF and share purchases.

Does Trading 212 make me own my shares?

Trading 212 holds the shares clients have on their behalf. The equity is held in custody at Interactive Brokers when you invest with Trading 212. These are among the largest brokers in terms of daily trades, with $160 billion in client assets.

Can I create more than one trading account?

On Trading 212, you can’t create and maintain 2 active accounts using the exact same information. If you are a UK-based client, you get to use the same email address and name to open a, CFD, Invest, and ISA.

Can I use a promo code and referral link at the same time?

A promo code can be used provided that your account wasn’t created using a referral link. If it was, you will receive an error message stating that the bonus has already been claimed. If you use a promo code during the next seven days after opening your account and meet the requirements, you’ll receive a free share.